A mixed bag week getting back to old holdings and digging for value in ASX uranium. Chuck in a few crypto wins on the surge in Bitcoin.

Portfolio News

In a week where S&P 500 rose 0.87% and Europe rose 1.79%, my pension portfolio rose only 0.31%. Heavy lifiting was done by De Grey Mining (DEG.AX) accounting for double the net gain on its own.

Drags were Korea related stocks, solar power ETF (TAN), nuclear technology again and silver mining in Canada

Big movers of the week were 88 Energy (88E.AX) (100%), NeuRizer (NRZ.AX) (100%), Resource Development Group (RDG.AX) (33.3%), CoreNickelCo (CNCO.CN) (25.9%), De Grey Mining (DEG.AX) (25.7%), Genmin (GEN.AX) (22.2%), Zinc of Ireland (ZMI.AX) (22.2%), JinkoSolar Holding Co (JKS) (21%), Northern Minerals (NTU.AX) (20%), F3 Uranium Corp (FUU.V) (19.6%), Kogan.com (KGN.AX) (14.6%), ClearView Wealth (CVW.AX) (13.9%), Sun Silver (SS1.AX) (13.7%), Peninsula Energy (PEN.AX) (12.2%), Northern Dynasty Minerals (NAK) (11.1%), Baselode Energy Corp (FIND.V) (10.5%), HelloFresh (HFG.DE) (10.5%)

A modest list of 17 stocks in the big movers list. One characterstic standing out is the penny stock moves - not hard to get a 100% move when the lowest price possible on ASX is $0.001. A fair amount of news action in the moves, the biggest of which is takeover offer for De Grey Mining (DEG.AX) by Northern Star Resources (NST.AX). This is stock takeover which will leave De Grey shareholders owning 19.9% of the combined entity. As for themes from the top gold/silver mining (3 stocks), battery materials (2 stocks), rare earths (1 stock), uranium (3 stocks)

Market edged warily higher - the words "record highs" were bandied about a bit - truth is the moves were wary. Jobs report released on Friday (Dec 6) was a bit stronger than some wanted raising fears that the Federal Reserve may choose to slow down rate cuts. The words were saying that but not the market

Crypto booms

Bitcoin price tested over the $100k mark ending the week 2.6% higher with a trough to peak range of 10.8%

Ethereum price kept moving higher without making an all time high but ended the week 6.8% higher with a trough to peak range of 16.7%

The heat bubbled over in to the altcoins - Aave (AAVEUSD), the lending protocol, popped 46% giving only one third away

Chainlink (LINKETH) also popped 46% giving half away and then popping again. Factor in the 16% pop in ETH - impressive

Harmony (OBEBTC) went a bit better with a 62% pop giving maybe a quarter away

Uniswap (UNIBTC) also popped 45% taking price past the last entry (the blue ray). Strategy running forward is to lock the gains into BTC or ETH and then hold

Even 0X (ZRXBTC) popped 53% - its chart has been languishing down here for months.

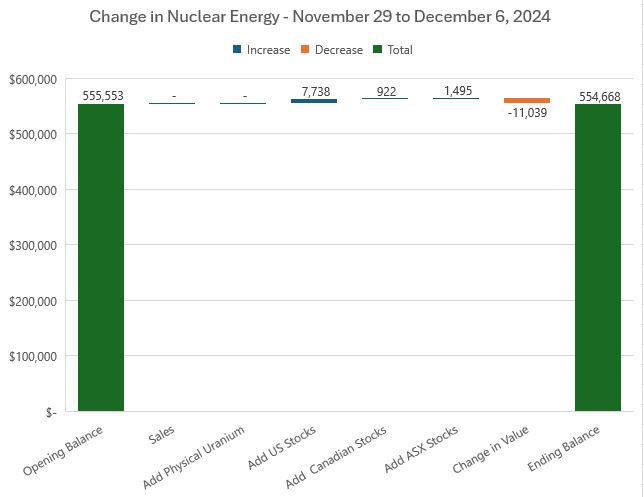

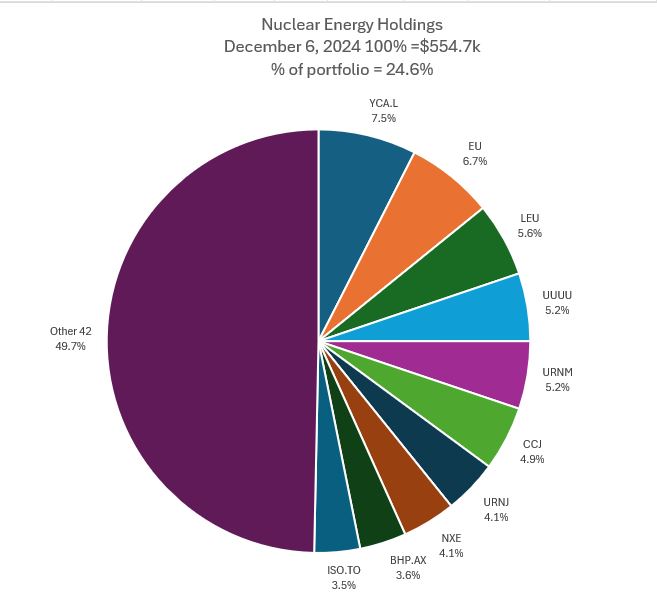

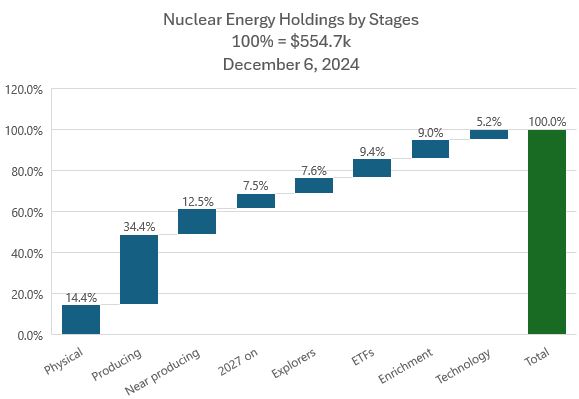

Nuclear Energy Holdings

A few additions in holdings and a 2% drop in valuation keeps the total holdings somewhat in line.

Change in the mix of holdings with the addition of Centrus Energy (LEU) moving it up two places to slot 3. BHP Group (BHP.AX) and IsoEnergy (ISO.TO) swap places at the bottom of the top 10. Share of portfolios comes down 0.2 percentage points to 24.6%

Subtle changes in the holdings by stage - small uptick in physical, small drops in the imporntat end of producing and near producing and 1 whole point up in enrichment.

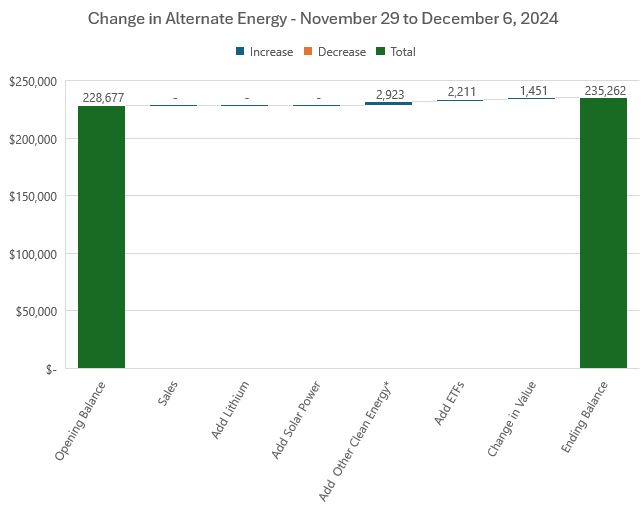

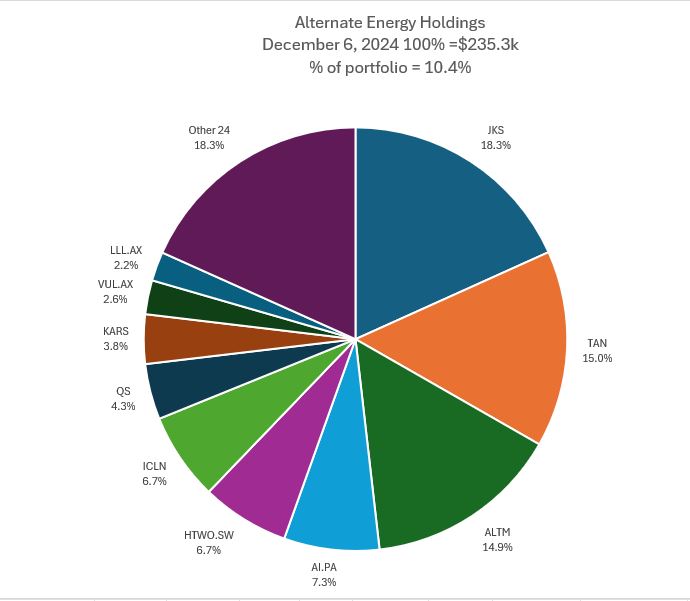

Alternate Energy Holdings

A few small changes in alternate energy holdings with the additions and a 6.3% pop in valuation

Change in the mix of holdings with the addition of KraneShares Electric Vehicles and Future Mobility Index ETF (KARS) moving it up one place to slot 8. JinkoSolar Holding Co (JKS) and Invesco Solar ETF (TAN) swap places at the top - got a feeling the South Korea events gave an uptick to non-Korean solar stocks. iShares Global Clean Energy ETF (ICLN) and L&G Hydrogen Economy UCITS ETF (HTWO.SW) swap places in the middle. SigmaLithium (SGML) drops out and is replaced by Leo Lithium (LLL) which remains suspended despite lodging financial statements. Sales proceeds from the sale of the Mali mine have been receievd and will be returned to shareholders in Janurary 2025.

Bought

Builders FirstSource (BLDR): Building Materials. TSP idea. Added a small holding and a credit spread

Westwater Resources (WWR): Battery Materials. Saw a tweet highlighting changing restrictions on critical material exports from China - on the list is graphite.

Am invested already via an ASX stock Sarytogan Graphite (SGA.AX) with deposits situated in the Karaganda region of Central Kazakhstan. A long way to go to production as there is only a PFS in place. Also holding Quantum Graphite Limited (QGL.AX) operating the Uley mine in South Australia.

Added a holding in this developer in Alabama which is expected to begin production in 2025.

F3 Uranium Corp (FUU.V): Uranium. F3 announced drill results with very high uranium grades before market open. Put in pending order ahead of market open 1 cent higher than previous close - was hit on that. Figured those that had not seen the news flow might be snoozing. They were - got hit and saw a 10% pop from the open.

Walked through some of the previous held stocks in managed portfolio and added a few back

HelloFresh SE (HFG.DE): Europe Restaurants. Been watching the charts with price breaking the downtrend and making a series of higher lows.

Made a re-entry in managed portfolio at 43% lower price than last exit. Overall the trade in this portfolio is not at breakeven - way less happy in personal portfolio. Over 100% headroom to the 2023 highs - seems a bunch of brokers saw the same thing after I did (the inset). Wrote covered call for 3.5% premium with 9.5% price coverage.

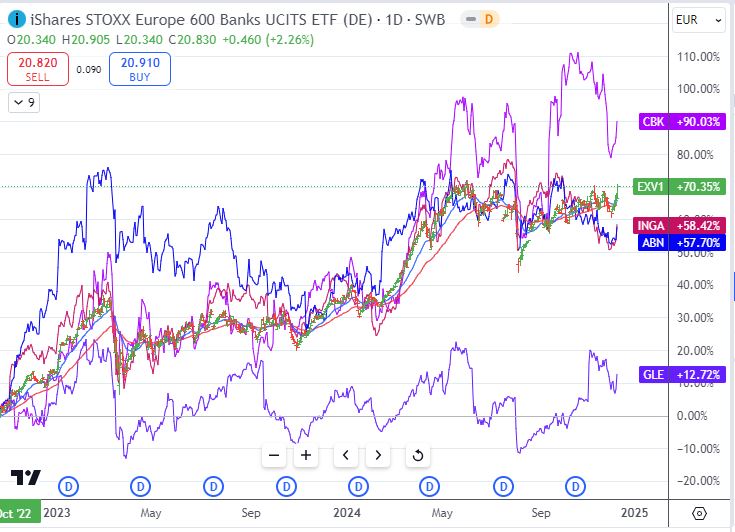

ING Groep N.V (INGA.AS): Dutch Bank. Chart shows price testing down to a short term support level and reversing.

Opened a small holding looking for price to work back to teh top of the channel - 17% profit possible there. The risk in the TA is that the top is a head and shoulders and price could be working back to teh neckline for the next leg down. Dividend yield 7.51%. Wrote covered call for 1.02% premium with 5.9% price coverage.

Comparison chart of recent additions to Europe Banks shows both Dutch banks lagging - had not checked this as trade time - relied on the base chart

Centrica plc (CNA.L): UK Utility. Added to holding on stock likely to be assigned on covered call. Also put in place sold puts at lower strike. Dividend yield 3.25%. Wrote covered call for 1.1% premium with 4% price coverage.

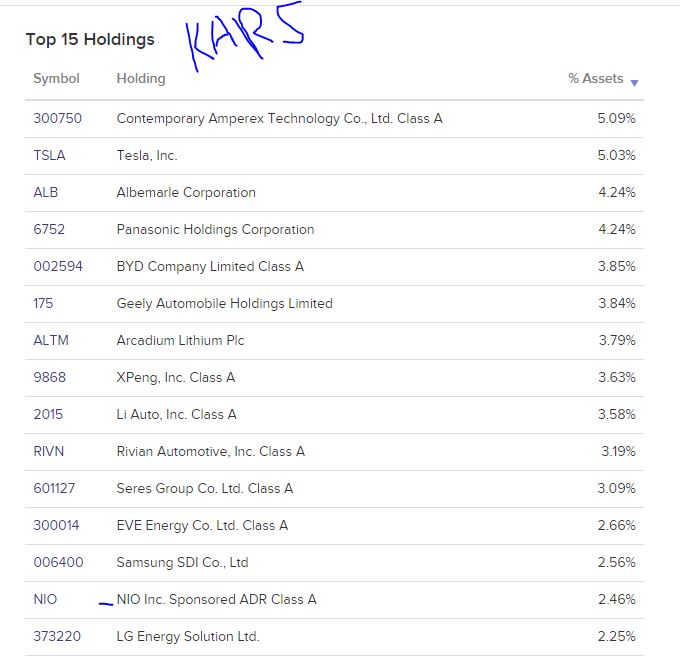

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. The whole electric vehicle sector is getting a bit of a re-rating on the back of Tesla (TSLA) happenings. Averaged down entry price in pension portfolio on this ETF which has 21% in EV's in the Top 15.

It also holds a slice of battery and lithium stocks - so well positioned for the re-rating (when it happens)

Centrus Corp (LEU): Uranium Enrichment. Price has been highly volatile as the news flow about enriched uranium deliveries from Russia ebbs and flows. Added to holding in pension portfolio to average down entry price - a modest 4.8% lower.

Quick update of the chart which also shows an open call spread risk reversal trade that is currently in the money. Seems like price is pivoting around the levels of the bought (65) and sold calls (75)

Wrote covered call for 2.5% premium with 19.8% price coverage - did write this very wide as premium is good and it is not hard to see price racing back to the lofty $100 levels.

Been watching the divergence between ASX uranium and North American uranium. They all mine the same stuff - they are all close to rpoducing or actualy producing - market is making the difference - look at this chart comapring two ASX stocks and the Sprott Uranium Mniners ETF (URNM - the bars)

Paladin Energy (PDN.AX): Uranium. 26 points behind the index and producing

Peninsula Energy Limited (PEN.AX): Uranium. 40 points behind the index and producing in the US in 2025.

Tilray Brands (TLRY): Cannabis. Read a Wall Street article about Tilray buying craft beer businesses all over the United States.

Check out the free link - no paywall - I paid

The chart is ugly with cannabis stocks taking another beating with DEA rescheduling the hearing to mid January - so no hope of lifting of restrictions on marijuana producers accessing banking systems in US for a while. Maybe craft beer is the way out. Doubled the holding in pension portfolio.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Changed the paramters a bit with two travel stocks emerging on the screens one of which operates primarily in New Zealand - split the two $250 each rather than the normal $500 new buy each.

Helloworld Travel Ltd (HLO.AX): Travel. Dividend yield 5.58%

Tourism Holdings Limited (THL.AX): Travel. Dividend yield 4.98%

Comparative chart shows the New Zealand business (the bars) appreciably under-performing the mixed country business. Get back to 2023 highs and profit targets will be hit. on both.

Sonic Healthcare Limited (SHL.AX): Healthcare. Dividend yield 3.75%

Chart shows price has broken the downtrend and made higher lows with plenty of headroom to make profit targets around the 52 week highs. This sector is super competitive and prone to takeovers.

Auto Invest

$600 spread across 5 uranium stocks and two index ETFs

Silex Systems Limited (SLX.AX): Uranium.

Global X Uranium ETF AUD (ATOM.AX): Uranium.

Elevate Uranium Ltd (EL8.AX): Uranium.

Global Uranium and Enrichment (GUE.AX): Uranium.

Terra Uranium Ltd (T92.AX): Uranium.

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index.

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index.

Top Ups

Monadelphous Group (MND.AX): Mining Services. Dividend yield 4.27%

Chart shows price recovering from the last dip giving an opportunity to add a top up below the last entry - easy profit target at the recent highs

Sold

Solvar Ltd (SVR.AX): Financial Services. Closed at profit target for 40% profit since June 2024.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. With price opening at $25.74, 28/27 credit spread will expire through the bottom. Spread arose following a trading error some time back where I landed up with a 28 strike sold put. To address that bought 27 strike puts in a ratio. Step one of exit was to sell the ratio for a 291% profit since October 2024. That profit was enough to recover the through the bottom loss on the credit spread. What had skipped my attention was the dates for the expiries of the sold and bought puts were not the same. Result was the bought put (27) went to exercise resulting in a short position. The broker liquidated that for 4.1% profit. This leaves open a December 20 expiry 28 strike sold put, which is in-the-moeny.

Hedging Trades

The Technology Select Sector SPDR Fund (XLK): US Technology. TPS article suggesting the technology sector is not overbought - makes me nervous. Put in place a 230/225 ratio put spread. With price opening at $234.95 (Dec 3) this offers protection for a drop in price between 2.15% and 4.42%.

Cryptocurrency

The Graph (GRTETH): Pending order hit for 50% profit since August 2024. Chart shows price has reversed strongly off daily support and made about half the journey to 2024 highs. If it reaches those highs there is a chance the trade before this one ends profitably too.

Holo (HOTETH): Pending order hit for what looks like a 38% profit since April 2024. This is a surprise exit level as normally the profit target is set at 50%. Will need to dig back and see if there is a trade missing from the chart. Binance is not very helpful for getting hold of data more than 6 months old.

Stellar (XLMETH): Was tracking back across old holdings - closed out this one in part - looks like a 94% profit since June 2022. Will need to dig in to the data to see if there were intervening trades. TIB notes suggest there might have been once since.

Income Trades

Quiet week with 11 covered calls written some wth January expiry (UK 1 Europe 4 US 6)

Naked Puts

Sold puts for stocks interested to own at lower entry prices

- 3D Systems Corporation (DDD): 3D Printing. Return 7.7% Coverage -1% - price slid below sold put level after market open.

- Centrica plc (CNA.L): UK Utility. Return 1.4% Coverage 4%

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 0.43% Coverage 13.7%

- NexGen Energy (NXE): Uranium. Return 2.4% Coverage 15.9%

- Sprott Uranium Miners ETF (URNM): Uranium. Return 3.6% Coverage 6.5%

- Wynn Resorts (WYNN): Gaming. Return 1.5% Coverage 1.4%

- Cameco Corporation (CCJ): Uranium. Return 1.07% Coverage 8.4%

- Sprott Junior Uranium Miners ETF (URNJ): Uranium. Return 3.3% Coverage 4.3%

Sold puts where stock may be assigned

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 0.97% Coverage 9.5%

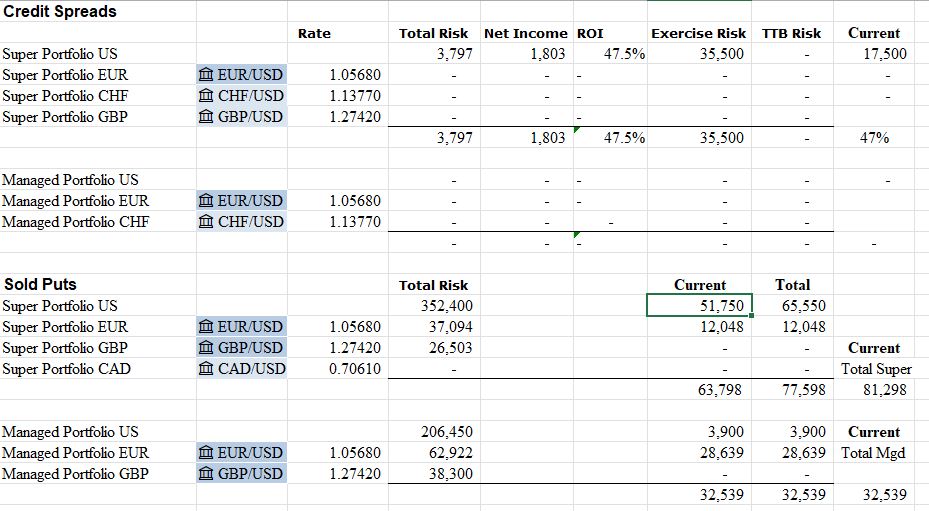

Credit Spreads

Builders FirstSource (BLDR): Building Materials. ROI 47.1% Coverage 2.5%

Exercise risk is well within margin parameters but will kick the largest one on Elevance Health (ELV) down the road next week

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

December 2-6,2024

#hive #posh

The sane countries were the ones who took crypto seriously and kept mining it, but they are much more prosperous and can pay off their debt.