I skipped my report last week as I was home rather late on Tuesday after a trip. However, with the continued carnage in the Altcoins this cycle as there are just too many of them who only rely on hype to get the price up, GambleFi actually shows to be a narrative that completely goes under the radar because in a way it's rather boring. As everyone only looks for quick 10x-20x sprint gains, GambleFi is a marathon with real products and real revenue that gets shared which both puts a limit on the upside but also on the downside. So the portfolio is holding up better than Bitcoin sinde the peak and continues to pay passive dividends week after week. They just decreased a tiny bit but still added up to 680$ for me in the last 2 weeks on a portfolio that is worth just below 50k.

Sportbet.one (SBET)

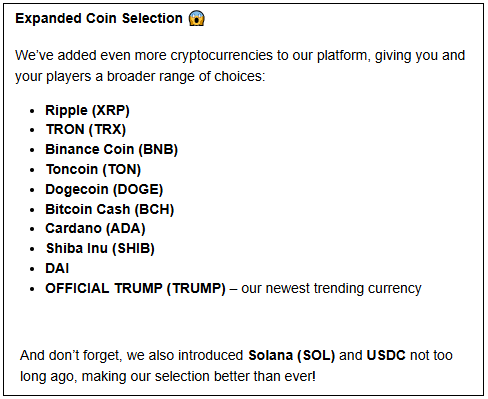

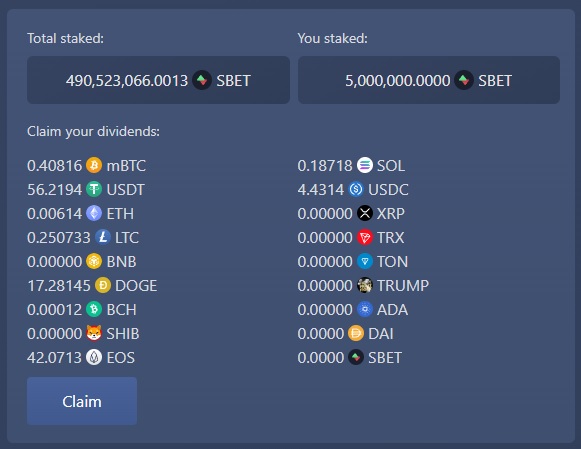

There was some more development in the last weeks for SBET as more currencies to bet with got introduced as they now are handling everything but EOS centralized. on the one hand this makes players have more choice and an easier entry, but at the same time it fractures the dividends a bit making it harder to build enough of them to withdraw properly.

|  |

|---|

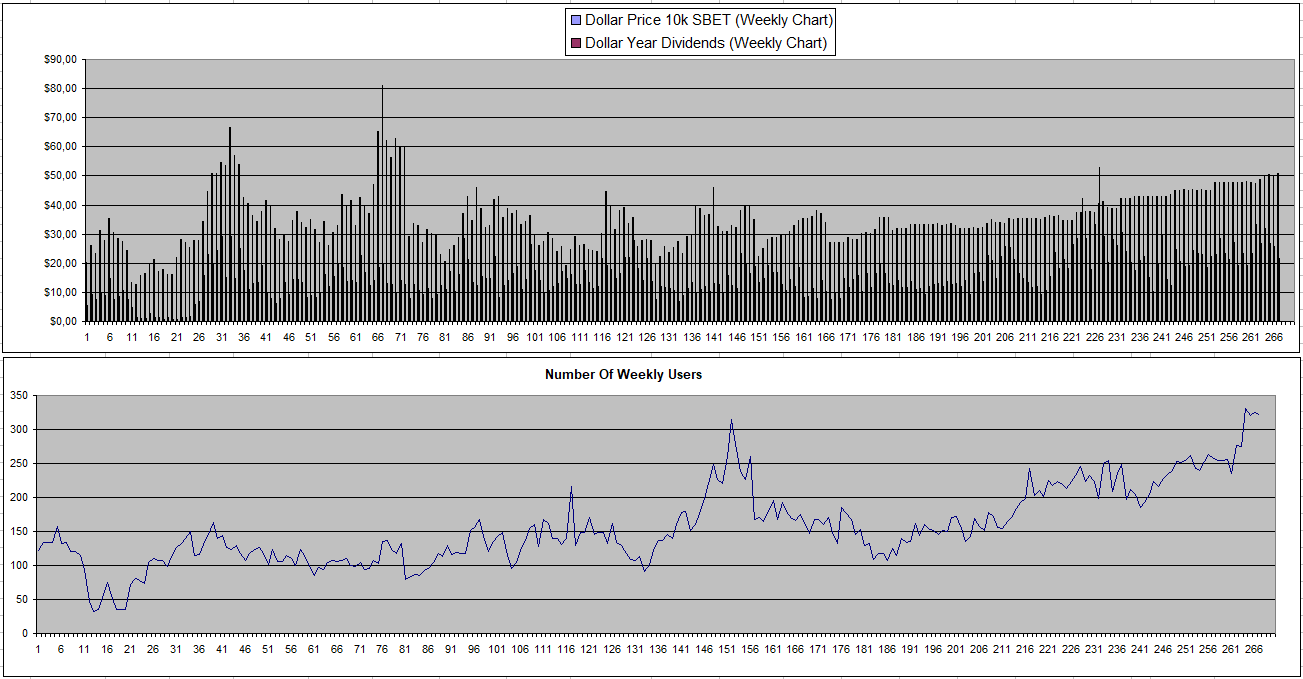

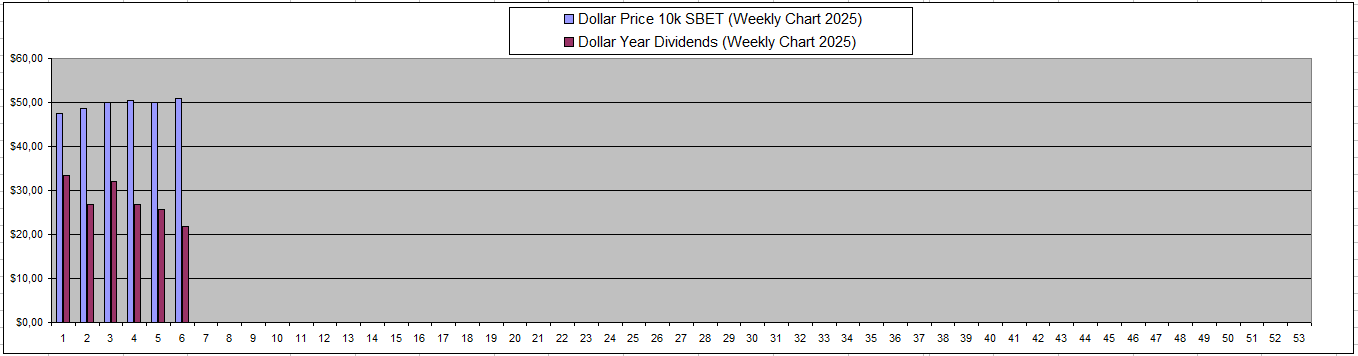

The number of weekly users continues to range above 300 which is around the all-time highs and I hope that they manage to at least maintain this. The price also remained around the same level but there is very low liquidity so it's hard to buy or sell without moving it a lot.

So far, the average APY this year has been 56% which means that in under 2 years you can recover your investment at this pace. I have been in it myself for 266 weeks so I got a ton of dividends during this period and I'm glad to continue holding and staking my SBET!

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB continues to fluctuate around a similar price while the revenue continues to come in which means the burn in the last 2 weeks was at over 25% expected in a year. This provides great support during the market crashes as they always quickly get bought up. So RLB is still a comfortable hold without going crazy on it as there is always the danger of the centralization.

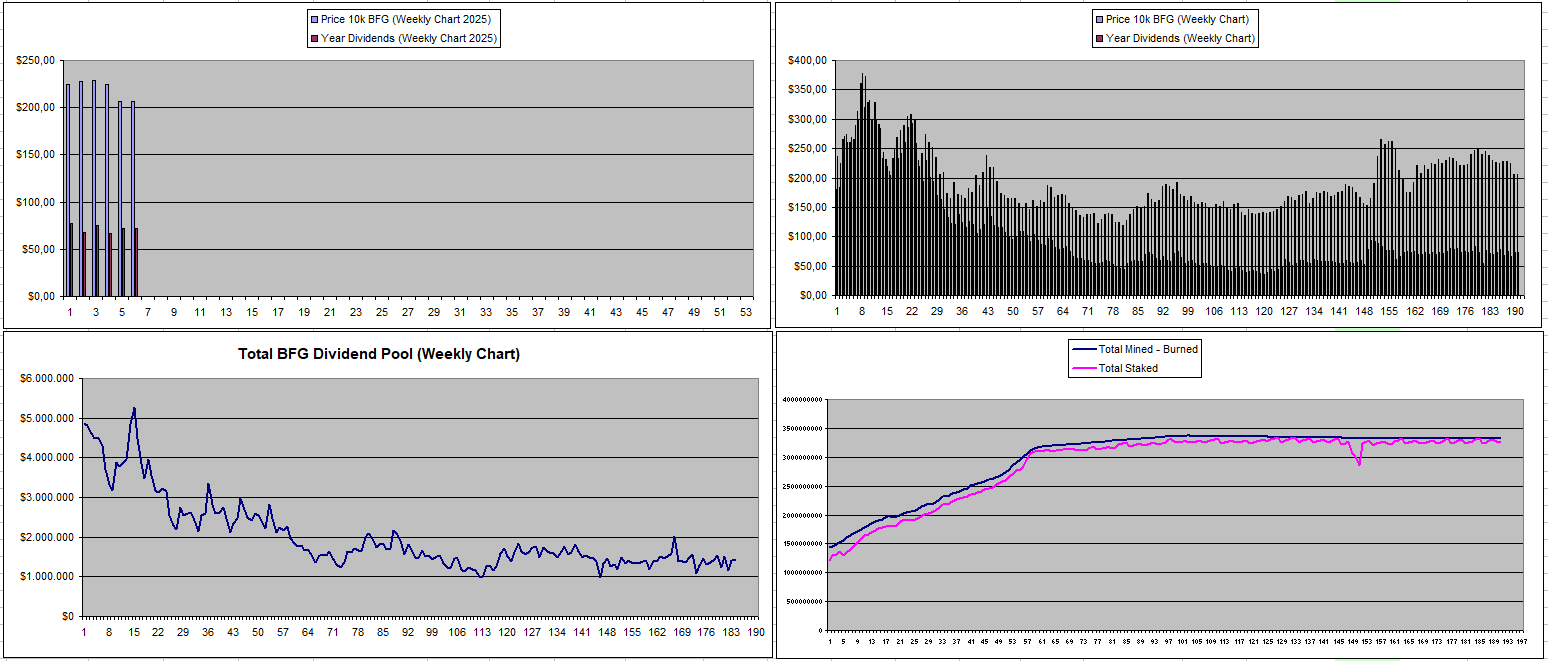

Betfury.io (BFG)

BFG also continues to be reliable with the price not moving so much compared to other altcoins and 500k Staked BFG giving around 70$ on a weekly basis consistently.

Owl.Games (OWL)

Someone seems to have bought 500k OWL and staked it which pushed the price 12.55% higher while dividends keep holding up at around 30$ weekly for 600k OWL Staked. This actually brings the value of my OWL holding at a higher valuation compared to what I bought it at around 90 weeks ago while I have been enjoying the weekly dividends. This remains just a reliable and solid money maker where enough time in it will pay back more than what you put in with the bags still holding their value.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

| 28/01/2025 | 600k | 3179$ | 2887$ | 29.58$ | 2112.43 | 66.45% | +1820$ |

| 04/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2142.50$ | 67.39% | +2212$ |

| 11/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2172.57^ | 68.34% | +2242$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

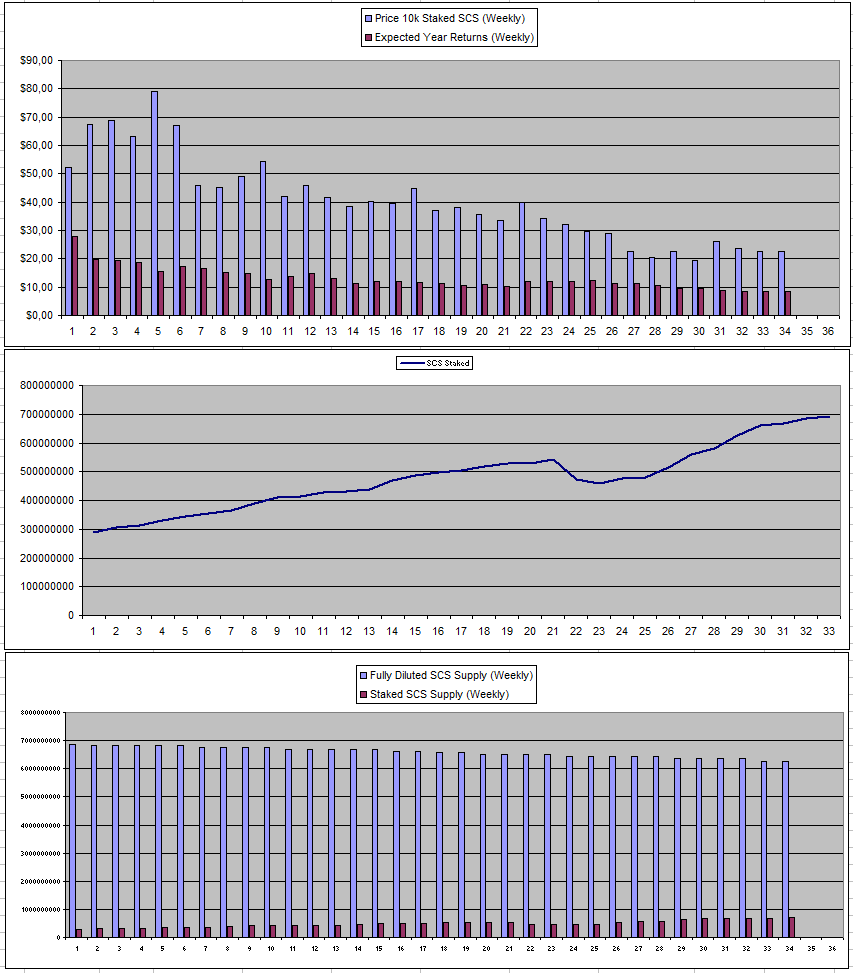

Solcasino.io (SCS)

There was a monthly burn again this time of 210k dollars or 93620 SCS which helped to keep the price up a bit and they now also support the Base Network in deposits which is making it easier for more players to onboard.

I only have the combined numbers of the past 2 weeks but it looks like the dividends are holding up at the current level of about 8$ a week for having 500k SCS staked which is worth around 1100$ now. With the inflation that is still going on and only 11.15% of the supply staked, I really need to dividends to be 50%+ APY before I can consider buying more SCS.

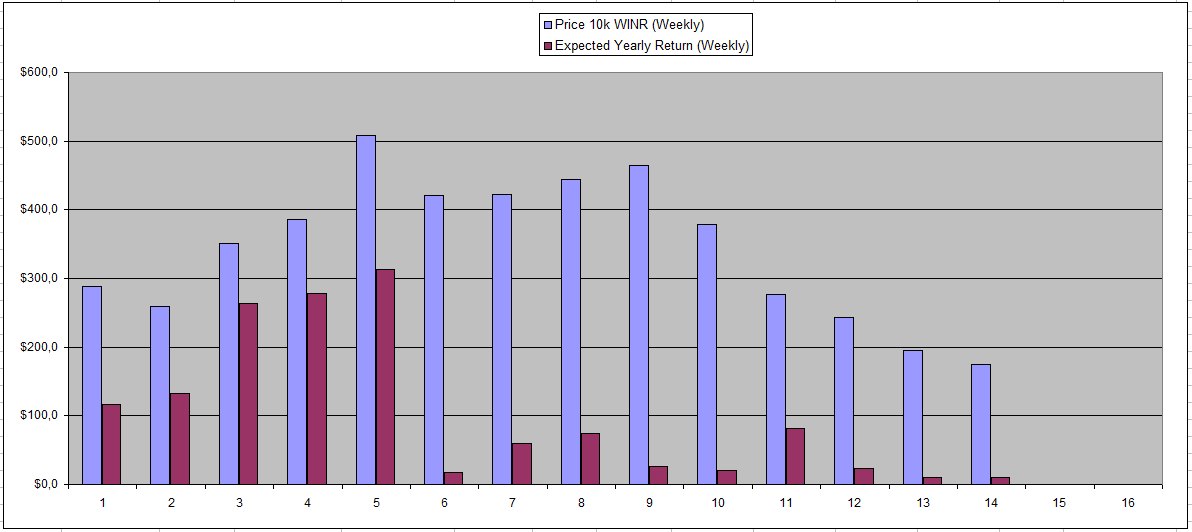

WINR is a bit of a disappointment lately and I think one of the issues is that 20% profit share on liquidity providing simply is too low for the risk involved. They did integrate Solana but so far it hasn't really done anything and the volumes are going down along with the total value locked. The returns are now back down to around 5% APY which is just too low for the risk of staking WINR and the price also has been adjusting to it. I am still looking to buy some more but think things can go a bit lower still before possibly recovering.

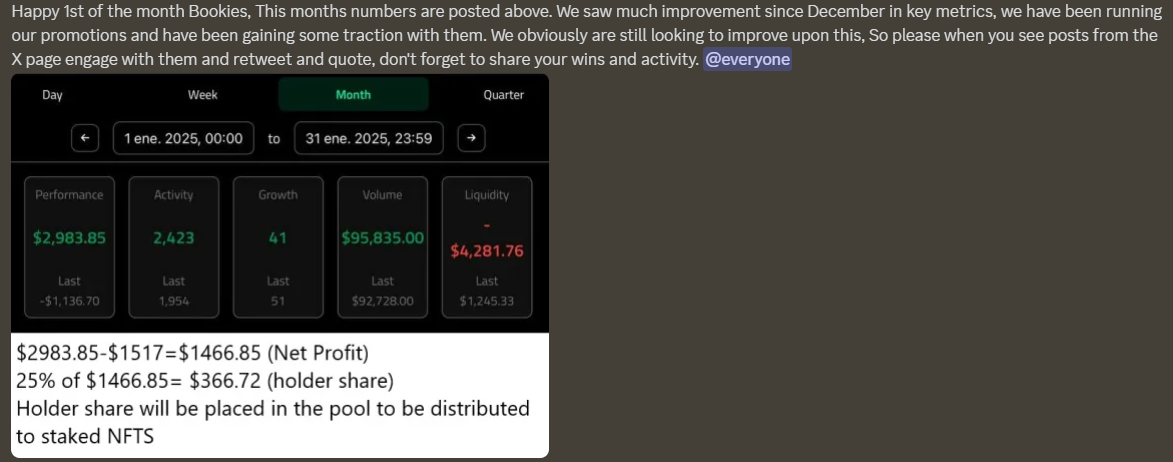

vBookie (NFTs)

The January Revenue report came out which at least showed profitability but it still was an absolute minimum and a total volume below 100k is kind of nothing. It also doesn't look like the profit share had been added to the claim site yet. Also only a couple NFTs traded hands in the past weeks.

| Last Week | This Week |

|---|---|

|  |

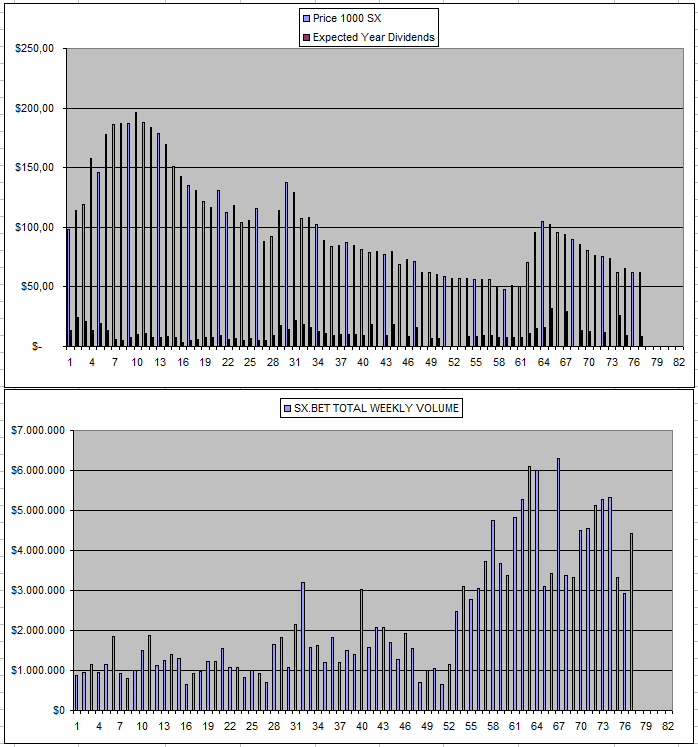

Sx.Bet (SX)

There wasn't that big of a volume spike on the Superbowl and I guess SX is kind of suffering from the altcoin fatigue that is in the market. So I guess patience on this one is the main story. I also only got a single dividend claim so I'm curious if next week it will be double or if these missing dividends will become a thing.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +43% APY |

| Betfury.io (BFG) | +35% APY |

| Owl.Games (OWL) | +42% APY |

| Sx.Bet (SX) | +14% APY |

| WINR Protocol (WINR) | +6% APY |

| Solcasino (SCS) | +37% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

I'm still at an average of over 300$ in dividends weekly for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using INLEO