Another rocky week to stay out of markets - a few small trades and one out and in trade. More work on sold puts than anything else

Portfolio News

In a week where S&P 500 dropped 1.94% and Europe dropped 0.08%, my pension portfolio dropped 1.78%. Drags were uranium across the board, Japan stocks (only 6 up), alternate energy (across the board apart from Arcadium Lithium (ALTM) up 7%). Positive moves in silver and gold, Europe stocks (only 1 down) and on ASX, De Grey Mining (DEG.AX) was the biggest positive in value terms up 6%

Big movers of the week were Heavy Minerals (HVY.AX) (17.4%), GoGold Resources (GGD.TO) (16.2%), Stuhini Exploration (STU.V) (14.2%), Direxion Daily Real Estate Bear 3X Shares (DRV) (13.4%), New Frontier Minerals (NFM.AX) (11.1%), Global Uranium and Enrichment (GUE.AX) (10.8%), Microequities Asset Management Group (MAM.AX) (10.6%), Sims (SGM.AX) (10.4%)

A short list of only 8 big movers - surviving seems to be theme. Big themes from the top - rare earths (2 stocks), silver/gold mining (2 stocks), uranium (1 stock). Quite surprised to see microcaps stock and metals recycler in a selloff week

In the absence of earnings reports, US markets were edgy all week not helped by stock markets closing for the funeral of Jimmy Carter while the bond markets stayed open.

Strong jobs market on Friday jolted the worry more with bonds sagging a bit more and a bigger rotation working through from tech. The market is in love with rate cuts

Crypto booms

Climb in Bitcoin price was short lived with a few hours above $100k before falling over the end the week 3.5% lower and with peak to trough range of 11.3%

Ethereum price tried to push higher too and then fell over hard ending the week 12.4% lower with a peak to trough range of 15.7%

Ugliness was across the altcoins - sample for Solana (SOL) down 21.6% from its peak

Going against the flow was Ripple (XRP) up 9% against USD and a more impressive 24% against ETH.

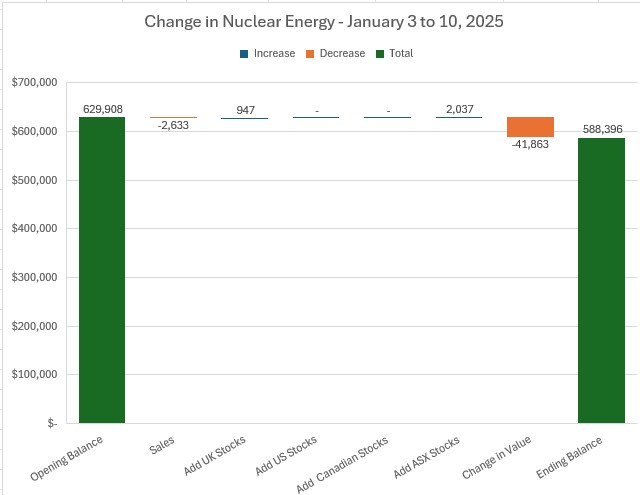

Nuclear Energy Holdings

One new stock added and a buy and sell in one other. Biggest change is 6.5% drop in valuation

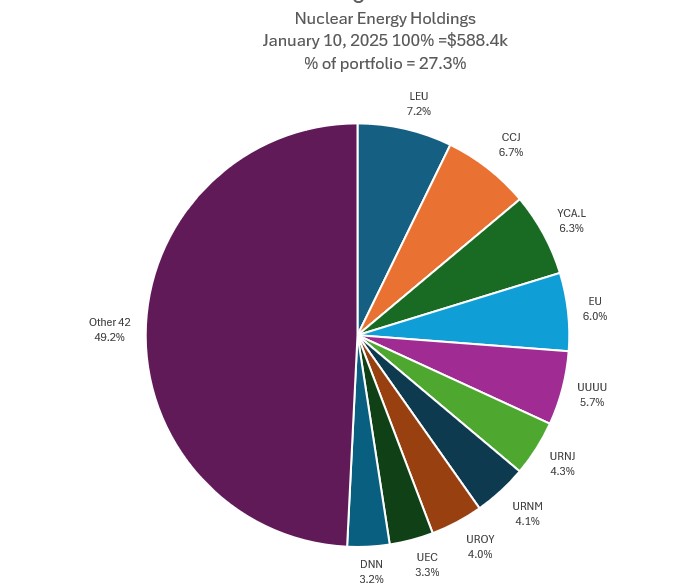

No change in rank of Top 10 of holdings with share of portfolio dropping over 1 point to 27.5%. One new stock added to take the Others to 42 stocks (counting dual listings as one stock)

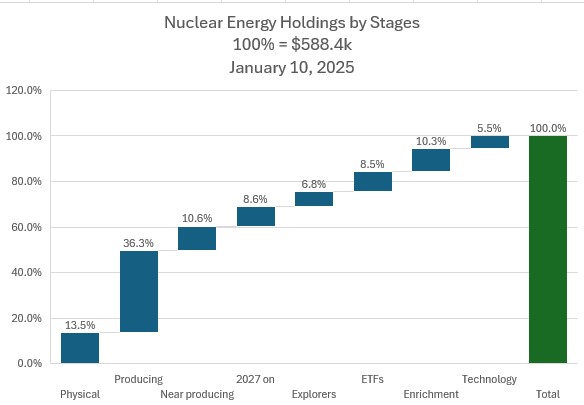

Not much to report on holdings by stage - did not post the image last week - it is lurking on another PC

The key is the first 3 columns are over 50% - that is the strategy

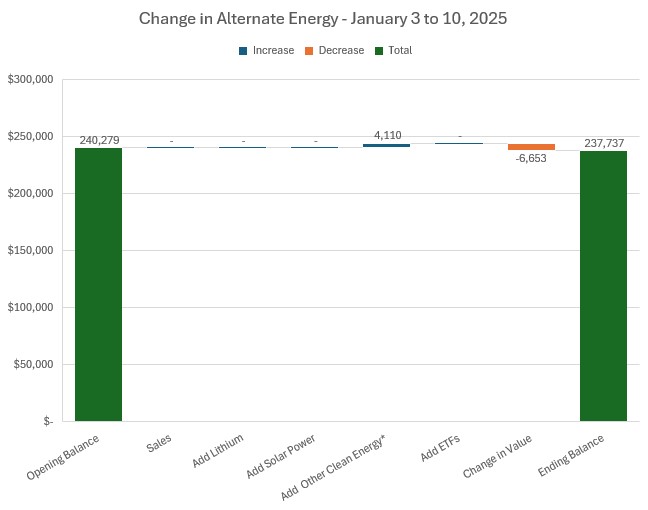

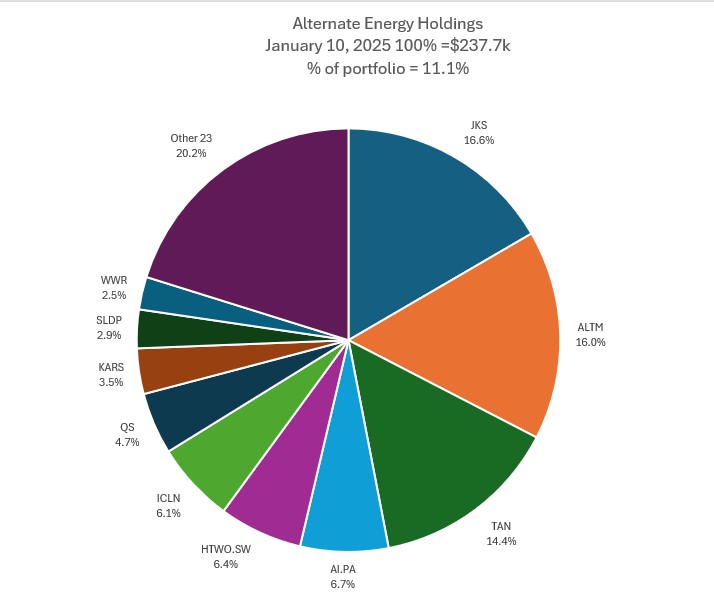

Alternate Energy Holdings

One addition in alternate energy stocks and a 2.8% drop in valuation.

One change in mix of holdings with SolidPower (SLDP) coming into slot 8 in Top 10 after additions made and displacing Gevo Inc (GEVO). Percentage of holdings rises to 11.1%

Bought

Solid Power (SLDP): Battery Technology. Doubled position size after stock shows signs of recovering from its malaise - seems there is a change in mood for these types of stocks - just look at Stem (STEM) move last week. Wrote covered call for 6.3% premium with 22% price coverage

Chart compares Solid Power (SLDP - the bars) with Stem (STEM - blue line) and the iShares Clean Energy ETF (ICLN - purple line) going back to cycle high in 2023. Clearly some way to go to get back to 2023 levels - will most likely exit when the double down positions get to break even.

Neo Energy Metals Plc (NEO.L): Uranium. Read a Mining Weekly article about the reopening of Beatrix Mine in South Africa to mine gold and uranium.

Indicative resource is 46 Mlbs of uranium at 51% rate - so potentially 92 Mlbs. Did not get the first order right - price is 0.0095 - less than a penny = easy to buy too little - 1200 instead of 12000. Got that right next day and averaged down the entry price too. Got to say I am not a fan of investing in South Africa but the size of the resource had me interested - the CEO too - these are his words

To have secured such a strategic asset, which consolidates our position in the Witwatersrand basin, the heart of South Africa’s uranium industry, is a major accomplishment and I believe truly sets us apart from many other uranium development companies and further sets us firmly on the path to being one of the next uranium production companies in the world

Sold

Silex Systems Limited (SLX.AX): Uranium Enrichment. Scaled down position size to lock in profits for 21.6% blended profit since February/July 2024 - Uranium Insider idea. Replaced portion of the holding later in the week at 5.5% discount to sale price. Uranium Insider buy idea.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

Auto Invest

$600 spread across 5 uranium stocks and two index ETFs

Uranium

Silex Systems Limited (SLX.AX): Uranium.

Global X Uranium ETF AUD (ATOM.AX): Uranium.

Elevate Uranium Ltd (EL8.AX): Uranium.

Global Uranium and Enrichment (GUE.AX): Uranium.

Terra Uranium Ltd (T92.AX): Uranium.

Indexes

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Yield 3.22%

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Yield 2.87%

Top Ups

Woodside Energy Group (WDS.AX): Oil. Dividend yield 7.57%

Chart shows the challenges of the strategy. The first signal (left hand blue ray) arrived in a time of sideways trading after a big run up in 2023. 2nd and 3rd signals were scale-ins at the top of the next cycle up. The new signal is way better as price has broken a long downtrend and has formed an inverse head and shoulders pattern. The scale ins were based on solid dividend yield and every ASX portfolio holds Woodside.

Income Trades

Eight covered calls written (UK 1 Europe 2 US 5).

More action in selling puts

Naked Puts

Sold puts on stocks likely to be assigned

- Engie SA (ENGI.PA): French Utility. Return 0.86% Coverage 3.4%

- QuantumScape Corporation (QS): Battery Technology. Return 1.1% Coverage 20%

- Commerzbank AG (CBK.DE): German Bank. Return 1.1% Coverage 20% - Feb expiry

- Commerzbank AG (CBK.DE): German Bank. Return 0.8% Coverage 2.2% - Jan expiry

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Return 1.86% Coverage 4.1% - Feb expiry

- Sigma Lithium Corporation (SGML): Lithium. Return 2.6% Coverage 3.5%

- Aurora Cannabis Inc. (ACB.TO): Cannabis. Return 4.6% Coverage 2%

- RTL Group S.A. (RRTL.DE): Satellite Broadcasting. Return 0.36% Coverage 0.7%

- Nokia Oyj (NOK): Network Equipment. Return 1.3% Coverage 0.4%

Sold puts on stocks happy to hold at lower prices

- Centrus Energy Corp. (LEU): Uranium Enrichment. Return 2.5% Coverage 11.7%

- Solid Power, Inc. (SLDP): Battery Technology. Return 12.5% Coverage 10%

Next two sold to get a breakeven price well below current price - fully expect to be assigned.

- Denison Mines Corp. (DNN): Uranium. Return 13.5% Coverage -1.5% - Jan expiry

- Denison Mines Corp. (DNN): Uranium. Return 42.5% Coverage -1.5% - Feb expiry

- Nokia Oyj (NOK): Network Equipment. Return 1.25% Coverage 13% - Feb expiry

Rolled out a few

- CleanSpark, Inc. (CLSK): Bitcoin Mining. 7.5% profit on buy back. 60% cash positive = lower strike.

- DHL Group (DPWA.DU): Europe Logistics. 103% loss on buy back. 10.7% cash positive => return 3.44%

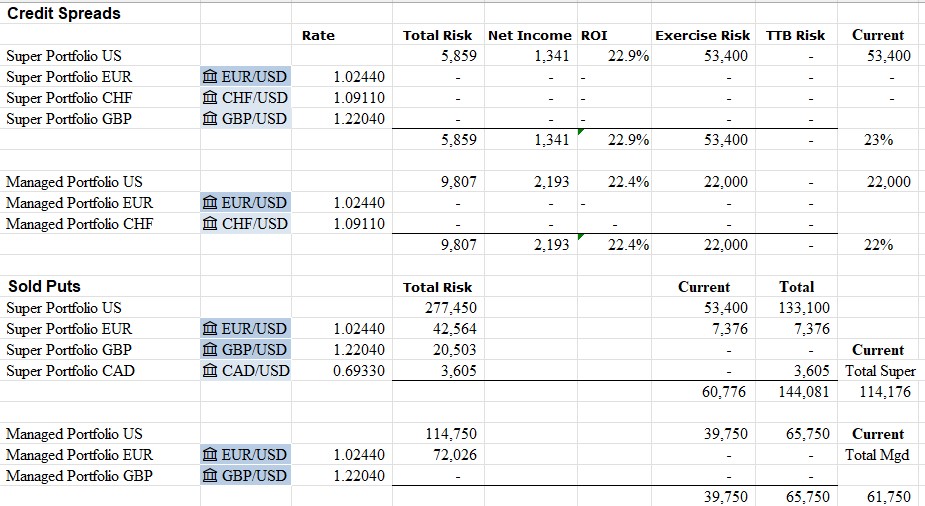

Credit Spreads

VanEck Gold Miners ETF (GDX): Gold Mining. With price opening at $35 am exposed to a 38 strike sold put which is part of a call spread risk reversal. Portfolio is a bit tight on capital for going to exercise. Converted the sold put to a credit spread by buying a 34 strike put option with the same expiry. This did also buy back a34 strike sold put in place for income purposes. The buy back afforded a 61% profit and covered 36% of the bought premium.

Linde plc (LIN): Specialty Chemicals. With price opening at $415.43 (Jan 6), 415/405 spread has traded in-the-money. As ticker size is high, chose to buy back the sold put (415) and sell a lower strike (410). Incurred a 72% loss on the buy back and was 39% cash negative. Increases the ROI on the spread from 17% to 290% with coverage at 1.2%

Exercise risk in pension portfolio became uncomfortable following the Friday selloff (Jan 10)

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

January 6-10, 2025

Edit: Fixed date to 2025

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

#hive #posh