A quiet week in the slide into holiday markets with a few profit taking trades. Most of the effort went into sold puts for income.

Portfolio News

In a week where S&P 500 rose 0.65% and Europe rose 0.96%, my pension portfolio rose 0.53%. This was helped along by 3.7% rise in De Grey Mining (DEG.AX), modest moves up in every European and Japanese stock, and solid rises in a range of alternate energy stocks (mostly in the the big movers list). Drags were Bitcoin mining and ASX/Canadian uranium. Premier American Uranium (PUR.V) added to the drag with price heading back to where it has been trading for a while after last week's no new jump.

Big movers of the week were Stem, Inc. (STEM) (83.6%), Solid Power (SLDP) (63.8%), Westwater Resources (WWR) (60.3%), New Frontier Minerals (NFM.AX) (38.5%), Gevo (GEVO) (38.2%), Panther Metals (PNT.AX) (33.3%), Baselode Energy (FIND.V) (20%), QuantumScape Corporation (QS) (18.5%), Cauldron Energy (CXU.AX) (18.2%), Delivra Health Brands (DHB.V) (16.7%), Lightbridge Corporation (LTBR) (13.9%), Tilray Brands (TLRY) (13.5%), AML3D Limited (AL3.AX) (12.5%), Latin Resources (LRS.AX) (10.7%), Mithril Silver and Gold (MTH.AX) (10.1%)

A slightly bigger list of 13 stocks in the big movers list feels like a little ray of sunshine. The notable moves are in alternate energy (6 stocks) with some big numbers at the top of the list in two SPAC stocks that have been well and truly beaten up. In a quiet week for spot uranium prices (down week) good to see 2 uranium stocks in the list. And 2 cannabis stocks is a bit of a surprise - rising off long-time lows.

US market wanted to push higher in the front of the week and then got a little nervous on tech moves. The week did break the Dow losing streak.

Crypto Bumbles

Bitcoin price tried to push higher but could hold the momentum ending the week 1.7% lower with a trough to peak range of 8%

Ethereum price started out the same way but then went into drift and ended the week 3.9% higher with a trough to peak range of 8.3%

Very few of the altcoin pairs (vs BTC or ETH) are showing positive trends. Harmony (ONEBTC) is an exception with with price cycling down to test 50 day moving average (red line) and 20 day moving average still above (blue line). Challenge for a trade set up is the last high was a lower high.

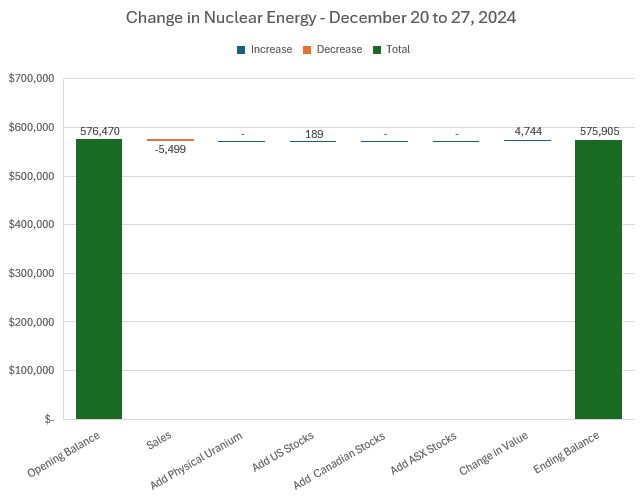

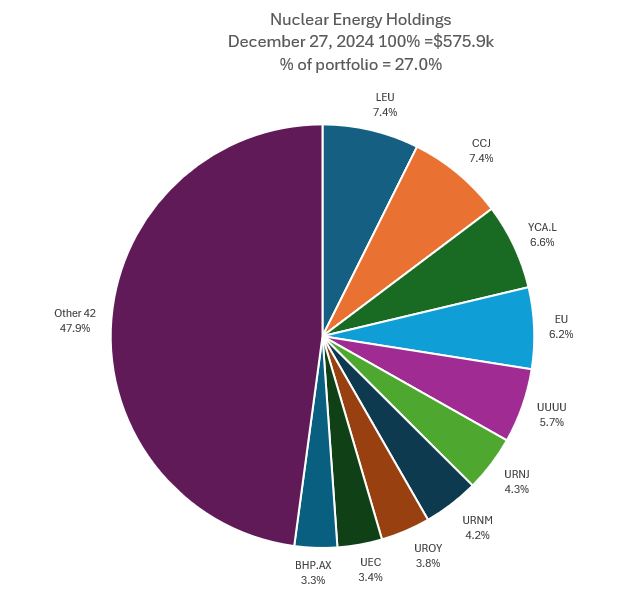

Nuclear Energy Holdings

Two changes in holdings, one a sale in nuclear technology and one addition in US stocks. Portfolio value went up 0.8% less than the market.

One small change in the mix of holdings with Centrus (LEU) swapping places with Cameco (CCJ) at the top of the Top 10. Share of portfolios drops 0.3 points. to 27%

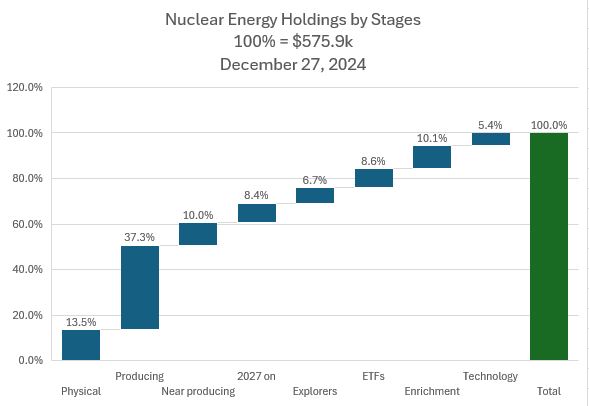

A few subtle changes in the stages chart through with half point ticks up in producing and enrichment. The one sale ticks nuclear technology down a little.

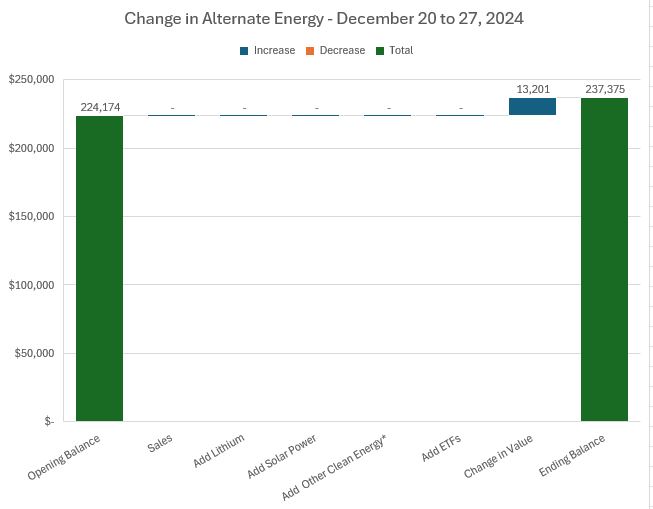

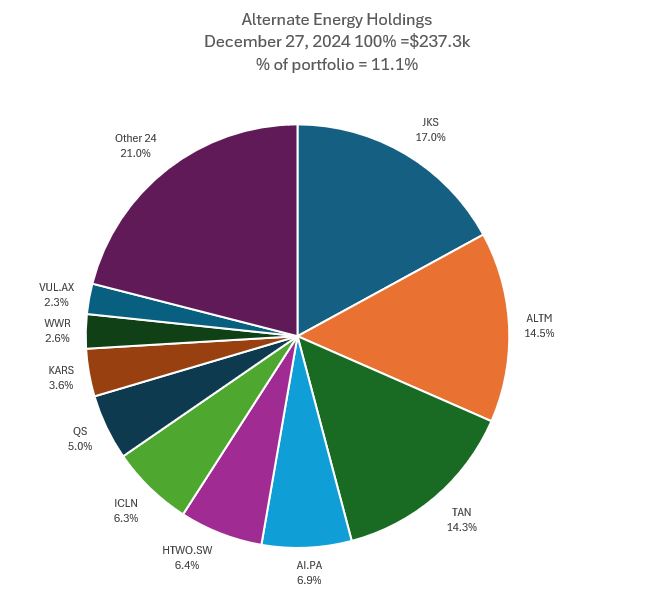

Alternate Energy Holdings

No changes in alternate energy holdings but a 5.9% increases in value, beating the market by a stretch.

A few changes in the mix of holdings with Arcadium Lithium (ALTM) swapping places with Invesco Solar (TAN) into slot 2. Westwater Resources (WWR) comes into the Top 10 displacing Posco (PKX). Share of portfolios goes up 0.4 points to 11.1%.

Bought

Denison Mines Corp (DNN): Uranium. Added to holding in small managed portfolio. Wrote covered call for 2.6% premium with 32% coverage.

Labcorp Holdings (LH): US Healthcare. TSP added to their holdings on the bird flu news. Added a small holding in pension portfolio and a credit spread

**Builders FirstSource, Inc. (BLDR): Building Materials. Assigned early on sold leg of 180/170 credit spread which has traded through the bottom - really strongly. Going to be a long road back to recover the entry miss (or let the bought put go to exercise). TSP idea

Sold

Honda Motor Co (7267.T): Japan Automotive. Honda announced merger with Nissan Motor Co (7201.T) with scheduled completion in 2026. Also saw announcement that Mitsubishi Motors Corporation (7211.T) had entered a memorandum of understanding with Honda-Nissan to co-operate on electric vehicles and batterification. With such long timelines choose to see two thirds of holding in personal portfolio for 23.8% profit since February 2017. In that same time Japanese Yen has weakened 14% against the Australian Dollar. I did have a Japanese Yen hedge in place until February 2023 which covered the majority of the weakening of the Yen

NANO Nuclear Energy (NNE): Nuclear Technology. Profit taking on partial holding for 435% profit since May 2024. Bought the stock after seeing an interview with the CEO - a very switched on nuclear physicist who understands markets.

Fission Uranium (FCU.TO): Uranium. The merger with Paladin Energy (PDN.AX) was finalised with stock held in Fission converting to the new Canadian listing for Paladin. Not seen the new stock in my portfolios yet. First day of trading was supposed to be December 27.

ASX Portfolio

No ASX Portfolio trades this week

Income Trades

53 covered calls written across 4 portfolios to start the next cycle (UK 4 Europe 6 US 43). One written for one week only expired.

Naked Puts

Busy week lining up sold puts on stocks happy to own at lower entry prices.

- Deutsche Bank AG (DBK.DE): German Bank. Return 1.27% Coverage 2.8% - 3 portfolios

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 1.22% Coverage 3.1%

- JDE Peet's N.V. (JDEP.AS): Europe Coffee. Return 1.23% Coverage 5.5%

- Marvell Technology (MRVL): US Semiconductors. Return 1.3% Coverage 12.7%

- Wynn Resorts (WYNN): Gaming. Return 1.15% Coverage 7.8%

- Global X Uranium ETF (URA): Uranium. Return 1.54% Coverage 8.3%

- Marriott Vacations Worldwide Corporation (VAC): Hotels. Return 1.12% Coverage 6.7%

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Return 1.12% Coverage 6.7%

- ING Groep N.V. (INGA.AS): Dutch Bank. Return 1.12% Coverage 6.7%

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 0.98% Coverage 2.5% - 2nd portfolio

Had a few long term trades with January expiry sold puts which was putting pressure on margin. Kicked a few down the road sooner rather than latter

- Global X Lithium & Battery Tech ETF (LIT): Lithium. 23% profit on buy back. 13.7% cash positive.

- Elevance Health (ELV): US Healthcare. 84% loss on buy back. 23% cash positive - TSP closed out a while back - still trying to get out of buying this.

Credit Spreads

- Honeywell International (HON): US Industrials. ROI 16.3% Coverage 3.2%

- Honeywell International (HON): US Industrials. ROI 14.4% Coverage 4% - same spread one day later.

- Elastic N.V. (ESTC): AI Software. ROI 17.6% Coverage 3.6%

- Robinhood Markets (HOOD): Financial Services. ROI 7.8% Coverage 11.5%

- Labcorp Holdings (LH): US Healthcare. ROI 8.1% Coverage 4.7%

- Linde plc (LIN): Specialty Chemicals. ROI 17.6% Coverage 1.9%

Spreads with low ROI suggests spreads are too wide.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

December 23-27,2024