Uranium market stirs with life again - time to top up. Other action is minor cherry picking plus some ASX movement

Portfolio News

In a week where S&P 500 rose 0.57% and Europe rose 2.68%, my pension portfolio rose a whopping 3.56%. Heavy lifiting came from resource stocks, uranium and a raft of businesses exposed to China trade. Japan stocks were well ahead on the week though every single stock went down on Friday after announcement of the new prime minister, Shigeru Ishiba, former defence minister.

Big movers of the week were Stroud Resources (SDR.V) (166.7%), Evolution Energy Minerals (EV1.AX) (41.7%), GoviEx Uranium (GXU.V) (38.5%), Mithril Silver and Gold (MTH.AX) (34.4%), Mineral Resources (MIN.AX) (33.9%), Pantera Minerals (PFE.AX) (31.8%), Bannerman Energy (BMN.AX) (31.4%), Hygrovest (HGV.AX) (30%), DevEx Resources (DEV.AX) (28%), Grange Resources (GRR.AX) (27.9%), CGN Mining Company (1164.HK) (25.4%), Paladin Energy (PDN.AX) (24.6%), Boss Energy (BOE.AX) (24.6%), Deep Yellow (DYL.AX) (23.1%), Wynn Resorts (WYNN) (22.5%), Genmin (GEN.AX) (21.4%), Elevate Uranium (EL8.AX) (20%), St George Mining (SGQ.AX) (20%), Lotus Resources (LOT.AX) (19.6%), Aeris Resources (AIS.AX) (19.5%), Centrus Energy (LEU) (19.5%), Cobalt Blue Holdings (COB.AX) (19.4%), 29Metals (29M.AX) (19%), Whitehaven Coal (WHC.AX) (18.8%), Loop Industries (LOOP) (18.6%), St Barbara (SBM.AX) (18.6), JinkoSolar Holding (JKS) (17.6%), Ping An Insurance (Group) Company of China, (601318.SS) (17.6%), NuScale Power Corporation (SMR) (17.3%), Lotus Resources (LOT.AX) (17.1%), iShares MSCI China Small-Cap ETF (ECNS) (17%), Vulcan Energy Resources (VUL.AX) (16.7%), KraneShares Electric Vehicles and Future Mobility Index ETF (KARS) (16.5%), Largo (LGO) (16.1%), Panther Metals (PNT.AX) (15.8%), Global X Lithium & Battery Tech ETF (LIT) (15.6%), South32 (S32.AX) (15.6%), NANO Nuclear Energy (NNE) (15.1%), Atha Energy (SASK.V) (15%), Cauldron Energy (CXU.AX) (15%), Global Uranium and Enrichment (GUE.AX) (15%), Uranium Energy Corp (UEC) (15%), Beamtree Holdings (BMT.AX) (15%), Arcadium Lithium (ALTM) (14.7%), Aura Energy (AEE.AX) (14.3%), Iluka Resources (ILU.AX) (14.3%), Stanmore Resources (SMR.AX) (14.1%), Integral Diagnostics (IDX.AX) (14.1%), Sarytogan Graphite (SGA.AX) (13.9%), Pilbara Minerals (PLS.AX) (13.3%), Arafura Rare Earths (ARU.AX) (12.9%), Glencore (GLEN.L) (12.8%), HelloFresh (HFG.DE) (12.4%), 3D Systems Corporation (DDD) (12%), Global X Uranium ETF AUD (ATOM.AX) (11.9%), Sprott Junior Uranium Miners ETF (URNJ) (11.7%), Lynas Rare Earths (LYC.AX) (11.5%), American Rare Earths (ARR.AX) (11.3%), BHP Group (BHP.AX) (10.9%), Terra Uranium (T92.AX) (10.9%), IsoEnergy (ISO.TO) (10.8%), Sigma Lithium Corporation (SGML) (10.8%), Denison Mines (DNN) (10.6%), Peninsula Energy (PEN.AX) (10.6%), Lightbridge Corporation (LTBR) (10.4%), Elixir Energy (EXR.AX) (10.3%), CanAlaska Uranium (CVV.V) (10.3%), Latin Resources (LRS.AX) (10.3%), CoreNickelCo (CNCO.CN) (10%), Silex Systems Limited (SLX.AX) (10%)

Another WOW list surpassing the previous record with 69 stocks rising more than 10% in a week. There are two standout themes one of which is obvious and the other not. Uranium is obvious. What do Wynn Resorts (WYNN) and Grange Resources (GRR.AX) have in common? Yep - you guessed it - China.

The China stimulus package has under-pinned iron ore, battery materials, rare earths, Macau gaming, coal mining, solar power, electric vehicles - all on the list. Uranium and nuclear are the clear leaders with 26 stocks - suggests that there are too many holdings in the portfolios. Thinking is to rationalise these when profits are taken into wider holdings of the ETF's

Markets wanted to fall away with a down day and an up day and a pop on any signs of good news - new records for some indices.

Crypto Bumbles

Bitcoin started out sideways and then tried to lift and sagged at the end of the week ending 0.1% higher on the week with a trough to peak range of 6.1%

Ethereum was also in drift mode ending 1.8% lower with a trough to peak range of 6.8%

Cardano (ADA) kept up the momentum of the week before rising 18% before giving half away

There was a similar patern across the altcoins - up 15 to 20% and then sagging half - Polkadot (DOT)

Thorchain (RUNE) did a little more than the 15% and made 28% - see below

Enjin (ENJETH) keep moving higher with a move of 19% and then higher into the new week.

Standout was Shiba (SHIB) popping 52% and then sagging less than half

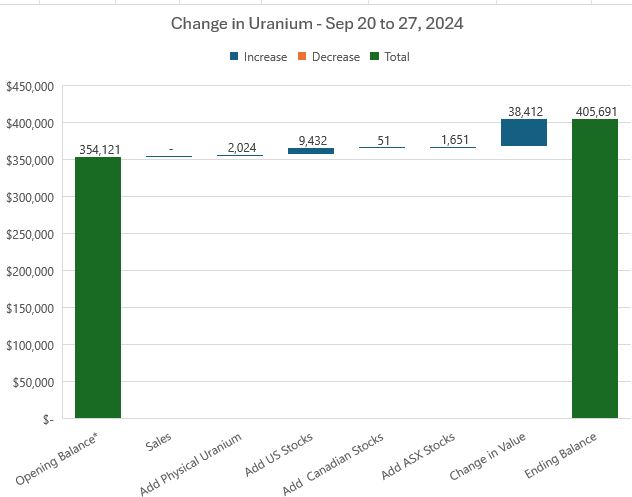

Uranium Holdings

Uranium market pushed higher again on the back of the Microsoft (MSFT) and Constellation Energy (CGE) deal on reopening Three Mile Island and a pledge by 14 major banks to fund nuclear energy.

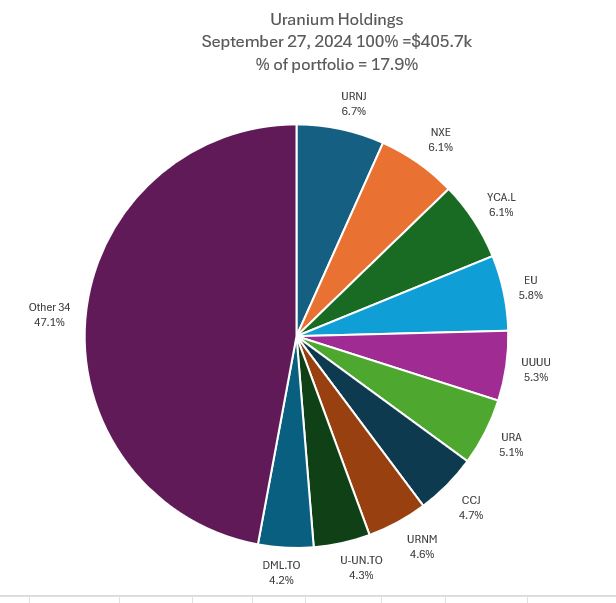

Valuation of the portfolios rose 10.3% and there were a few additions made across all the segments - cannot help but follow some of the momentum. Did also add a few more options trades. Portfolio share rises 1.5 percentage points to a lofty 17.9% - so much for a 15% target.

Additions make for some changes with Sprott Junion Uranium Miners (URNJ) taking over #1 spot and Nexgen Energy (NXE) moving into slot 2. The share of Others goes up 3 percentage points and is now 34 stocks - that will get trimmed in due course as the share of ETF's grows.

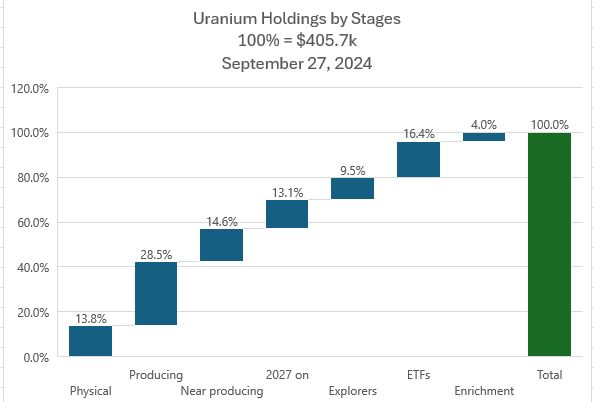

The holdings by stages chart shows an interesting move - physical share drops as values of all others outperform spot price. Enrichment goes up with the add back of Centrus Energy (LEU)

Alternate Energy Holdings

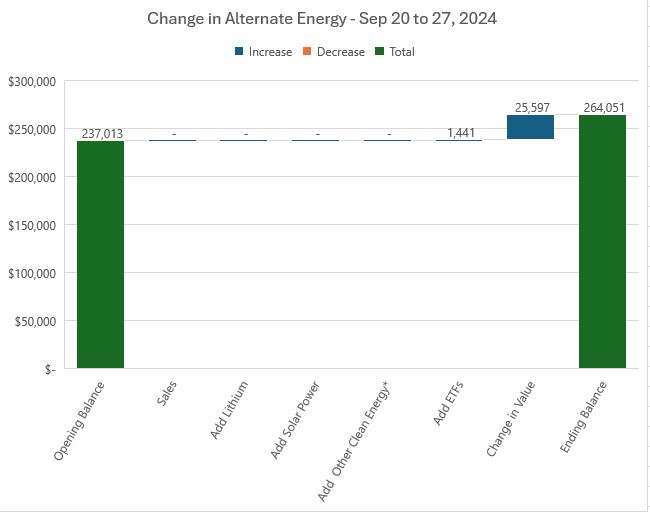

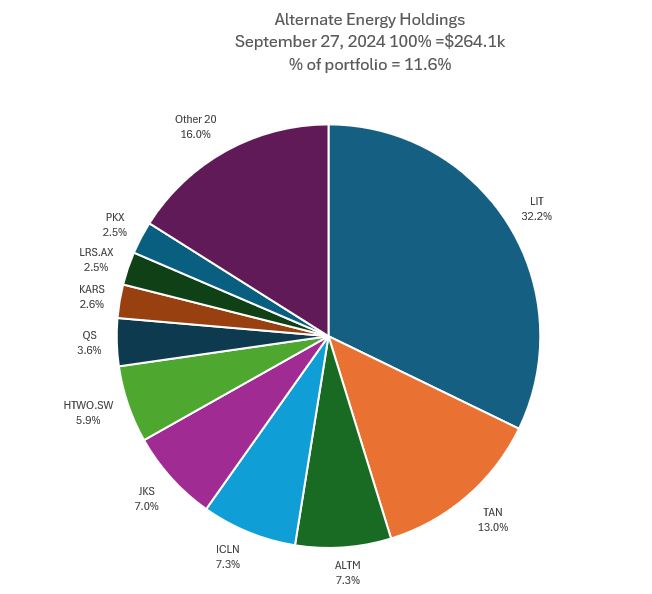

Alternate energy surged on the China stimulus package rising 10.8% across the portfolios. Only one addition to report in the ETF's and share of portfolios rises 0.6 percentage points to 11.6%

Mix of holdings changes with Arcadium Lithium (ALTM) moving up one place pushing the iShares Global Clean Energy ETF (ICLN) down a place despite the add to the ETF and the news of taking their Mt Caitlin mine into care and maintenance. Krane Shares Electric Vehicle ETF (KARS) rises two places to slot 8 and Latin Resources (LRS.AX) swaps places with Posco (PKX).

Bought

Global Uranium and Enrichment (GUE.AX): Uranium. Averaged down entry price. Global increased JORC on the Tallahassee Project to 59 Mlbs in early September. Also running projects in Utah, Colorado and Athabasca Basin. Cornerstone shareholder in Ubaryon, a private Australian company which owns 100% of a next generation enrichment technology.

GTI Energy Ltd (GTR.AX): Uranium. Allocation under rights issue at a discount to market price and including options with September 2028 expiry - price needs to move more than double to warrant exercise. Encouaraged to see Triangle Investors on X talking up the GTR tenements in Wyoming.

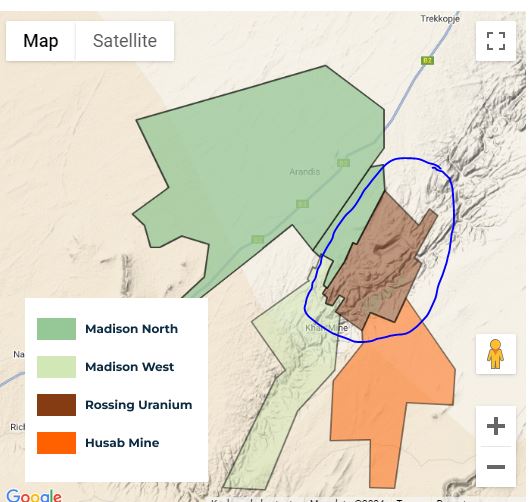

Star Minerals Limited (SMS.AX): Uranium. Was researching ownership of Rossing Uranium in Namibia and saw the announcement that Star Minerals entered an earn in contract on Madison Metals (GREN.CN) Cobra Project at Madison North in Erongo Provice in Namibia.

The resource is adjacent to Rossing Uranium mine, which produced 6 Mlbs in last full year of operation and has completed a bankable feasibility to extend life of mine to 2036.

Société BIC SA (BB.PA): Europe Consumer Products. Multiplier change through dividend payment time results in a short stock position. Added to portfolio to cover the short and get to 100 shares to write covered calls. Entry was at 0.5% premium to assigned price. Will recover that with the first covered call. Wrote covered call for 0.58% premium with 2.8% price coverage.

iShares Global Clean Energy ETF (ICLN): Alternate Energy. Averaged down entry price in managed portfolio. Constituent stocks are moving higher - riding back. Wrote covered call for 1.04% premium with 4.17% price coverage.

Uranium Energy Corp (UEC): Uranium. UEC announced acquisition of Sweetwater Mill from Rio Tinto which will underpin price - opened a first holding in managed portfolio.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Scaled into holding in pension portfolio - have a sense that the junior will accelerate once spot price starts moving. Wrote covered call for 0.96% premium with 20% price coverage.

Centrus Corp (LEU): Uranium Enrichment. Replaced portion of stock assigned in pension portfolio at 7.3% premium to assigned price - ouch. Wrote covered call for 1.6% premium with 13.9% price coverage.

NexGen Energy Ltd (NXE): Uranium. Scaled into holding in pension portfolio deploying some of proceeds for sale of enrichment assets. Wrote covered call for 1.5% premium with 20% price coverage. That implied volatility tells me this is the stock the market wants to hate

Uranium Royalty Corp (UROY): Uranium. Have a covered call that is likely to be assigned - with price nudging around the sold strike bought stock to cover delivery at 1% premium- want to remain invested. The covered call was sold at 4% premium - no loss there.

Sold

Mithril Silver and Gold Limited (MTH.AX): Silver Mining. Banked some profits to fund uranium purchase for 60.7% profit since June 2024. Next investors idea.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Kogan.com Ltd (KGN.AX): Retail. Dividend Yield 2.91%.

Chart shows a dramatic collapse from Q1 2024 highs and then a reversal and build off a solid base. With Christmas season ahead, there is enough headroom to hit 40% profit target well below the previous higs.

Top Ups

29Metals Ltd (29M.AX): Base Metals. Base metals got swept up in the China stimulus - made for a good chance to average down entry price. Dividend Yield 3.36%

Chart shows the tick up after the China stimulus news - averages down entry

Sold

Appen Ltd (APX.AX): IT Services. Closed out at target at 52 week high for 26.2% blended profit since February/March/June 2023/April 2024.

Chart tells a story about the trading approach - first entry was after downtrend was broken with two entries following that as price traded sideways but entering at each one month high. Then price collapsed as Appen lost a key Google contract. There was one more entry after the next downtrend break and that delivered all the profits.

Qantas Airways Limited (QAN.AX): Airline. 31.2% blended profit since January/April 2024. Change of CEO seems to have helped.

Qantas chart looks a lot more convincing. First entry comes after the break of the downtrend and price then cycles higher, consolidates a bit and then moves higher again. There would have been signals in late 2022 but I was not prepared to invest while Alan Joyce was still CEO - never trusted his judgment.

Humm Group Ltd (HUM.AX): Financial Services. 26.9% blended profit since January 2023/January 2024.

Chart is another example of the challenges of this approach. Entries come after downtrends are broken and the break confirmed with a one month high. Going to guess the first entry (left hand blue ray) was the 2nd time the signal came up. It was taken and price then fell over. Second downtrend break and signal arrived late or I missed it early on. Landed up with a scaling in entry again with price falling over not long after entry. At least the exit method worked with a 25% profit target around the 52 week high.

Good news is with the 3 sales before month end, no need to fund the account for the auto-invest orders coming up next week.

Cryptocurrency

Thorchain (RUNEETH): Pending order hit for 50% profit since August 2024.

Income Trades

61 covered calls written across 4 portfolios (UK 2 Europe 11 US 48) with one expiring - had written a weekly on ChargePoint (CHPT) last week.

Naked Puts

Naked puts sold at prices quite happy to own stock at.

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank Return 0.9% Coverage 5.7%

- Centrus Energy (LEU): Uranium Enrichment. Return 0.9% Coverage 5.7%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 6.0% Coverage 5.6%

- The Trade Desk (TTD): Digital Media. Return 0.4% Coverage 15.8%

- Nokia Oyj (NOK): Network Equipment. Return 1.5% Coverage 7.3%

- QuantumScape Corporation (QS): Battery Technology. Return 3.8% Coverage 6.57%

- Denison Mines (DNN): Uranium. Return 2.0% Coverage 20.7%

- Invesco Solar ETF (TAN): Solar Power. Return 1.18% Coverage 9.0%

- Global X Uranium ETF (URA): Uranium. Return 3.8% Coverage 4.1%

Energy Fuels (UUUU). Added in 5 strike sold put to fund the January 2025 10/15 bull call spread. This brings net premium on the call spread down to $0.08 - one more sold put and the call spread will be fully funded. This lifts profit potential to 681% but price has to move 178% from the $5.38 close (Sep 23) in the next 4 months. Got the eye off the ball on this as the last sold put was for July expiry.

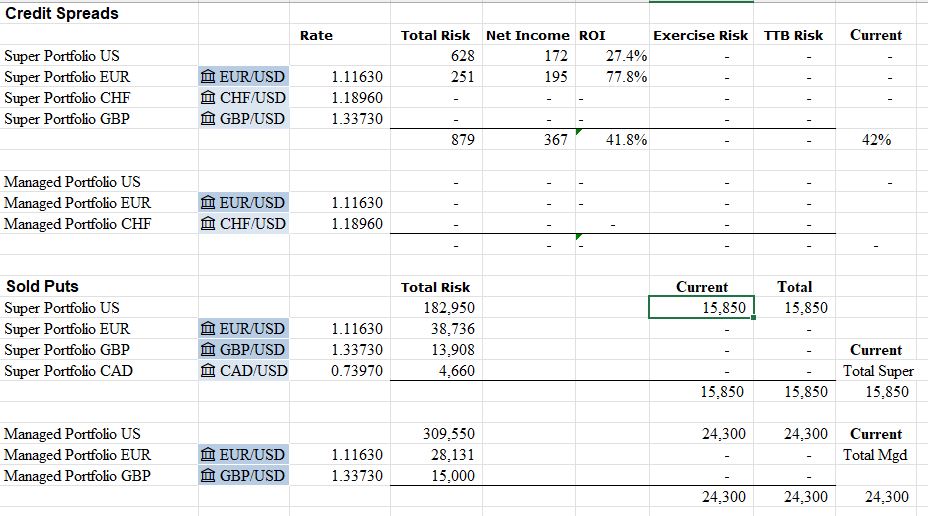

Credit Spreads

No change

Exercise risk is well within margin limits especially with markets moving upwards

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

September 23-27, 2024

#hive #posh

Congratulations @carrinm! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 60000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: