Choppy markets make for a stay away approach - tinkering on the edges in uranium and alternate energy. Adjustments on sold puts ahead of options expiry.

A special post #747 - the most famous Boeing ever built

Portfolio News

In a week where S&P 500 rose 1.5% and Europe rose 3.6%, my pension portfolio dropped 0.83%. Too much uranium and nuclear technology and not enough Europe. Heavy lifting done by De Grey Mining (DEG.AX) up 3.4%, Europe up 5% and Japan. Apart from uranium, big drags were in alternate enery - e.g., Solid Power (SLDP) down 37% and Stem Inc (STEM) down 58%.

Big movers of the week were Solis Minerals (SLM.AX) (66.7%), Blue Star Helium (BNL.AX) (50%), Synlait Milk (SM1.AX) (32.1%), Bayhorse Silver (BHS.V) (30%), Heavy Minerals (HVY.AX) (27%), Mayne Pharma Group (MYX.AX) (19.7%), Kairos Minerals (KAI.AX) (18.7%), St George Mining (SGQ.AX) (18.7%), Koonenberry Gold (KNB.AX) (18.5%), Stuhini Exploration (STU.V) (15.4%), GoviEx Uranium (GXU.V) (14.3%), Panther Metals (PNT.AX) (14.3%), Aeris Resources (AIS.AX) (12.9%), Lifeist Wellness (LFST.V) (12.5%), Microequities Asset Management Group (MAM.AX) (12.5%), Global Atomic Corporation (GLO.TO) (11.8%), Lightbridge Corporation (LTBR) (11.8%), PZ Cussons (PZC.L) (11.4%), Wynn Resorts (WYNN) (10.2%), 3D Systems Corporation (DDD) (10.1%)

A modest list of 20 big movers - too bad the uranium selloff happened on Friday (Feb 14) - would have been a bigger list. A few big themes represented - from the top: gold/silver mining (5 stocks), rare earths (2 stocks), uranium/nuclear (3 stocks), marijuana (1 stock). A few key moves too - Solis Minerals (SLM.AX) shifting focus from lithium to copper in Peru. Always nice to see a 30% move on a stock added in the week - in milk. A few earnings related moves too - like Wynn Resorts (WYNN) popping earnings by 90%

US markets had an up and down week - strong earnings keeps driving things forward and robust inflation and tariff discussion pull things back

Crypto Drifts

Bitcoin price tracked sideways a bit and then drifted lower ending the week 0.6% lower with a trough to peak range of just 5%.

Ethereum price looks even more drifting but it did end 1.4% higher on the week with a trough to peak range of 9.5% all on one day midweek.

Binance Coin (BNB) got a 21% pump giving away half.

Litecoin (LTC) also got a pump of 15% but was able to build past that high for a run and giving away only a third.

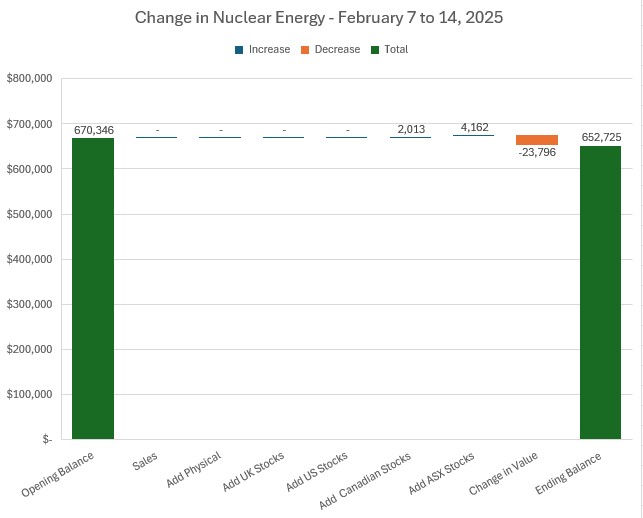

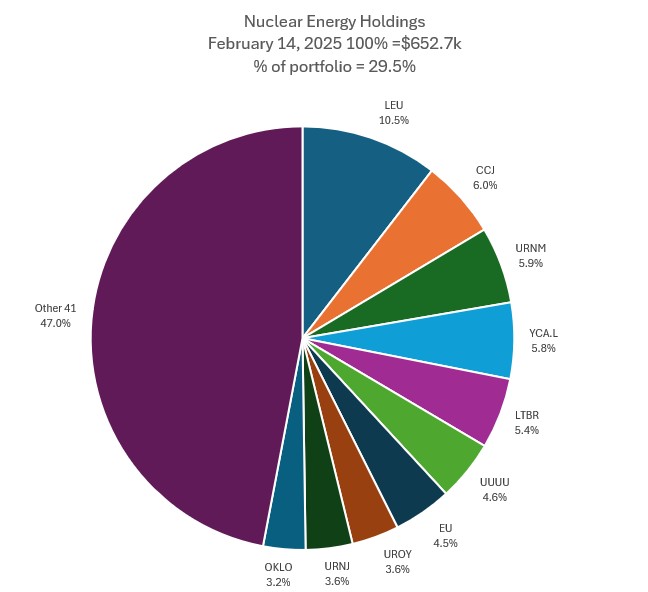

Nuclear Energy Holdings

A few additions in holdings in Canada and ASX stocks but a notable 3.6% decline in portfolio value.

A few small changes in mix of holdings with Lightbridge Corporation (LTBR) moving up one place into slot 5. Largest holding, Centrus Energy (LEU) creeps over 10%. Share of portfolios drops over half a point to 29.5%. Will drop a lot more next week as there will some assignments on covered calls.

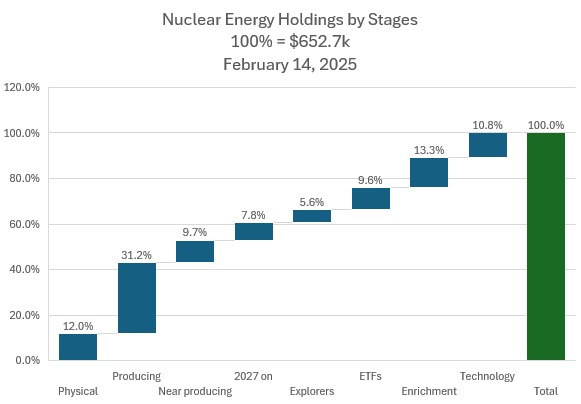

One key change is the holdings by stage with the share of Enrichment going up over 1 point to 13.3% and nuclear tech going up 0.4 points. The growth was there - a few small adds in enrichment helped.

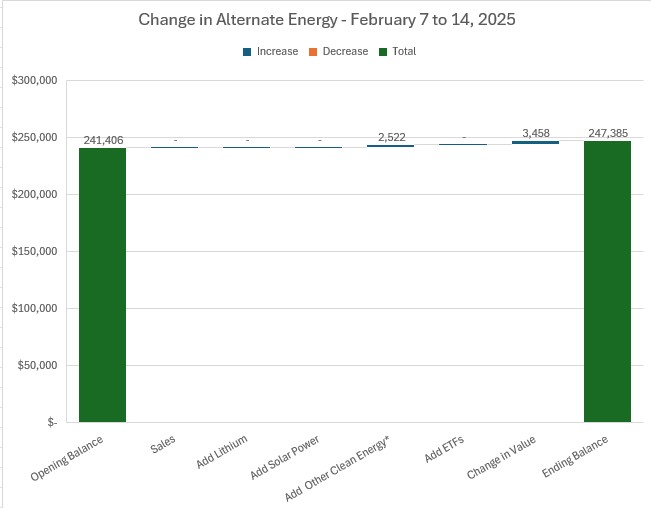

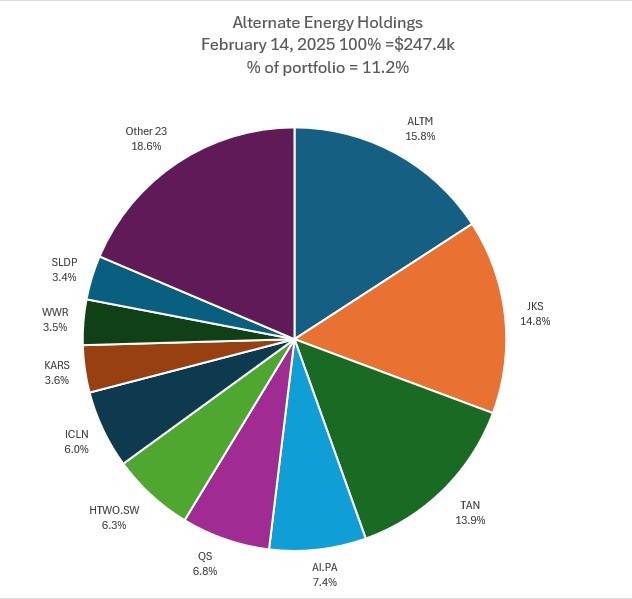

Alternate Energy Holdings

One addition in the week and a 1.4% increase in valuation of the portfolio holdings.

One small change in mix of holdings with the addition to Westwater Resources (WWR) lifting it one place into slot 9. Share of portfolios rises 0.3 points to 11.2%

Bought

Anfield Energy Inc (AEC.V): Uranium. Scaled into holding in managed portfolio using sold put premium on nuclear tech stocks like last week - adding to US exposure as a near producing and explorer opportunity.

Westwater Resources (WWR): Graphite. Scaled into holding in managed portfolio.

Got to say high trading costs kill me - these trades are similar in value yet the Canadian trade has trading costs more than 3 times higher than US trading. Same day in US options markets received commission on 3 out of 4 trades where I was providing the liquidity the broker needed - never happens anywhere else.

Silex Systems Limited (SLX.AX): Uranium Enrichment. Scaled into position in managed and personal portfolios. Price is something of a rollercoaster - each of the middle size cycles is a 40% move. Makes for a tradeable stock in a commodity area that is getting hot. New broker target marked at top of the last cycle.

Did a 2nd tranche later in the week after price was smacked down. Looks like holdings in Centrus Energy (LEU) will get assigned on covered calls - one way to keep in uranium enrichment without paying the huge premiums for Centrus.

Vulcan Energy Resources Limited (VUL.AX): Lithium. Share purchase plan addition - going to take a while to recover that entry price (reporting in Alternate Energy changes next week).

Dividend Reinvestments

Not a great believer in reinvesting dividends as I almost always have better ways to deploy free capital. These tow are an exception as they invest in indexes in my local market

Intelligent Investor Australian Equity Income ETF (INIF.AX): Australian Index. Distribution Yield 2.0%

Intelligent Investor Australian Equity Growth Fund (IIGF.AX): Australian Index. Distribution Yield 1.1%

Yields not exactly stellar for index funds - gong to dump that idea - can get more in a cash account.

Sold

Derichebourg SA (DBG.PA): Waste Management. Pending order hit at 52 week high for 5.4% profit in pension portfolio since September 2024. Only 2.1% blended profit since July 2023/May 2024 in managed portfolio - averaging down produced the profit. Ran out of patience on a stock with no options market to write covered calls. 5 months of covered calls would have made that profit. Stock screen idea.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Synlait Milk Limited (SM1.AX): Food Products. Synlait manufactures milk product mostly in New Zealand and exports to Australia, US and China. Bent one of the rules about this portfolio holding only Australian businesses = why - milk into China is a key market

Chart shows price has been smashed in 2024 - bottomed out - made a short term uptrend and then went sideways. Maybe this time

Top Ups

Fortescue Limited (FMG.AX): Base Metals. Dividend yield 8.00%. 2nd time entering in this portfolio.

Chart shows this entry averages down holding cost a little. Price has broken the downtrend but not yet found the upward momentum. Really looking for iron ore markets to start moving again. Must say was tempted to dump all the other iron ore holdings when this signal came along

Sold

Duratec Ltd (DUR.AX): Engineering Services. Closed out at 40% profit target since July 2024.

Chart shows a good example of the strategy. Price breaks the downtrend and proves it wants to go up. Entry signal comes along when 20 day moving average crosses (blue line) above the 50 day moving average (red line) - where the blue arrow is - with price making a one month high. There is one other place further along when that happens and price does make a one month high. No trade entry made as price is in touching distance of a 52 week high (the top red arrow). This prevents scaling in when price is at a heady level.

Income Trades

Covered Calls

As befits the week before options expiry a quiet week with only 2 covered calls written (Europe 1 US 1)

Naked Puts

A little busier writing puts

A few stocks running away will be assigned. Sold puts at lower strikes to capture income and get replacement entries possibly. All bar one for February expiry = two weeks risk

VanEck Gold Miners ETF (GDX): Gold Mining. Return 1.34% Coverage 2.3%

Centrus Energy Corp. (LEU): Uranium Enrichment. Return 1.22% Coverage 18.9%

Lightbridge Corporation (LTBR): Nuclear Technology. Return 6.5% Coverage 20.6%

Oklo Inc. (OKLO): Nuclear Technology. Return 9.02% Coverage 22.3% - March expiry

Scaled in sold puts on stocks not held - looking for lower entry or income

- NuScale Power Corporation (SMR): Nuclear Technology. Return 7.24% Coverage 2.6%

- Uranium Royalty Corp. (UROY): Uranium. Return 7.24% Coverage 2.6%

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 0.09% Coverage 15.6% - why bother = free money even after trading costs.

Rolled a few down the road - at each roll out the return increases

- DHL Group (DPWA.DU): Europe Logistics. 64% profit on buy back. 79% cash positive.

- ASP Isotopes Inc. (ASPI): Nuclear Technology. 13% profit on buy back. 23% cash positive.

- Elevance Health, Inc. (ELV): US Healthcare. 71% profit on buy back. 12% cash positive - down a strike. Looking for exit as TSP have done their exit

- Honeywell International Inc. (HON): US Industrials. 64% loss on buy back. 43% cash positive.

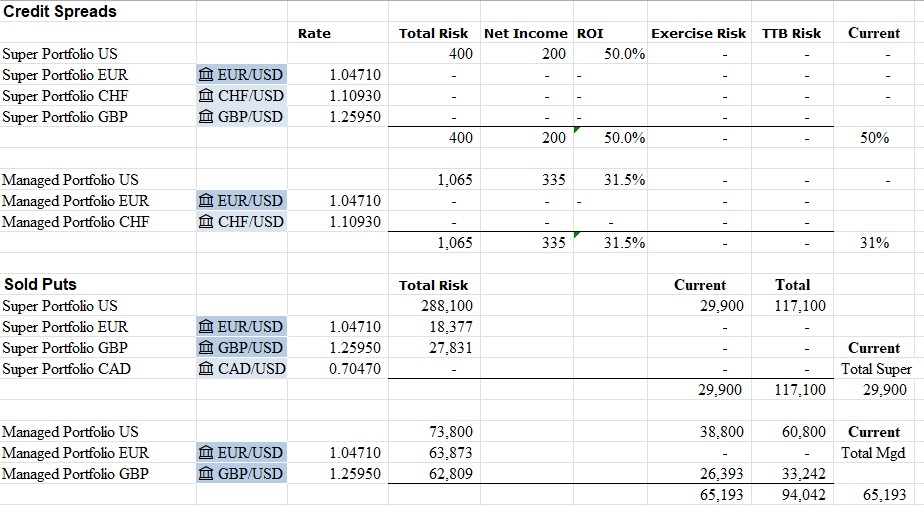

Credit Spreads

No change

Exercise risk in all portfolios is well within cash margin limits. The total risk capital in pension portfolio is a bit high BUT there will be a few stocks assigned to raise capital coming expiry (Feb 21)

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

February 10-14, 2025

This post was shared and voted inside the discord by the curators team of discovery-it

Join our Community and follow our Curation Trail

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program

!discovery 30

#hive #posh

Congratulations @carrinm! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 66000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP