A choppy week with action coming into uranium and alternate energy stocks - that is where the trades were plus a little nuclear technology.

Portfolio News

In a week where S&P 500 rose 0.26% and Europe dropped 2.8%, my pension portfolio rose 0.37%. Europe and Japan was a drag. Lifitng came from uranium, lithium, SMR's, semiconductors and a few Canadian gold and silver explorers.

Big movers of the week were Castillo Copper (CCZ.AX) (50%), Lithium Universe (LU7.AX) (40%), NeuRizer (NRZ.AX) (33.3%), NANO Nuclear Energy (NNE) (29.3%), JinkoSolar Holding Co (JKS) (29%), Zinc of Ireland (ZMI.AX) (28.6%), Anfield Energy (AEC.V) (25%), Global Uranium and Enrichment (GUE.AX) (24.6%), AML3D (AL3.AX) (24.1%), Stem (STEM) (19.1%), Centrus Energy (LEU) (17.5%), ARN Media (A1N.AX) (16.1%), Star Minerals (SMS.AX) (16%), iShares MSCI China Small-Cap ETF (ECNS) (14.8%), GoGold Resources (GGD.TO) (13.1%), Uranium Energy (UEC) (13.1%), Baselode Energy (FIND.V) (13%), Karoon Energy (KAR.AX) (12.7%), Stuhini Exploration (STU.V) (12%), Cobalt Blue Holdings (COB.AX) (11.2%), Northern Minerals (NTU.AX) (10.5%), Heavy Minerals (HVY.AX) (10.5%), Bannerman Energy (BMN.AX) (10%), Ping An Insurance (Group) Company of China (601318.SS) (10%)

24 stocks moving more than 10% in the week is more in line with normal markets. Similar profile to the prior week with China stimulus pushing along base metals (3 stocks), lithium (1 stock), China (2 stocks). Uranium and nuclear was also on the move in a more subdued way (7 stocks over 10% but many more between 5 and 10%) and a few moves in alternate energy (2 stocks) nad rare earths (2 stocks).

Markets seemed a bit edgy between Middle East events (and the impact on oil) and apprehension about the jobs number. Jobs number came in higher than expected which encouraged markets to a new Dow record. Seems like the soft landing is being believed with two 25 basis rate cuts pencilled in for 2024. There are only 2 Federal Reserve meetings left in 2024.

Crypto Drops

Bitcoin followed markets lower to start the week and then recovered half to end 2.7% lower with a 7.7% peak to trough range

Ethereum chart looks much the same but with bigger numbers ending the week 7.8% lower with a peak to trough range of 13.3%

Noticed that a lot of the altcoins were starting to cycle higher relative to Ethereum - sample - Litecoin (LTCETH) has made 7 cycles since the end July uptrend began. 4 of those have reversed off the 20 day moving average (blue line) and 3 off the 50 day moving average.

One more - Chainlink (LINKETH) - now in 4th cycle higher after the moving averages crossed over. These patterns are very tradeable. Maybe jinxed this with a late cut and paste - dropping blow the 50 day

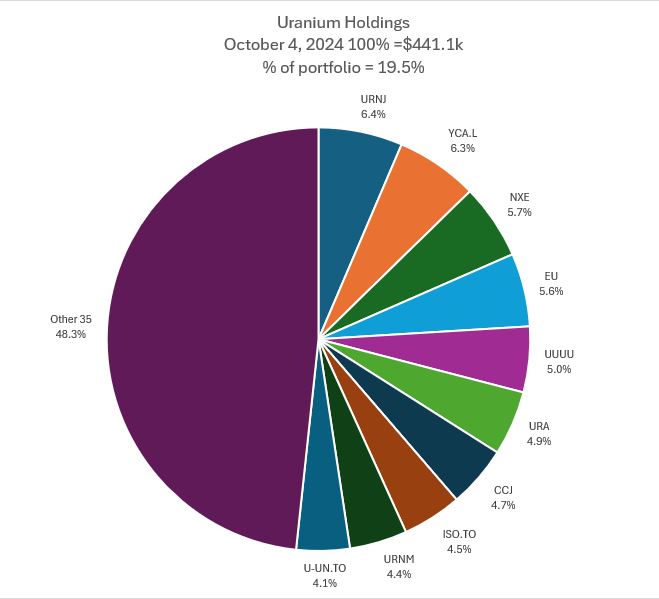

Uranium Holdings

Uranium news is being led by the demand story especially for data centres with Google joining the debate this week. Supply side stories are quieter but IsoEnergy (ISO.TO) did announce takeover of Anfield Energy (AEC.V), and Global Atomic (GLO.TO) gave an October timing for funding the Dasa Mine. It all feels like a slow build with spot price moving up a little.

YellowCake plc (YCA.L) moves up one slot with the additions made there. IsoEnergy (ISO.TO) comes into Top 10 at slot 8 with the additions made there and Denison Mines (DML.TO) drops out to slot 11. Share of Others is now 35 stocks with the addtions made in the week and rises 1.2 percentage points. Share of overall portfolio is now 19.5% - a tad high.

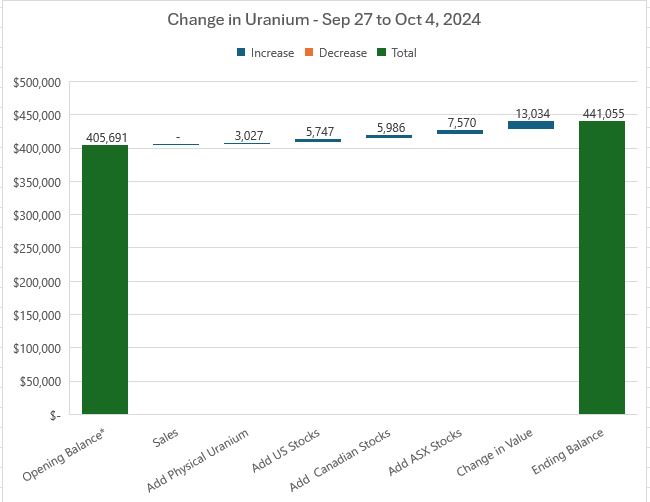

Sources of change sees additions in each category and an overall rise in valuation of 3.2%

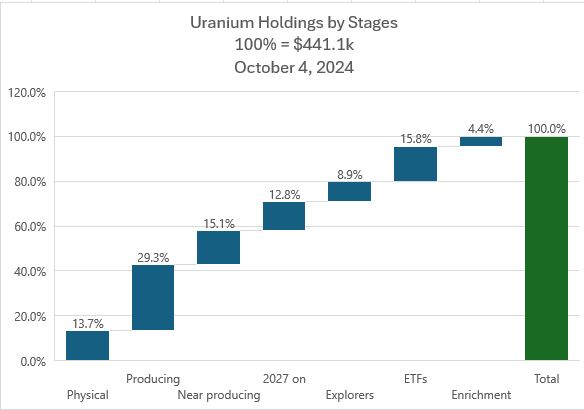

Holdings by stage sees a subtle change with 1.2 percentage points rise in the first 3 columns - that is the strategy - lean to the producing and physical end of the scale

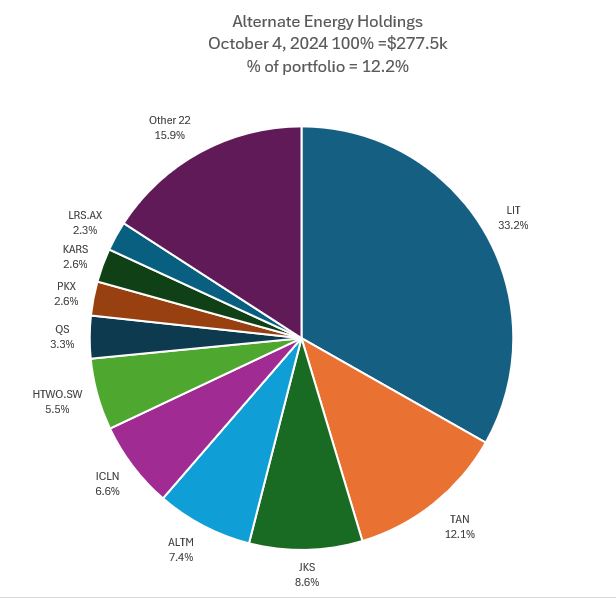

Alternate Energy Holdings

Overall share of portfolio rises 0.6 percentage points to 12.2%. JinkoSolar (JKS) jumps up one place to slot 3 based on rise in value. Posco (PKX) rises two places into slot 8 with the addition there. There was a small increae in valuation - forgot to snip the chart and now the Arcadium Lithium (ALTM) has blown up the look back.

Bought

Cauldron Energy Limited (CXU.AX): Uranium. Cauldron have just completed a private placement and offered the chance for shareholders on record on Oct 4 a chance to subscribe at the same price - a tidy discount and an added option. Added to my holding to grab that opportunity- 10% discount feels like free money to me.

Uranium market is looking solid going into the month end balancing for the ETF's and the September setting for the long term contract price. Decided to allocate A$10k to pension portfolio focused on ASX stocks that have best leverage to rising uranium price - producing or with firm plans to be producing or doing enrichment.

Bannerman Resources (BMN.AX): Uranium. Planned 2027 production at scale from Etango project, Namibia

Boss Energy (BOE.AX): Uranium. Producing from Honeymoon project, South Australia, with ramp up from 2025.

Deep Yellow Ltd (DYL.AX): Uranium. Planned 2026 production from Tumas project, Namibia. Appointed ex-Paladin Chief Engineer this week bringing the old team together.

Paladin Resources (PDN.AX): Uranium. Producing from Langer-Heinrich project in Namibia and in process of acquiring Fission Uranium (FCU.TO) with projects in Athabasca Basin.

Silex Systems Limited (SLX.AX): Uranium Enrichment. Commercialising unique laser-based enrichment technology for enrichment of uranium, silicon and medical isotopes. Uranium enrichment project is US-based in Paducah, Kentucky = a friendly place for US supply.

Added to holdings of US uranium assets already producing with plans to scale.

Uranium Energy Corp (UEC): Uranium. Bought Sweetwater mill and Wyoming uranium assets from Rio Tinto the week before. Added to holdings ahead of the rebalance. Wrote covered call for 1.9% premium with 10.6% price coverage.

Ur-Energy Inc (URG): Uranium. Producing at Lost Creek and scheduled to restart at Shirley Basin in late 2025/2026. Am under-invested compared with the ETFs

Taking a punt on two properties to average down entry prices where price has shown a willingness to reverse

Global Atomic Corporation (GLO.TO): Uranium. Still waiting finlaisation of funding of the scale Dasa project in Niger

Standard Uranium Ltd (STND.V): Uranium. Athabasca Basin explorer with a massive portfolio and lagging track record

Yellow Cake plc (YCA.L): Uranium. Scaled into holding as physical uranium stocks appear to be lagging the miners - this will change

Largo Inc (LGO): Vanadium. With China stimulus and changes to rebar standards, demand for vanadium should grow. Added to holding in pension portfolio to scale in

POSCO Holdings Inc (PKX): Korean Steel. With lithium markets waking up on China stimulus, added to holding to average down entry price. Looking for a long term development of a lithium-based battery business.

Global X Uranium ETF (URA): Uranium. With price opening at $29.10 (Sep 30), added a January 2025 30/35 bull call spread to match an existing 28 strike sold put. With a net premium of $1.25 this offers a maximum profit potential of 300% for a 20.3% move in price. The net premium comes down to $0.59 with the sold put premium which ramps up profit potential to 947% with 3.8% price coverage. The sold put expiry is October which gives a few more months of premium opportunity to get this to a free trade.

Why do the trade? There was an open sold put below current price. On the prior edition of the chart there was an Elliot Wave drawn in on the previous run from mid 2023. Looked like that could match the current pullback but Leg 3 looked steeper - hence setting up a wider spread. There may not be enough time for price to move above the sold call (35) unless the move is steeper. That is fine as legs 4 to 5 takes price past $35 anyway.

Baselode Energy Corp (FIND.V): Uranium. Baselode was droppoed out of the indexes used by the ETF's which required closing out ETF positions. This prompted John Quakes, on X, to load up - followed suit with a small purchase. Baselode controls 100% of approximately 272,804 hectares for exploration in the Athabasca Basin area, in northern Saskatchewan, Canada. The land package is free of any option agreements or underlying royalties. Baselode's Athabasca 2.0 exploration thesis focuses on discovering near-surface, basement-hosted, high-grade uranium orebodies outside the Athabasca Basin.

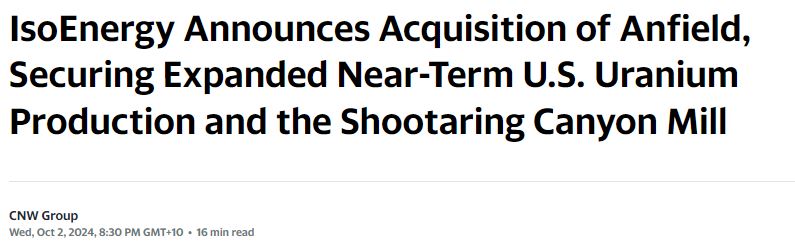

IsoEnergy Ltd (ISO.TO): Uranium. IsoEnergy announced the acquisition of Anfield Energy (AEC.V).

Share prices moved in opposite directions. Put in place a pending order to sell Anfield at implied value and bought more IsoEnergy to average down entry price. Later in the week took the same approach across all the portfolios - risk in the trade is if some other business comes along and trumps the deal.

IsoEnergy Ltd. is a leading, globally diversified uranium company with substantial current and historical mineral resources in top uranium mining jurisdictions of Canada, the U.S. and Australia at varying stages of development, providing near, medium, and long-term leverage to rising uranium prices.

And this is the challenge - a diverse range of assets and not a strong focus to develop their main asset, the Hurricane deposit in Athabasca Basin. The Anfield team is focused on their main asset, the Shootaring Mill in Utah with projects in Colorado, Utah, Arizona and New Mexico

Rolls-Royce Holdings plc (RR.L): Aerospce/Defense. Pending order hit in pension portfolio. Timing follows award of contracts to build SMR's in Czech Republic. A missile barrage from Iran also helps the defense side of the business. Wrote covered call for 0.62% premium with 5.4% price coverage.

Mitsubishi Heavy Industries (7011.T): Japan Industrials. Share price has been moving ahead on the back of development in nuclear tech side of the business. Pending order a few weeks back was missed - added in a new one at the bottom of a day range (Oct 2) on a pullback.

Centrus Energy Corp (LEU): Uranium Enrichment. Becoming patently clear that the uranium supply shortfall has a pivotal bottleneck - enrichment. Centrus Energy is the world’s most diversified supplier of enriched uranium fuel. Share price has moved up 34% since last options expiry. The replacement stock bought after expiry will go to assignment = time to put on a longer window options trade. With price opening at $60.57, set up a January 2025 expiry 65/75/55 call spread risk reversal. With net premium of $3.31, the 65/75 bull call spread offers maximum profit potential of 202% for a 23.8% move in price (so a smaller move than the last two weeks). The sold put (55) makes the trade a cash positive trade with price coverage of 9.2% and brings breakeven down to $53.49

Let's look at the chart which shows the bought call (65) as a blue ray and the sold call (75) as a red ray and the sold put (55) as a dotted red ray with the expiry date the dotted green line on the right margin. This feels like a blue sky tradebut the sold call (75) is below the 2022 highs. There have been several blue arrow price scenarios which takes price past the bought call (65). The green arrow is the 2022 move and that will comfortably take the trade to the maximum. The risk in the trade is the sold put (55) level is in the middle of the price move. One could argue that the tops of the consolidation zone from April to July could be a support zone. Of note price closed at $64.30 (Oct 2) just out-the-money and is headed in-the-money in pre-market (Oct 3)

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

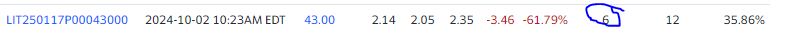

Global X Lithium & Battery Tech ETF (LIT): Lithium. China stimulus has reawakened lithium and electric vehicle markets. Thta has pushed price for this stock way past covered call strike price which will trigger a massive capital loss. Rather than buy the stock back, chose to set up a January 2025 expiry 46/52/43 call spread risk reversal. With net premium of $1.58, the 46/52 bull call spread offers maximum profit potential of 279% for a 15.6% move in price from the $45 open (Oct 2). The sold put (43) makes the trade a cash positive trade with price coverage of 4.4% and brings breakeven down to $42.45

Let's look at the chart which shows the bought call (46) as a blue ray and the sold call (52) as a red ray and the sold put (43) as a dotted red ray with the expiry date the dotted green line on the right margin. Price looks like it has made a double bottom after the year long down trend. The blue arrow price scenario comes from the previous uptrend and is mid-sized of the rises seen. That size move will take this trade comfortably to the maximum. The sold put (43) level is in the middle of nowhere land but it would give a re-entry above the covered call assignment level - that fixes the problems in that trade if it flows that way.

Options chain shows the sold put was the volume for the day.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

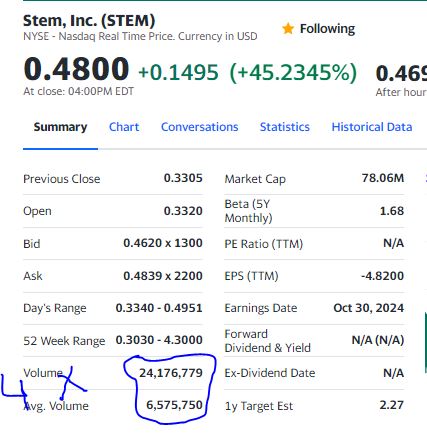

Stem Inc (STEM): Alternate Energy. Stem, Inc. operates as a digitally connected, intelligent, and renewable energy storage network provider worldwide. Chart is plain ugly and a classic example of how SPAC vehicles were used to list edgy businesses and let the following shareholders pay. Took a punt at doubling position size

ASP Isotopes (ASPI): Specialty Chemicals. A leader in isotope enrichment technology for the medical, green energy and industrial sectors. Read a tweet in the week highlighting that 85% of isotopes come from Russia and 15% from Netherlands - there are other makers - bought into two this week - this is the second one.

Coty Inc (COTY): Consumer Products. Assigned early on sold put. Breakeven after all sold puts $8.90, 1% lower than $8.99 close (Oct 4)

Gevo, Inc (GEVO): Specialty Chemicals. Gevo is commercializing the next generation of renewable gasoline, jet fuel, and diesel fuel with the potential to achieve zero carbon emissions, addressing the market need of reducing greenhouse gas emissions with sustainable alternatives. Introduced to this idea in a tweet - with the pop in price of Stem (STEM) added this to pension portfolio. Options market with close together strikes made interesting opportunities. Added a November expiry 2/1.5 long call/short put - trade is cash neutral (apart from trading costs) and is looking for price to keep moving higher with some momentum. Wrote covered call for 3% premium with 21% price coverage.

Sold

Stem Inc (STEM): Alternate Energy. Pleasantly surprised to see a 45% pop in price on 4 times average daily volume. Sold next day for 38% potential profit - my accountant will book the huge capital loss. Average loss is 89% - will work with that as that was the idea of the trade.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

AutoInvest

Global Uranium and Enrichment Ltd (GUE.AX): Uranium.

Silex Systems Ltd (SLX.AX): Uranium.

Elevate Uranium Ltd (EL8.AX): Uranium.

Global X Uranium ETF AUD (ATOM.AX): Uranium.

Terra Uranium Ltd (T92.AX): Uranium.

Top Ups

Sims Metals (SGM.AX): Steel. China stimulus popped prices for iron ore and steel stocks. With an entry a little higher than the month ago entry took the chance to average down price a bit further from the two first high entries.

Chose not to add to Bluescope Steel (BSL.AX) on same day as that entry would would have increased entry price - best let the price run.

29Metals Ltd (29M.AX): Base Metals. Not paying attention to orders executued on Friday and did this again at 10% more expensive than the one before.

Nickel Industries Ltd (NIC.AX): Base Metals.

Sold

Sigma Healthcare Ltd (SIG.AX): Healthcare. Closed around 52 week high for 25.5% blended profit since December 2023/January 2024.

Chart shows big run up in price at the time of the merger announcement with Chemist Warehouse. Market order got taken at the top of that spike. Did average down the next market day and that is essentially where the profit came form.

Super Retail Group Ltd (SUL.AX): Retail. Sold at 52 week high target for 26.1% profit since July 2024. Makes for a second cycle win for this stock

Hedging Trades

Pan American Silver (PAAS): Silver Mining. Wrote covered call for 1.2% premium with 10.4% price coverage.

The Technology Select Sector SPDR Fund (XLK): US Technology. With price opening at $221.24 put in place an October expiry 220/215 ratio put spread. This offers protection for a price drop between 0.85% and 3.2% - just enough to address Iran nerves. Trade is cash neutral

[Means: Ratio Spread. Sell more options than one buys with sold premium funding bought premium. ]

Income Trades

15 covered calls writen across 4 portfolios (UK 1 US 13 Canada 1)

Credit Suisse X-Links Crude Oil Shares Covered Call ETN (USOI): OIl. With falling oil prices, covered call strategies have better legs. Scaled into holding in managed portfolio. Yield 18.06%. Prospects of Iran interevention in Lebanon increases oil price volatility - good for writing calls.

Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO): Silver. Silver looks like it wants to break above $31 level - added to holdings of this ETN that trades coverd calls on silver as a hedge and income play. Yield 16.86%

Naked Puts

- CVS Health Corporation (CVS): US Healthcare. Return 1.53% Coverage 5.2%

- Centrus Energy Corp. (LEU): Uranium Enrichment. Return 3.0% Coverage 5.5%

- Global X Lithium & Battery Tech ETF (LIT): Lithium. Return 0.73% Coverage 6.5%

- Wynn Resorts, Limited (WYNN): Gaming. Return 1.15% Coverage 7.1%

- DHL Group (DPWA.DU): Europe Logistics. Return 0.61% Coverage 5.8%

- Glencore plc (GLEN.L): Base Metals. Return 0.61% Coverage 5.8%

- enCore Energy Corp. (EU): Uranium. Return 0.61% Coverage 5.8%

JinkoSolar Holding (JKS): Solar Power. Return 6.36% Coverage 8.9% - ArcelorMittal S.A. (MT.AS): Europe Steel. Return 1.5% Coverage 1.5%

Energy Fuels Inc. (UUUU): Uranium. Return 4.2% Coverage 13.4% - added to fund premium on a January expiry bull call spread.

Rolled out a few sold puts - soem went to lower strikes.

Centrus Energy Corp. (LEU): Uranium Enrichment. 95% profit on buy back. 256% cash positive

NuScale Power Corporation (SMR): Nuclear Technology. 90% profit on buy back. 79% cash positive and 11% lower strike

NexGen Energy Ltd. (NXE): Uranium. 60% profit on buy back. 42% cash positive

Fiverr International Ltd. (FVRR): Internet Services. 23% profit on buy back. 13% cash positive and 8.7% lower strike

NuScale Power Corporation (SMR): Nuclear Technology. 43% profit on buy back. 13% cash positive - one of tw short positions kicked down the road - not patiner enoug to let this run to expiry in the up market - stretch the risk and bank the profit.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

September 30 - October 4, 2024

tib investing stocks bitcoin crypto options uranium

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

#hive #posh