GambleFi continues to really shine in the current market conditions with values which are holding up and good dividends continue to flow in. I'm looking to expand this portfolio the coming years but for some of the projects I aim to buy more of I need lower prices so I'm patiently waiting for now collecting the earnings each week.

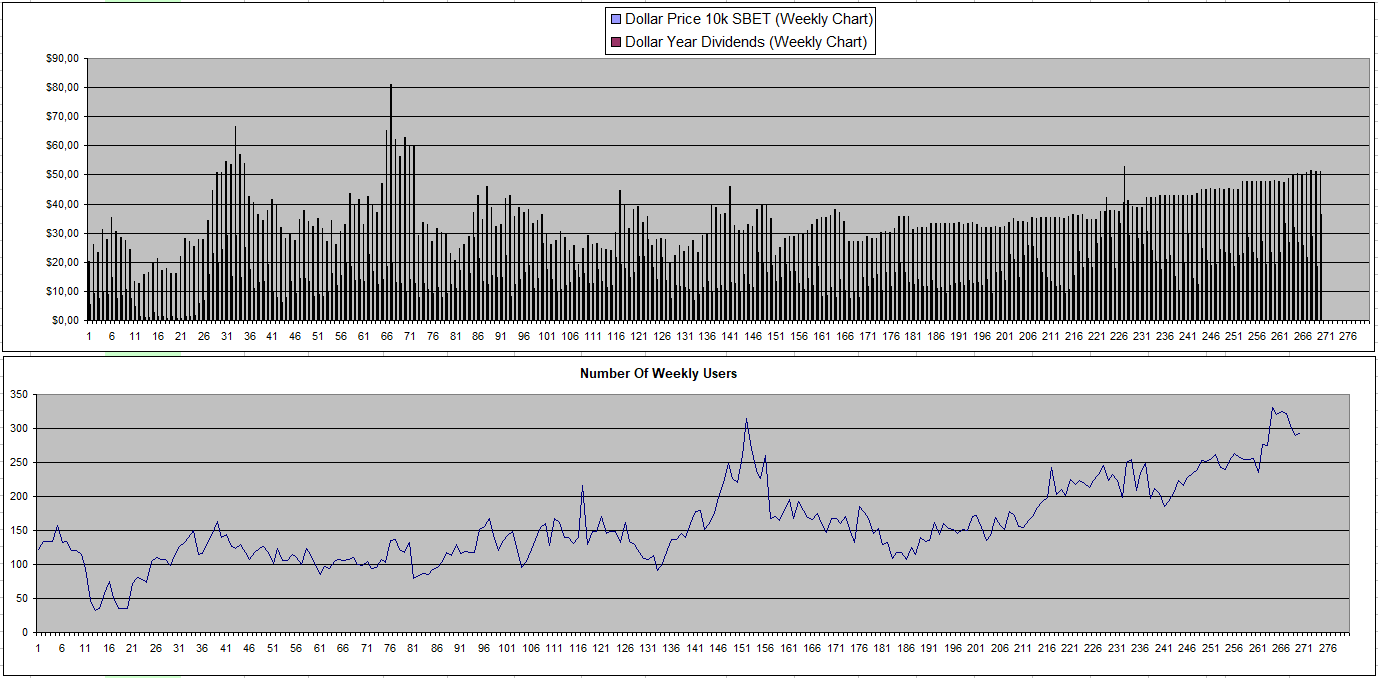

Sportbet.one (SBET)

So last week there was no USDT / UDSC distribution but it actually was just a bug in the interface which showed things wrongly while the dividends actually were distributed. When they popped up this week it looked again that the USDT / USDC was not released so I went to ask on Telegram and I quickly got a reply with what was going on and not much later it was just fixed. This once again confirms that each time something goes wrong, the team properly handles it which they have been doing for 5+ years.

With so many different currencies accepted now, the list of dividends that get claimed really adds up. However, it really makes the site so much more accessible to crypto holders as all the big coins and cults are accepted now. At the same time, it makes everything way more centralized as only EOS is a currency that can be bet with in a decentralized way.

I did count the USDT dividends I didn't see I got last week this week. Overall I continue to be very pleased with my SBET investment as it provides a great reliable cash flow. At this point, I would say the price should reflect closer to a 30% APY so I consider it undervalued.

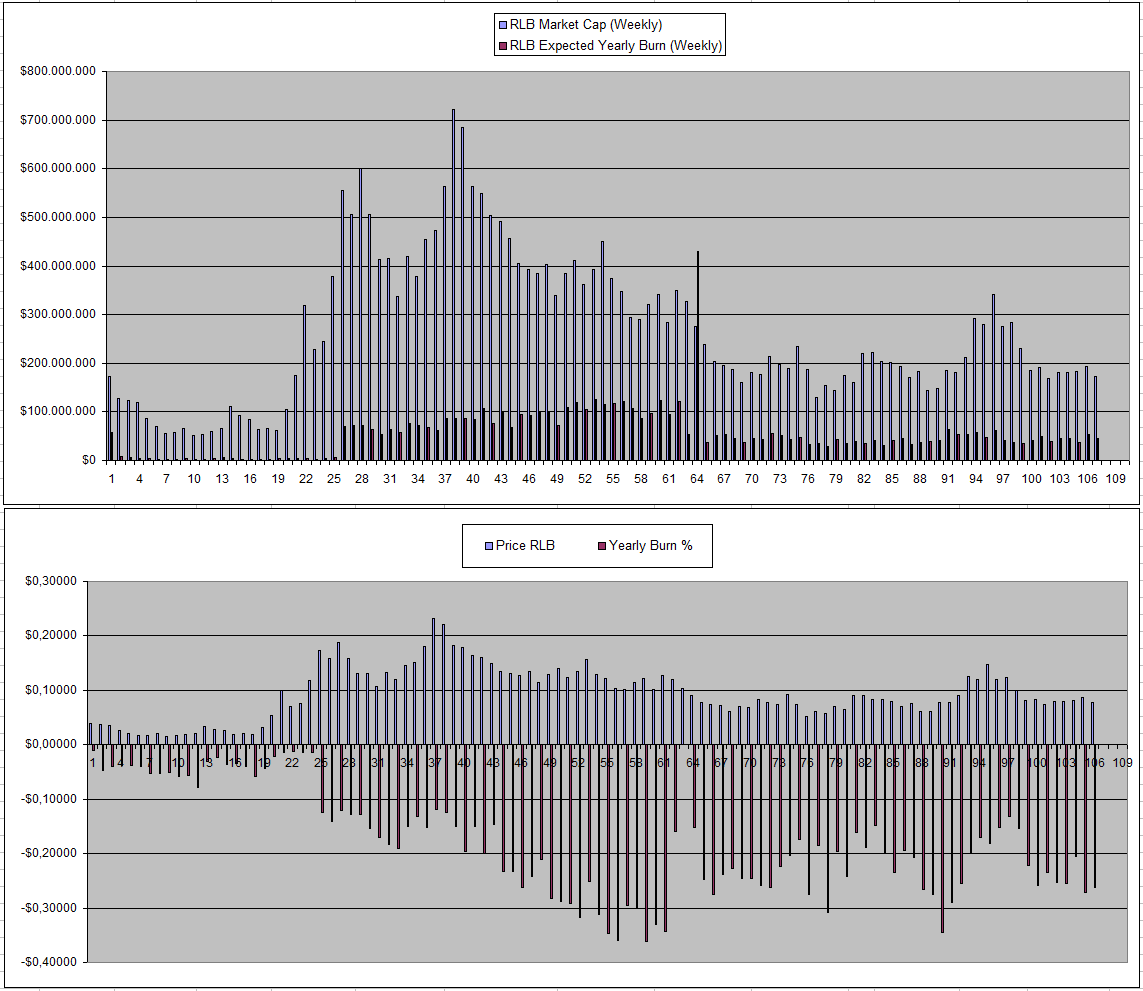

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB continues to be linked to the crypto market but if anything I would say that offers an opportunity it the fundamental downside risk is (unless they exist scam) rather limited due to the constant burn. Last week the rate as at 26% of the supply yearly and unless the price of RLB goes up this should stay there or increase. So I would say that RLB when bought with dollars now is a great deal.

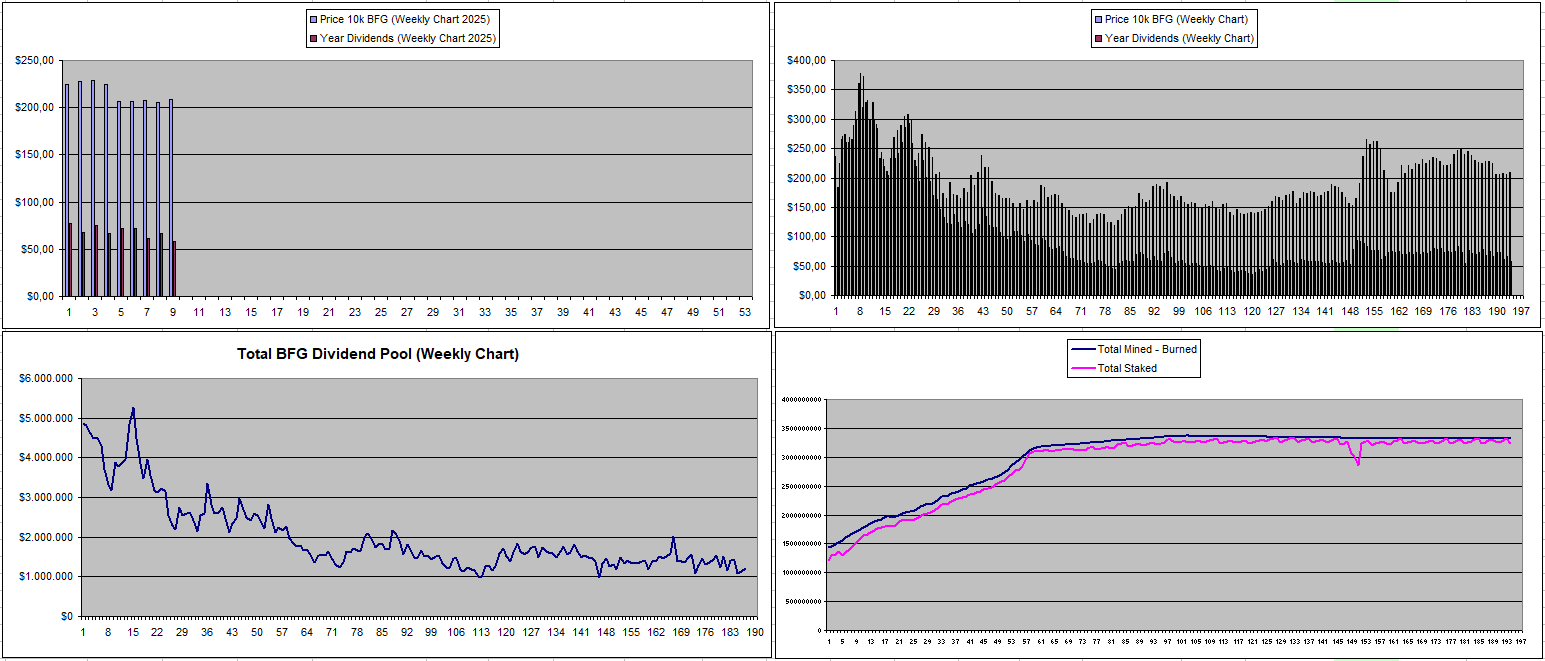

Betfury.io (BFG)

RLB has become much more like SBET aside from the fact that they remain fully centralized and have lower ROI. However, all the supply in in circulation and I don't think there are any team unlocks. the price and the dividend remain more or less stable now during shaky times. It would be nice though to see the Dividend pool trend up again as it still feels like its stable around the bottom with the risk of slowly but surely dropping more.

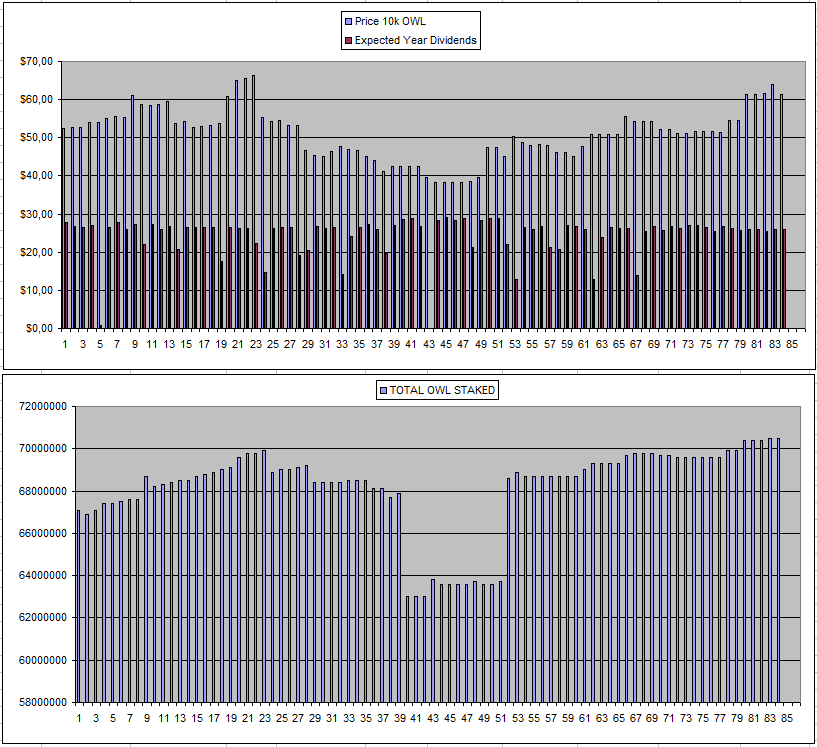

Owl.Games (OWL)

OWL continues to be the stability itself now for 80+ weeks since I first invested. I've been getting around 30$ weekly stable now that the month pool replenishment delays seem to be a thing of the past. By now, I earned 71%+ of my initial back and if I would sell I would be up +73%. So purely on the numbers this has been an excellent investment even though I still have a lot of questions when it comes down to the projects / the development / the team.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

| 28/01/2025 | 600k | 3179$ | 2887$ | 29.58$ | 2112.43 | 66.45% | +1820$ |

| 04/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2142.50$ | 67.39% | +2212$ |

| 11/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2172.57^ | 68.34% | +2242$ |

| 18/02/2025 | 600k | 3179$ | 3271$ | 29.37$ | 2201.94$ | 69.26% | +2294$ |

| 25/02/2025 | 600k | 3179$ | 3387$ | 29.81$ | 2231.75$ | 70.20% | +2440$ |

| 04/03/2025 | 600k | 3179$ | 3247$ | 30.05$ | 2261.81$ | 71.14% | +2329$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

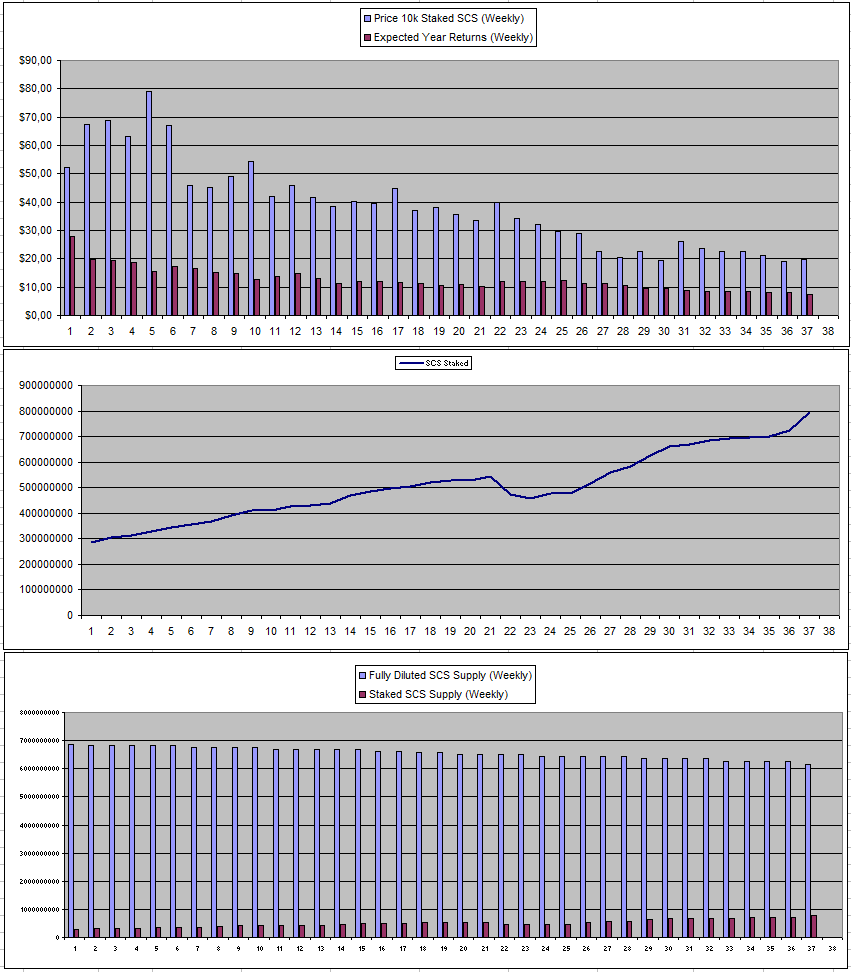

Solcasino.io (SCS)

The feared scenario is kind of taking place for Solcasino as more and more SCS is released which gets both staked or dumped putting pressure on the Dividends as the USDC pool doesn't not seem to increase and very little details are communicated about it. There was another monthly SCS burn last week which was all the SCS the casino earned by players who use that to gamble. This decreased the max supply by -1.536% or around 180k Dollars

At just 12.88% of the supply staked in the USDC pool which last week increased by 9.38% there is a lot more sell pressure left if they are not going to increase the USDC Pool that is. So far this has not happened and the 7.9$ dividends last week dropped to 7.18$ so that trend also continues. So either prices need to drop quite a bit more for me to add to my bag or the USDC pool needs to go up to actually provide some support.

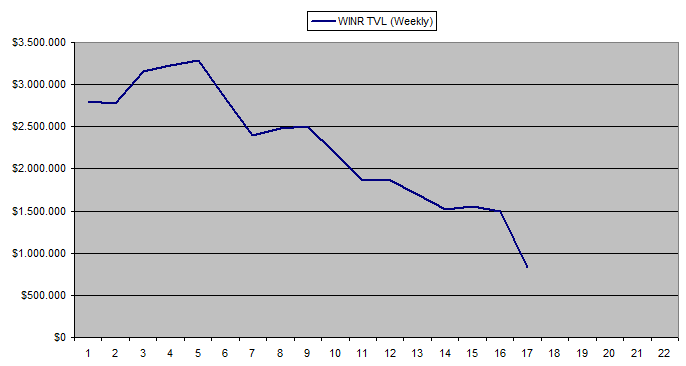

WINR at this point feels like a multi-cycle bet from here on out and I do plan to build a position where I have a stake in place at least every couple of months. While there was a +8.62% APY which actually is not that bad, the liquidity in the pools saw quite some exiting especially in the USDC Pool with the total TVL on WINR going down from 1.5M to list 800k. It also looks like the SOL pool failed in a similar way to BRETT in the past and it has been removed for now.

There was another update on the discord with the March 2025 plans which kind of feel like me that not that much fundamental will happen really.

I kind of hope that the price dips more in the coming weeks as I'm looking to add to my position. So far, things are holding stable in the current crypto correction and nothing really moved during the recent bitcoin pumps & dumps.

vBookie (NFTs)

So far, 3 days into Mach no info has been shared on the February results so I assume they are bad again and they are once again facing a very uphill battle getting some adoption and more users. There also haven't been ant NFT sales.

| Last Week | This Week |

|---|---|

|  |

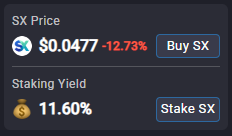

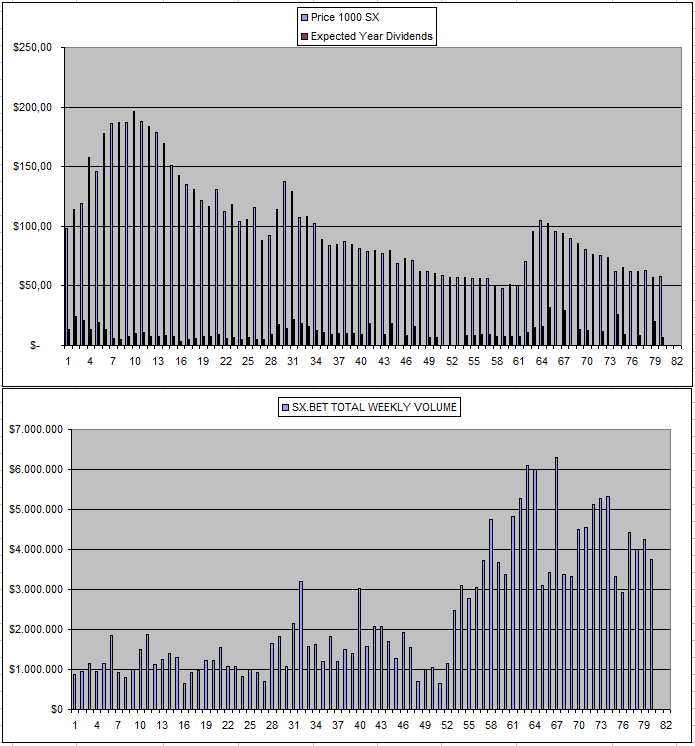

Sx.Bet (SX)

However I do see a need and usecase for something like SX as the crypto betfair which allows gamblers to bet decentralized with much smaller juice which really is needed in order to be profitable in betting these days as it's crazy how accurate the lines and odds are being set. In that regard, I'm still interested to add to my bags also as a multi-cylce bet.

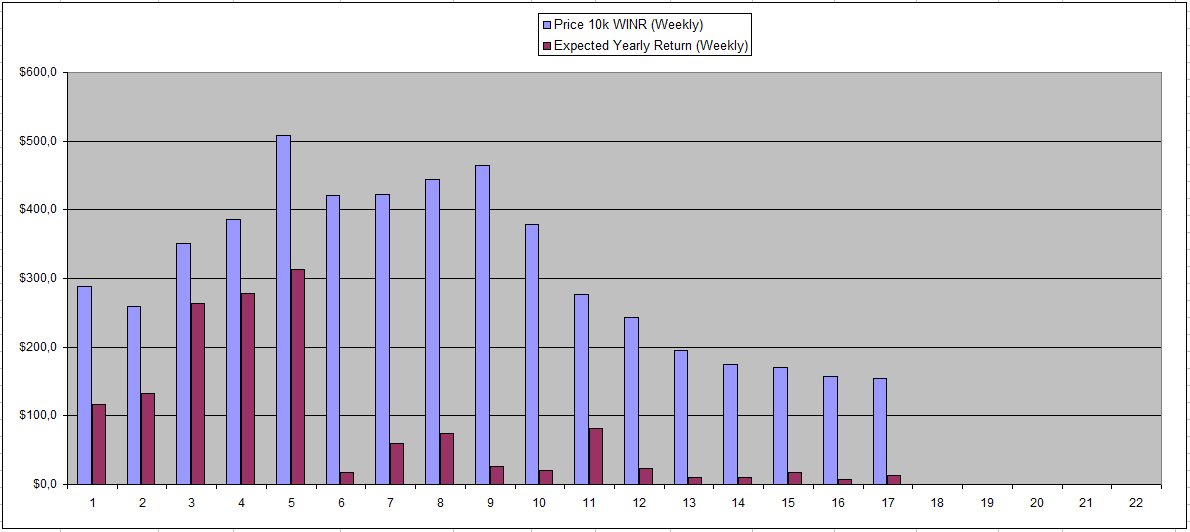

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +71% APY |

| Betfury.io (BFG) | +28% APY |

| Owl.Games (OWL) | +42% APY |

| Sx.Bet (SX) | +12% APY |

| WINR Protocol (WINR) | +8% APY |

| Solcasino (SCS) | +38% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

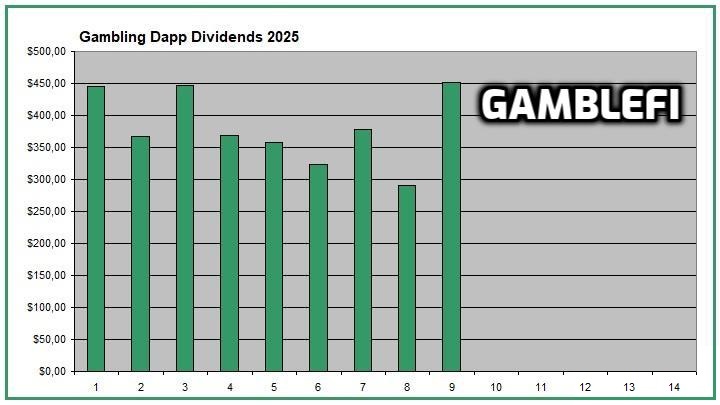

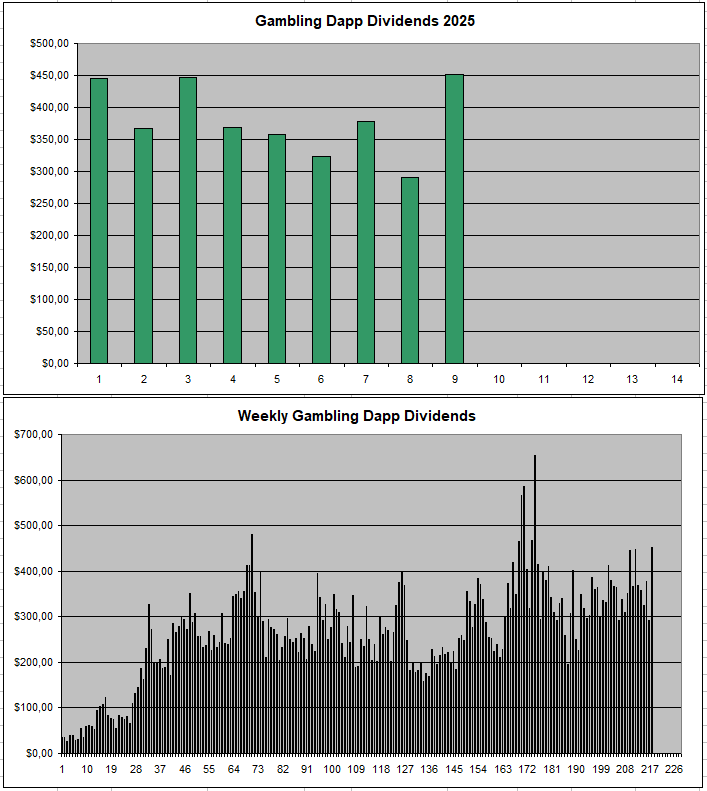

Personal Gambling Dapp Portfolio

I earned and increased 451$ in passive earnings last week for holding and staking 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using INLEO

What a nice wallet. I've had Betfury for a while now and it's always worked great. It also gives you the option to earn interest on Bitcoin.