2024 has come to a close so it's time to look at each of the individual projects that I'm invested in to see how they did and give an outlook for what I expect in 2025. Overall, it was a good year where GambleFi did what it is made for, providing high and steady dividends from all the people who enjoy gambling their money away. As a Sports Bettor who has managed to narrowly beat the market for a couple %, being on the other side of being the casino/sportsbook is just way easier and it also has become more profitable as my portfolio has grown over the years.

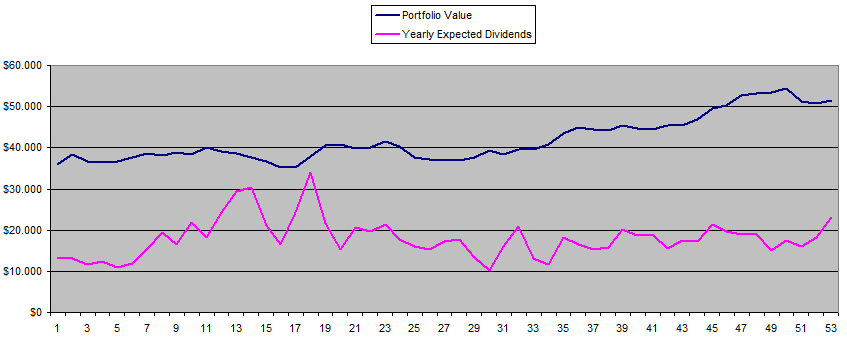

I started the year with an overall portfolio which was worth around 29k and it ended at around 51k, the total amount of passive dividends I earned were around 19k and I reinvested around 5k of those into the portfolio. In reality the earnings were quite a bit more as most were done in BTC/ETH or other coins which appreciated over the year.

So wile there is no crazy crypto 10x-100x story with this portfolio, it's also not the purpose as the main aim is to get a steady portfolio value and a great source of income out of it. I still thing GambleFi is one of the most sound sectors as it's one of the only ones where values are actually based on numbers and real returning customers.

This is How I rate the individual Projects

Sportbet.one (SBET)

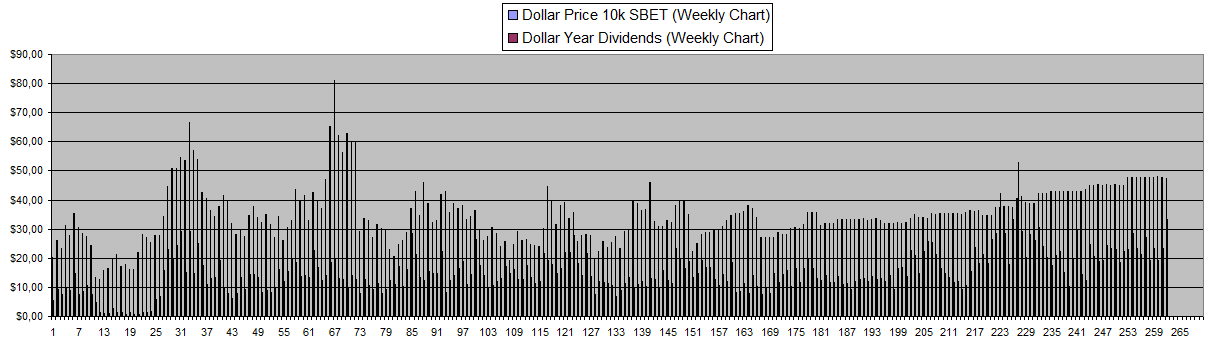

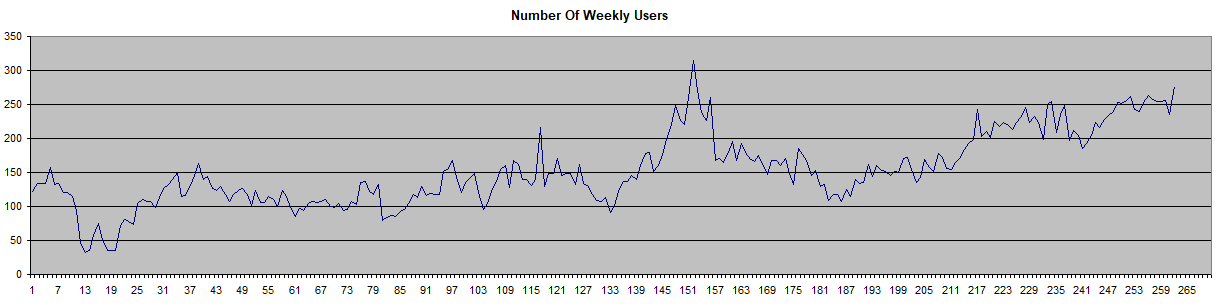

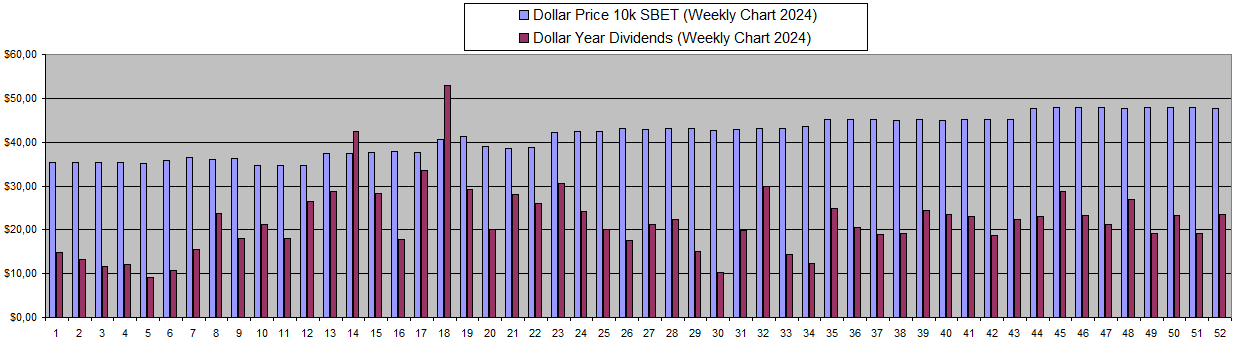

This has been my biggest investment out of this portfolio now for years to the point where I have tracked data on the dividends for the last 260+ weeks! It's so much that the chart in excel needs to be expanded to show things properly.

I haven't bought or sold a single SBET all year just keeping the 5 Million that I own staked while collecting the dividends each Monday. SBET started at a price of 0.00353$ and finished the year at 0.00475$ so a +35% increase. It needs to be said though that not much is needed to move the price up or down as there is thin liquidity. So both buying and selling can be a hassle. In total if I just sold each week for USD, I would have earned exactly 11k which means the APY on average was 62% calculated with the price at the start of the year. The fully diluted Market cap right now is still only 4.7 Millon and when only counting the circulating supply it is half at 2.35 Million.

As far as the development goes, it once again went rather slow as it's more or less seen as a 'finished product'. They did integrate a way to easily deposit and withdraw Solana and also moved all coins aside of EOS into their own native coins as USDT and pNetwork no longer support EOS. This increased the centralization risk as the only way for them to not have control is to use EOS as a currency to bet with. In the end, 99% of the gamblers don't really care about this even though it is something to be aware of as this means there is a risk of a rug pull. However, the 5+ years of flawless operation so far gives some trust almost no other project can match in the space.

The average number of users has been going up slowly but steadily still with a lot of potential to grow. This were the exact numbers for 2024

SBET 2025 Outlook: I expect SBET to continue in a similar way to the past 5+ years. Gamblefi generally underperforms in the bull market and overperforms in the bear market which makes it a nice buy and hold. In order to buy this one and receive dividends, you need to go out of your way and get an EOS account while buying it at coinstore. I don't see that many doing this so the returns likely always will stay quite high. Last week, they came in at over 70% APY and if if stays there it will eventually lead to someone buying and pushing the price up. I have enough and will just let it ride in both the bull and the bear market unless something fundamentally changes.

Betfury.io (BFG)

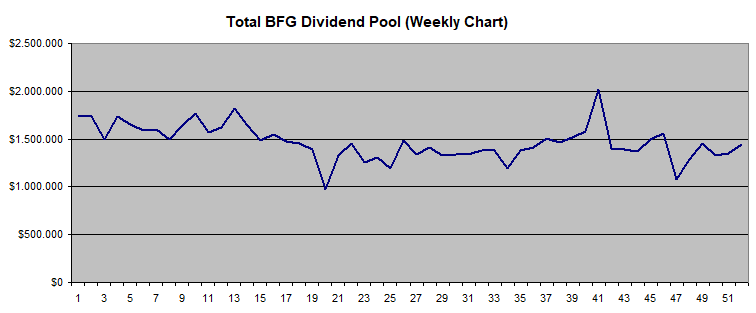

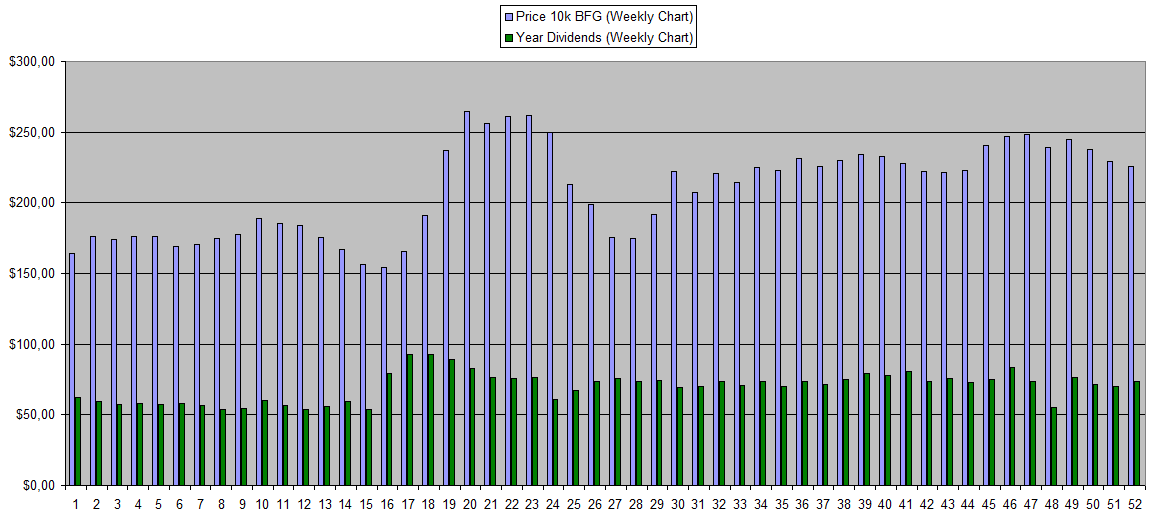

BFG is turning more and more into the pattern of SBET with stability as the name of the game ever since all the tokens were released in circulation. The Price of BFG at the start of the year was 0.0164 and went up to 0.0225$ by the end of the year so a 37% increase. They tried to artificially pump it by giving double the dividends for those who stake their tokens for a year (which pretty much just reduces the returns for those who don't stake). This game a slight increase in returns but in the end, the only real thing that counts is the reward pool and how good that holds up.

This reward pool more or less stayed flat and the general rules is that the price more or less quals around 30% APY. My 500k BFG which I staked at the time the staking went live gave a total of 3.6k Earnings which based on the price at the start of the year equal +44% APY. I never had any issue withdrawing earnings.

Last week the returns were at 34.58% and the reward pool went up a bit.

BFG 2025 Outlook: I expect for things to remain stable for BFG maybe with some small growth. In the end, it does have a 75M Fully Diluted Market cap while there is quite some competition from other projects.

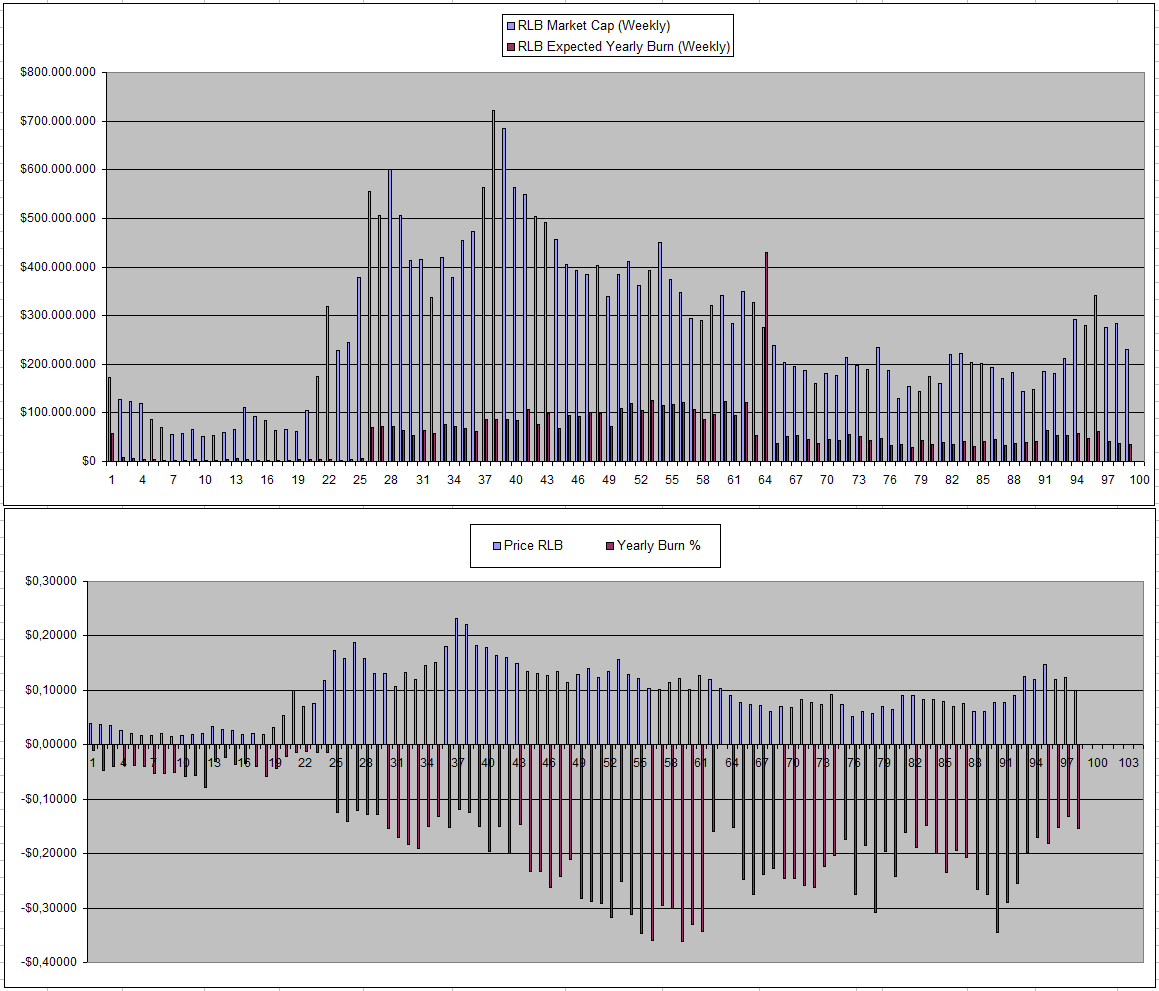

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

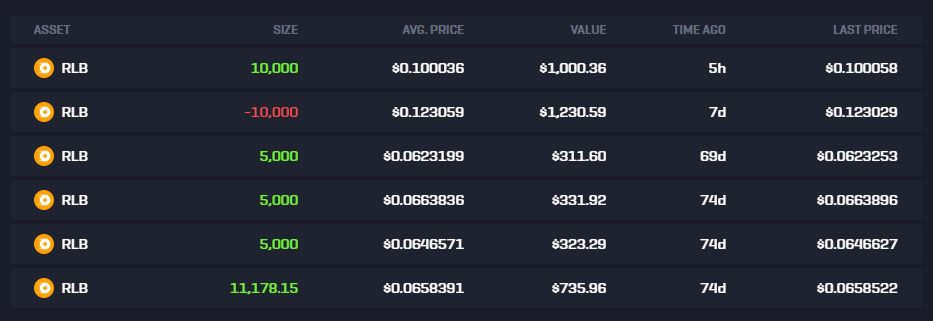

I used to be mainly invested in the NFTss but KYC requirements forced me to sell and I got quite lucky on that as I managed to sell my Sportbot at the time when there still was a big whale using the sportsbook. Ever since they kind of collapsed. With the funds of the Rollbots I sold, I saw a good opportunity to buy RLB. Last week the Yearly expected burn reached below 15% so I sold some but this week it again was above it so I managed to buy back at a lower price.

RLB at the start of the year was at 0.128$ while right now it's at 0.1$ so around a -12% decrease all while purely on tokenomics they by far should be the most sound. The big issue with Rollbit is that it just looks too good to be true knowing that 15%+ of the supply gets burned in a year. So far however this is exactly what is happening.

RLB 2025 Outlook: I do expect things to just continue to go their way without any major issues which eventually will push the price of RLB up. I'm sticking to the strategy where I'm selling some of my bag if the burn gets below 15% yearly and see where it goes.

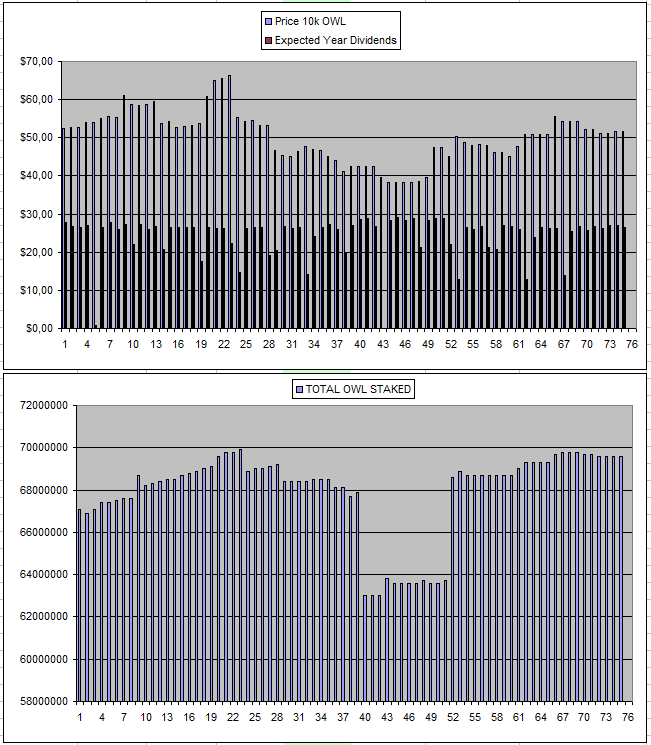

Owl.Games (OWL)

Pretty much nothing happened all year for OWL aside from the dividends being paid out reliably as a nice return. The price at the start of the year was 0.00515 while right now it's a bit lower at 0.00479$ (-7%). My 3090$ investment at the start of the year gave a total of 1453$ in dividends so a +47% APY.

In the last 18 Months since I first invested, I managed to earn back 64% of my investment from the dividends and I never had an issue withdrawing so far.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

| 03/12/2024 | 600k | 3179$ | 2766$ | 30.72$ | 1869.58$ | 58.81% | +1456$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

OWL 2025 Outlook: Looking at how things went so far, I don't expect much to change for OWL even though some activity would be nice to see. At the same time I'm already happy if it doesn't get rugged allowing me earn back what I invested? I'm not planning to put anything more into it.

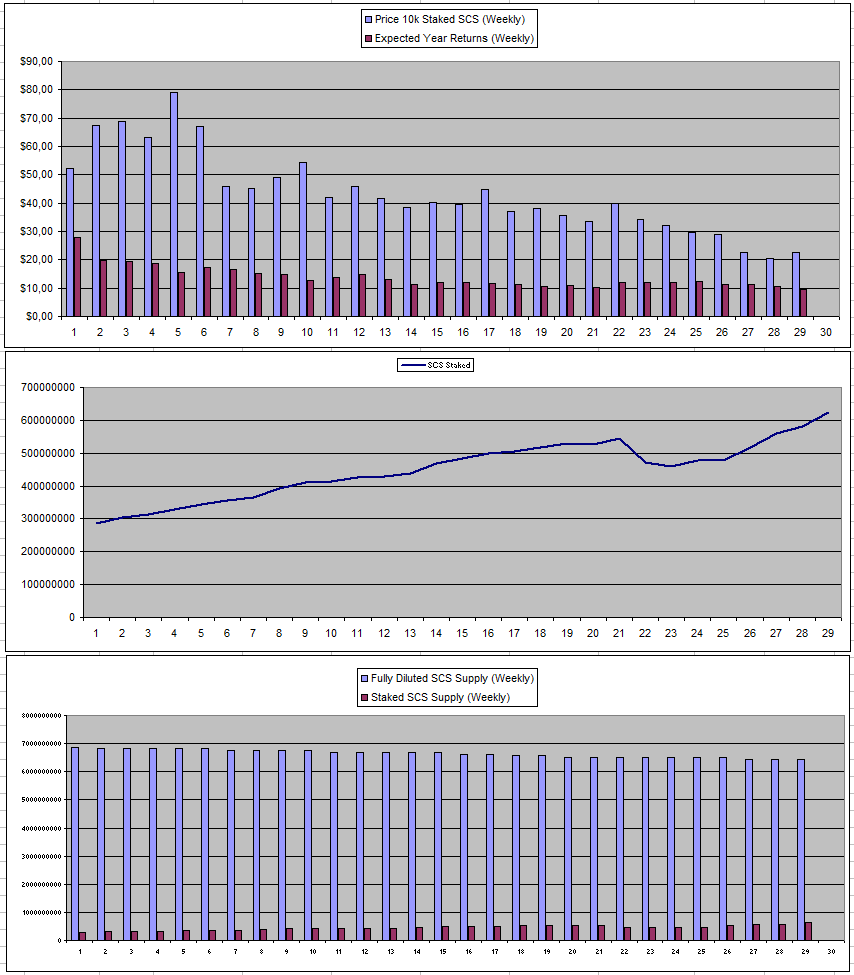

Solcasino.io (SCS)

Solcasino for sure is interesting as it similar to the others gives nice dividends for staking. However, SCS is still in a token release phase which means there is selling pressure kind of similar to BFG years ago. I only started investing in it this year with a very slow amount just to test in and ramped things up a bit as the price kept falling. SCS a year ago was at around 0.0056$, it pumped to 0.0268$ to afterward see a never ending dump to now 0.002$.

The good thing is that the fully diluted market cap is only around 14 Million now while they do have quite some users and revenue. At the same time only around 10% of the supply is staked at the moment so likely it will be hard to pump like crazy unless there si some massive adoption.

I only recently ramped up my position and still don't hold too much while the returns right now are around 10%-50% APY but they are under pressure as last week along there was a +7.47% increase in staked SCS with a long way to go still

SCS 2025 Outlook: I expect the SCS dilution to continue which puts pressure on the price while at the same time it feels like the team wants to get the price of SCS up and there are multiple ways they can do this. SCS is still in a buying range for me and I likely will add more along the way unless there is a sudden big pump.

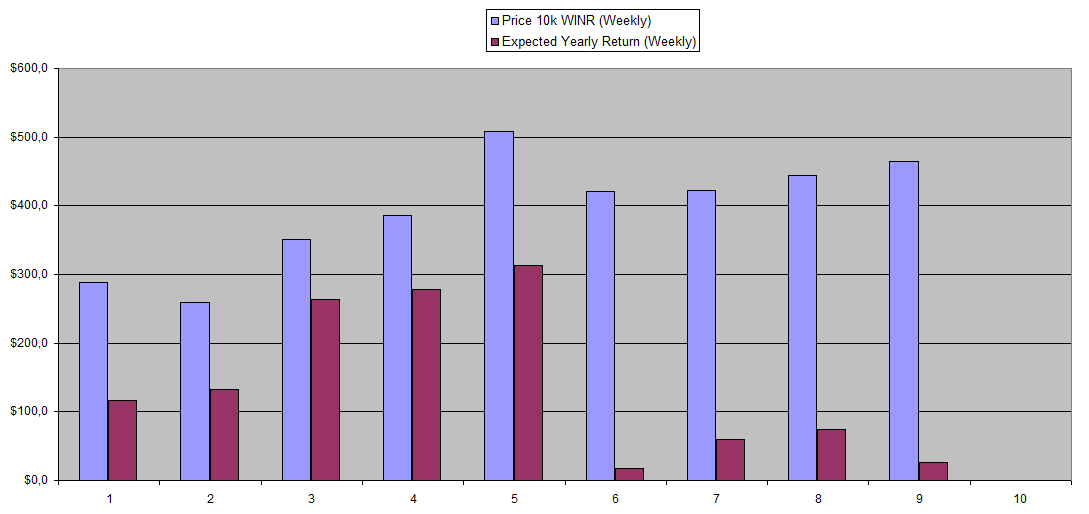

I first invested in WINR at the start of the year at a price of 0.077$ just buying 10k WINR. This wile on January 1xt it was at 0.131$ which means at the current 0.0468$ price it's down -65% of the year. However, I'm glad that I made that buy as it allowed me to closer track the project and see that they actually have something with big potential.

There was a lot of development during the year with te WINR chain being released which kind of reset everything but at the same time there were also multiple growth problems and delays. The price went as low as 0.0186$ which I used to double down getting up my position to 150k WINR at an average buy price of 0.032$.

WINR 2025 Outlook: I do see WINR as the Project possibly with most potential and I can only really see it grow in 2025. I have my bag set at what I thing was a good price and I'm happy to let it run and follow the ride this year. In the end, it remains GambleFi so there are numbers that hold down the potential price peak so I see it doing well but not go crazy.

vBookie (NFTs)

Last year, DefiBookie went down leaving everyone think it got rugged as the devs got scared of regulatory issues which were always known since the start. However, they did build real tech and managed to re-deploy it under vBookie. In the end it is an extremely low cap project with a market cap of the NFTs under 500k so either it will do really well or go down to zero.

| Last Week | This Week |

|---|---|

|  |

Right now they are still kind of finding their way trying to attract more users. last month there was a small loss so no dividends which also pushed the price of the NFTs down again.

vBookie 2025 Outlook: Purely as a risk/reward I still see vBookie NFT's as a solid play right now since it's so cheap while the tech has some potential and the intention to make it all work certainly is still there. This probably is the best chance right now to hit a 10x-40x so I just keep holding my 26 NFTs

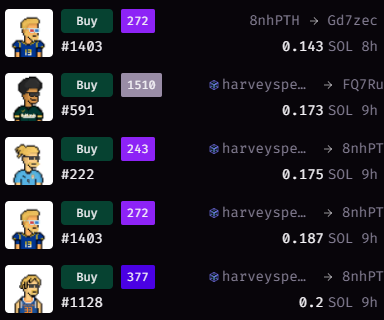

Sx.Bet (SX)

SX is really trying to build the Crypto Betfair but even with Feels at zero and betting incentives, it remains hard to really hard to attract users. Because of the 0% fees they also moved to paying dividends just with inflation and the idea that one day they will be turned on again. They are working on getting a casino ruling using WINR Protocol and I do expect that to release in 2025

The price of SX started the year at 0.117$ but now is down to 0.075$.

SX Outlook: I expect a continued struggle in 2025 for SX to actually attract users but at the same time a continued growth and development. So I'm happy to keep holding and if there are good signs or a much lower price at some point, I might buy some more.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +70% APY |

| Betfury.io (BFG) | +35% APY |

| Owl.Games (OWL) | +50% APY |

| Sx.Bet (SX) | +15% APY |

| WINR Protocol (WINR) | +6% APY |

| Solcasino (SCS) | +41% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

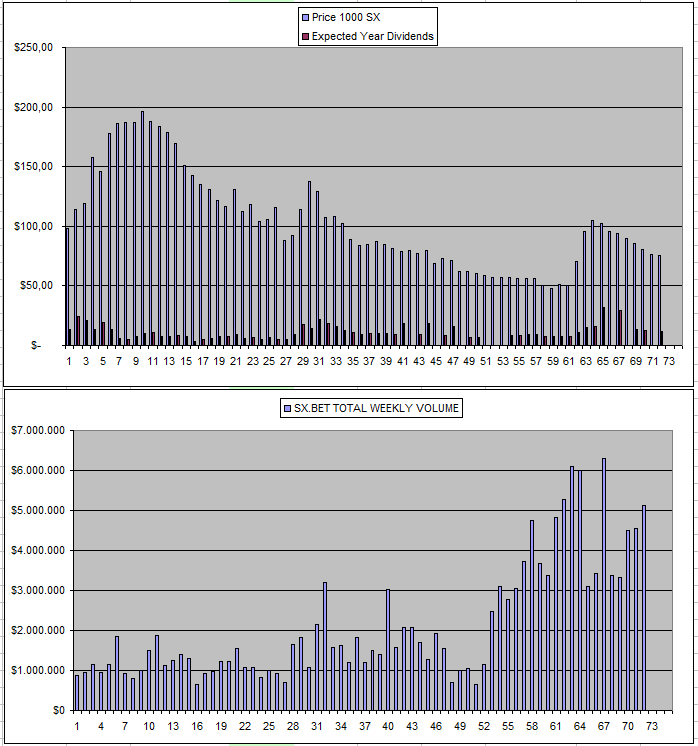

Personal Gambling Dapp Portfolio

It actially was a great first week with 445$ in passive GambleFi Earnings for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 27.4k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha

!BEER

View or trade

BEER.Hey @costanza, here is a little bit of

BEERfrom @thehockeyfan-at for you. Enjoy it!Do you want to win SOME BEER together with your friends and draw the

BEERKING.