These candles indicate possible end of correction?

Let's see

The situation intrigued me to know because etheruem corrected 36% from its maximum price of 2000 dollars approximately if other alcoins have not corrected so much and others have risen in price, in this period while bitcoin corrects.

And I found this data

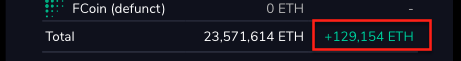

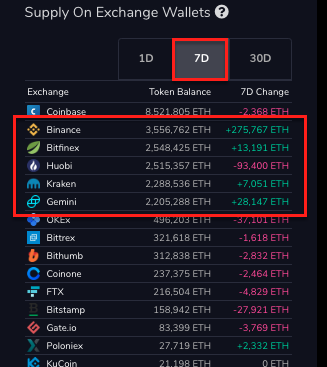

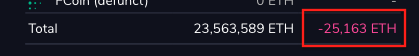

In the last 7 days they have sent 129,000 Ethereum to the exchanges for sale.

This is the reason why Ethereum has corrected up to 36%

In the binance exchange they have made a deposit for more than 275,000 etheruem, there were also important deposits in other exchanges.

Strong selling pressure this week has kept etheruem prices low

What happened in month

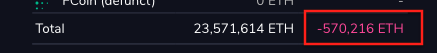

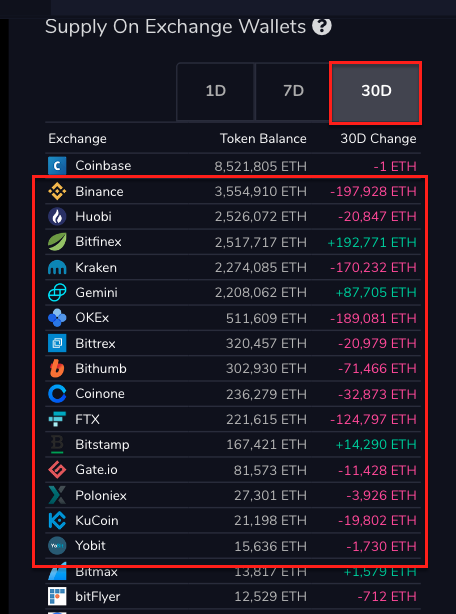

In the last 30 days they have withdrawn 570000 Ethereum from the exchanges. In other words, there was a great buying pressure.

Withdrawals that were important on many exchanges led by Binance, Kraken, FTX and Okex

What happened on the last day

On the last day, purchases and withdrawals from exchanges continue

The purchase of these last 30 days and of this day, by investors and the withdrawal of the exchanges is a good fundamental

data source: https://www.viewbase.com/coin/ethereum

Candlestick analysis

Monthly Candles

Ethereum candle remains bullish, investors have bought large amount of ethereum

What may be happening is that we have already had 6 months with bullish candles and some big investors are taking profits after a previous shooting star candle.

It is important that the candle of the month closes above the previous candle, invalidating the candle of the previous month shooting star of change of trend

Days candles

As we see in the Ethereum chart during the week, we see how the price was pressed down around 1578 dollars, the candles have left several daily wicks around that price.

But it has remained above the 2018 high, a good bullish sign, this week, leaving a first doji candle that could indicate the end of the correction, and a large candle today, absorbing the selling pressure.

Fundamentals

Ethereum's large transaction fees, I think it has been, for a long time, the big problem so that the price does not rise any more. This is being used by other alcoins that are offering alternative solutions to ethereum problems.

If we add to this the correction of Bitcoin we can understand why Ethereum fell by 36%

But we began to see signs of recovery with the close implementation of EIP-1559

The EIP-1559 enhancement could be closer than ever with one of Ethereum's most important enhancements.

The possibility of destroying ETH predicts a deflationary supply situation.

Ethereum miners will be discouraged from inflating network congestion artificially.

Conclusion

We have candles in ethereum that could indicate the beginning of the uptrend and good fundamentals that may be supporting this possible beginning of the end of the correction.

What do you think will continue the selling pressure or will the early implementation of the improvement of EIP-1559 be enough to start a new uptrend?

Will the price rise impact other alcoins like Hive and Leo?

Remember to give your post a vote, Always support good content. Thanks

Follow me it costs you nothing and you get a Healing Reward with Your Vote

Protect your assets use Stop loss

The alcoins market is very dependent on the price of Bitcoin, when Bitcoins goes up the alcoins go up more, but also in the other sense, so I suggest that you periodically review a Bitcoin and use stop loss and move it when they are already in profit. Do not let a profit become a loss.

We will continue monitoring

To be attentive

Protect your Investments

Feel free to use and share my post or graphics, but please mention, @criptoar as the author. Otherwise, consider plagiarism and I will call you and advise my friends to do the same.

READ DISCLAIMER: this publication / analysis is only for general information purposes. I am not a professional trader and I will never be a financial advisor. The material in this publication does not constitute any trading advice of any kind. This is the way I see the paintings and what my ideas are.

Perform your own analysis before making an investment decision. Use money that you are willing to lose if you make an investment.

If you make exchanges or investments after reading this publication, it is entirely at your own risk. I am not responsible for any of your gains or losses. By reading this publication, you acknowledge and agree that you will never hold me liable for any of your profits or losses.

For your vote or comment, thank you

Posted Using LeoFinance Beta