Not all too much happened with my GambleFi Portfolio as the Prices and Dividends held up quite well during the Altcoin dump. I did take the opportunity to do another weekly SCS buy now getting my total to 500k.

Solcasino.io (SCS)

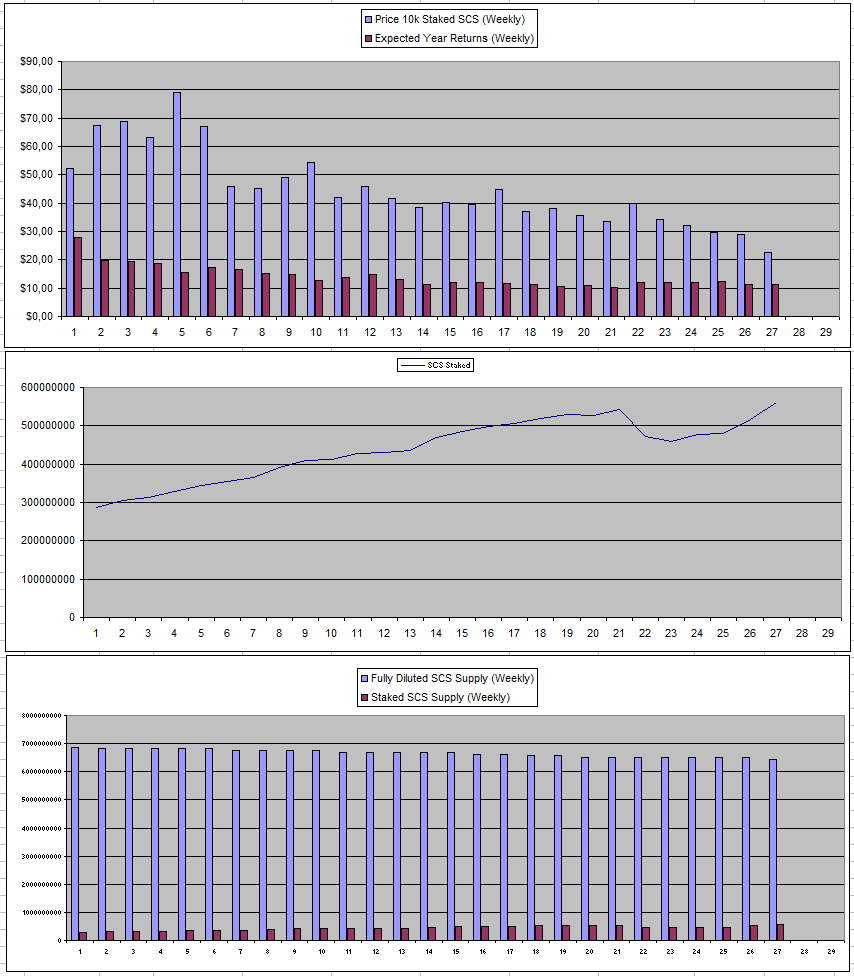

SCS right now feels like it's in a price range where it's worth accumulating some with an eye to just hold for the long run an get the Dividends each week. I still can't say I'm fully sold on it since only a small part of the supply is staked, the fact that it's very centralized, they don't give that much info of the SCS Pool which is what matters most, they rely on OwlDao for their software who I don't fully trust, ...

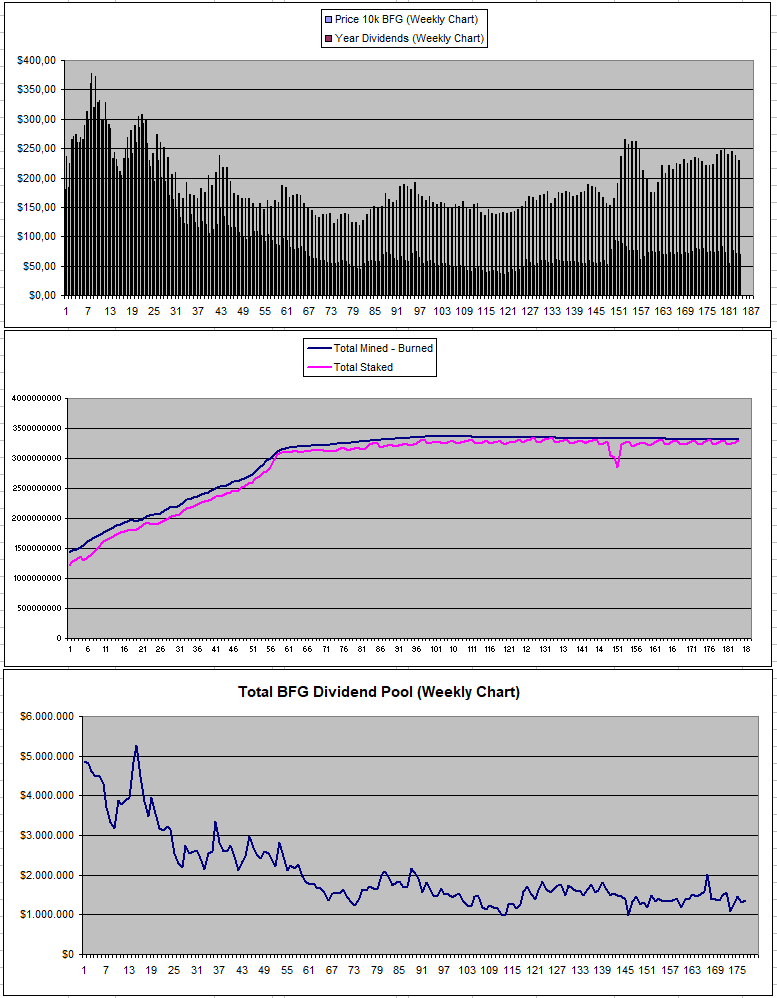

However, it does really feel like a solid platform with devs that want the best for it with an eye on the future. The selling pressure from those who earn SCS by staking their NFT's simply is bigger than the buying pressure even though the Returns from the SCS Pool remain in a zone where they are nice. The big unknown of the large supply that is not yet staked however really puts a lot of weight on it and requires very hilg yield at the moment. In a way it's similar to what Betfury used to be during the phase where BFG could be mined. (see chart below). This is with the difference that APY was over 100% at some point.

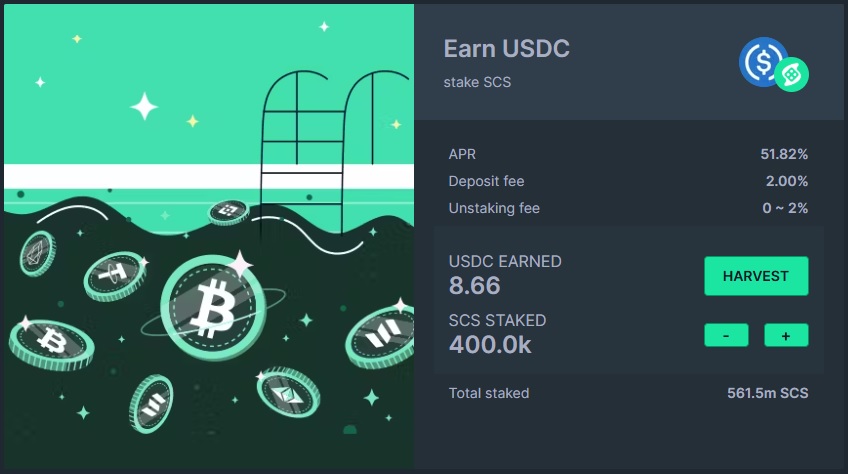

Having 400k SCS staked for a week allowed me to claim 8.66$ and I did pay 224$ today to buy 100k more SCS (Staking fees included in that price). There was another rather large increase in Staked SCS with 8.73% compared to last week which still now only brings the staked SCS compared to the max supply also at 8.73%. At a current APY of around 50%, that would me more around 5% in case all SCS would be staked which never is going to happen as a lot is kept liquid or is locked in liquidity pools.

Right now, at a price of 0.0022$ and a total supply of ~6.43 Billion SCS Max Supply, the Fully Diluted Market Cap is 14 Million Dollars. Add to that Roughtly 6 Million worth on NFTs which puts it at 20 Million. Lats month around 200k Dollars was the profit just from players that use SCS to gamble and I can imagine that this is a minority. On a yearly basis this equald more that 10% of the total market cap valuation. Purely based on those numbers it feels now like it's an ok accumulation zone and I'm looking to buy some more as the price keeps dipping.

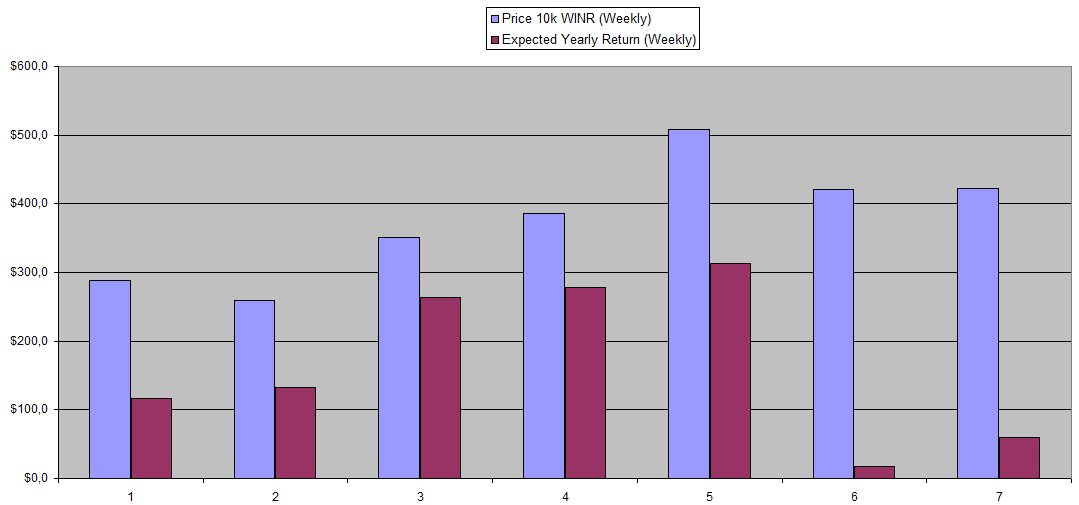

Generally, it's more of the same for WINR with a team that keeps working and bringing good things but some key things that keep getting delayed like the vWINR migration and the Brett pool. So it's mainly a waiting game. It also looks like they will deploy a casino on Hyperliquid chain called hyperbet.lol, this along with sx Network who are going to use them as a layer to introduce their casino might help bring more overall volume and revenue as a part of it is all shared to WINR Holders.

I didn't really track things while just.bet was offline and just now claimed my dividends for the first time in many weeks which also included part of the previous weeks. So it remains to be seen where they will actually be going forward.

I'm still waiting for the Brett pool to be restored but knowing how long it has taken already I don't expect it to be there anytime soon.

vBookie (NFTs)

I haven't fully watched up with what is going on with vBookie as it mainly is a wait each month to see what the numbers were and if there is any revenue share. The NFT floor price tends to fluctuate between 0.2 SOL and 0.5 SOL. which not that much offered for sale.

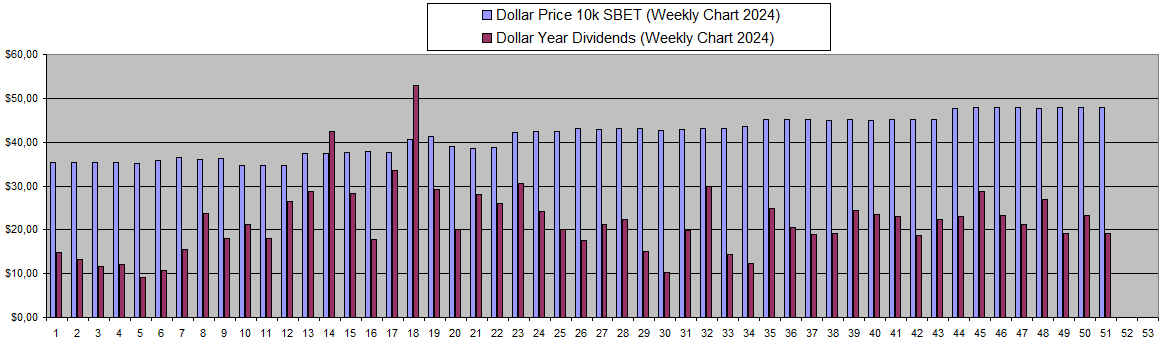

Sportbet.one (SBET)

There was a slight decrease in dividends from SBET but overall it was a good reliable year with very little price fluctuation and solid returns. Just being invested for 1 year and claiming the earnings weekly already pays back a large part of the investment while it offers a counter weight for the crypto market as these tend to hold up in bear markets.

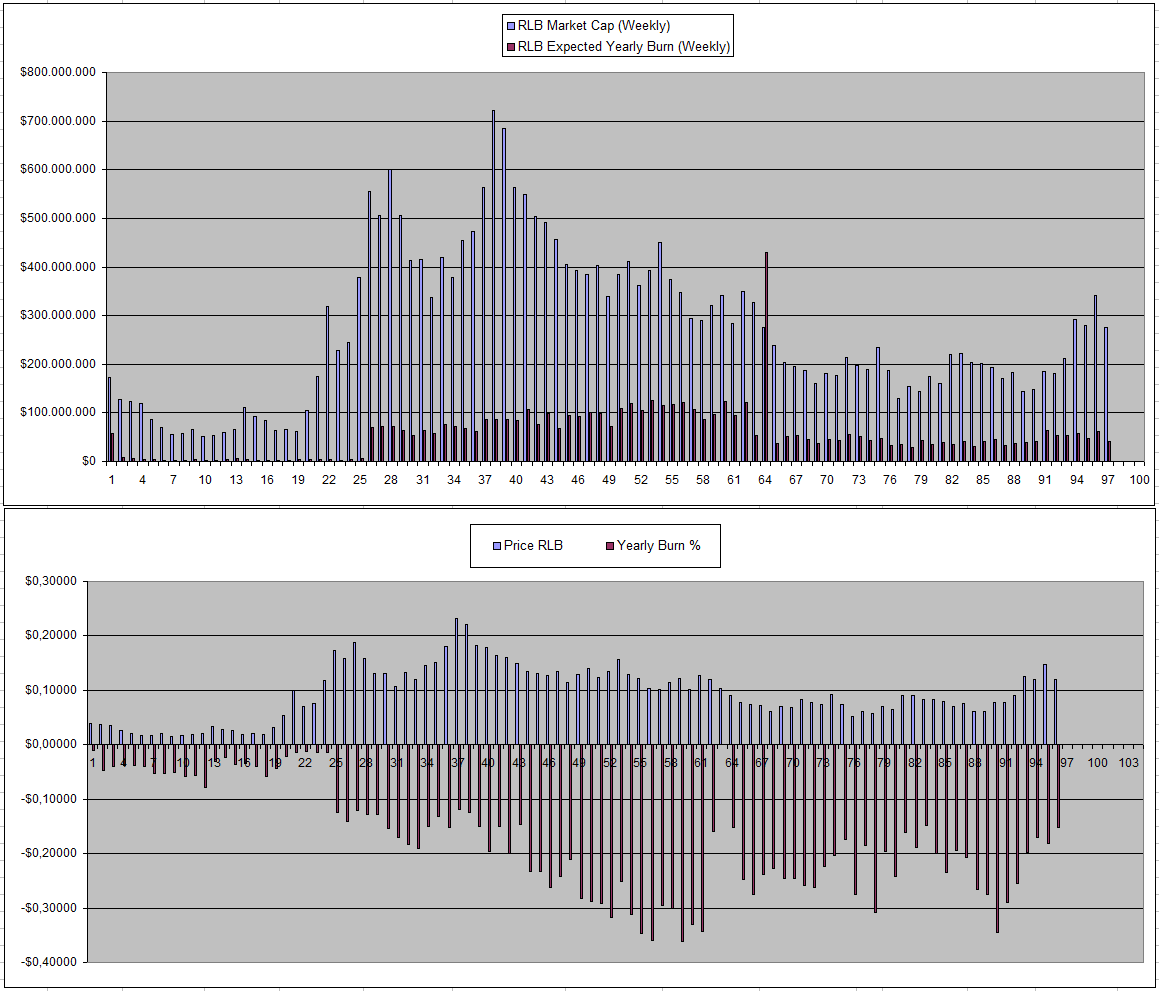

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB now seems to have established a price above 0.1$ while the userbase and earnings haven't actually increased from the looks of it. This mainly means that the burn rate is coming down. Last week it got closer to 15% which is the point where I consider to start selling a bit of my holdings.

For now though, I'm still earnings and putting them in the free to enter lotteries which have earned me around 7$ in bonus money which can be played free I believe with a 5x rollover?

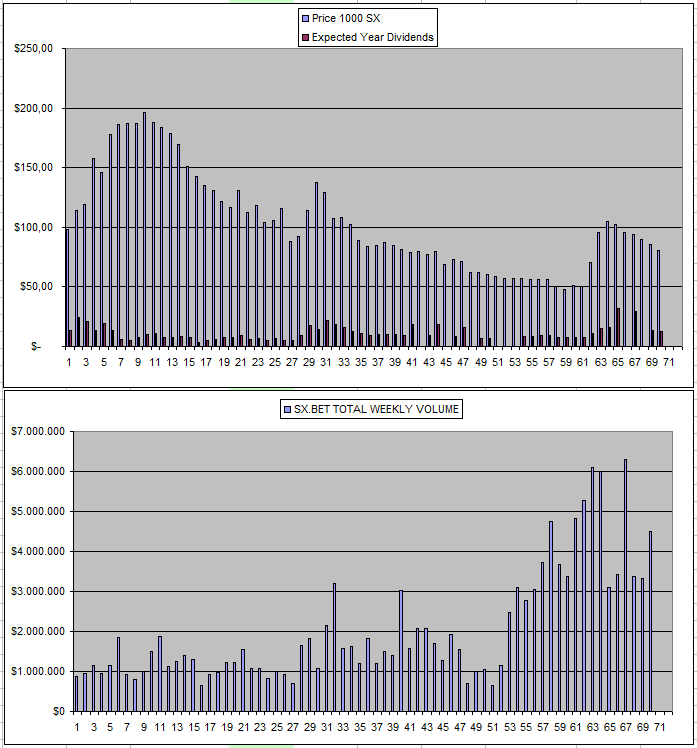

Sx.Bet (SX)

I seem to be stuck again on the site where metamask doesn't open a window when I try to claim my dividends for the week. The SX price also continues to drop while the weekly volume remains between 3 and 6 Million.

For now, I just continue to claim and restake the SX that I'm getting with the belief that this could become the crypto betfair one day.

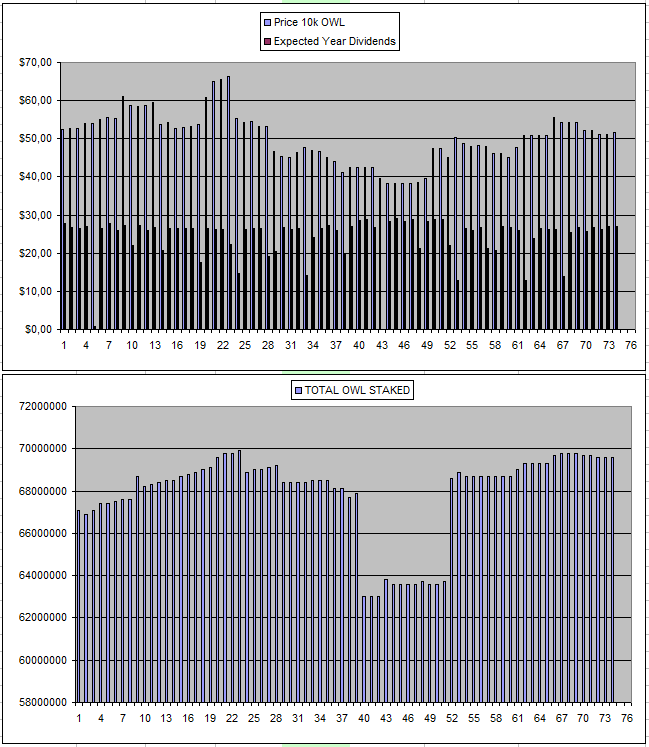

Owl.Games (OWL)

It's nice to see the weekly earning coming in and the fact that there was not a monthly dip due to the delay in the Pool refill. Aside from that nothing really seems to happen though.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

| 03/12/2024 | 600k | 3179$ | 2766$ | 30.72$ | 1869.58$ | 58.81% | +1456$ |

| 10/12/2024 | 600k | 3179$ | 2715$ | 30.14$ | 1899.72$ | 59.76% | +1435$ |

| 17/12/2024 | 600k | 3179$ | 2716$ | 31.15$ | 1930.87$ | 60.74% | +1467$ |

| 24/12/2024 | 600k | 3179$ | 2731$ | 31.04$ | 1961.91$ | 61.71% | +1514$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

Betfury.io (BFG)

It was another week with no real progress or increase for BFG Dividends which still nicely keep coming in each week

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +40% APY |

| Betfury.io (BFG) | +30% APY |

| Owl.Games (OWL) | +52% APY |

| Sx.Bet (SX) | +15% APY |

| WINR Protocol (WINR) | +14% APY |

| Solcasino (SCS) | +50% APY |

| VBookieSports (NFTs) | +39% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

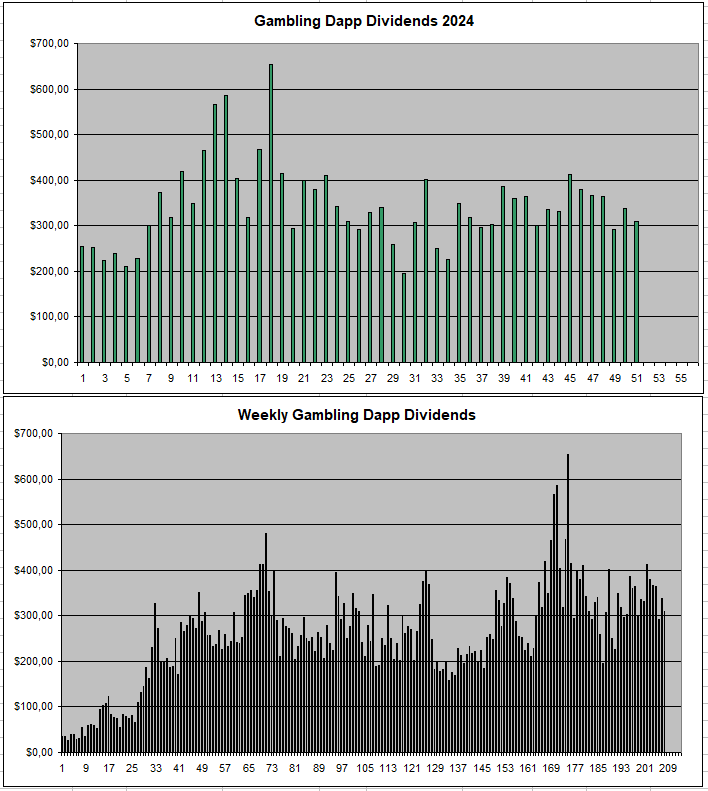

Personal Gambling Dapp Portfolio

Onlt just above 300$ in passive earnings again last week for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 27.4k SX | 150k WINR | 400k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha

!BEER

View or trade

BEER.Hey @costanza, here is a little bit of

BEERfrom @thehockeyfan-at for you. Enjoy it!We love your support by voting @detlev.witness on HIVE .