RioCan Real Estate Investment is a Canadian real estate company that manages a diverse portfolio of properties across the country, specializing in shopping centers and mixed-use developments. With a strong presence in Ontario, RioCan's holdings encompass a range of businesses, including grocery stores, restaurants, cinemas, and corporate offices.

The company generates the majority of its revenue from Canadian operations, though it also maintains a presence in the United States. As a key player in the Canadian real estate market, RioCan is recognized for its expertise in retail properties. Despite the challenges posed by the COVID-19 pandemic, RioCan has demonstrated resilience and adaptability, positioning the company for continued growth and success.

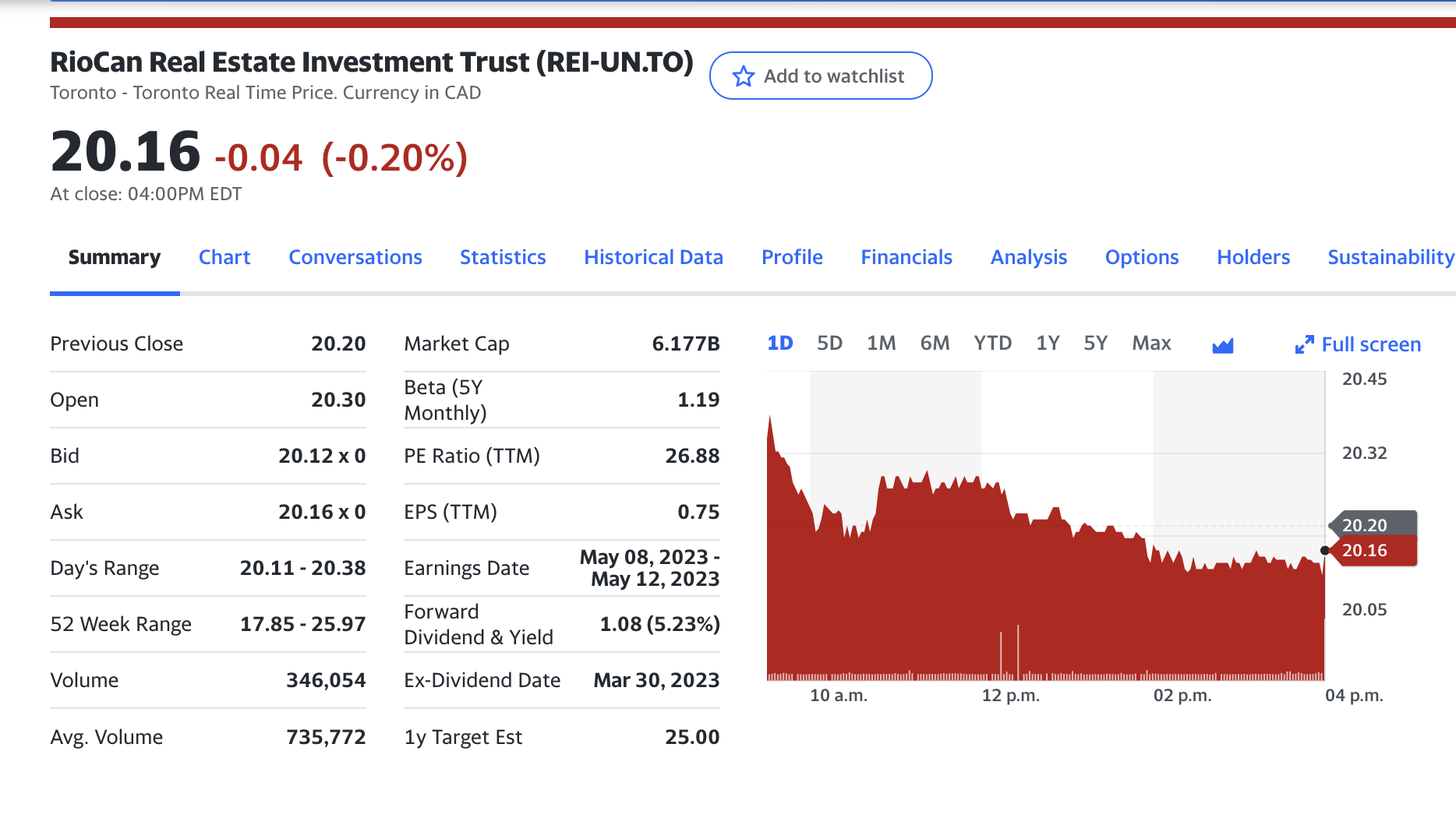

And I finally made my first purchase of shares with RioCan. Hoping to make a nice dividend earnings. And I have another 50 shares waiting to be bought if price drops down to $19 CAD. And a very good dividend yield of 5.23%. You can't go wrong with those dividend earnings.

Posted Using LeoFinance Beta

Congratulations @cptsilva! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 400 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Why not just use HBD savings? 20% apr

I just did both. I'm owner of RioCan and HBD. RioCan has a 5.23% div yield which great for a stock. I am also earning that 20% apr for the HBD.