Many people have lost jobs in this pandemic but along with that a lot of people have also bought a home as well as plots. As in India, many consider owning a home to be one of the biggest financial goals of a lifetime. Now, this can be an arguable debate that buying a house is a good or bad investment, but for us Indians (including me) having a home is considered an asset no matter what.

PC: Pixabay.com

In one of my earlier posts I have written about Is it Right Time to Buy a House in India, and explained about it that why is it the right time. Now if you are convinced that you are gonna buy a house, let's go through the cost breakup i.e. what will be the actual cost of buying a home in India as of now. Everyone wants to have a home in his name, but the problem as of now is that buying a home is not cheap. It can be 10 times your annual income if you are planning to buy it in a metro city and close to your place of work. And this is because people like us take the help of home loans thinking the amount of rent which they pay will be equal to the EMI they will be paying.

The problem with the home loan is that you do not get the full amount in the loan you have to have 10-20% of the home amount as a down payment because banks only give about 80-90% of the loan. Then there is stamp duty, registration as well as home interiors cost which you need to take care of. Say for example you are gonna buy a 1 BHK flat for Rs 30 lakhs then you have to give around Rs 3 lakh as a downpayment, around Rs 3 lakh as a Registration and Stamp Duty, which comes around Rs 6 lakh.

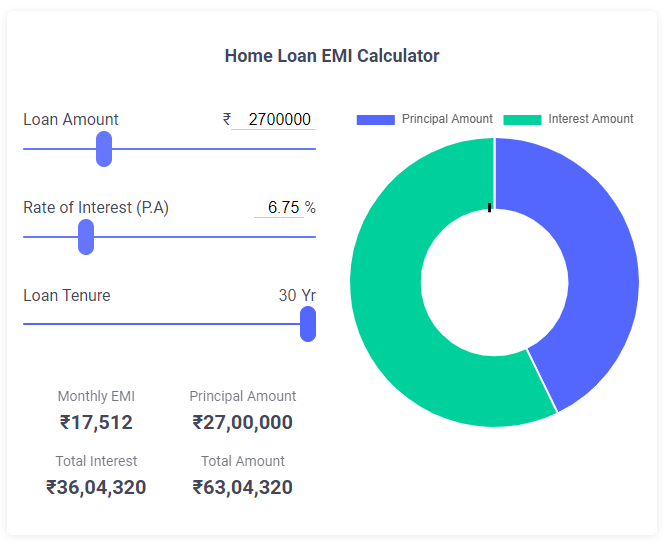

Then comes the biggest financial burden, i.e. home loan interest. The home loan interest rates are decade lows but still for a longer duration it tends to make a big hole in your pocket. Let's take the example that you are gonna go for a Rs 27 lakhs loan for a period of 30 years at a 6.75% interest rate. Then your EMI will be around Rs 17512 for 30 years assuming the interest rate is constant throughout the loan tenure. The total interest paid by you over the course of 30 years is Rs 36.04 Lakhs and that means the total repayment amount is at Rs 63.04 lakh.

PC: Groww.com

Now in my case when I have taken the loan, I have reduced the tenure to 10 years as well I used to do part prepayment so that my interest paid comes out less and thus I could close the loan in 7 years.

Now along with this, there are other charges like loan processing fees, documentation charges, legal opinion charges, property valuation fees etc. Then comes MODT (Memorandum of Deposit of the Title Deed) charges which lenders charge for holding the title deed and it ranges between 0.1% to 0.3% of the home loan amount. But all these charges comes around 1% of the loan amount.

For the sake of total cost let's assume you have to pay the developer extra for floor rise, car parking, etc which usually do not go beyond 10% of the total cost. So it will come around Rs 3 Lakh. And then the furnishing which we take roughly around Rs 3 Lakh.

So the actual cost of owning a home is Rs 3 Lakh (Down Payment) + Rs 63 Lakh (Home loan Interest + Principle) + Rs 27000 (Processing fee 1% of the loan amount) + Rs 3 Lakh (Stamp duty and registration) + Rs 3 lakh (for car parking and amenities) + Rs 3 Lakh (Furnishing) = Rs 75.27 Lakh

That means Rs 30 lakh property now will cost you around Rs 75 lakh in 30 years (assuming you pay for the full 30 years and do not pre-pay it). This post is all about knowing the actual cost before doing such a big investment.

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more, by @codingdefined.