Edging in to US Election and promising no more adds to uranium. Guess what? Added uranium. Hedged a bit on the back of rising silver

Portfolio News

In a week where S&P 500 dropped 1.38% and Europe dropped 1.09%, my pension portfolio dropped a more modest 0.49%. Positive contributions came from ASX lithium stocks plus the bounce back in troubled Mineral Resources (MIN.AX), Japan stocks (only 4 down), nuclear technology. Biggest single value mover was from Fiverr International (FVRR). Biggest source of drag were uranium stocks mostly sliding between 4 and 10%.

Big movers of the week were ASP Isotopes (ASPI) (59.6%), Fiverr International (FVRR) (34.6%), Castillo Copper (CCZ.AX) (28.6%), Mineral Resources (MIN.AX) (19%), Oklo (OKLO) (17.7%), Global Uranium and Enrichment (GUE.AX) (17.6%), 3D Systems Corporation (DDD) (17.3%), JinkoSolar Holding Co (JKS) (16.4%), Société Générale (GLE.PA) (15%), Terra Uranium (T92.AX) (12.7%), Lightning Minerals (L1M.AX) (12.3%), Largo (LGO) (11.6%), Sarytogan Graphite (SGA.AX) (10%)

A short list of 13 big movers this week. From the top the big themes represented: nuclear technology (2 stocks), batery materials (2 stocks), uranium (2 stocks), alternate energy (2 stocks), lithium (1 stock). Jump in a few on news and earnings.

Market continued the earnings gyrations - one day happy and the next day not happy depending on guidance more than results.

A few quotes

It was a tough week for US stocks as uneven results from the dominant tech sector put indices on the back foot.

Magnificent 7 is the new buzzword - 5 of the 7 reported and only 2 were a little disappointing. The headline writeers are talking tech up again.

Meanwhile the focus turns to the US Election. The US economy appears to be in solid shape despite a lackluster jobs report on Friday (Nov 1). The S&P 500 has performed well since the candidacy for the Democrats was changed.

the S&P 500’s performance in the run-up to Election Day has historically been a strong indicator of whether the incumbent party’s candidate will retain control of the White House — correctly forecasting all but four presidential races over the last 96 years.

Which 4? The last one wrong was 2020 - maybe somethig else was going on? 2020 was a difficult year to be running as the incumbent. Given that uncertainty, have chosen to not reinvest much of the capital released at last options expiry. This time next week, we will know.

Crypto Backs Off

Bitcoin price pushed higher passing the previous week high and then fell over ending the week 1% higher with a peak to trough range of 8.3%

Ethereum price pushed higher but could not pass previous high and fell over ending the week 1.5% lower with a peak to trough range of 11.5%

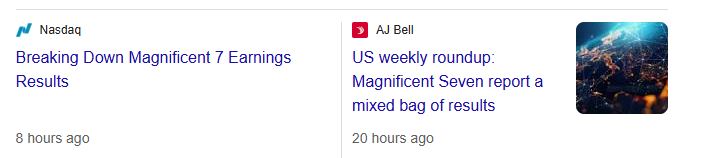

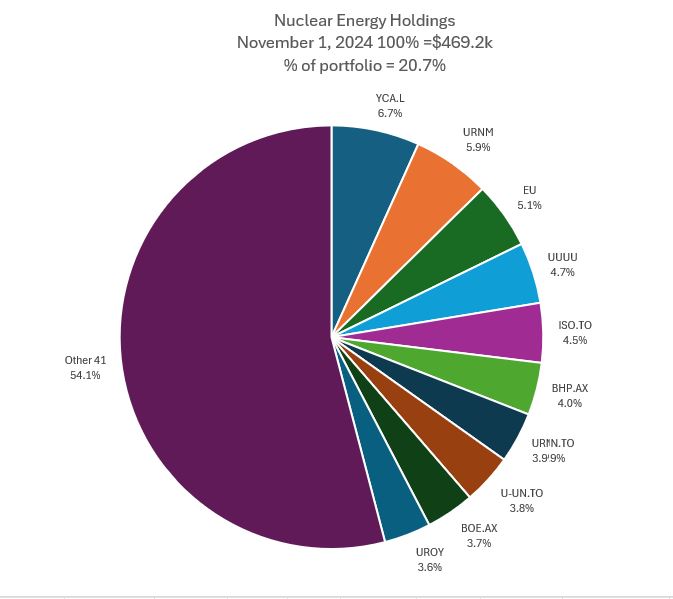

Nuclear Energy Holdings

A challenging week for uranium valuations with a 5.3% drop across the board, mostly in uranium and not in nuclear technology. No sales in the week and additions made across all 3 markets and physical.

Change in mix with the additions shift Sprott Uranium Miners (URNM) up a place to slot 2 and Sprott Junior Uranium Miners (URNJ) up a palce to slot 7. Recovery in sentiment for BHP Group (BHP.AX) sees it rise a place to slot 5. The addition to YelowCake plc (YCA.L) sees its share rise 0.5 percentage points. No changes in what is is in the Top 10. Overall share of portfolios rises 0.5 points to to 20.7%

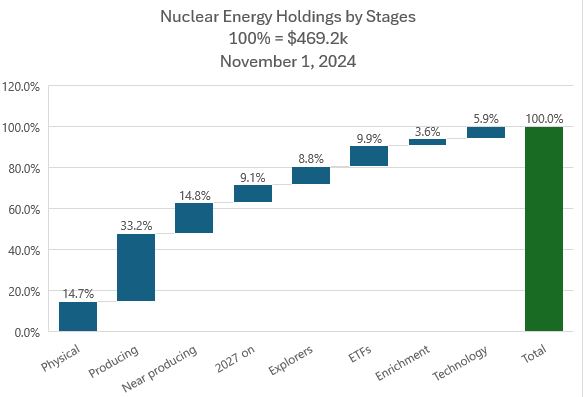

Analysis of holdings by stage sees near producers up by 0.4 percentage points, explorers up by 0.6 percentage points, ETFS up 1 point with the additions made there and enrichment up 0.7 points with an addition there and improving sentiment.

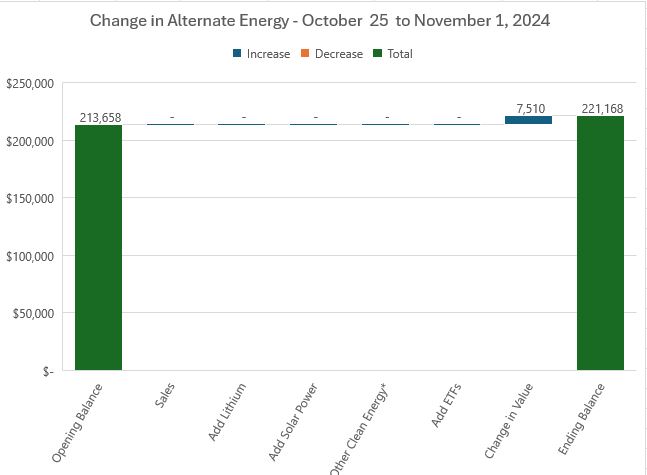

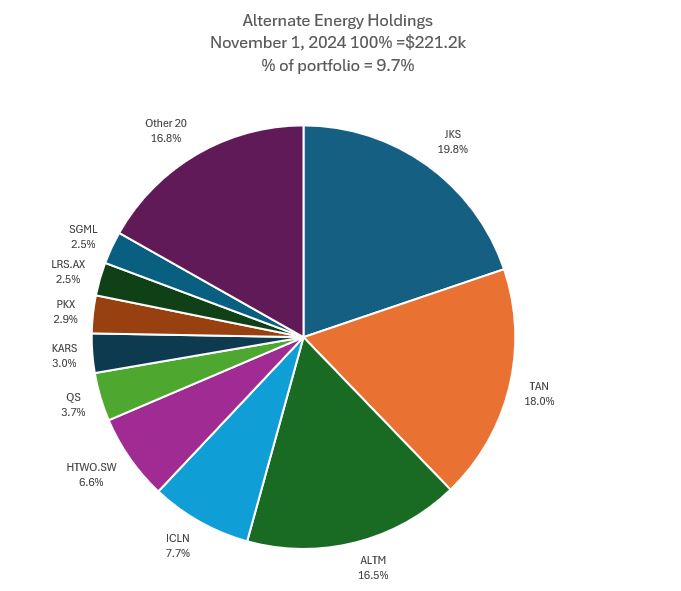

Alternate Energy Holdings

No change in alternate energy holdings with valuations improving 3.5% (mostly solar)

Change in the mix with share of portfolio rising 0.5 points to 9.7% and JinkoSolar (JKS) moving up a place to slot 1. Latin Resources (LRS.AX) moves up a place to slot 9. No other changes in the Top 10.

Bought

Paladin Resources (PDN.AX): Uranium. Paladin released quarterly operations report which highlighted some restart challenges at the Langer Heinrich mine in Namibia. Yes, there was production and sales but throughput was a bit down and costs were higher than FID AISC. Share price was smacked 20% - investors think this is permanent. They will fix the challenges. Averaged down entry price in my pension portfolio by adding back to get holding size back to $10k

Averaging down on the pullback in uranium ETFs - that is enough add backs for now.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Added to pension portfolio.

Sprott Uranium Miners ETF (URNM): Uranium. Added to pension portfolio.

Forsys Metals Corp (FSY.V): Uranium. Scaled into holding in pension portfolio. Looking for a takeover of one of the Namibian explorers/developers by Rosatom or Orano.

Alerian MLP ETF (AMLP): US Oil. Pullback in oil price gives an opportunity to add back some oil. Alerian underperforms the oil majors (Exxon (XOM) and Marathon Oil (MRO) shown for comparison.

Make up half the gap makes for a tidy profit - and dividends are tax free.

Stuhini Exploration (STU.V): Silver Mining. With the sale of Honey Badger Silver (TUF.V) added to holding to average down entry price. Why choose this one is a good question.

Chart looks like a forever downtrend and maybe not even bottomed out. Overlay is Honey Badger Silver (TUF.V - the purple line). It was looking much the same until the spike from last week. Maybe hoping for one of those spikes on rising silver market. Better model is to study silver more carefully and then pick possible winners.

Silex Systems Limited (SLX.AX): Nuclear Enrichment. TerraPower signed a deal with ASP Isotopes to develop an HALEU enrichcment facility for small modular reactors. The whole segment of enrichment should step up behind this move. Added to holding in personal portfolio to scale in - on a down day.

Yellow Cake plc (YCA.L): Uranium. Added to holding in personal and managed portfolios to average down entry price - waiting for spot uranium to move. Needs a patient wait.

Fission Uranium Corp (FCU.TO): Uranium. Added a small parcel deploying spare capital in small managed portfolio. Fission is subject to a takeover by Paladin Resources (PDN.AX). That takeover has received court approval but is subject to a security review from the Canadian Ministry of Innovation, Science and Industry - a bit weird given Paladin is an Australian business with exisitng properties in Canada in addition to Australia and Namibia. Because of this, price is trading at something of a discount to the implied value of the original Paladin offer.

Note: Sold all the Fission stock in other portfolios at the time of the takeover offer.

Sold

Honey Badger Silver Inc (TUF.V): Silver Mining. Closed out at 52 week high for 38% blended profit since May/August 2021/January 2022/December 2023/March 2024. Last 3 tranches were the profit drivers - ran out of patience

Orthocell Limited (OCC.AX): Australian Pharmaceuticals. Closed out holding in pension portfolio to raise cash for next month pension payment. Locks in 7.7% profit since January 2021. Out of pateince despite Ortocell getting approval for its Remplir product in Singapore this month. Part of the out of patiences is the company just completed a dilutory private placement not open to exisiting shareholders. Needless to say that placement inlcuded a huge pile of warrants to give the chance for more feeding from the pig trough.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Sayona Mining Limited (SYA.AX): Lithium.

Chart shows price has levelled out after the dramatic collapse in lithium prices. Cannot say it has reversed yet but the mood in the lithium market has improved lately.

Sold

Insignia Financial Ltd (IFL.AX): Financial Services. Closed out at target above 52 week high for 26.1% blended profit since November 2022/January/February/April/July 2024.

Chart is a good example where the strategy does not work well and when it works well. First entry (left hand blue ray) was on 2nd cycle after downtrend was broken. Price then failed to maintain momentum and collapsed before establishing a double bottom with a few entry chances after that. The scaling in effect recovered the high entry price of the first entry.

Hedging Trades

Coeur Mining (CDE): Silver Mining. Two tranches - 2nd one to average down a little. 1.77% 10.3%

iShares Silver Trust (SLV): Silver. Replaced stock assigned in pension portfolio at 2.17% premium to assigned price - two months covered calls to recover that. 1.1% 5.9%

Income Trades

7 covered calls written in two of the four portfolios (Europe 1 US 6)

Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO): Silver. Added to covered call ETN on silver at same time as adding the other hedging positions. Price tends to lag the iShares Silver Trust (SLV) but yield is 18.17% - makes up for that. Saves doing the work writing the covered calls and replacing stock when it gets assigned.

Naked Puts

A bit more action in the sold put side

Stocks happy to won at a lower entry price

- DHL Group (DPWA.DU): Europe Logistics. Return 2% Coverage 5.1%

- Barclays PLC (BARC.L): UK Bank. Return 2.93% Coverage 3.8%

- Dutch Bros Inc. (BROS): US Restaurants. Return 2.83% Coverage 17%

- Elevance Health, Inc. (ELV): US Healthcare. Return 2.08% Coverage 2.6%

- Nokia Oyj (NOK): Network Equipment. Return 1.33% Coverage 7.8%

- Coeur Mining, Inc. (CDE): Silver Mining. Return 2.18% Coverage 24%

- Oklo Inc (OKLO): Nuclear Technology. Return 11.7% Coverage 14.5%

- Société Générale (GLE.PA): French Bank. Return 3.1% Coverage 3.5%

- Denison Mines Corp. (DNN): Uranium. Return 4% Coverage 5%

Stocks that could pass covered call strike

- Fiverr International Ltd. (FVRR): Internet Services. Return 2.5% Coverage -2.8% - strong sales guidance propels stock 24% in one session (Oct 30). Will allow this to go to assignment to average down entry price. As it happens Friday close (Nov 1) was above sold strike.

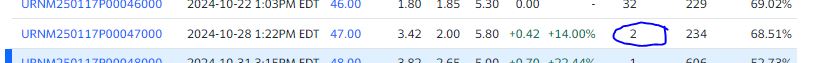

Sprott Uranium Miners ETF (URNM): Uranium. With price opening at $47.75 (Oct 31) added January 2025 expiry 47 strike sold put to leverage funding of a January 2025 54/60 call spread risk reversal. Price has to move 25.7% to reach the 164% maximum profit on the spread. While coverage is only 1.6%, breakeven is now down to $43.03 - comfortably below the market. Option chains shows this was the volume for the day.

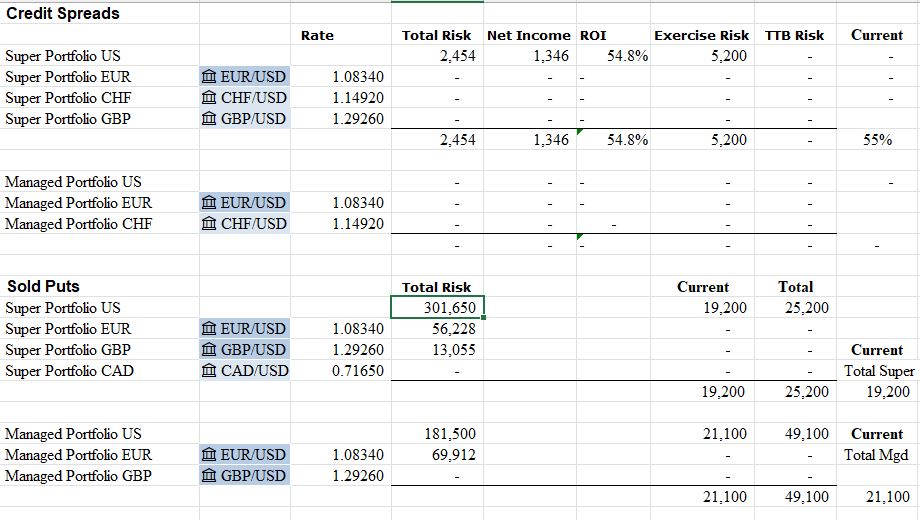

Credit Spreads

Pfizer Inc (PFE): US Pharmaceuticals. Pressure seems to be building again for a court case against Pfizer for mRNA injuries. Was looking at putting in place a short term ratio put spread. Did not work out that way - late night finger trouble resulted in a December 6 27 strike long put option funded by a December 20 28 strike sold put. Effectively this creates a diagonal 28/27 credit spread and a bought put at strike 27. To win price needs to drop below $27 by December 6. Going to take some fixing to get this right. Credit spread has a ROI of 62.6% with coverage of 2.14%

- Robinhood Markets (HOOD): Financial Services. ROI 50.8% Coverage 8.5%. Rising markets are good for retail investor channels - added one spread here

Went back to TheStreetPro research to tap into new additions they are making in their holdings. Rather than buy stock, put in place credit spreads at or below their entry prices

- Applied Materials (AMAT): US Semiconductors. ROI 57.5% Coverage 3.8%

- Elastic N.V. (ESTC): AI Technology. ROI 54.1% Coverage 0.3%

Exercise risk across the portfolios is very low with only one largish exposure (on a stock happy to add to). Total Risk in pension portfolio appears high but it does include one large holding that is considerably out-the-money with December 2024 expiry = never a risk of assignment unless the business goes bankrupt. That will not happen.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

October 28 - November 1, 2024

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

#hive #posh