Traditional Stock Market Opportunity Hunting

I have some capital and I am still looking for some new trades. The last time I looked I couldn't find much new compelling cases. I started looking again as we have been getting some movement the past month and not everything has been green. We seem to be over the Jan - Early March daily green candle climb.

Using Dividend Yield To Identify Potentially Underpriced Stocks

While I am young, I still like dividend stocks. I know they are less likely to give me a 5-10x return, but I am always happy to pull a 10% + dividend return for a year. From all my time watching stock prices, it always seemed to hit me these stocks always had a +/- 20% price range and paid dividends. If you buy in towards the bottom, and hold long enough you typically did well. This assume nothing in the business falls apart, if it does, you might be holding much longer than you wanted if you stick for positive returns. Dividends help me stay in longer as I am getting a piece back each year in cash.

THE LIST

- PM Philip Morris

- CVX Chevron

- MO Altria Group

I am sure you may have heard of these... in fact I was surprised to see two Tabaco companies make the list. While I don't like smoking - I don't think I should get to tell others what they can and can not do.... so they can drink and smoke all night. I just want to own the companies selling the products that seem to be super resilience even with the side effects.

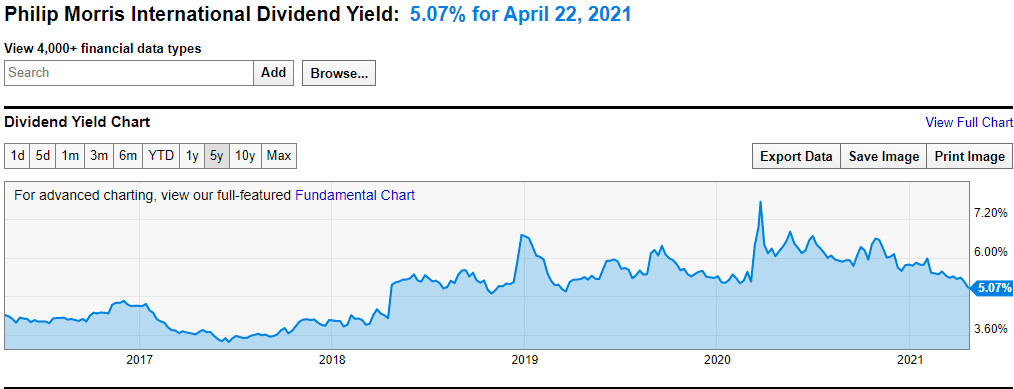

(PM) Philip Morris

Taking a look at the 5 year dividend yield chart over at Ycharts you can see it has been running higher since mid 2018. While its trending lower, it is right at its 5 year average. If I was looking to target this trade, there would not be much room before my exit. I would be looking for a Dividend yield to drop to 4.5%, at the current rates that gives a share price of about 104 or an 10%+ gain. If I hit those numbers I would close and walk away.

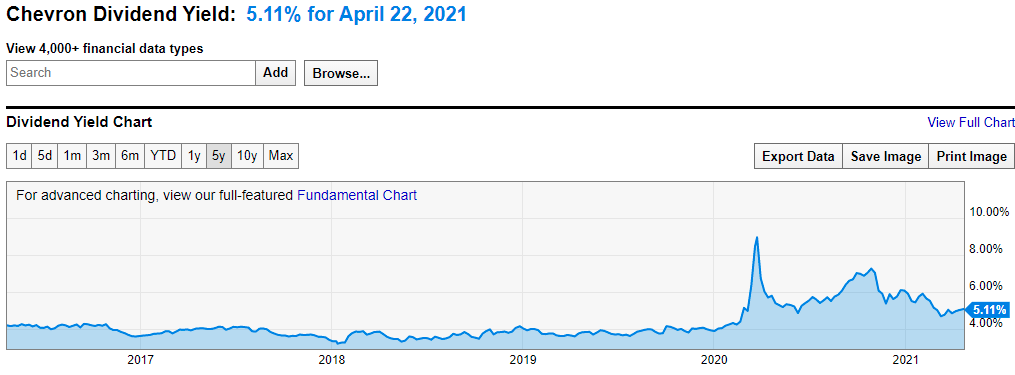

(CVX) Chevron

- 5 Year Avg 4.33

- Price Needed. 119

- ROI. 19%

Chevron looks a bit better. Since the Covid crash it has been hurting and paying a high dividend. Assuming that demand picks up, and we are still a few years away from EV, I think this looks like a decent opportunity. I already missed some big returns, but if the trend continues I think it looks like a nice trade to enter.

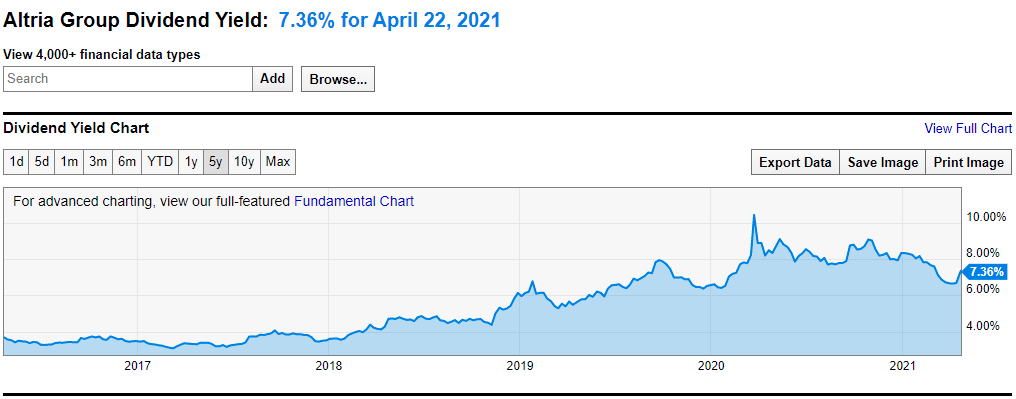

(MO) Altria Group

5 Yr Avg 5.47%

Price Needed $62.5

ROI 34%

Altria is another Tabaco play, found it when looking over PM. Seems to have a bigger dividend, although it was climbing even prior to Covid, but took a massive spike then as well. Even if we target 6.25% before we close out we are looking at a 17% gainer. I also like the fact it dumped over some FUD news about not allowing certain cigarettes'. I doubt anything will pass quickly, or if this is even something they want to focus on this year. Hard to see pushing this through while the rest is still a disaster. I think this looks like a great way to make a quick 15% return this year before closing out.

Thoughts?

What do you think about my strategy, do you use dividend yields as tool to screen for underpriced companies based on prior history?

sincerely,

@cluelessinvestor - aka a random nobody on the internet spewing nonsense

This post NOT financial advise, it contains my personal opinion and experience and is intended for educational purposes. Perform your own research and analysis prior to making investment decisions.

Posted Using LeoFinance Beta

I am long MO in a big way. Got most of mine at about 8% It's about 1/3 of my portfolio. Less people smoke every year, but they also sell wine and own a large chunk of budweiser beer :-)

Vices are a good business.

Posted Using LeoFinance Beta

It seems like a really good chance to take. I jumped in today too, not quite as heavily weighted as you, but still think it will do well for me as long as the dividends stay safe.

Might be hard to sell if the price levels return given a still 5% dividend, but I tend not to get too greedy and take profits.

Posted Using LeoFinance Beta