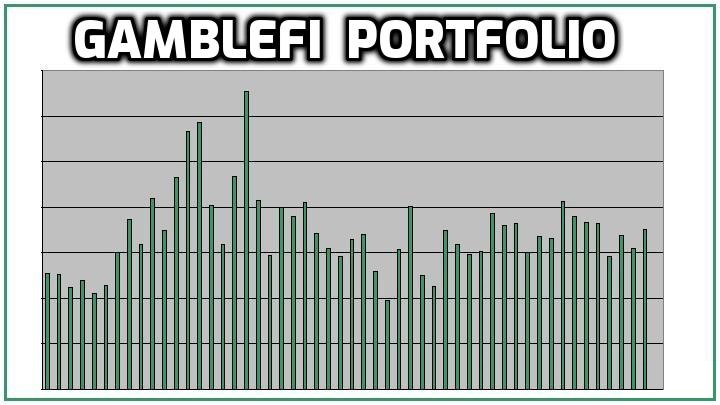

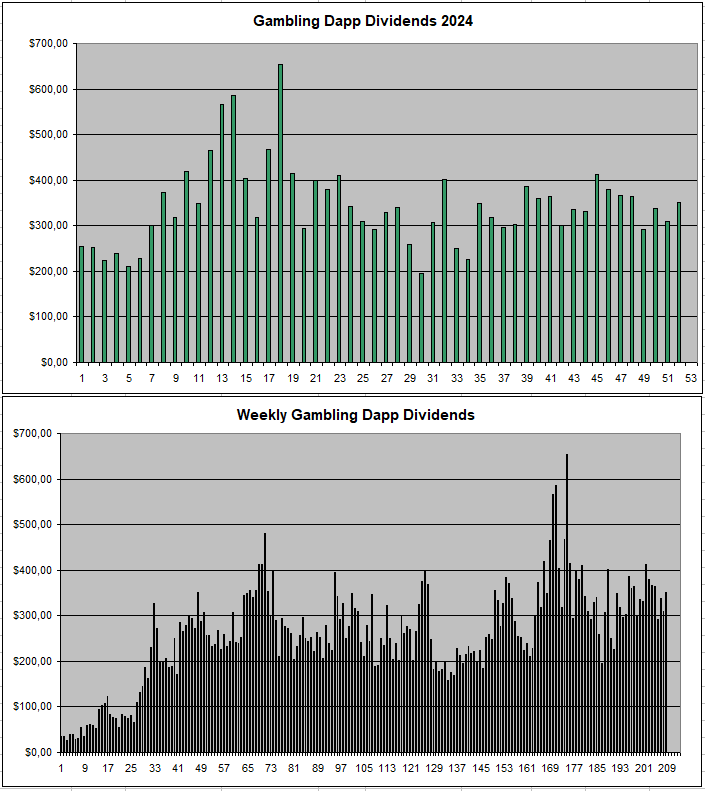

This was the final week of 2024 which overall was a pretty good year for my GambleFi Portfolio which earned me an average of around 350$ each week in passive returns. I did reach my goal of having 50k as a total value of the portfolio but I kind of want to extend that in 2025 toward 100k, especially knowing that these coins tend to be the most bear market resistant. I will make a full year breakdown next week.

Solcasino.io (SCS)

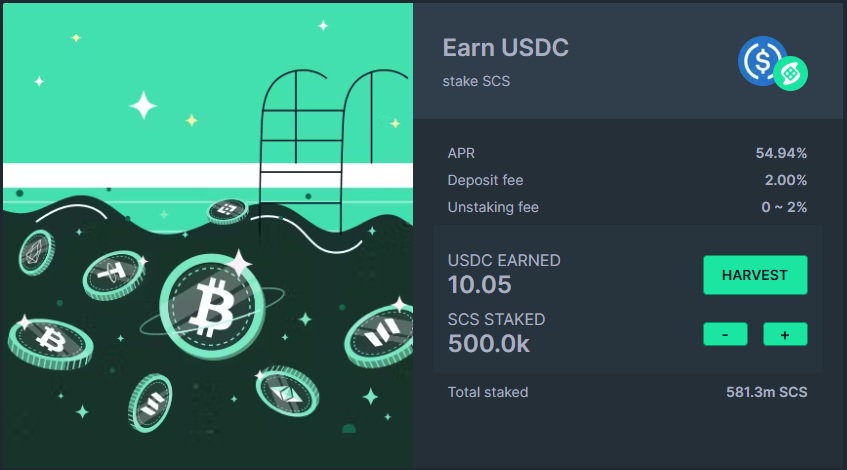

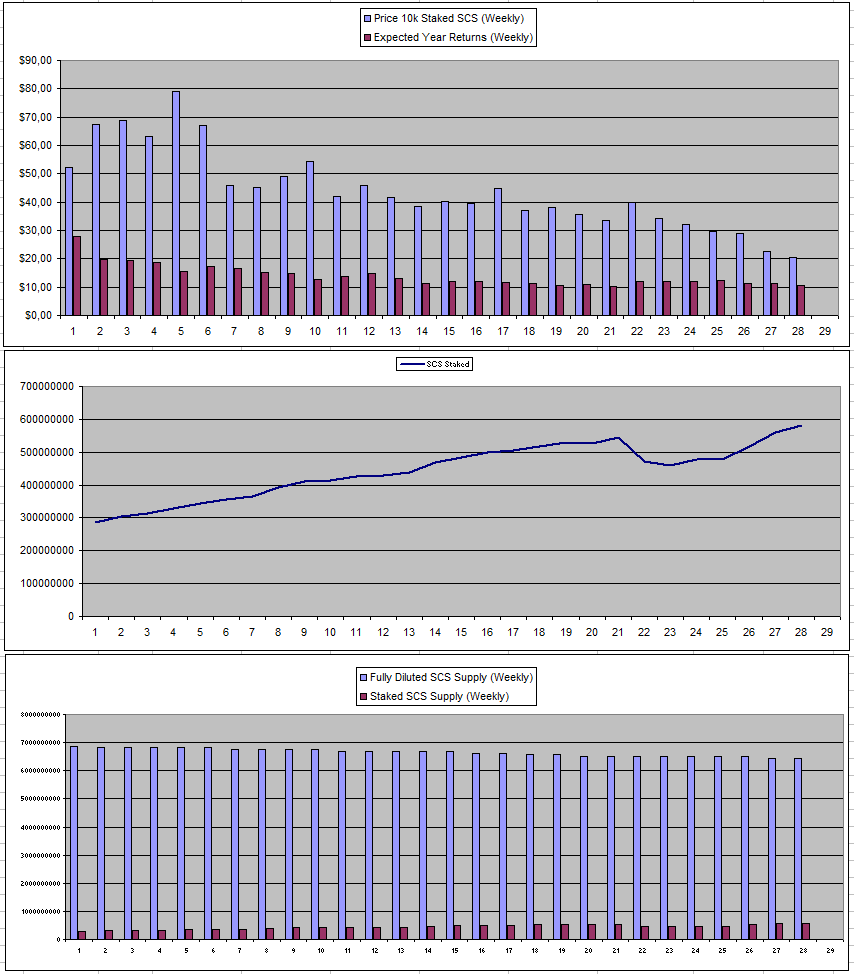

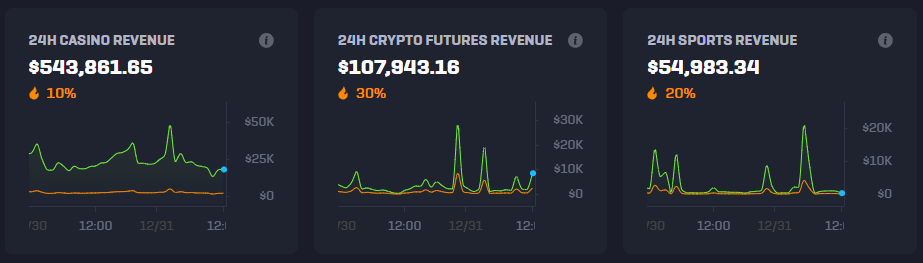

SCS continues to go lower in price now falling below 0.02$ and I do plan to keep cost-averaging on the way down as I do see the price now as a reasonable buy level to have a stack that will continue to earn dividends weekly. The 500k I have staked now brought it 10$ which which is a point where it starts to be worth something and make a difference.

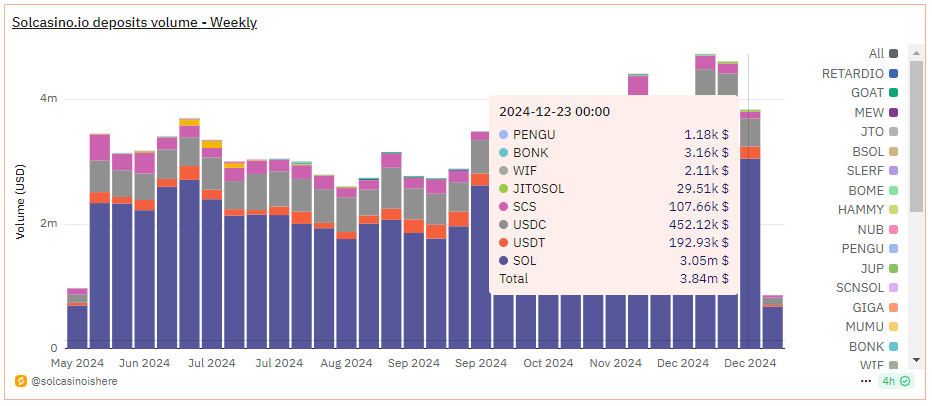

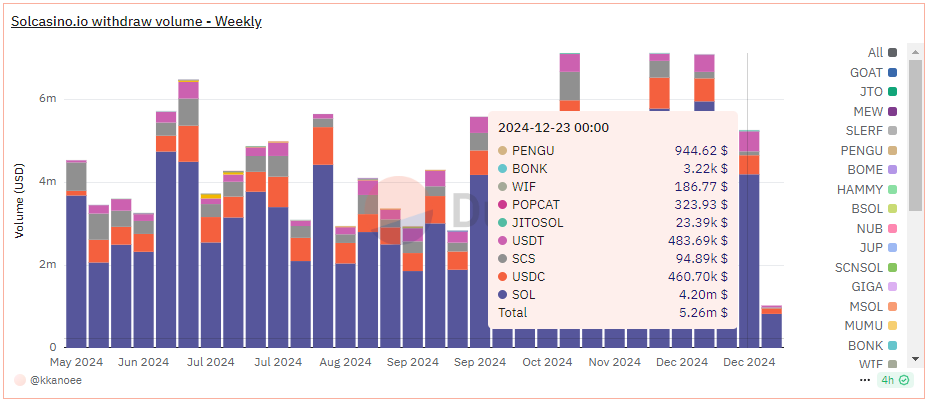

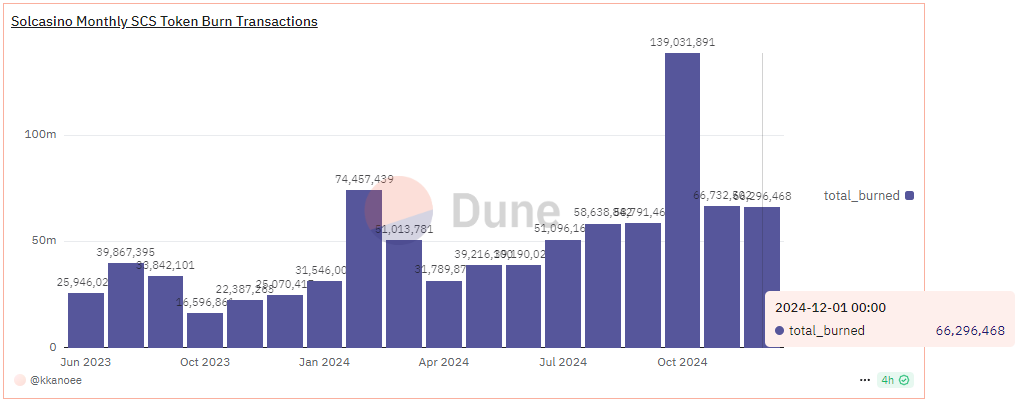

The staked SCS also continues to go up last week with another +3.53% compared to what was staked and right now only 9.04% of the max total supply is staked. That is the main reason why the price is going down very similar to how it used to be for BFG when that was in a token release window. The team released a page on Dune (Link) with all kinds of on-chain statistics which will be nice to follow. These mainly show the deposits / Withdrawals / Burns

Looking at the dividends, they actually do hold up quite well despite the fact that more SCS is staked and the returns are increasing as the price continues to go down. I assume this will continue with more SCS getting stakes which puts pressure on the returns which again puts some more pressure on the price. In the past there were multiple occasions where the team stepped in to provide some kind of price support and there will be another SCS burn at the start of January.

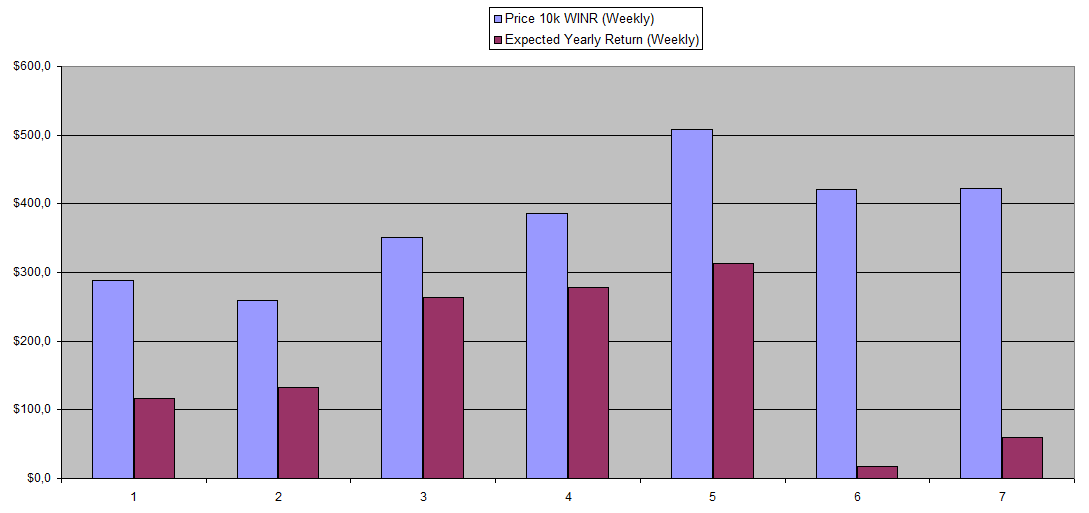

Last week, I got 16.61% APY from my staked WINR but the same issues remain as the vWINR merge along with the fixing of the Brett pool seems to always get pushed back for months now. It is going to be interesting to see how things will go in 2025 and I do expect quite some developments going forward. I'm quite happy that I managed to stack my WINR bag at an average price of 0.032$ as now it's trading at 0.0455$.

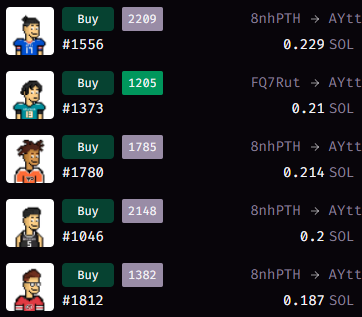

vBookie (NFTs)

The floor price right now feels very low again and it's another wait to see what the actual numbers in December were and if there is going to be a revenue share or not.

| Last Week | This Week |

|---|---|

|  |

Sportbet.one (SBET)

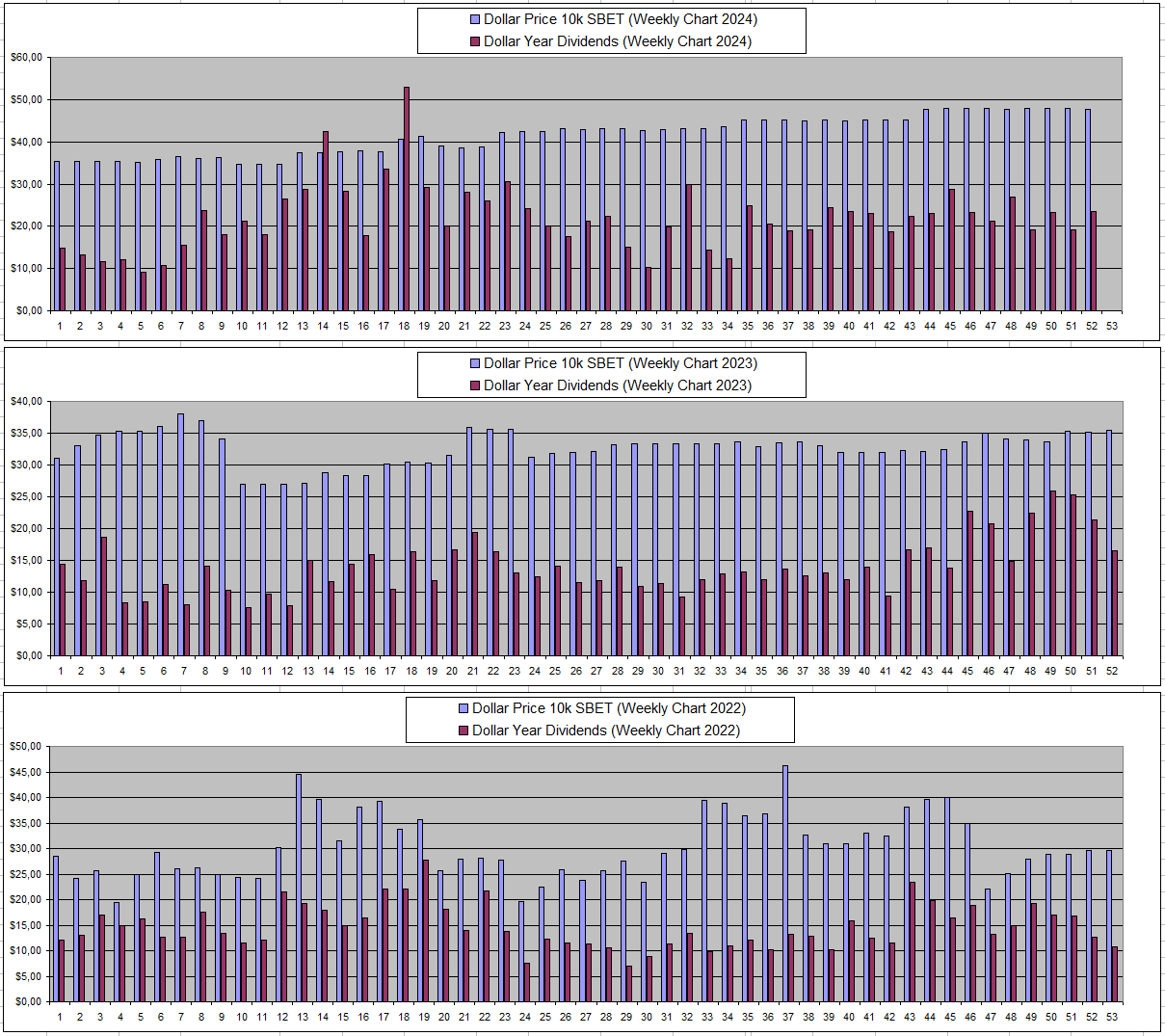

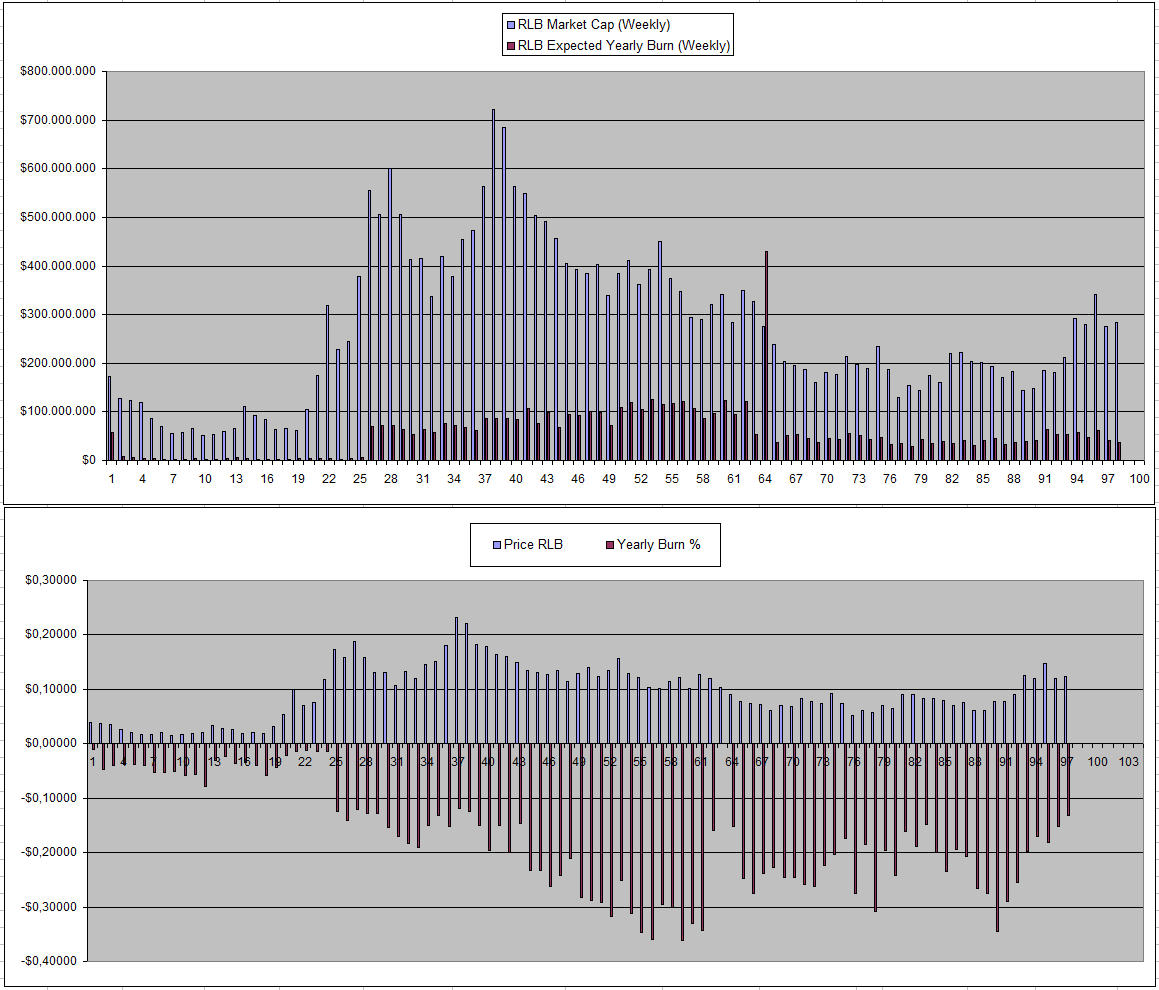

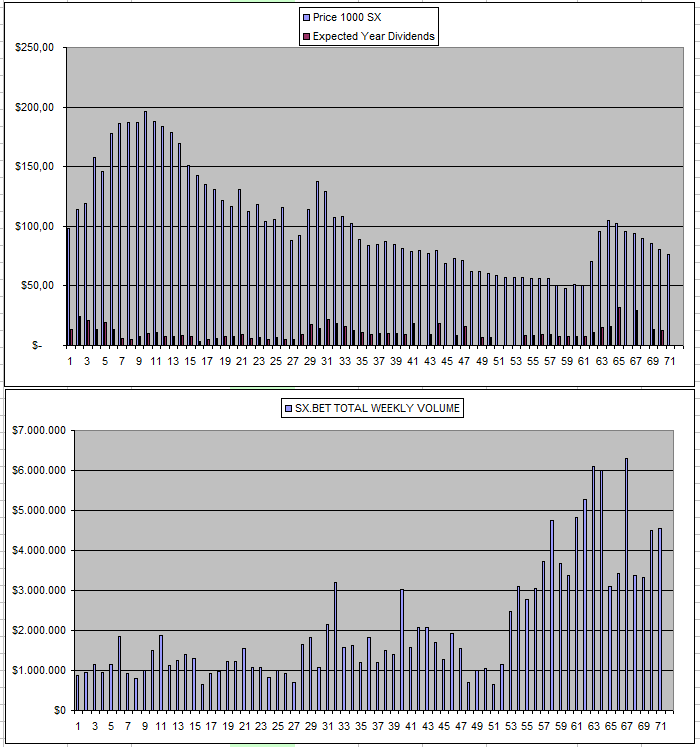

SBET remains the reliability itself with another year of flawless operation never missing dividends which have been very stable. This is 5-years of data worth from SBET that I personally tracked showing the price and the Dividends on a weekly basis.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

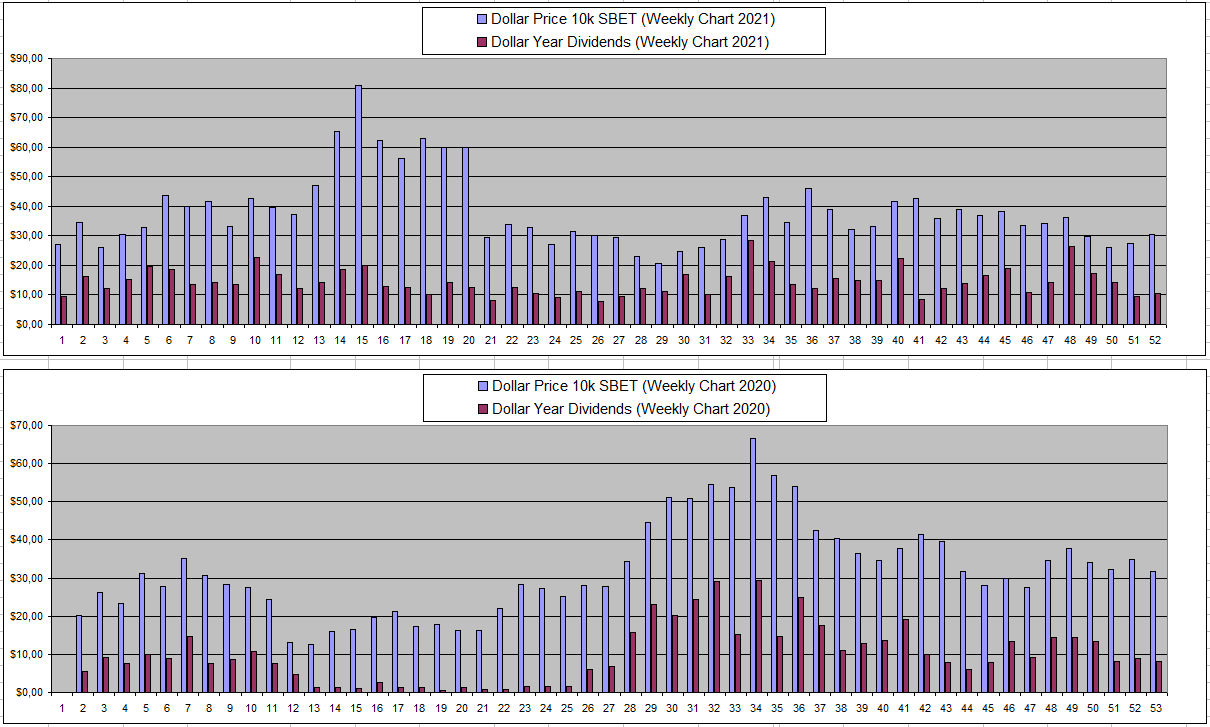

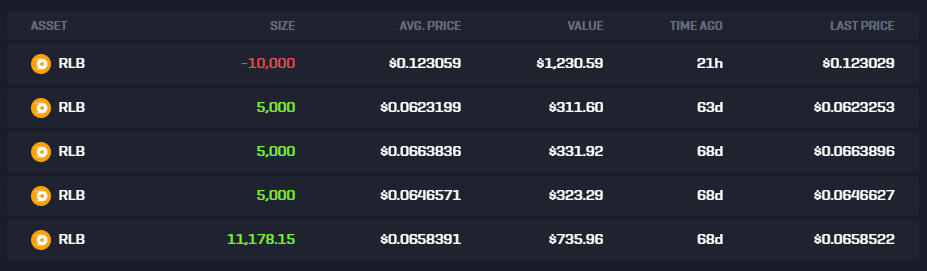

RLB got to a point where the burn reached lower than 15% yearly so as planned in advance I started to take some profit on it selling 33% of my holding to USD. If the burn doesn't go above 15% again I might sell some more and in case RLB would crash further going below 0.1$ which gets it above 15% again I will buy it back. In an ideal situation it would always fluctuate which allows me to get more and more and more but I'm not counting on that.

While I don't have data anymore of NFT dividend returns, I regularly check up on the Sportsbot that I sold which now is at just 8.18$ of monthly share which is near the all-time lows. at some point when the whale was active it was 140$+.

Sx.Bet (SX)

There were no dividends added this week but I did manage to claim one ones of last week. I haven't fully been caught up with what is happening with the project.

Owl.Games (OWL)

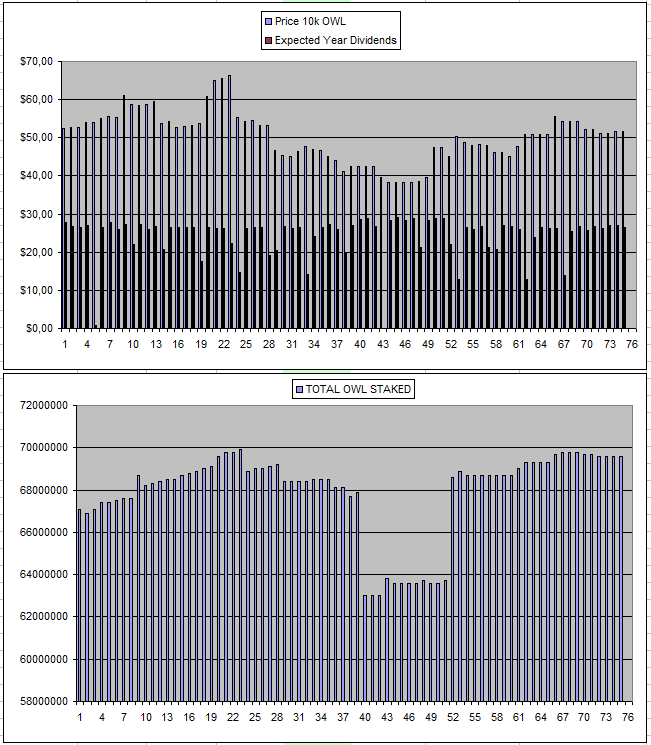

More reliability also for OWL which shows in the chart these past 75+ weeks in which I managed to earn back around 63% of the investment while I would be up in total in case I would end up selling my bag now. It has been a great source of passive income that I can withdraw every couple of months to invest in other projects.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

| 03/12/2024 | 600k | 3179$ | 2766$ | 30.72$ | 1869.58$ | 58.81% | +1456$ |

| 10/12/2024 | 600k | 3179$ | 2715$ | 30.14$ | 1899.72$ | 59.76% | +1435$ |

| 17/12/2024 | 600k | 3179$ | 2716$ | 31.15$ | 1930.87$ | 60.74% | +1467$ |

| 24/12/2024 | 600k | 3179$ | 2731$ | 31.04$ | 1961.91$ | 61.71% | +1514$ |

| 31/12/2024 | 600k | 3179$ | 2731$ | 30.42$ | 1992.33$ | 62.67% | +1544$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

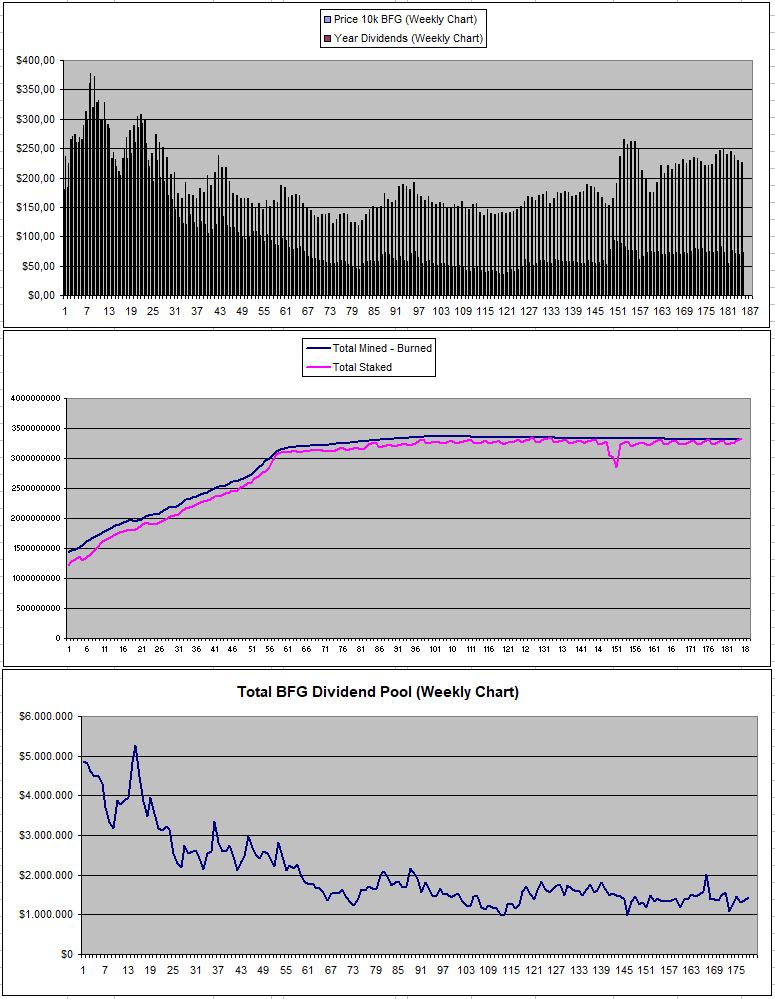

Betfury.io (BFG)

BFG dividends again were up to 70$ last week and it has been a stable year with some development but limited actual growth.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +49% APY |

| Betfury.io (BFG) | +33% APY |

| Owl.Games (OWL) | +51% APY |

| Sx.Bet (SX) | +15% APY |

| WINR Protocol (WINR) | +16% APY |

| Solcasino (SCS) | +51% APY |

| VBookieSports (NFTs) | +39% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

350$+ last week in passive earnings again last week for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 27.4k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha

!BEER

View or trade

BEER.Hey @costanza, here is a little bit of

BEERfrom @thehockeyfan-at for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.