No more uranium adds idea fails - added more uranium and then got a raft more at options expiry. Good thing the Russian ban came along

Portfolio News

In a week where S&P 500 dropped 2.08% and Europe dropped 2.56%, my pension portfolio dropped 2.39% - between the two. The drags were ASX uranium stocks, all of Europe (not holding much anyway), most of Japan, Korean steel, nuclear technology. A bit of daylight on ASX lithium stocks and UK stocks was it.

Big movers of the week were Blue Star Helium (BNL.AX) (66.7%), Vulcan Energy Resources (VUL.AX) (26.2%), Zinc of Ireland (ZMI.AX) (22.2%), Anfield Energy (AEC.V) (15%), Tyro Payments (TYR.AX) (13.3%), American Rare Earths (ARR.AX) (12.5%), Sharp Corporation (6753.T) (12.5%), Standard Uranium (STND.V) (11.8%), Castillo Copper (CCZ.AX) (11.1%), ProShares UltraPro Short QQQ (SQQQ) (10.9%), Latin Resources (LRS.AX) (10.5%), AML3D (AL3.AX) (10.3%)

A very short list of big movers with only 11 stocks on the list. Part of this is timing with ASX closed at the time the Russian uranium ban was announced which pushed up North American listed uranium stocks. Hard to pick themes this week - news driving the top 2 with Blue Star starting work on 5 new wells and Vulcan securing development financing for their lithium project in Europe. 2 uranium stocks and 2 lithium stocks make the list - and there was one short stock - it was a down week after all.

A favourite phrase got rolled out in the week - post election rally stumbles. Was a week of nerves as markets absorbed Trump's team picks, Jerome Powell was a bit strong on the economy and then the RFK pick trembled the pharma stocks. The headlines - picked one for each day from midweek and two for Friday mood.

Crypto booms

Bitcoin price kept the momentum running from the week before in its own post election rally to create at all time high ending the week 12.7% higher with a trough to peak range of 15.2%

Ethereum price momentum did not hold falling over and ending the week 0.3% lower with a peak to trough range of 12.4%. The cash went to Bitcoin.

Like last week, Cardano (ADA) kept motoring with a 44% pop giving away less than a quarter of that.

A few charts with similar shapes - 25% pop and giving away half toward the end of the week and then reaching to make new high this week. EOS example

There is more to the story than a post election rally. Rumours are that Gary Gensler will get fired as head of SEC - that certainly played into Ripple price (XRPUSD) up 114% at one stage

The other rumour beginning to float is problems in Ethereum - it has not shown the same surge as the altcoins.

Pump and dump in HIVE with a 67% pop against Bitcoin at the same time Bitcoin made its all time high.

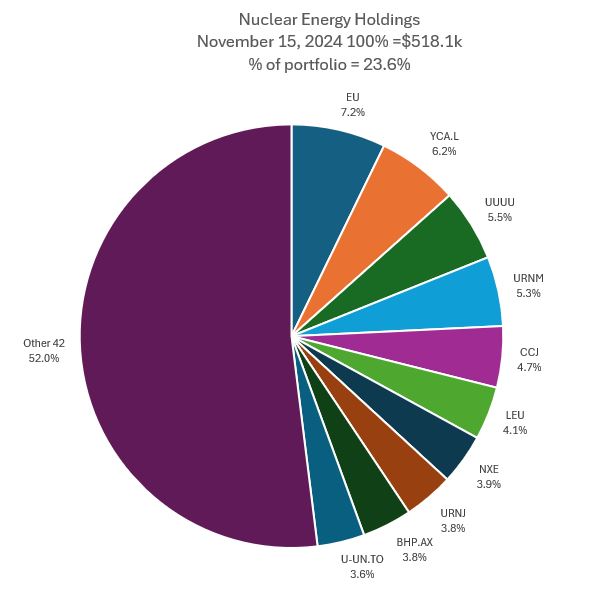

Nuclear Energy Holdings

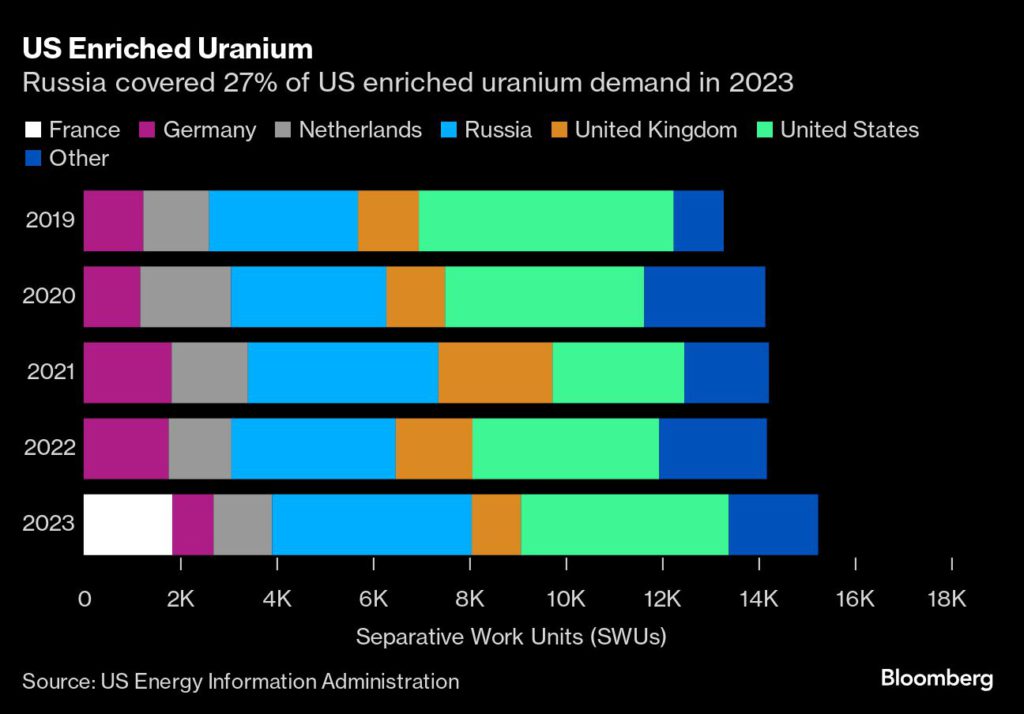

Late hitting news pushed uranium spot up a few dollars before the weekend and after ASX close (Nov 15). The pale blue bits on these charts show why this is important - that is Russia supply

Chart is from this article below

https://www.mining.com/web/russia-temporarily-limits-nuclear-fuel-shipments-to-us/

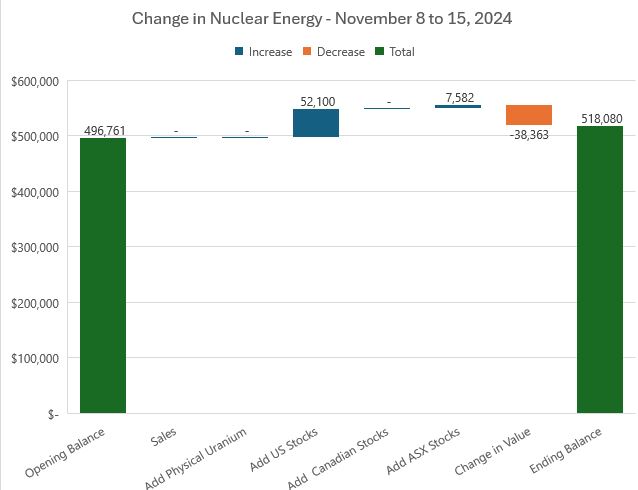

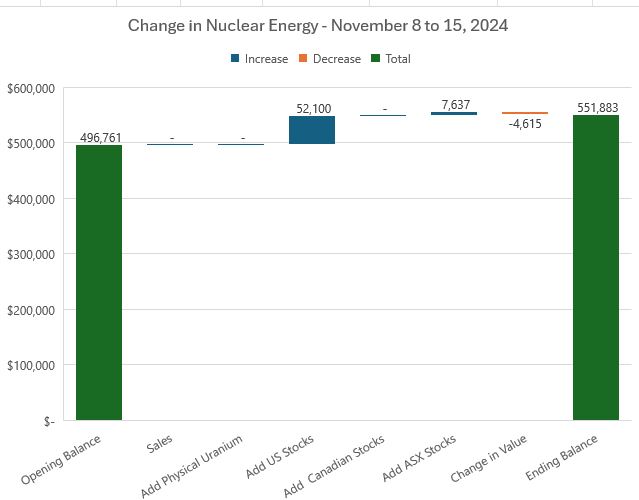

A busy options expiry adds a few more stocks on sold puts assigned and a tough week for uranium sees overall portfolio drop 7.72%.

There is a timing distortion in here as ASX was closed when Russia ban was announced - it opened higher appreciably on Monday. The 2nd chart shows valuation change after market close on Monday (Nov 18) and ASX open (Nov 19). Those sags almost fully recovered.

The additions make for some changes in mix - firstly with percentage of portfolio jumping nearly 2 points to 23.6%. Coming weeks will see some profit taking and focus in on producers and near producers. EncoreEnergy rises 4 places to slot 1. Sprott Uranium Miners (URNM) drops two places to slot 4. Cameco Corporation (CCJ) and Centrus (LEU) and NexGen (NXE) come into the top 10 in slots 5 and 6 and 7. Sprott Junior Uranium Miners (URNJ) drops 2 places to slot 8 and BHP Group (BHP.AX) drops 4 places to slot 9 with Sprott Physical Uranium Trust (U-UN.TO) dropping to 10th. Falling out the Top 10 are Uranium Royalty Corp (UROY) and Uranium Energy Corp (UEC).

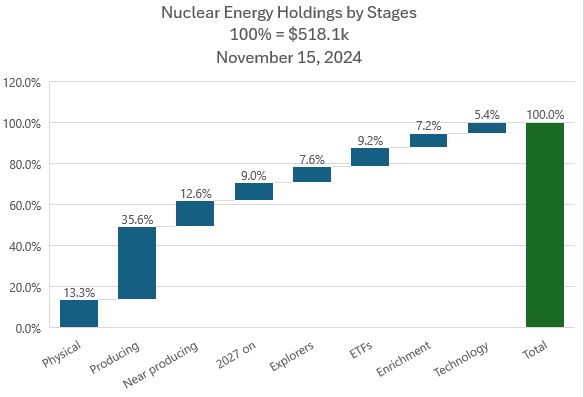

Holdings by stage sees producers go up 1.7 points with the additions to Cameco (CCJ) and Encore Energy (EU). Enrichment goes up 1.7 points too with the addition of Centrus (LEU). 2027 on cohort goes up with the addition of NexGen (NXE). Relative weight of explorers falls a bit

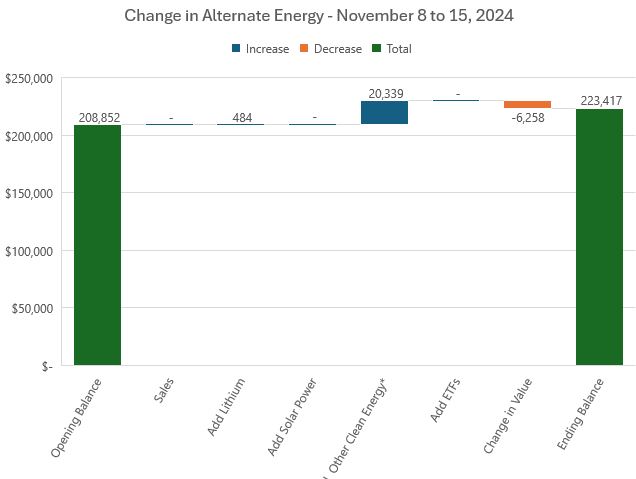

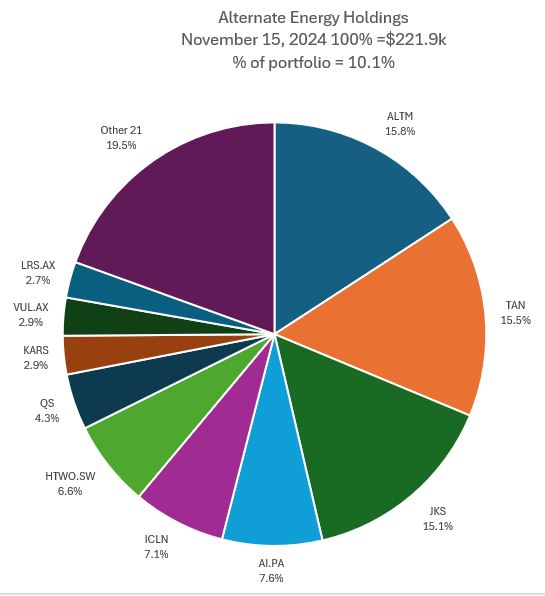

Alternate Energy Holdings

Alternate energy portfolio has a few changes with a small lithium addition and a sizeable addition in Other Clean Energy - hydrogen play via Air Liquide (AI.PA)

Changes in mix with a few additions sees share of portfolio rising nearly one point to 10.1% and Arcadium Lithium (ALTM) rising two spots to take number 1 slot and JinkoSolar dropping two places to slot 3. New addition, L'Air Liquide (AI.PA) comes into Top 10 at slot 4. Vulcan Energy comes into slot 8 on the rise in value there. Dropping out of the Top 10 are Latin Resources (LRS.AX) and Leo Lithium (LLL.AX)

Bought

Paladin Energy (PDN.AX): Uranium. Paladin cut guidance for 2025 production from Langer Heinrich in Namibia - close to 1 million lbs less than previously projected. Share price was hammered. Spot price sagging did not help either.

Added parcels in personal and pension portfolios figuring market was over reacting with a short term bias and not looking forward enough. Provided Paladin has not already got fixed contracts in place above projected production, risk is low. Would have thought their announcement would mention it if they did.

Lotus Resources Limited (LOT.AX): Uranium. Lotus Resources are running a rights offering closing this week at $0.25 a share. Read through the offering documenets and there do not appear to be any options attaching to the new shares. In the personal portfolio addded a tranche below the offer price. Took the lazy way out in the managed and pension portfolios and took up the offering in a modest position size. At the end of the week when Peninsula Energy Limited (PEN.AX) announced delayed build up to Lance production share price got beaten down even further. Added a 2nd tranche for the week even lower (17.6% lower) in the personal portfolio.

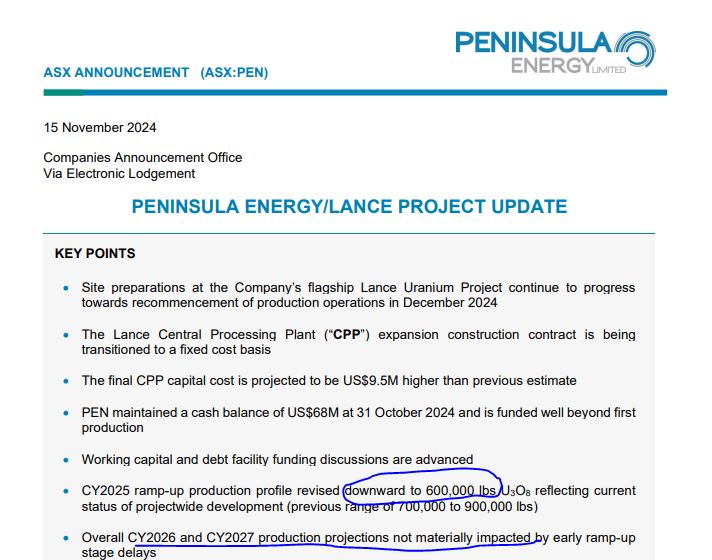

Peninsula Energy Limited (PEN.AX): Uranium. Operations update for Lance project indicated a reduction in 2025 production to 600,000 lbs and another capex overrun of $9.5 million. Price was smashed on ASX down 25%.

Added a tranche in personal portfolio to average down entry price - this is consistent with last week's focus on US producers and near producers even though the management team seems to have some cost control problems.

ASP Isotopes Inc (ASPI): Nuclear Technology. On a day where uranium and uranium enrichment went down, ASP was heading up - time to add a few options trades in the pension portfolio. Options are available up to April expiry. As prices do move hard when they move, it is better to be a bit closer in - chose to work with January 2025. Put in place two trades. First was January expiry 9/12/6 call spread risk reversal. Bought a 9/12 bull call spread for a net premium of $0.53 offering maximum profit potential of 466% if price moves 50.6% from $7.97 closing price (Nov 12). Funded this fully by selling a December expiry 6 strike put option which is 24.7% price coverage. Breakeven for this put option is $5.96 should trade go to assignment.

That feels like a blue sky trade. Next is a bit more blue sky, set up a 10/7 risk reversal. This implies buying a January expiry 10 strike call option and funding that by selling a 7 strike put option with same expiry. Breakeven on this trade if the sold put goes to assignment is $6.85 with 12.2% coverage and on the bought call of $9.85 with no upside limit.

Now for the chart which shows the call spread risk reversal bought call (9) as a blue ray and the sold call (12) as a red ray and the sold put (6) as a dotted red ray with the expiry dates the dotted green line on the right margins. Chart also shows the risk reversal as light blue rays. Did say this is a blue sky trade as the chart has never been this high. The lower sold put (6) is below the last reversal and the bought call (9) is just around the highs. Can price move that high and that fast?

The blue arrow is borrowed from the chart for Lightbridge Corporation (LTBR) - its most recent move was steep enough but maybe not long enough. As the trades were both cash positive, I am not fussed as the entry points if they do not work and price falls a bit are fine for the long haul.

Next chart is update on the Lightbridge Corporation (LTBR) chart - the right hand blue arrow is the pace of the 2007 rise. The chart does show that this trade did trade over the top and is now just out-the-money.

CleanSpark (CLSK): Bitcoin Mining. With Bitcoin racing to touch $90k, there is a stock move that does not make sense. In TIB716, I shared a chart showing how CleanSpark has outperformed Bitcoin in the current cycle going back to March 2024 highlighting how CleanSpark had outperformed Bitcoin since the peak of the Bitcoin rally (the rectangle covers that part of the chart).

Something has changed in the dynamic in the recent time - there is 44 points of gap between the two. At a time when Bitcoin is at an all time high, a Bitcoin miner should be following along.

Keen to capture some of the gap, went looking again at options markets. Was quite surprised to see how tight call options were out in time - put in place a 15/22.5/12 call spread risk reversal. The surprising part is the 15/22.5 call spread has January 2026 expiry and the sold put that funds the call premium is December 2024. With net premium of $1.35 maximum profit potential is 456% for a 46.4% move from $15.37 open (Nov 14). The sold put brings breakeven to $11.89 and has price coverage of 21.9%.

Let's look at the chart which shows the bought call (15) as a blue ray and the sold call (22.5) as a red ray and the sold put (12) as a dotted red ray with the expiry dates the dotted green lines on the right margins. The sold put (12) level is below the bottom of the consolidation zone traded in the first half of the year and is around the top of the last zone. The price scenario from the last run up comfortably takes the trade past the sold call (22.5) maybe even before the sold put expires. The red arrow is the half way mark between the relative prices of CleanSpark and Bitcoin (half the 44 points).

Did some digging as to why there is this divergence. CleanSpark is due to report earnings quite soon (that purple E). Last earnings from two competitors (MARA Holdings (MARA) and Riot Platforms (RIOT)) disappointed analysts - guessing they think there will be more of the same

Notably both Mara and Riot are trading around the mid point of the gap between CleanSpark and Bitcoin.

The risk in the trade comes when Bitcoin trades down from the lofty $90k level to the range it has been in for most of 2024 (if it does). My sense is in 12 months from now there will be a new consolidation range above where price was for most of 2024. The other risk in the trade is the high Bitcoin price draws in a new army of miners.

Lightbridge Corporation (LTBR): Nuclear Technology. Pending order on a short term December expiry 7.5/5 risk reversal taken up as price collapsed 11.6% from $7.25 open to $6.48. With net premium of $0.58 price has to move a lofty 16.9% to breakeven. Partial fill on a trade set up a few weeks ago.

L'Air Liquide S.A. (AI.PA): Specialty Chemicals. Assigned on sold put. Breakeven after 3 months of sold puts is €160.89 vs €160.80 close (Nov 15). Will report like this all the way through -

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Assigned on sold put. Breakeven after 1 month of sold puts is £5.34 vs £5.38 close (Nov 15).

Cameco Corporation (CCJ): Uranium. Breakeven $52.95 vs $53.59 on this trade only and $44.36 after 2 months of sold puts.

Gevo, Inc (GEVO): Specialty Chemicals. Assigned on sold put which was part of a risk reversal in which the call expired out-the-money. Breakeven after all closed Gevo trades is $1.06 vs $1.43 - a different trade approach is working well even though not n the way it was planned to work through.

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Breakeven after 4 months of sold puts is €13.76 vs €14.79 close (Nov 15).

3D Systems Corporation (DDD): 3D Printing. Assigned on sold put. Breakeven after 1 month of sold puts is $2.75 vs $2.97

enCore Energy Corp (EU): Uranium. Assigned on sold put. Breakeven after 1 month of sold puts is $3.80 vs $3.59

QuantumScape Corporation (QS): Battery Technology. Assigned on sold put. Breakeven after 1 month of sold puts is $4.73 vs $4.74

Centrus Energy Corp (LEU): Uranium Enrichment. Assigned on sold put leg of 85/80 risk reversal - makes for breakeven on this trade alone of $79.85 vs $70.16 close (Nov 15). Trade set up when enrichment and nuclear technology ran away - a bit of a FOMO trade. With the Russian ban, Centrus enrichment will become very important though they have been dependent on HALEU supplies from Tenex in Russia

CVS Health Corporation (CVS): US Healthcare. Assigned on sold put. Breakeven after 1 month of sold puts is $54.05 vs $53.19. One month of covered calls will address that.

NexGen Energy Ltd (NXE): Uranium. Assigned on sold put. Breakeven after 1 month of sold puts is $7.39 vs $7.38

The net takeaway from this series of assignments in writing naked puts below market price on quality stocks is a workable strategy when markets are trading up with only occasional down weeks. It is the hard downs that are the problem area - keep exercise risk under close scrutiny.

Sold

Marathon Oil Corporation (MRO): US Oil. Assigned early on covered call - somebody wanted the dividend - for 1.9% profit since April 2024. Dividend was the same as the call premium = a coincidence. 2nd tranche ran to expiry for 2.8% blended profit since April/May 2024 and kept the dividend.

Fiverr International (FVRR): Internet Services. Assigned on covered call for 16.6% loss in pension portfolio on LIFO basis - way worse on FIFO. Assigned at higher strike in managed portfolio for 19.9% blended profit since May/June 2024. Fiverr has been a challenging investment - lots of naked put writing to claw back. Will analyse it next week.

Marriott Vacations Worldwide Corporation (VAC): Hotels. Assigned on covered call for 16.8% blended loss since August/September/December 2023/August 2024. Trade set up as a Revenge Travel idea at the end of Covid-19. Worked hard to use sold puts to trade out of the high entry price of the 1st large tranche from a credit spread and did recover 64% of the capital loss through income trades.

Société BIC SA (BB.PA): Europe Consumer Products. Assigned on covered call for 2.8% profit since September 2024.

Société Générale SA (GLE.PA): French Bank. Assigned on covered call for 5.2% blended loss since May/August 2024. Income trades recovered 2.8 times that loss.

Vallourec S.A. (VK.PA): Europe Steel. Assigned on covered call for 8.4% loss since April 2024. Income trades since then only recoverd 44% of the loss.

Marvell Technology Group Ltd (MRVL): US Semiconductors. Assigned on covered call for 24.6% profit since April 2024 = TheStreetPro idea. Income trades added a further 39% to the profit.

HelloFresh SE (HFG.DE): Europe Restaurants. Assigned on covered call for 11.5% blended profit in personal portfolio since October/November/December 2023/January/July 2024. Stock screen idea.

Aurubis AG (NDA.DE): Metal Fabrication. Assigned on covered call for 1.5% loss in personal portfolio since December 2023. Stock screen idea. Income trades covered that loss - only need 2 at 1% a month. Stock screen idea.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

Kogan.com Ltd (KGN.AX): Retail. Dividend yield 3.09%

Chart shows this trade used to average down entry price with the last cycle higher just holding to make a higher low - not convincing look though to make a higher high but Christmas period is upon us.

Sayona Mining Limited (SYA.AX): Lithium. Added a 2nd tranche to scale in on a lithium recovery at same price as one done 2 weeks back

Chart shows price headed into a consolidation zone after breaking the downtrend and finding support off a long held low (the green line). Feels like a hold for the long haul needed.

Income Trades

Seventy covered calls ran to expiry with 10 assigned (in brackets) (UK 6 Europe 11 (5) US 49 (5) Canada 4)

48 naked puts ran to expiry of which 14 were assigned (in brackets) (UK 1 (1) Europe 15 (2) US 32 (11))

Rolled out one sold put.

- Fiverr International (FVRR): Internet Services. 44.9% loss on buy back 8.3% cash positive and 7.1% lower strike. Just as well as price dropped well below the old strike but stayed above the new one.

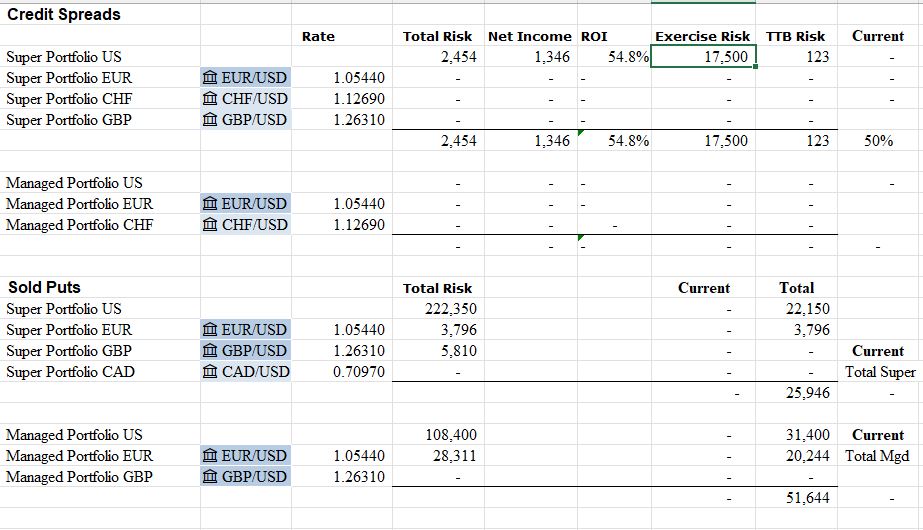

Credit Spreads

No change in credit spreads with one trading TTB - Pfizer (PFE) and one at risk of exercise - Applied Materials (AMAT)

Exercise risk after options expiry is well under control - the big total risk nuber is one position which expires in December and iss well above the sold strike - not a risk at all.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

November 11-15,2024

#hive #posh