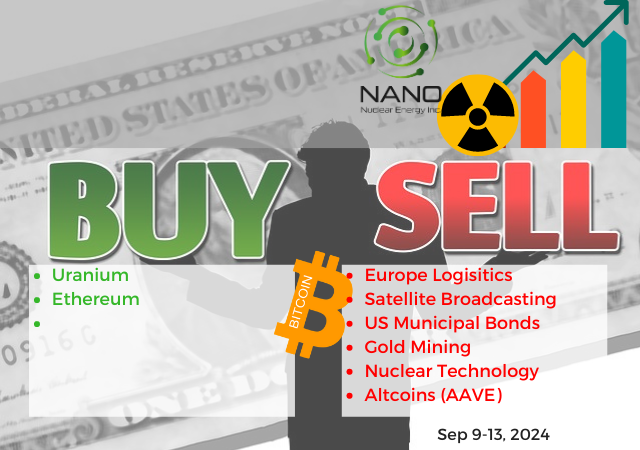

Uranium turns the corner the day after my portfolios get loaded up. A few sales to reduce margin pressure - getting rid of stuff that is not working that well.

Portfolio News

In a week where S&P 500 rose 4.01% and Europe rose 2.05%, my pension portfolio rose 4.42%. Gotta guess my portfolios have less Europe and more uranium

Big movers of the week were NANO Nuclear Energy (NNE) (117%), 88 Energy (88E.AX) (100%), Sagalio Energy (SAN.AX) (60%), Appen (APX.AX) (43.5%), NuScale Power Corporation (SMR) (38.7%), Coeur Mining (CDE) (37.9%), GTI Energy (GTR.AX) (33.3%), NeuRizer (NRZ.AX) (33.3%), 3D Systems Corporation (DDD) (31.4%), Pantera Minerals (PFE.AX) (30.4%), Cauldron Energy (CXU.AX) (29.4%), Stroud Resources (SDR.V) (28.6%), Mithril Silver and Gold (MTH.AX) (27.6%), Mineral Resources (MIN.AX) (25.1%), Hecla Mining Company (HL) (25.1%), Latin Resources (LRS.AX) (25%), AML3D (AL3.AX) (24%), Commerzbank (CBK.DE) (23.8%), Mission Produce (AVO) (22.8%), Deep Yellow (DYL.AX) (21.8%), Honey Badger Silver (TUF.V) (21.4%), Lotus Resources (LOT.AX) (21.4%), IsoEnergy (ISO.TO) (21.1%), Pilbara Minerals (PLS.AX) (20.3%), GoviEx Uranium (GXU.V) (20%), Elevate Uranium (EL8.AX) (19.6%), HelloFresh (HFG.DE) (19.3%), Uranium Energy Corp (UEC) (19.2%), Hercules Metals (BIG.V) (18.9%), GoGold Resources (GGD.TO) (18.9%), SUN SILVER (SS1.AX) (18.9%), Anfield Energy (AEC.V) (18.2%), enCore Energy (EU) (18.1%), Skyharbour Resources (SYH.V) (17.2%), Bannerman Energy (BMN.AX) (16.7%), F3 Uranium (FUU.V) (16.3%), Global Atomic Corporation (GLO.TO) (16.2%), Resource Development Group (RDG.AX) (16%), CleanSpark (CLSK) (15.9%), TechGen Metals (TG1.AX) (15.2%), Condor Energy (CND.AX) (14.8%), Boss Energy (BOE.AX) (14.7%), Atha Energy (SASK.V) (14.6%), POSCO Holdings (PKX) (14.2%), Norwegian Cruise Line Holdings (NCLH) (14%), Pan American Silver (PAAS) (13.9%), 29Metals (29M.AX) (13.6%), Advanced Micro Devices (AMD) (13.4%), Global Uranium and Enrichment (GUE.AX) (13%), ARN Media (A1N.AX) (12.7%), Lightbridge Corporation (LTBR) (12.6%), Orthocell (OCC.AX) (12.5%), Paladin Energy (PDN.AX) (12.5%), Marvell Technology (MRVL) (12.5%), CoreNickelCo (CNCO.CN) (12.5%), Premier American Uranium (PUR.V) (11.8%), Centrus Energy (LEU) (11.8%), Sprott Junior Uranium Miners ETF (URNJ) (11.8%), Stuhini Exploration (STU.V) (11.5%), Sigma Lithium Corporation (SGML) (11.5%), Nickel Industries (NIC.AX) (11.3%), St Barbara (SBM.AX) (10.9%), QuantumScape Corporation (QS) (10.8%), Ur-Energy (URG) (10.5%), VanEck Gold Miners ETF (GDX) (10.4%), iShares Silver Trust (SLV), Red 5 (RED.AX)

Never seen a list as long as this with 67 stocks rising more than 10% in a week. The big themes are obvious from the top - nuclear technology (3 stocks), silver/gold mining (13 stocks), uranium (21 stocks), lithium (6 stocks), other alternate energy (3 stocks) - a broad based move in alternate energy and nuclear power. There are a few gas companies (one in Peru and one in Northern Territory). There are two 3D printers - stuff happening there too.

Nuclear tech stocks are volatile but a 147% move in a week in one is driven by something solid - maybe it was the news announcements in the week for Nano (NNE)?

or maybe speculation about the supply for the Oracle (ORCL) data centre to be powered by nuclear? Suffice it to say, all the nuclear technology stocks made it to the big movers list

other news moves in the list - 3D Systems (DDD)

Commerzbank (CBK.DE)

Back to markets - week started out a little shaky but the inflation numbers brought back the chances of a big Federal Reserve rate cut. The journalists do make me laugh. Last week they said a big rate cut would trigger panic as fear is Fed would overdo it. This week big is better.

Crypto Bounces

Bitcoin price pushed up most of the week ending the week 6.3% higher with a trough to peak range of 10.4%. That weekly resistance level drawn in last week (top green line) held.

Ethereum price was heading the same way but fell off in weekend trading ending the week 1.7% lower with a peak to trough range 8.5%. The rug pull of the Base Defi project hit sentiment.

Aave (AAVE) the lending protocol continues to attract buyers with a pop of 28% at one stage (see below)

Coti (COTIBTC) continued higher after reversing the week before with a 35% pop.

Phantom (FTMBTC) cycled back below 20 day moving average and popped 25% to make a higher high with another mini cycle into the next week.

A lot of the charts had the same shape - a push higher around the 10% mark and then giving half away in the new week - Ripple (XRP) example

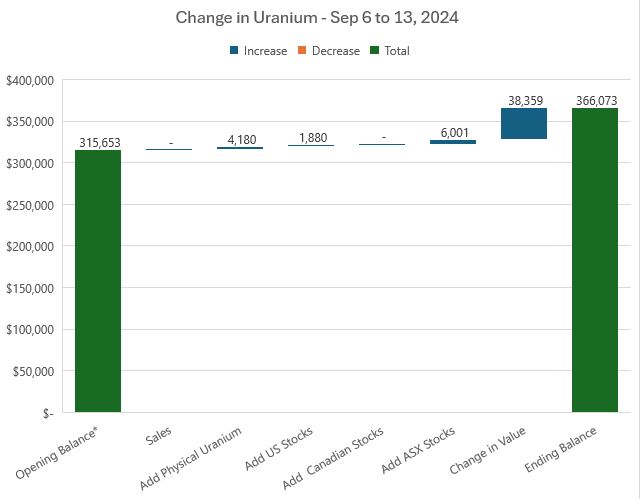

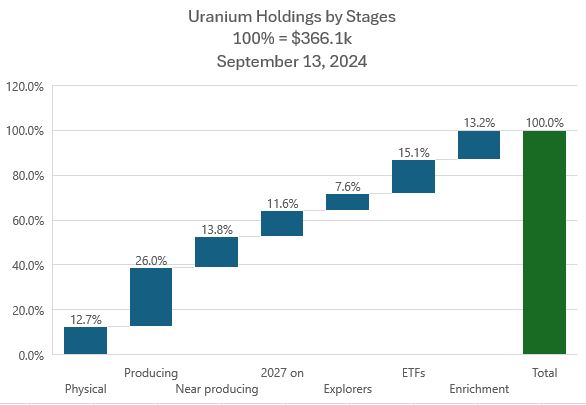

Uranium Holdings

News of the week was a statement from Vladimir Putin about a few key commodities

"Please take a look at some of the types of goods that we supply to the world market . . . Maybe we should think about certain restrictions — uranium, titanium, nickel,”

The translation is key - the words in Russian were apparently quite a bit more vague.

https://www.world-nuclear-news.org/articles/putin-considering-restricting-uranium-sales

The market reaction was not vague - they read it as a happening and uranium stocks jumped. You will have seen the number of uranium stocks in the big movers list and overall valuation in my portfolios went 12.8% up. Timing worked well for the additions made in the days before the announcement

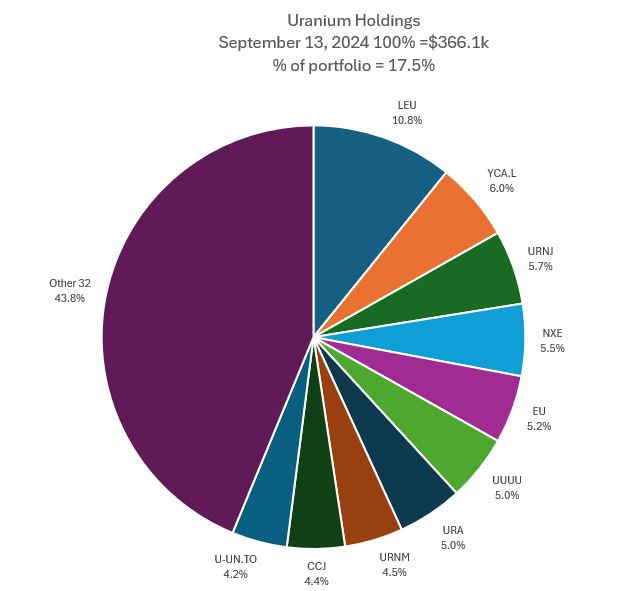

The mix of holdings saw some changes - not surprisingly the share of portfolios jumped near 1.5 percentage points to 17.5%. Sprott Junior Uranium Miners (URNJ) jumped one place with the add there displacing NexGen Energy (NXE). EnCore Energy (EU) jumped two places into 5th displacing Energy Fuels (UUUU) and Global X Uranium ETF (URA). Cameco (CCJ) switched places with Sprott Physical Uranium Trust Fund (U-UN.TO). The share of Others went up over 2 percentage points and increased by one with the addition of Cauldron Energy (CXU.AX)

The holdings by stage does see an important change with Near Producing going up by 1.3 percentage points. A number of the ASX additions made in the week are in this class.

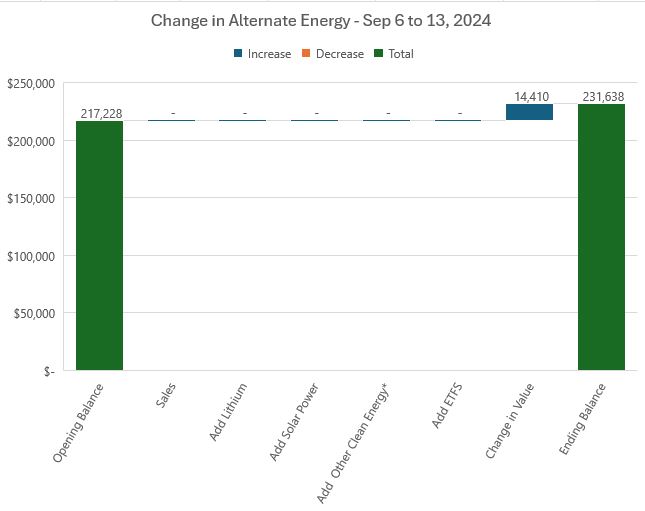

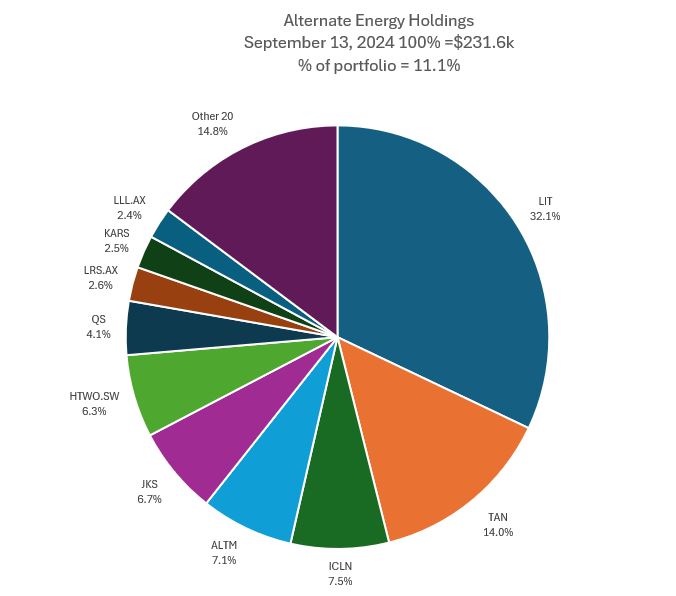

Alternate Energy Holdings

Alternate energy holdings also moved especially on the back of news that China's CATL is considering mothballing a key lepidolite mine in the south-eastern Jiangxi province, as well as one of its three lithium carbonate production lines. This helped to push the value of alternate energy holdings 6.6% up

https://www.mining.com/catl-to-cut-lithium-production-at-key-mine/

The share of holdings stayed at 11.1% with only 2 moves in rankings. JinkoSolar (JKS) swapped places with L&G Hydrogen ETF (HTWO.SW) and Latin Resources (LRS.AX) jumped two places into 8th place. Share of Others did go up 0.4 percentage points driven by changes in value of stocks like Pilbara Minerals (PLS.AX) and Sigma Lithium (SGML)

Bought

A tweet from the World Nuclear Association meetings about an interview with John Borschoff, CEO of Dep Yellow (DYL.AX) had me thinking about time to scale in a bit more specifically in uranium stocks - aim for ASX listed stocks that are in production or close to production. For each stock scaled into holding in the amount by which each stock is unprofitable

Lotus Resources Limited (LOT.AX): Uranium. Reopening Kayelakeera mine in Malawi with production in 2025

Boss Energy Limited (BOE.AX): Uranium. Already producing from Honeymoon mine, South Australia

Peninsula Energy Limited (PEN.AX): Uranium. Reopening Lance mine in Wyoming with production from Q4 2024 raming in 2025

Deep Yellow Limited (DYL.AX): Uranium. Planned production from Tumas mine, Namibia from 2026.

Bannerman Energy Ltd (BMN.AX): Uranium. Planned production from Etango mine, Namibia from 2027.

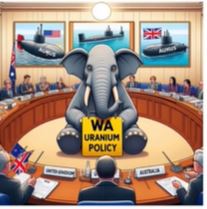

Cauldron Energy Limited (CXU.AX): Uranium. Cauldron announced results from its uranium drilling program its Manyingee South project, Western Australia. Location next to Paladin (PDN.AX) Manyingee project.

The potential is this is one of the world's premier uranium deposits yet to be opened up. The elephant in the room is that Western Australia currently has a ban on uranium mining. Will need a change of policy or of government in WA and/or in Commonwealth to get this changed.

Watch webinar with CEO Jonathan Fisher includes an overview of the bifurcation of supply between East and West.

https://www.finnewsnetwork.com.au/archives/finance_news_network471057.html

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Averaged down entry in pension portfolio with prices moving upwards. One way to recover from the ugly sold put assignment last week. Wrote October expiry covered call for 3.3% premium with 6.4% price coverage - fully expect to see that get assigned.

Uranium Royalty Corp (UROY): Uranium. Read an analysis on X similar to one I did the other day about the royalty projects contained in UROY. The view was the royalty projects were essentially free as the uranium inventories valued at current spot plus the cash on hand equalled the total market cap. Doubled the holding in the pension portfolio to average down entry price.

Sold

A few sales in the pension portfolio to reduce margin pressure amidst high exercise risk.

DHL Group (DPWA.DU): Europe Logistics. 11.6% blended loss since December 2023/March 2024. Income trades have recovered 82% of the capital losses thus far.

RTL Group S.A. (RRTL.DE): Satellite Broadcasting. Trimmed the holding to raise capital - for a 2.8% loss since December 2023 on a FIFO basis. Loss for the most recent tranche bought to average down was smaller - but a loss nonetheless. Income trades have recovered 31% of the capital loos - options market is not very liquid out-the-money. The story of Europe.

BlackRock MuniYield Quality Fund III (MYI): US Municipal Bonds. Falling yield market is not the time to be selling bond holdings BUT needed to find capital somewhere. Had been averaging down entry price on the municipals as yields have topped out and started to fall. My accountant will bank the capital loss from the early buys (19.7% from November 2021/January 2022) but there are profits to be made on a LIFO basis (3.5% from December 2023/January 2024). Of note: US municipal bonds interest is tax free in US hands (not mine). My accountant will go FIFO (max loss).

De Grey Mining Limited (DEG.AX): Gold Mining. Sold a small parcel in pension portfolio to fund next pension payment. Locks in 1,835% blended profit since August/November 2016. Still remains largest holding in the portfolio. Stock idea based on seeing a headline saying the Hemi discovery is as big as the Witwatersrand (the world's largest gold field to date)

GE Vernova (GEV): Nuclear Technology. With price closing at $225.59, closed out the call side of a December expiry 155/170/135 call spread risk reversal. That leaves the 135 strike sold put as a naked put. Somehow I do not see that ever being at risk of being assigned. Standalone the trade made 88% profit since April 2024. if the sold put does go to expiry it is not possible to calculate the profit percentage asn the put premium fully funded the call premium - a free trade.

Borrowing a chart from next week - still shows the open sold put (135). Trade shows the disadvantage of using call spreads - when a stock takes off like a rocket ship would have been better with a straddle trade or a credit spread. Options liquidity was low at the time and ticker price is a bit high to be exposed to 100 shares.

ASX Portfolio

No trades. Have decided to not add any more funds other than to fund monthly auto invest. Have invested just over $50k since April 2022. Return is showing a 5.35% simple return - not exactly shooting he lights out. There were a few top up trade signals in the week - chose not to add to holdings.

Hedging Trades

The Technology Select Sector SPDR Fund (XLK): US Technology. Rolled out and down 207.5 and 210 strike sold puts to October expiry 205. Looking for market recovery to lift prices a bit. Leaves open a 215/207.5 bear put spread - will bank that shortly.

Cryptocurrency

Aave (AAVEETH): Long standing pending order hit. Hard to know what the profit % was without digging back into the trade history.

Chart shows this partial exit at the highs reached in the week. There was a an exit a few weeks back which is 50% profit from the entry before (the bottom blue ray). There was an entry marked on the chart late in 2022 - profit from that entry is 32%

Process is simple - make an entry trade and set a 50% profit target on that trade amount. Binance allows pending orders to stand - they do not expire.

Income Trades

Quiet week for with only three covered calls written in two portfolios (all US).

Naked Puts

Centrus Energy Corp (LEU): Uranium Enrichment. Rolled out 45 strike sold put for 81% loss on buy back and 2.2% cash positive. This roll out takes the cumulative sold puts into loss territory again (2nd time). Made this trade fresh and forgot to delete an outstanding trade - the pending trade executed and now have a calendar put spread in-the-money. Will watch this each day and probably let the bought put go to assignment (i.e., run this as a protective put.)

Rolled a few sold puts to buy time for capital rebuild.

- The Technology Select Sector SPDR Fund (XLK): US Technology. 42.2% profit on buyback. 20.6% cash positive. Two trades both going to lower strikes.

- NexGen Energy Ltd. (NXE): Uranium 1.3% loss on buyback. 5.8% cash positive

Commerzbank AG (CBK.DE): German Bank. Unicredito (UCG.MI) takes 9% stake taking over stake held by German government and pushes price past covered call strike. Sold a naked put below market to claw back an entry point Return 1.46% Coverage 4.2%

- Cameco Corporation (CCJ): Uranium. Return 1.26% Coverage 16.4% - added at a price happy to buy stock at.

- Mission Produce, Inc. (AVO): Food Products. Return 0.8% Coverage 6% - sold at same strike as covered call likely to go to assignment.

Credit Spreads

None in place. With all the work raising capital and improvement in US Technology stocks, exercise risk is well within risk parameters. Forgot to snapshot the spreadsheet.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

September 9-13, 2024

#hive #posh