There was a delay last week in dividends from SBET as they merged to a new system but quickly after making my update post it was all handled properly without any issues to I still added it into my stats making the weekly 136$ dividends into 363$ as SBET remains my largest stake with good returns. This week, I got the first dividends from vBookie which is a project I wrote off back when it was called DefiBookie, I added a bit to my SCS position during the current dip and WINR currently is in Maintenance mode.

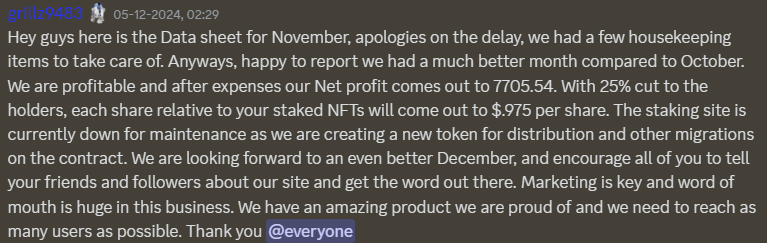

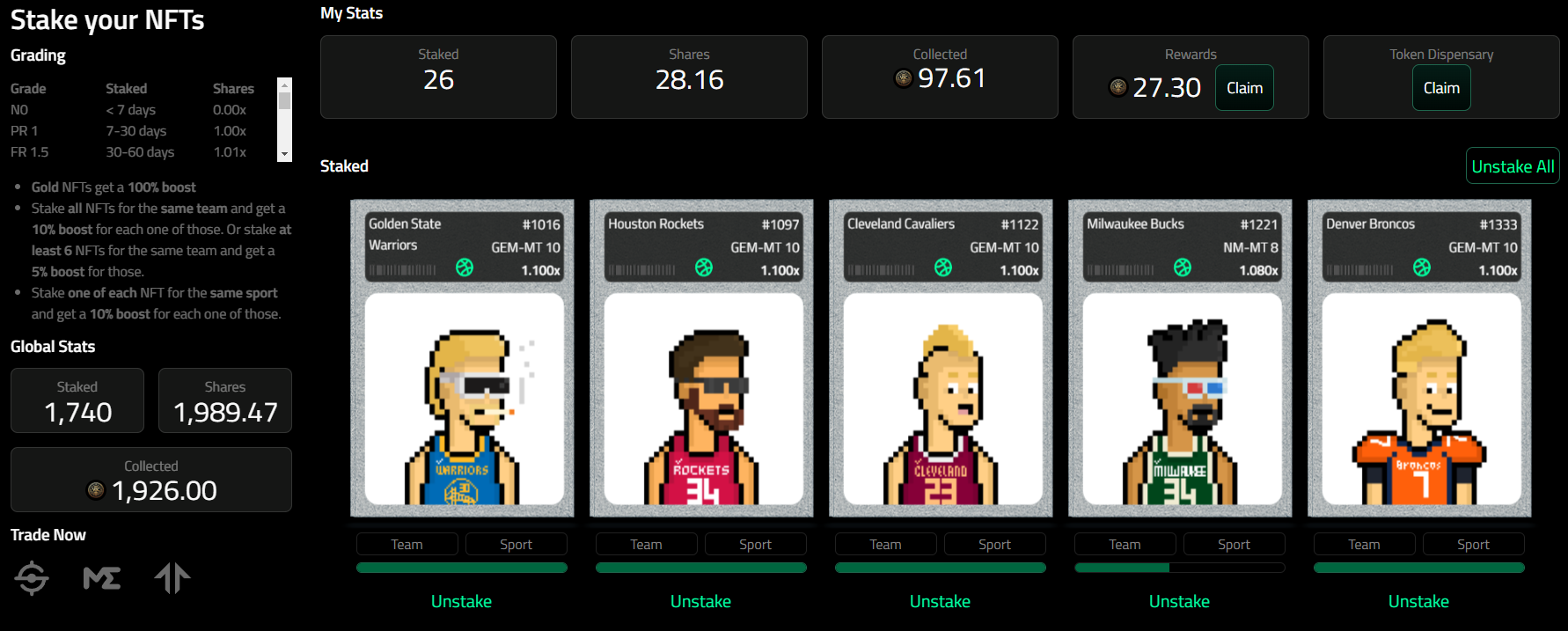

vBookie (NFTs)

There was a report for the month of November which showed profit so for the first time since week 13 this year there was a payout which came at an average of 0.975$ per staked NFT also depending for how long they have been staked.

My 26 NFTs received 27.30$ VBC (vbookiecoin) which I assume can be turned into USDC. At the current price of

At the current floor price of 0.19 SOL for an NFT (41$) this would give a 28.5% APY and it's quite tempting to spick up a couple more at the current price as it's not that hard to see revenue increase. As tte same time, I'm quite happy already that my NFTs finally start generating some dividends again.

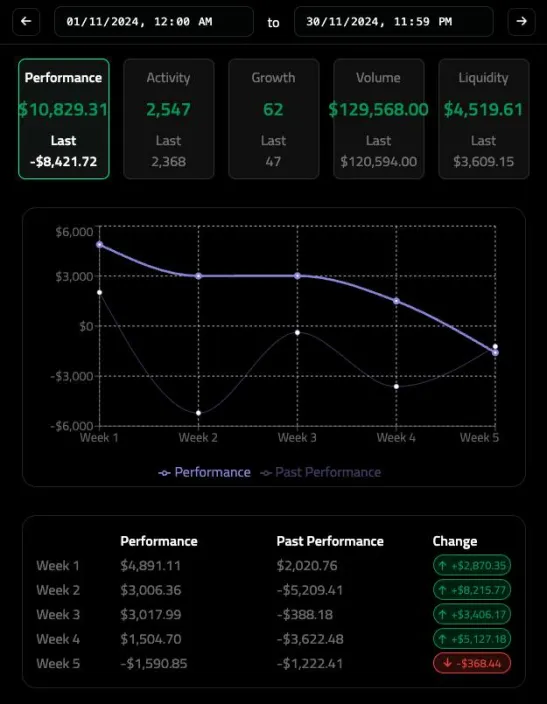

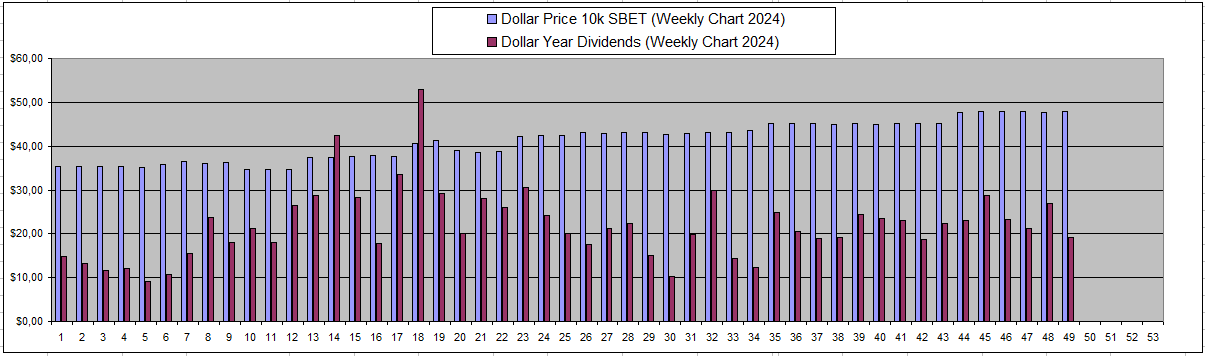

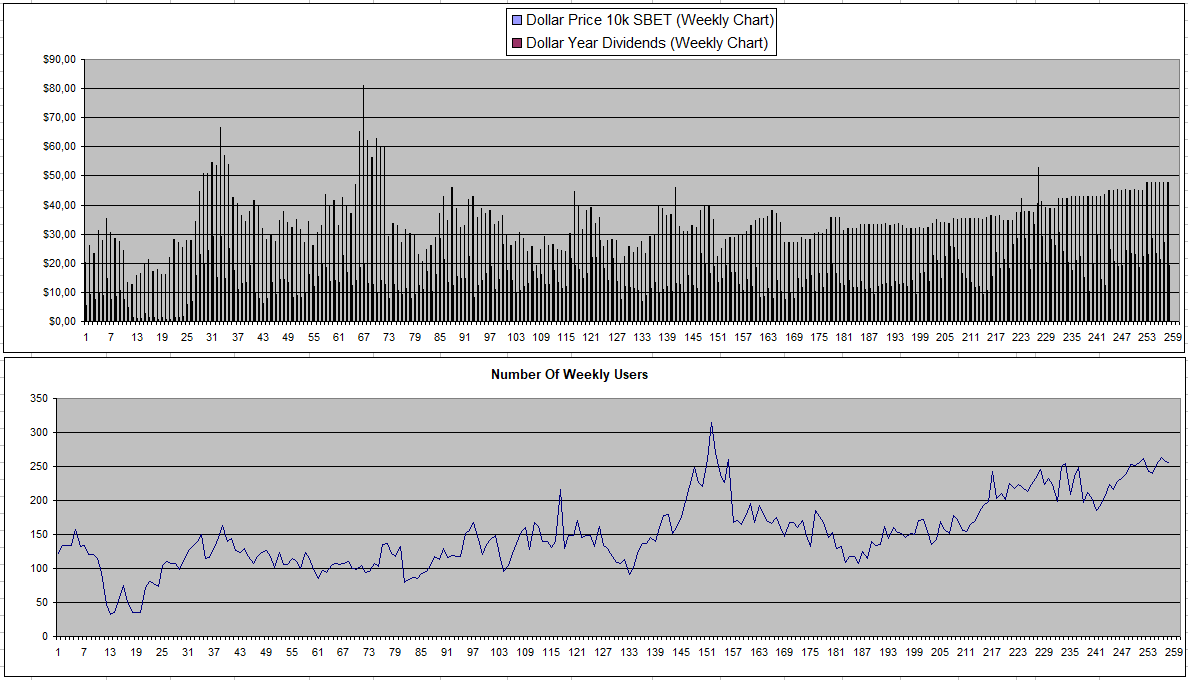

Sportbet.one (SBET)

Not the highest dividends from SBET last week but the migration into a new token system was successful. The USDT I saved up over the weeks from dividends came in handy to buy the dip in some other coins as it's easy to transfer into Binance. Since SBET is traded against USDT with not much buying or selling going on, the price remains pretty stable which is nice to have during market corrections. Overall, SBET has been a nice revenue generating project over 5+ years now with more or less a set it an forget it approach claiming dividends once each week and using them to re-invest into other projects.

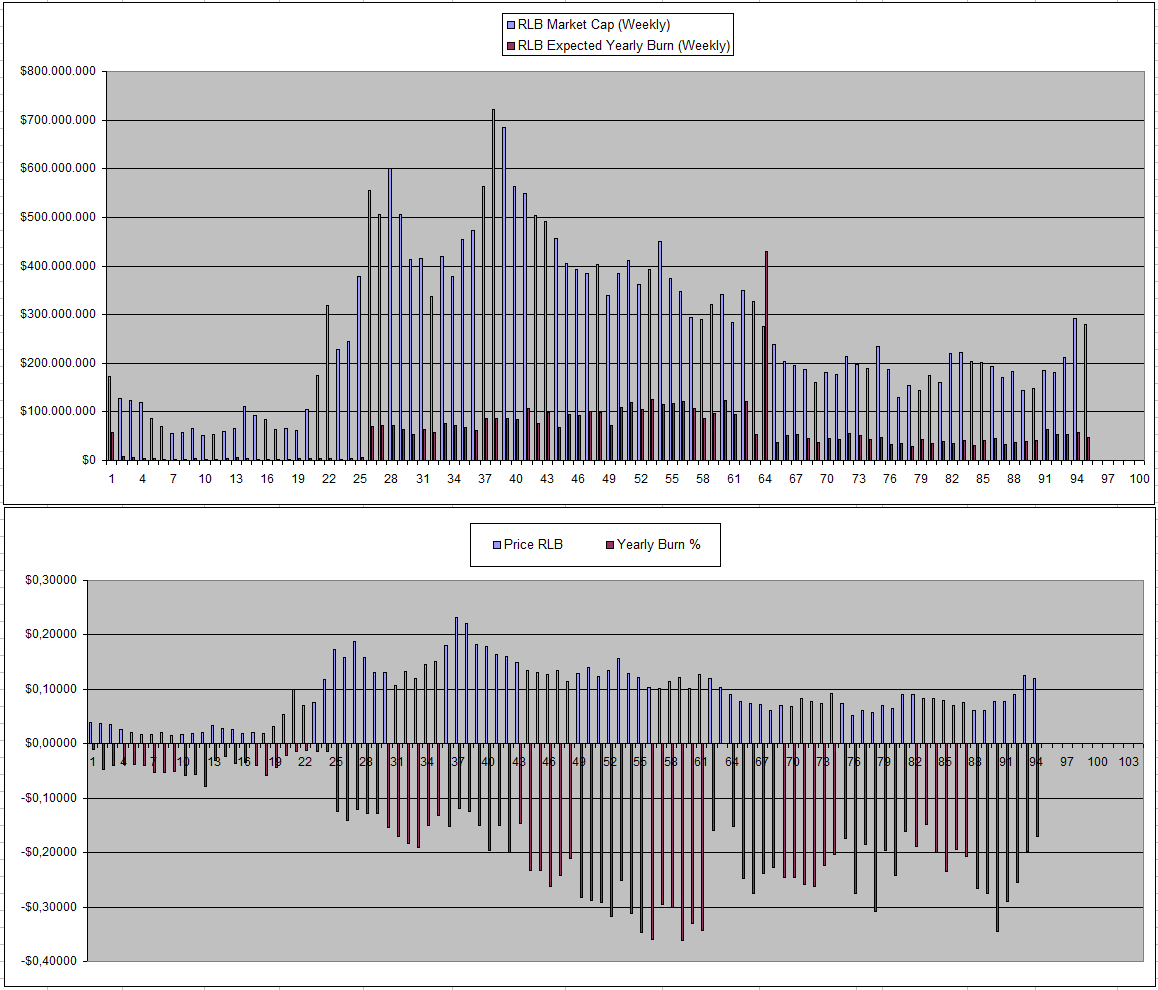

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

The RLB burn dropped a bit more to 17% Expected yearly and the price of RLB started to come down a bit as it's very much linked to the crypto market in general. It's still above the 15% which I have as a target to possibly start selling a bit so for now I'm happy to hold and see the supply of RLB go down week by week.

From the looks of it, the revenue from Leverage trading is going up as they allow a very convenient way to do it and many likely got liquidated by the volatility.

| Date | Brett Pool | Brett Staked | Brett Now | Earnings |

|---|---|---|---|---|

| 12/11/2024 | 186582$ | 10000 BRETT | 11604 BRETT | +1604 BRETT |

| 19/11/2024 | 159763$ | 10000 BRETT | 6878 BRETT | -3122 BRETT * |

| 26/11/2024 | 129122$ | 10000 BRETT | 6874 BRETT | -3126 BRETT * |

| 03/12/2024 | 68$ | 10000 BRETT | ???? BRETT | - *** |

| 10/12/2024 | Offline | 10000 BRETT | ???? BRETT | - *** |

(* Caused by bug which was fixed)

(** Another bug or Drain of the Liquidity Pool ?)

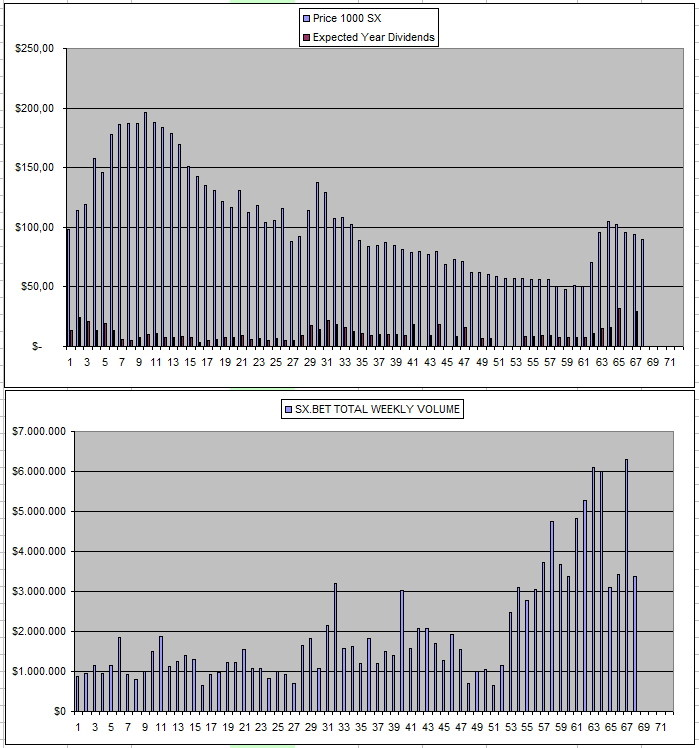

There will also be a first 3rd party platform who will start using WINR for their own casino. This is sx.bet which I'm also invested in. 20% of the revenue will go toward WINR stakers while part of it will also go to SX Stakers.

So overall I'm still hopeful on WINR and see everything in the past week just as temporary problems that come along with launching something new. In the end it all remains high risk high reward investing in a sector that still needs to get mainstream adoption.

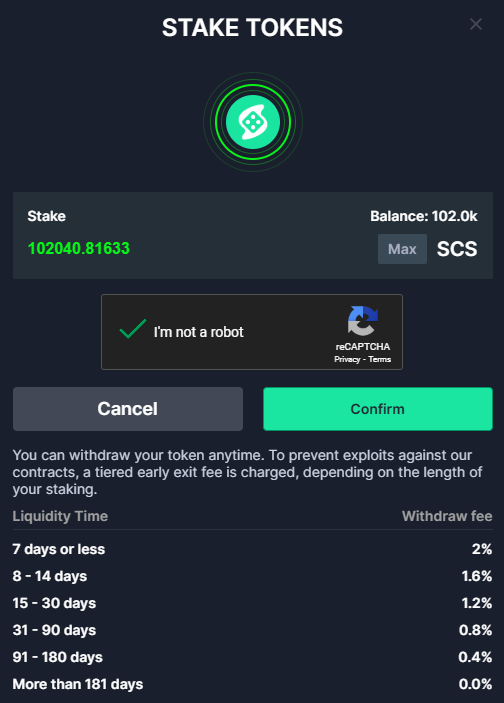

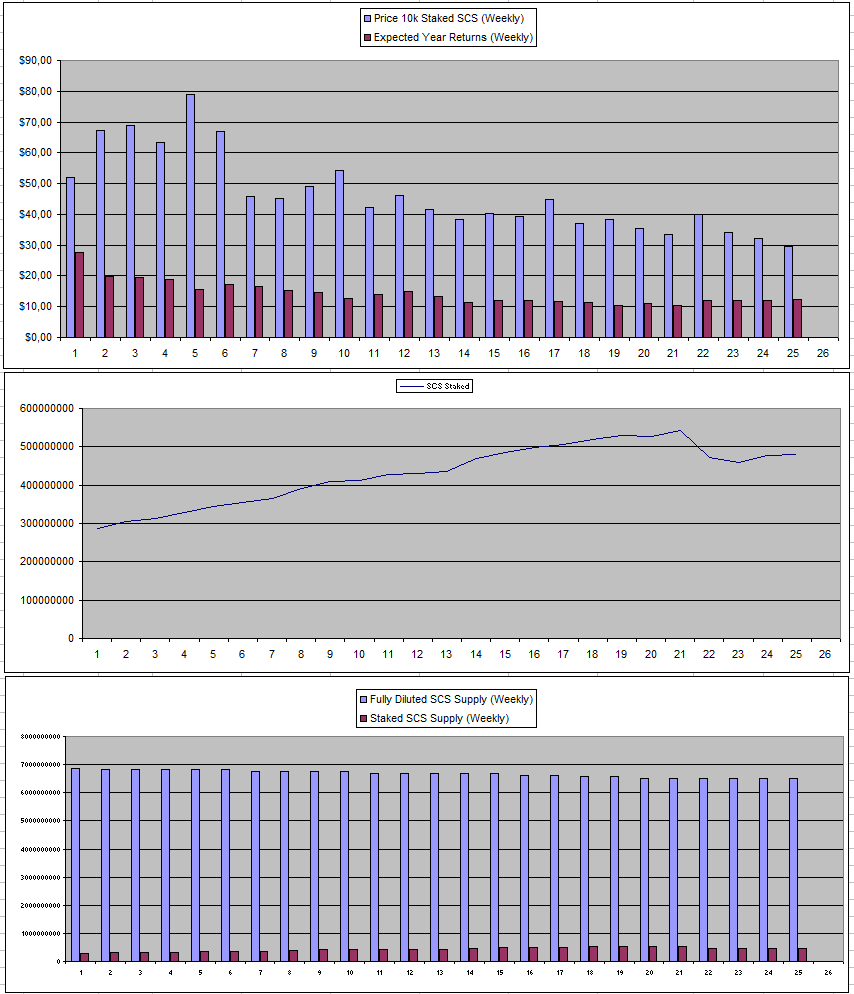

Solcasino.io (SCS)

SCS because of the recent dip for me got into a price range where it starts to be worth the risk. I did increase my stake to 200k last week already which now gave 4.7$ in Dividends and I bought 100k extra paying 271$ for it (including the 2% staking fee in the price). This now brings me at 300k stakes and I have a target to at least get to 500k and some hope that it possibly will dip a bit more.

Right now I still only invested 1178$ which in total is now worth around 800$ so a very limited drop and limited investment. I will see that I can get it at least to 400k SCS this week as the current price range just feels very reasonable for a coin to just stake an hold for the longer run while raking in dividends week by week which is the entire focus of this portfolio.

Sx.Bet (SX)

Volume was down again last week and there were no dividends as last week I got them double.

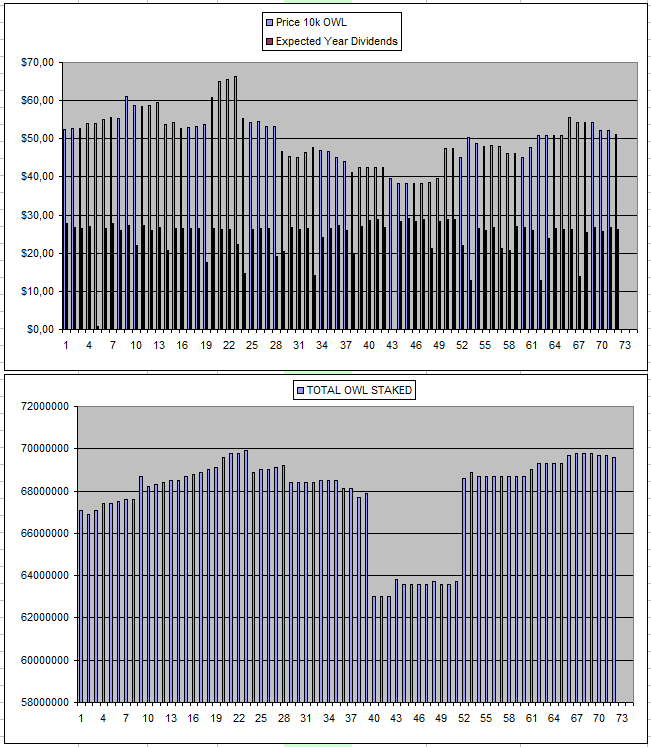

Owl.Games (OWL)

It's nice to see that there was no delay dip this time and I continue to work my way into recovering the entire investment just from the dividends received. I did another withdraw but really don't like the 5$ fee that is charged each time. Right now this is at 60% already. It will be another 2-3 months before I do the next withdrawal.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

| 03/12/2024 | 600k | 3179$ | 2766$ | 30.72$ | 1869.58$ | 58.81% | +1456$ |

| 10/12/2024 | 600k | 3179$ | 2715$ | 30.14$ | 1899.72$ | 59.76% | +1435$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

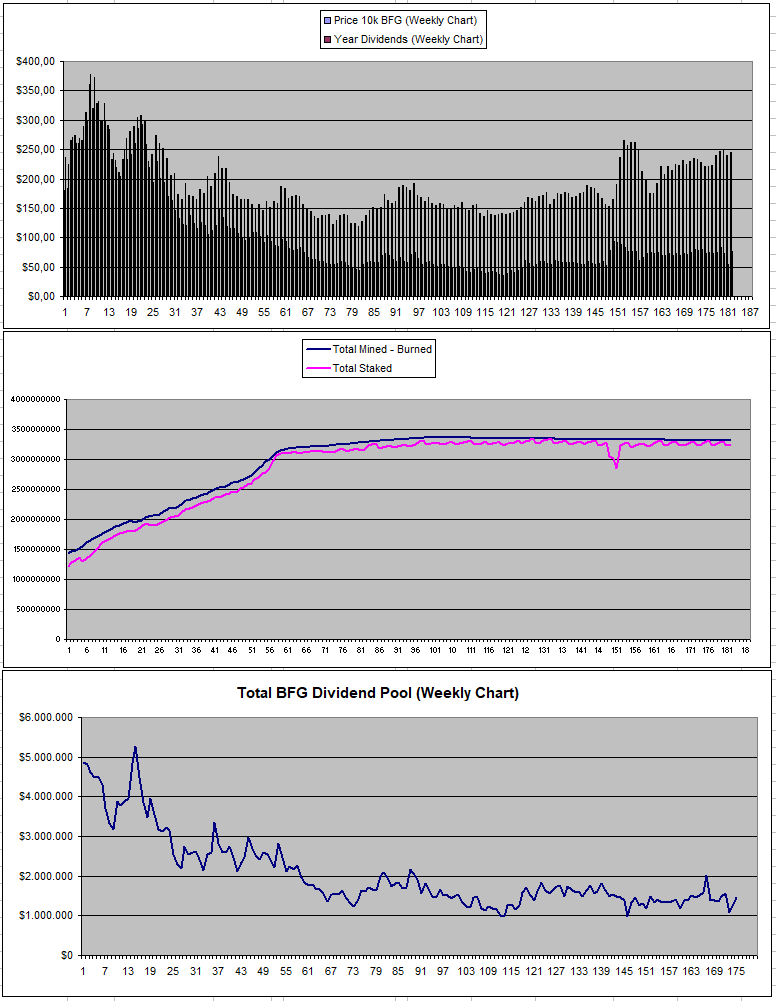

Betfury.io (BFG)

The dividends were normal again this week above 70$ for having 500k BFG staked and it looks like the dividend pool is going up again.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +40% APY |

| Betfury.io (BFG) | +31% APY |

| Owl.Games (OWL) | +51% APY |

| Sx.Bet (SX) | +16% APY |

| WINR Protocol (WINR) | +0% APY |

| Solcasino (SCS) | +41% APY |

| VBookieSports (NFTs) | +28% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

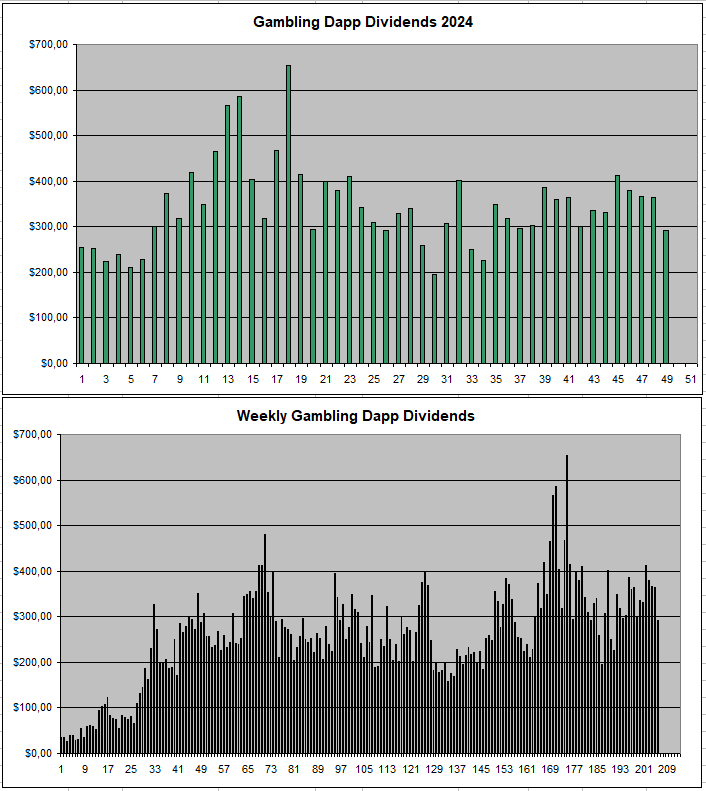

Personal Gambling Dapp Portfolio

There were 291$ in dividends last week for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 27.4k SX | 150k WINR | 300k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha

I think one or more of these project will have a great rally in the bull.

Still looking at getting into WinR, but have not pulled the trigger yet.

With the current dump in the crypto market I have opened up a new position in NEAR. Airdrome Finance on Base is my next target and I might even go as far as pick up some BRETT if it keeps dropping :)

!LOLZ

Posted using SportsTalkSocial

lolztoken.com

They're always taking things literally.

Credit: lofone

@costanza, I sent you an $LOLZ on behalf of thehockeyfan-at

(3/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.