A quiet sideways week in markets makes for a quiet week in the portfolios. A few cash flow plays on sold puts and uranium explorers

Portfolio News

In a week where S&P 500 dropped 0.17% and Europe rose 0.37%, my pension portfolio rose 0.19%. The divergence is more nuclear tech in the portfolios than S&P00 and not enough Europe in the pension portfolio.

Big movers of the week were Aurora Cannabis (ACB.TO) (63.4%), Lightbridge Corporation (LTBR) (34%), Oklo (OKLO) (33.4%), Centrus Energy (LEU) (32.3%), Euro Manganese (EMN.AX) (27.9%), Largo (LGO) (22.6%), Domino's Pizza Enterprises (DMP.AX) (19.4%), 3D Systems Corporation (DDD) (18.6%), BASSAC SA (BASS.PA) (18.5%), St George Mining (SGQ.AX) (18.5%), Cue Energy Resources (CUE.AX) (15%), Delivra Health Brands (DHB.V) (14.3%), Northern Dynasty Minerals (NAK) (13.4%), ArcelorMittal S.A. (MT.AS) (13.2%), Terra Uranium (T92.AX) (13.2%), Heavy Minerals (HVY.AX) (12.1%), New Frontier Minerals (NFM.AX) (11.8%), Pantera Lithium (PFE.AX) (11.8%), Articore Group (ATG.AX) (11.4%), American Rare Earths (ARR.AX) (11.1%), Collins Foods (CKF.AX) (10.7%), Gemfields Group (GEM.L) (10.6%), Westwater Resources (WWR) (10.1%)

A bigger list of 23 stocks making moves of 10% or more. A few of the big themes represented - from the top - marijuana (2 stocks), nuclear technology (3 stocks), alternate energy materials (4 stocks), gold mining (1 stock), rare earths (2 stocks), uranium (1 stock). A few surprises - 2 Australian food businesses and one precious gems business - a hold over from an investment that started in Mozambique in rubies and garnets and then flowed to graphite.

Top of the pops was Aurora Cannabis (ACB.TO) with good earnings - maybe the tide is turning

Headlines point to a drifting sort of week - market is looking for reasons to be cheerful and then gives away when it is not quite what they thought

Crypto Sags

Bitcoin price did a gyro week - with a trough to peak range of 10.6% and ending the week 1.6% higher - better than US markets but a bit more edgy

Ethereum chart looks the same - wanted to run with buyers with a 19% trough to peak range and then sagging away to 3.8% rise on the week. Also better than US stocks.

Of all the altcoins in my portfolios only one did better - Litecoin (LTC) up 24% and still going

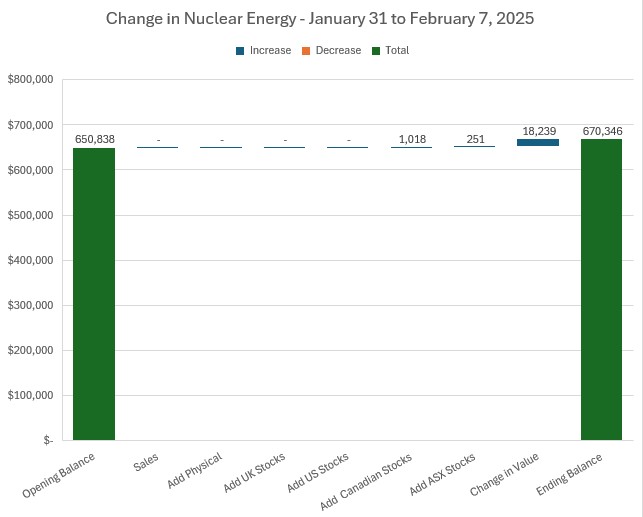

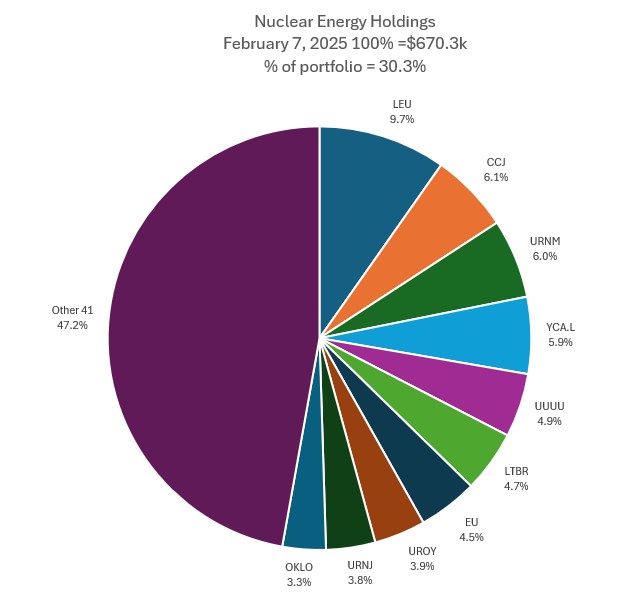

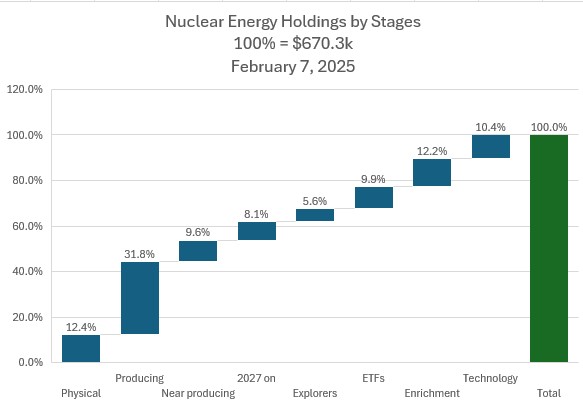

Nuclear Energy Holdings

News of the week was the potential reallocation of Federal clean energy budgets - opening up speculation about the potential for nuclear small modular reactors. UK Prime Minister also announced SMR and regulatory reforms to open up UK to SMR's

A few small additions in holdings with the monthly ASX auto-invest and two US explorers listed in Canada. Overall valuation rises 2.8% mostly nuclear technology

Key change in mix of holdings with jump in share of leader Centrus Energy (LEU) by 2.1 percentage points. Cameco Corporation (CCJ) rises 2 places into slot 2. Energy Fuels (UUUU) moves up one place into slot 5. After entering Top 10 last week, Lightbridge Corporation (LTBR) moves up another 3 places into slot 6. Coming into Top 10 is Oklo (OKLO) displacing NexGen Energy (NXE). Share of portfolio rises to 30.3% up over half a point.

Some key changes in holdings by stage with 2 points jump in Enrichment and 2.5 points in Technology - dragging everything else down. Will be paying close attention to the Near producing column as these are slated to produce from 2025 on - so far none have started to get into Producing column.

Got to the end of my Uranium Insider first year subscription. They triggered my Nuclear by Stage thinking - invest a bit more in physical and producing and near producing. In one whole yar they did not move their thinking about the stocks they suggested other than putting Global Atomic (GLO/TO) on hold. They completely missed the melt up in nuclear technology stocks . Was the $497 worth it? Yes. Was it worth paying $597 next time around around. Get better interviews with Triangle Insider - got his finger on the markets

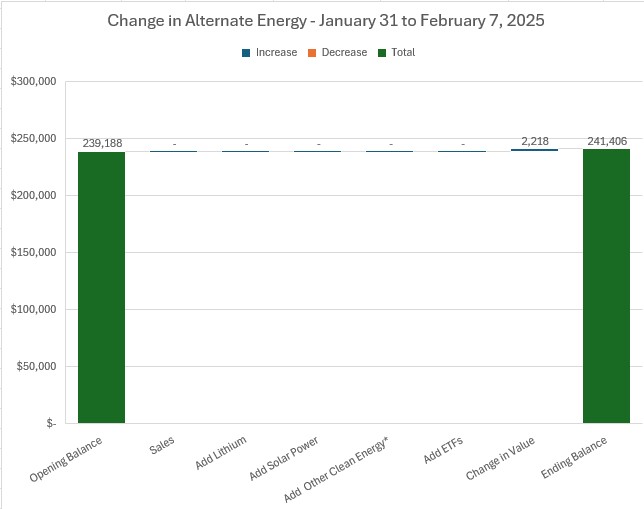

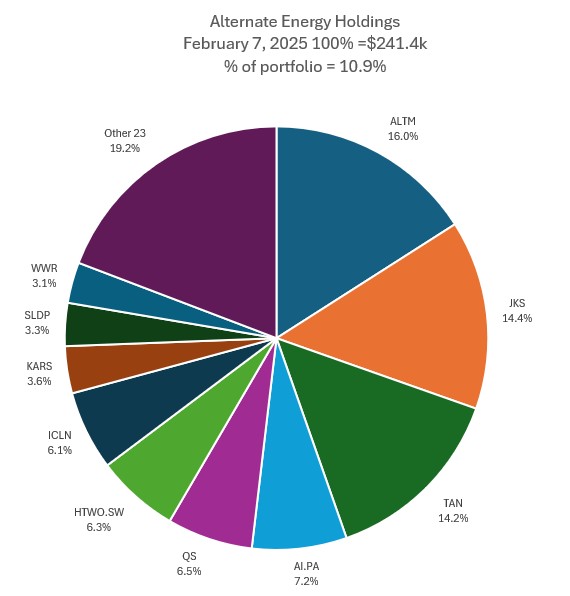

Alternate Energy Holdings

No change in holdings with a small 0.9% increase in values.

Only one change in the mix of holdings with JinkoSolar Holding Co., Ltd. (JKS) and Invesco Solar ETF (TAN) changing places in slots 2 and 3. Share of portfolios remains at 10.9%

Bought

iShares MSCI Brazil ETF (EWZ): Brazil Index. A bit of a punt - reading tweets about the tariffs - some one suggested Brazil. Why not?

Did have a quick look at a chart - reversing after breaking the downtrend. As it happens TSP ran an article and had this to say - saw this after the trade

an interesting chart because it has a lot of resistance at 26 but if it can pullback near 24-ish it would have a head and shoulders bottom so if it got into that 24 area the risk/reward seems good because if it plunges much under there, you know you’re wrong.

https://pro.thestreet.com/trade-ideas/the-options-market-will-add-fuel-to-the-fire (you can read 3 articles free as a non-member)

Can see a call spread risk reversal relying on that 24 level.

88 Energy Limited (88.AX): Alaska Oil. Pending order to double position size at 1/10 of a cent expired. There are over $1.5 billion shares wanted at that price. Price has been bobbing back and forth - added another 0.5 million share one tick higher - put in pending order to close out 2 ticks higher. Will amend that to exit at breakeven if the market continues its stubborn way. Looking to see if Trump overturns blocked access to Federal lands in Alaska.

Was asked the question on X, where to invest $50 in uranium. My answer below - the thesis is to be invested in physical and stocks producing or close to producing and then add in some speculation on an explorer or two.

The key message was I felt that nuclear technology (e.g., SMR's) have already run away. As it happens they ran even more in the day of trade after the reply. As I already have these positions and am likely to be assigned on the stock I hold in Oklo, Inc (OKLO), I did the sold puts part and used the proceeds to buy an explorer or two. My inclination given the uncertainty about Canada-US trade is to focus on US - hence buying the two stocks below. Was keen to buy Myriad Uranium Corp. (M.CN) but my broker does not provide access to buy in Canada Pure market - and it seems quite hard to open an account from outside Canada.

Anfield Energy Inc (AEC.V): Uranium. Does not quite fit the bill as an explorer as it has plans to be producing from Velvet Wood and Slick Rock projects through its Shootaring Canyon mill in Utah. The explorer part is other projects in Colorado and New Mexico.

Premier American Uranium (PUR.V): Uranium. Premier is an out and out explorer. Have watched a few interviews by Triangle Investor with Colin Healy - CEO. He appears to know what he is doing - building an exploration business through acquisition and exploration drilling.

Premier American Uranium Inc. is focused on the consolidation, exploration, and development of uranium projects in the United States, aiming to strengthen domestic energy security and support the transition to clean energy. One of PUR’s key strengths is the extensive land holdings in three prominent uranium-producing regions in the United States: the Grants Mineral Belt of New Mexico, the Great Divide Basin of Wyoming and the Uravan Mineral Belt of Colorado.

Sold

No sales

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Lycopodium Limited (LYL.AX): Mining Services. Dividend yield 6.99%

Chart shows pricing breaking downtrend off a flattish bottoming with 20% head room to the recent highs. Happy to add the stock after exiting another mining services stock recently

Auto Invest

$600 spread across 4 uranium stocks, one gold ETF and two index ETFs. Made some changes this month - rebalanced the allocation to ETF's with International $80, Australia $60, Gold Mining $60 (new) and added one more uranium stock as a more likely winner - Deep Yellow (DYL.AX).

- Silex Systems Limited (SLX.AX): Uranium.

- Global X Uranium ETF AUD (ATOM.AX): Uranium.

- Deep Yellow Limited: Uranium. (New)

- Global Uranium and Enrichment (GUE.AX): Uranium.

- Terra Uranium (T92.AX): Uranium.

Indexes

- VanEck Gold Miners ETF (GDX): Gold Mining. (New)

- Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Yield 3.22%

- Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Yield 2.87%

Income Trades

Only two covered calls written all week both in Canada

Naked Puts

Kicked the can down the road on the first of a few large exposures

- Global X Lithium & Battery Tech ETF (LIT) 7.2% loss on buyback. 19.4% cash positive. Return adjusts to 5.8% leaving behind a parcel to go to assignment if the market decides

Sold puts on stocks likely to be assigned on covered calls.

- Oklo, Inc (OKLO): Nuclear Technology. Return 6.4% Coverage 13.8%

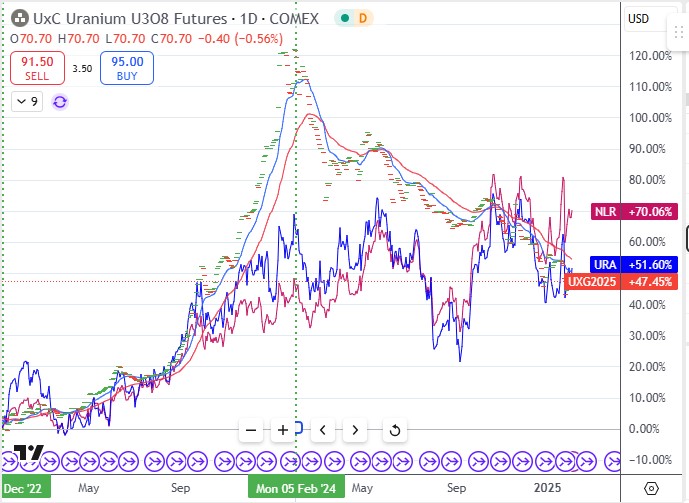

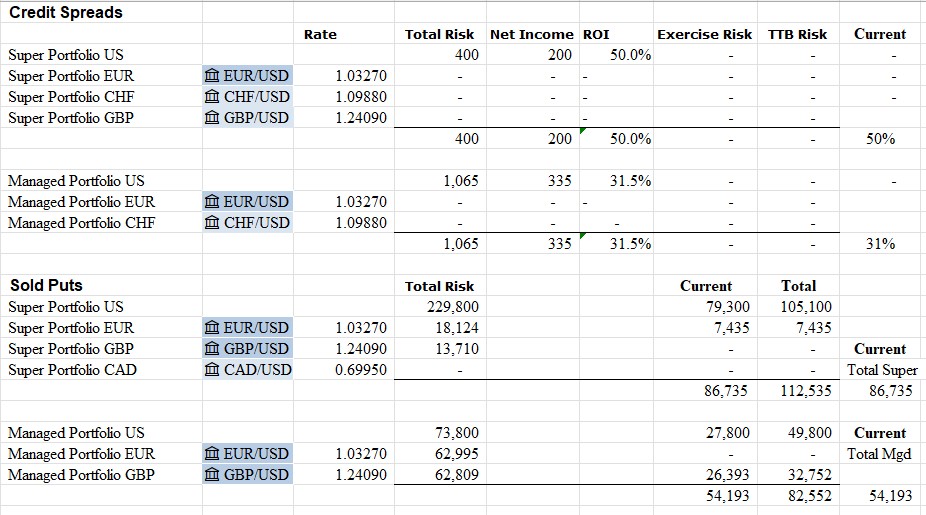

Credit Spreads

VanEck Uranium and Nuclear ETF (NLR): Nuclear Power. TSP added this ETF to their bullpen - after being on the sidelines on nuclear for ages. They have not bought. Added a 87/85 credit spread with 33.3% ROI with 3.5% price coverage - not bad work for just under 3 weeks. Next day wrote a wider 89/86 with March expiry in pension portfolio for 50% ROI with 2% price coverage. Pushing this a little harder as it looks like holdings in Oklo (OKLO) will get assigned with a big opportunity left on the table.

Ran comparison charts against Uranium futures (the bars) and the Global X Uranium (ETF - blue line) going back to the cycle low and the cycle high. This ETF has outperformed between 15 and 20 percentage points on both maps. The key difference is that this ETF has significant holdings in electricity generation and little uranium - see the Top 15 Holdings.

Clearly there are better profit margins generating power than their are mining uranium or building nuclear stuff.

Exercise risk in pension portfolio getting a little high with one stock, Honeywell International Inc. (HON), dropping 7.8% on the week to go in-the-money on news of its plans to split 3 ways. Works for me as am only interested in their Advanced materials assets (where Converdyn uranium enrichment will go)

https://finance.yahoo.com/news/honeywell-shares-tumble-split-plans-114448807.html

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

February 3-7, 2025

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

#hive #posh