A massive week for nuclear stocks felt like a good time to take some profits off the table. A few adds made in Europe stocks.

Portfolio News

In a week where S&P 500 rose 1.74% and Europe rose 3.29%, my pension portfolio rose 1.95%. Stars were in nuclear and uranium apart from Global Atomic (down 27% on private placement news) and Japan. Europe holdings were up 3.4% - just not enough of them. Drags were ASX resource stocks other than uranium, and some alternate energy in US

Big movers of the week were Oklo (OKLO) (60.5%), Westwater Resources (WWR) (47%), Lightbridge Corporation (LTBR) (41.1%), Delivra Health Brands (DHB.V) (33.3%), Standard Uranium (STND.V) (29.4%), 3D Systems Corporation (DDD) (25%), Koonenberry Gold (KNB.AX) (23.5%), ASP Isotopes (ASPI) (20.1%), NANO Nuclear Energy (NNE) (18.7%), Centrus Energy Corp (LEU) (18.2%), Loop Industries (LOOP) (16.5%), Baselode Energy (FIND.V) (15.8%), Uranium Royalty Corp (UROY) (15.1%), Northern Dynasty Minerals (NAK) (14.3%), Atha Energy Corp (SASK.V) (13.8%), Ur-Energy (URG) (13.5%), TechGen Metals (TG1.AX) (13.3%), Uranium Energy Corp (UEC) (13.1%), Lithium Universe (LU7.AX) (12.5%), Euro Manganese (EMN.AX) (12.5%), Deep Yellow (DYL.AX) (12.4%), Mitsubishi Heavy Industries (7011.T) (11.9%), Stem, Inc. (STEM) (11.6%), Panther Metals (PNT.AX) (11.1%), Boss Energy (BOE.AX) (10.8%), Global X Uranium ETF (ATOM.AX) (10.8%), GoviEx Uranium (GXU.V) (10%)

A more respectable big movers list with 26 stocks moving 10% or more. A big week in the big themes department - from the top: Nuclear technology (5 stocks), battery technology (5 stocks), cannabis ( 1 stock), uranium (10 stocks) gold/silver mining (2 stocks), other alternate energy (1 stock)

US markets celebrated softer rhetoric about tariffs and applauded the early decisive steps taken since inauguration day. That pushed S&P500 to all time highs - solid earnings along the way helped.

Europe led and popped especially after Trump addressed the Davos forum - the tariff rhetoric was toned down.

He demanded that global interest rates be reduced and urged OPEC to lower oil prices. He also called for deregulation of banking rules.

Crypto Drifts

Bitcoin price went into fall down mode with a few bounces ending the week 0.5% lower with a a peak to trough range of 10.5% - late move in the week points to capitulation at the same time US stocks sagged. Bitcoin is now correlated.

Ethereum price was in drift mode all week ending 9.5% lower on the week and with a 12.6% peak to trough range.

Pick a favourite from the last few weeks - Ripple (XRP) - down 21%

Chainlink (LINK) went against the trend with a 21% pop giving half away. Too bad I failed to put in a profit target for the spike before - was 50% in there.

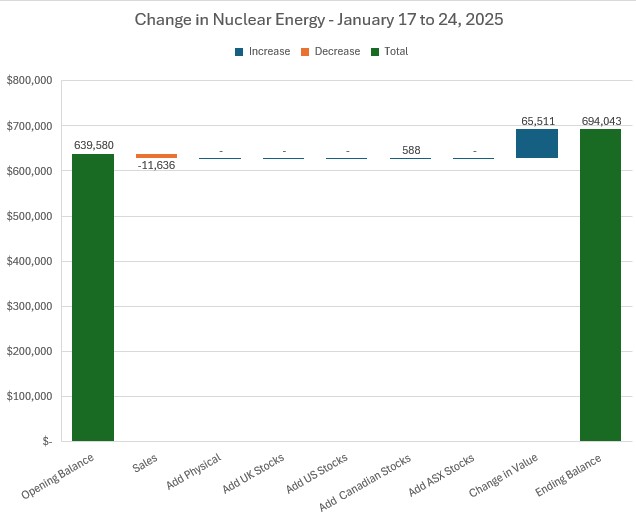

Nuclear Energy Holdings

A massive week in nuclear technology especially with a few sales made and a whopping 10.2% jump in valuation.

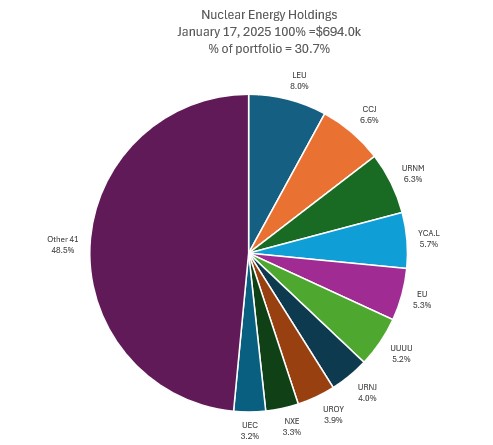

A few changes in the mix of holdings with Cameco Corporation (CCJ) moving up on place to slot 2. Sprott Junior Uranium Miners (URNJ) moves up a place to slot 7 and NexGen (NXE) drops two places to slot 9 after the sale there. Denison Mines (DNN) drops out the Top 10 and is replaced with Uranium Energy Corp (UEC). The jump in valuations takes share of portfolio up 1.5 percentage points to 30.7% even with the sales

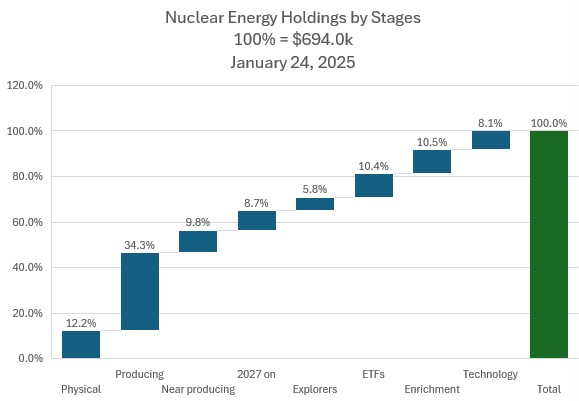

Changes in holdings by stage are a drift lower for the physical up to near producing and a jump in nuclear technology and enrichment up 2 percentage points between them (and that is after selling a slice of one of them).

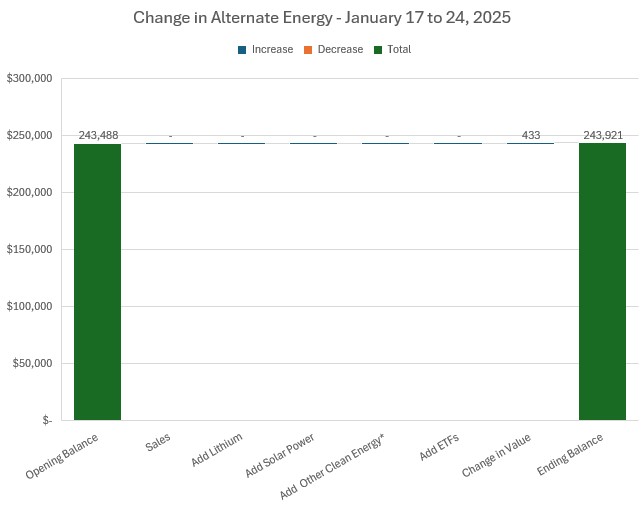

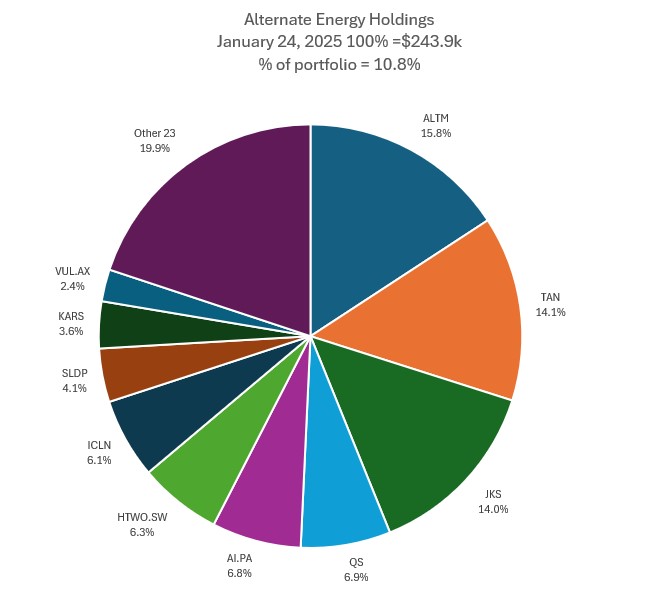

Alternate Energy Holdings

No change in holdings and a modest 0.2% increase in valuations

Mix of holdings changes with Air Liquide (AI.PA) moving up one place into slot 4. WestWater Resources (WWR) moves into Top 10 on its jump in price replacing Vulcan Energy (VUL.AX). Share of portfolios drops 0.3 points to 10.8% with alternate energy stocks lagging nuclear stocks

Bought

Glencore plc (GLEN.L): Base Metals. Rounded up holding to be able to write covered calls - replaces stock assigned at small discount to assigned price. Wrote covered call for 1.1% premium with 10.4% price coverage.

Standard Uranium Ltd (STND.V): Uranium. Kind of hoping rising sea will lift all boats - averaged down entry price in managed portfolio. It did - Standard was the best performing uranium stock of the week.

Chart shows price appears to bottom up and starting 2nd cycle higher. Reference stock is Sprott Junior Uranium Miners (URNJ) - nearly 50% profit target in that gap.

HelloFresh SE (HFG.DE): Europe Restaurants. Scaled into holding in managed portfolio - price consolidating a little on the uptrend

ING Groep N.V (INGA.AS): Dutch Bank. Replaced stock assigned at 3.6% premium to assigned price - added to scale in to be able to write covered calls. That changed multiplier makes a mess again.

Sold

Silex Systems (SLX.AX): Uranium Enrichment. Been watching price gyrate in big swings - took profits to bring holding back to $10k and locked in 50% blended profit since July/September 2024. Uranium Insider idea - profit pays the subscription. Averaging down in September helped jazz up the return.

Amazon.com (AMZN): US Retail. Closed out at 52 week high in managed portfolio for 31% profit since April 2024 - TSP idea.

NANO Nuclear Energy (NNE): Nuclear Technology. Taking initial capital off the table locks in 630% profit since May 2024. Taking minimum gain would be 119% profit since July 2024 - a lot moved in those first 2 months.

NexGen Energy CDI (NXG.AX): Uranium. With addition of US listed stock last week closed out ASX position for 1.6% profit since May 2024 - can write options more readily on US holdings.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Worley Limited (WOR.AX): Mining Services. Dividend yield 4.00%

Chart shows price has been trending lower all of 2024 with quite wide cycles - has now reversed and starting 2nd cycle higher. Reference comparison with another mining services stock Monadelphous (MND.AX - blue line) shows 16 percentage points to close the gap. Profit target looks like it will be 25% around 52 week high

Top Ups

Mount Gibson Iron (MGX.AX): Iron Ore. Dividend yield 5.06%

A chance to average down entry price after price did not keep momentum after first two entries in late 2023 (left hand blue rays). Price has now broken the downtrend and making a short term uptrend. Big gap to reference stock Fortescue Minerals (FMG.AX - blue line) suggests a good chance to make 40% profit target.

Sold

Started the process of tidying up some rats and mice provoked by the Star Entertainment Group notice last week.

DGL Group Limited (DGL.AX): Waste Management. 69.6% blended loss since February/March 2023.

Hedging Trades

Pan American Silver Corp (PAAS): Silver Mining. Watched a Rick Rule presentation where he talked about arithmetic around the ratio between US deficit and US net worth - about $5 trillion more in net worth. His view is gold holding needs to rise with that amount of uncertainty and could revert to the mean - from 0.5% to 2%. That got me looking to adding to hedge trades on gold and silver. Put in place a February expiry 21/19 credit spread and a March expiry 23/25/20 call spread risk reversal. Not sure what are the best timelines - will test the water out a bit. Opened a 23/25 bull call spread for a net premium of $0.55 offering maximum profit potential of 264% if price moves 14% from $21.91 closing price (Jan 22). Spread fully funded by selling 20 strike put options with 8.7% price coverage

Income Trades

57 covered calls written (UK 3 Europe 5 US 49) - wider spreads and taken a view of writing only on part of holdings given the volatility in a few places. Prefer to hold the stock

Naked Puts

Stocks happy to hold at lower entry prices - multiple entries as same trades done across portfolios at different times and strikes

- Gevo, Inc. (GEVO): Alternate Energy. Return 17.5% Coverage 8.5%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 6.6% Coverage 16.6%

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 0.99% Coverage 5.0%

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 1.07% Coverage 7.7%

- NexGen Energy Ltd. (NXE): Uranium. Return 5% Coverage 7%

- Sigma Lithium Corporation (SGML): Lithium. Return 3% Coverage 13.8%

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 0.85% Coverage 6.3%

- JDE Peet's N.V. (JDEP.AS): Europe Coffee. Return 1.5% Coverage 6.5%

- QuantumScape Corporation (QS): Battery Technology. Return 7.75% Coverage 2%

- Builders FirstSource, Inc. (BLDR): Building Material. Return 1.23% Coverage 10.4%

- Star Bulk Carriers Corp. (SBLK): Shipping. Return 1.38% Coverage 11.6%

- NuScale Power Corporation (SMR): Nuclear Technology. Return 7.2% Coverage 11.8%

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 1.04% Coverage 4.8% - pp

- Deutsche Bank AG (DBK.DE): German Bank. Return 1.21% Coverage 6.6% - pp

Credit Spreads

One new credit spread as part of hedging action

- Pan American Silver Corp (PAAS): Silver Mining. ROI 30.7% Coverage 5%

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

January 20-24, 2025

#hive #posh