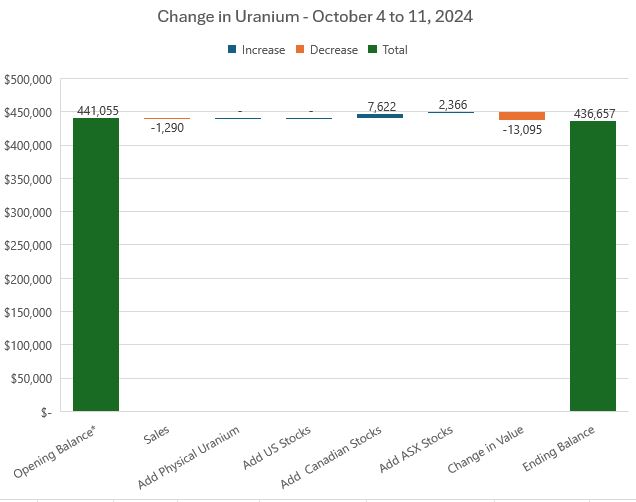

A down week for uranium gives opportunity to add a little more to average down entry prices. This is the end of the adds there.

Portfolio News

In a week where S&P 500 rose 1.15% and Europe traded flat, my pension portfolio rose 0.46%. Drags were ASX resource stocks (some lithium and base metals and a few uranium stocks), Japan (only 4 stocks positive), solar power in US and a mixed bag of Canadian stocks. The whole value profile is biased by the huge run up in one stock - top of the leaderboard below

Big movers of the week were Arcadium Lithium (ALTM) (80.5%), Castillo Copper (CCZ.AX) (50%), Panther Metals (PNT.AX) (50%), Orthocell (OCC.AX) (43.5%), Stem Inc (STEM) (31%), Heavy Minerals (HVY.AX) (23.8%), Evolution Energy Minerals (EV1.AX) (23.5%), Gevo (GEVO) (22.6%), Lithium Universe (LU7.AX) (21.4%), Sun Silver (SS1.AX) (20.8%), Titan Minerals (TTM.AX) (19%), DGL Group (DGL.AX) (18.9%), AdAlta (1AD.AX) (16.7%), St Barbara (SBM.AX) (14.9%), Duratec (DUR.AX) (14%), Northern Dynasty Minerals (NAK) (13.5%), Standard Uranium (STND.V) (12.5%), Sarytogan Graphite (SGA.AX) (12.4%), Resource Development Group (RDG.AX) (12%), Lightning Minerals (L1M.AX) (10.8%), Loop Industries (LOOP) (10.1%)

A modest list of 21 stocks moving more than 10% in the week. News is an important driver with Arcadium Lithium (ALTM) being taken over by Rio Tinto, farm in deal at Castillo Copper (CCZ.AX), gold nugget discovery at Panther Metals (PNT.AX) and regulatory approval in Singapore for Orthocell (OCC.AX). Lithium is the leading theme (3 stocks), with battery materials (3 stocks) and alternate energy (1 stock). Silver/gold mining scores with 4 stocks.

Markets spent the week edging sideways to higher highs and record closes. And the analysts are beginning to talk more and more of a soft landing - or even a no landing. With less than a month to go the US Election this is no surprise to me - the money men behind the Democrats cannot afford a correction as the Democrats will certainly lose if there is one.

Crypto Drifts

Bitcoin price drifted lower to test the $60k level of last week, rejected that and end the week 1% higher with a peak to trough range of 8.5%

Ethereum price was a mirror testing the low of last week, rejecting that and ending 1.1% higher with a peak to trough range of 7.7%

The cycling along the moving averages on ETH pairs continued but mostly down for the week - a sample from last week - Litecoin (LTCETH)

Positive price action in Chiliz (CHZBTC) with a second cycle after reversing and a pop of 25%. News is a some new partnerships (e.g., with Alfa Romeo F1 Team Sauber) and more likely to do with the airdrop of PEPPER coins.

Uniswap (UNIBTC) confirms the reversal from the downtrend after a few months trading sideways with a 28% pop.

Uranium Holdings

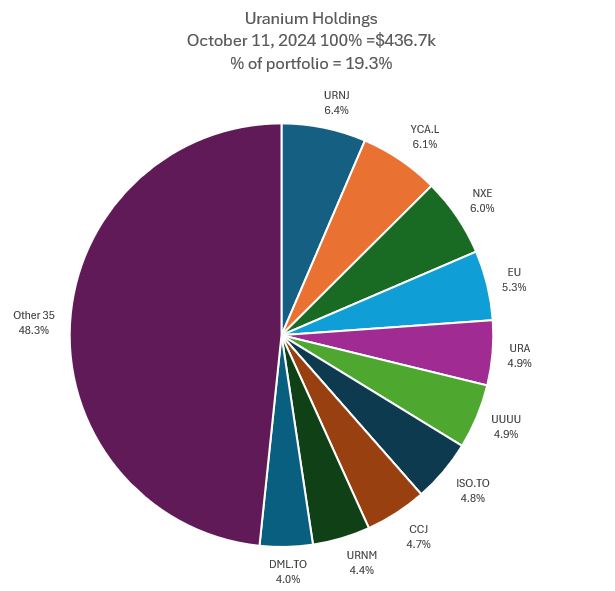

A quiet week for uranium and valuation follows suit with a 3% reduction in value. Additions were made in Canada and on ASX with one set of sales in Canada.

Mix of holdings sees a few changes with Global X Uranium ETF (URA) and Energy Fuels (UUUU) swapping places. IsoEnergy (ISO.TO) swaps places with Cameco (CCJ) and Denison Mines (DML.TO) comes into slot 10 displacing Sprott Physical Uranium Trust (U-UN.TO). Share of Others stays unchanged despite the selling down in one stock. Share of overall portfolio comes down 0.2 percentage points to 19.3%.

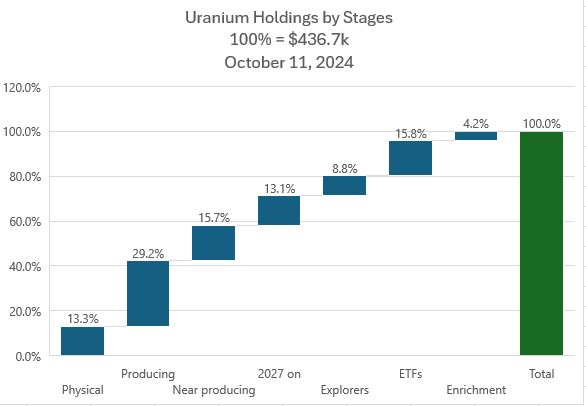

Holdings by stage sees a small step up in near producing and 2027 on with the additions there and a small slide in phyiscal with the lagging of spot price to mining valuations.

Portfolio news is option agreements between two portfolios holdings - Atha Energy (SASK.V) and Terra Uranium (T92.AX).

https://ceo.ca/@globenewswire/atha-energy-announces-option-agreements-with-terra

Alternate Energy Holdings

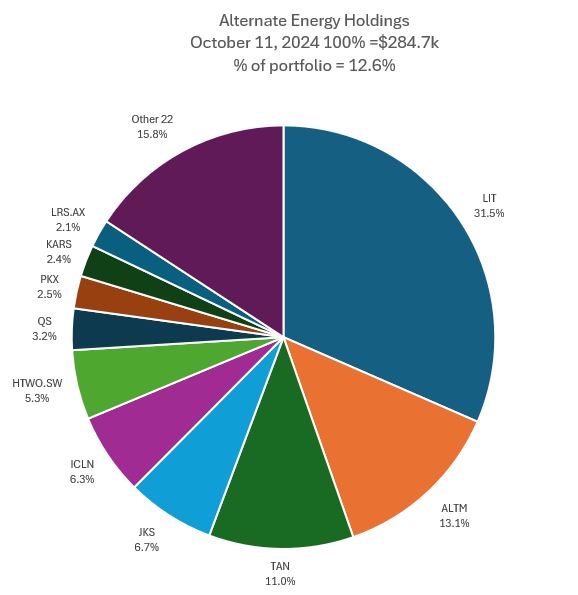

Valuation went up 2.6% mostly driven by the Arcadium Lithium (ALTM) takeover. No change in holdings in the week. That takeover pushes Acradium Lithium (ALTM) up two places into slot 2. Jinko Solar (JKS) drops a slot with nearly 2 percetage points drop in weight. Share of portfolio rises 0.4 points to 12.6%

Bought

Lotus Resources Limited (LOT.AX): Uranium. News is the reopening of Kayelakeera plant in Malawi has been accelerated by several months

Scaled in holding in pension portfolio to match sizing on other ASX holdings.

iShares 7-10 Year Treasury Bond ETF (IEF): US Treasuries. With yields spiking (Oct 7) opened a new holding in pension portfolio - picked the shorter duration rather than going 20 Year plus. Also sold 96 strike October at-the-money puts with 0.34% return. Feels like a 0.34% discount on buying the stock.

Global Atomic Corporation (GLO.TO): Uranium. Global ran a capital raise ahead of their funding round - price was hammered by markets below the raise price

Topped up holdings in each portfolio. The Dasa resource is key to future uranium supply - the mine build is making progress. Worth a punt despite the Niger jurisdiction risk.

Coty Inc (COTY): US Consumer Products. Assigned early on sold put. Breakeven after sold puts for last 12 months is $9.18, a small premium to $9.21 close (Oct 11)

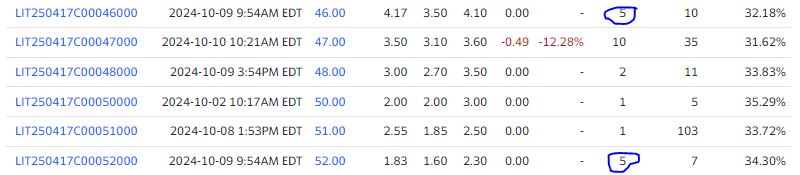

Global X Lithium & Battery Tech ETF (LIT): Lithium. China stimulus has reawakened lithium and electric vehicle markets. Takeover by Rio Tinto (RIO.AX) of Arcadium Lithium (ALTM) added to that price impetus. Set up a April 2025 expiry 46/52/44 call spread risk reversal in the managed portfolio. With net premium of $2.43, the 46/52 bull call spread offers maximum profit potential of 147% for a 14.6% move in price from the $45.37 open (Oct 9). The sold put (44) makes the trade a cash positive trade with price coverage of 3% and brings breakeven down to $42.95 should the sold put go to assignment.

Let's look at the chart which shows the bought call (46) as a dotted blue ray and the sold call (52) as a dashed red ray and the sold put (44) as a dotted red ray with the expiry date the dotted green line on the far right margin. The trade is essentiall y teh saem as one made the week before but with more time. The blue arrow price scenario comes from the previous uptrend and is mid-sized of the rises seen. That size move will take this trade comfortably to the maximum. The sold put (44) level is in the middle of nowhere land but it would give a re-entry above the covered call assignment level - that fixes the problems in that trade if it flows that way.

Options chain shows the call options were the volume for the day.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

Glencore plc (GLEN.L): Base Metals. Added to holding in personal portfolio to average down entry cost. Wrote covered call for 0.9% premium with 9.9% price coverage.

GoGold Resources Inc (GGD.TO): Gold Mining. Averaged down entry price in pension portfolio.

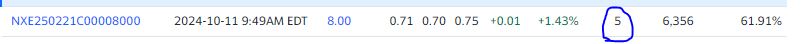

NexGen Energy (NXE): Uranium. Price has been nudging upward over the past month passing $7 for the first time since July 2024. The technical review of the Federal Indigenous Review Team (FIRT) is due to complete October 20. NexGen's Rook-1 field is key to meeting the supply deficit when it kicks in in 2030 or 2031. Some say it is essential to be delivered. Put in place an open ended Feberuary 2025 expiry 8 strike call option. Funded that fully by selling November expiry strike 7 put options in a ratio

Quick look at the chart which shows the bought call (8) as a blue ray and the sold put (7) as a dotted red ray with the expiries the vertical green lines. The red arrow points to the date of the FIRT review extension. If the outcome is positive, the project will go to the next stage of development. Price could well follow an Elliot Wave like pattern - using the one from the April 2023 up trend shows leg 2 to 3 going past the bought call (8) before expiry. There is a level of support/resistance around the $7 mark (pencilled blue line). Currrently this portfolio has an average cost higher than that - would not be unhappy being assigned at that price.

Also the options volume for the day

Sold

Anfield Energy Inc (AEC.V): Uranium. Pending order at implied value of IsoEnergy offer (ISO.TO) taken up for 23.6% blended profit since April/June 2024 in pension portfolio. Averaging down helped ramp up the profits. In managed portfolio, only closed out half the position to cover the possibiliy of a competing bid coming along. Profit there was 18.8% percent blended profit since April/June 2024. Profit in personal portfolio was 50% from July 2024.

The trade idea was to close out the acquired holding and switch to the acquirer. The purchase of IsoEnergy (ISO.TO) was made the week before.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Domino's Pizza Enterprises Limited (DMP.AX): Restaurants. Dividend yield 3.20%.

Chart shows price breaking the downtrend and making a double bottom with enough headroom to make a 40% profit target without having to close that big price gap from January 2024.

Eagers Automotive Limited (APE.AX): Automotive Retail. Dividend yield 6.00%. Have had buy signals on two automotive retail stocks in the week - the other is Autosports Group (ASG.AX) where price popped on an acquisition they made.

Made the choice based on a price comparison chart going back to cycle low. Eagers (purple line) is lagging by 38 percentage points and has shown a solid bottoming formation since May 2024

Auto-Invest

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Distribution yield 3.5%

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Distribution yield 1.6%

Sold

APM Human Services International Limited (APM.AX): Human Resources. Takeover yields 14.1% blended loss since October 2023/March/July 2024. Only one tranche marginally profitable

Austal Limited (ASB.AX): Shipbuilding. Closed out at extended profit target for 47.7% profit since January 2024. Chart shows the entry after Austal won a medical ship contract from US Navy. Somehow missed the news that South Korea's Hanwha Ocean (042660.KS) was in talks to acquire Austal - would have exited earlier. This is now the second profitable exit on a Sharesies stock (see TIB689 for the rationale of the last entry)

The chart shows the way the model is designed to work - enter after downtrend is broken and trade up to exit at 35% plus profit target. By the nature of Austal's business there may well be more opportunities.

Hedging Trades

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. Read a few tweets suggesting gold miners have lagged rising gold price - good model to hedge is to watch the miners close the gap. Bought a parcel of stock. Wrote covered call for 1.85% premium with 9.3% price coverage.

Added in some options trades to test a few open ended trades. Next day with price opening at $40.03 (Oct 11) bought January 2025 expiry 41 strike call option and funded that with a ratio of strike 38 sold puts. Price needs to move 2.4% to go in-the-money and there is 5.3% price coverage.

Chart shows the bought call (41) as a blue ray and the sold puts (36 and 38) as dashed red rays with the respective expiries the vertical green lines. The blue arrow is a cloned price scenario which has been repeated a few times. Trade will need a move that size to go in-the-money. The more probable scenario is for price to keep cycling higher along the pencilled in blue line. The sold put levels are below the last two reversal points - happy to buy at this level.

Now I did check the lagging story after the event going back to the 2023 lows - not true in a rising market. Each time gold price has sagged or gone sideways it becomes true and price outperforms the miners. The chart shows SPDR Gold Trust (GLD) as the bars and Van Eck Gold Miners ETF (GDX) as the purple line. Go back to 2022 cycle low and miners outperformed by 10 points. Go back to 2016 lows and there were periods of outperformance but ended at the same spot. Go back to the 2012 cycle high is the one time under-performance is clear at a massive 70 percentage points.

The Technology Select Sector SPDR Fund (XLK) US Technology. With price closing at $230.81, 210 strike sold put expired out-the-money. Reduces the loss on the hedge to 8.2% but with one more expiry to run 12.5% further out-the-money the hedge should complete in profit

Income Trades

Quiet week with only 5 covered calls written (UK 1 US 3 Canada 1)

Naked Puts

Sold puts on stocks that could be assigned on covered calls

- Sixt SE (SIX2.DE): Car Rental. Return 0.91% Coverage 1.6% - close in expiry

- Sixt SE (SIX2.DE): Car Rental. Return 2.34% Coverage 4.8% - November expiry

- Sixt SE (SIX2.DE): Car Rental. Return 1.27% Coverage 4.2% - different portfolio

- 3D Systems Corporation (DDD): 3D Printing. Return 4% Coverage 0% - aiming for discounted entry price if stock is assigned

- HelloFresh SE (HFG.DE): Europe Restaurants. Return 3.44% Coverage 2.9%

- Société Générale (GLE.PA): French Bank. Return 1.14% Coverage 0.7% -

Sold puts on stocks happy to acquire at lower prices

- VanEck Gold Miners ETF (GDX): Gold Mining. Return 0.67% Coverage 11.2%

- NexGen Energy Ltd. (NXE): Uranium. Return 7.6& Coverage 1.4%

- iShares 7-10 Year Treasury Bond ETF (IEF): US Treasuries. Return 0.34% Coverage 0% - aiming for discounted entry price

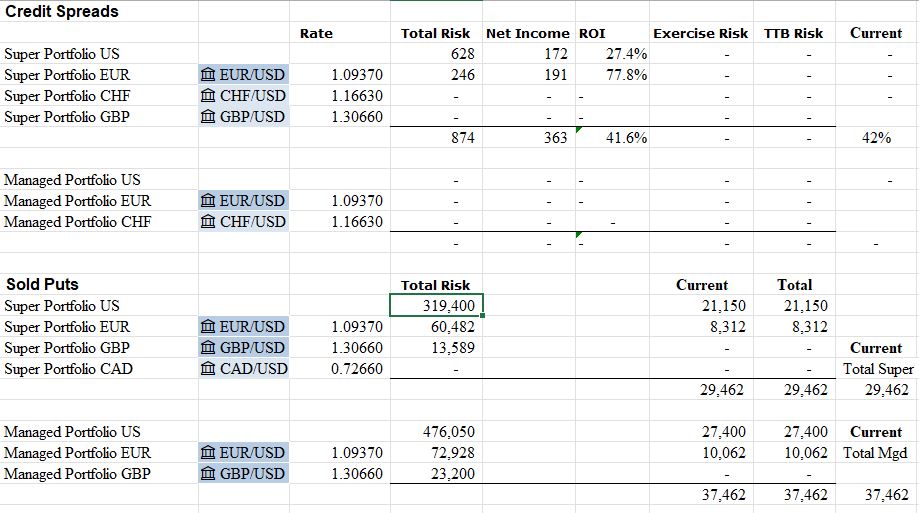

Credit Spreads

No change - the few spreads in place are out-the-money

Exercise risk across the portfolios is well within cash margin. However, the total risk in the pension portfolio is out of line despte the low exercise risk. Work to do to reduce that.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

October 7-11, 2024

#hive #posh