Let's take an updated look at Hive Gaming tokens.

None of the below is investment advice, it is just an examination of technical indicators.

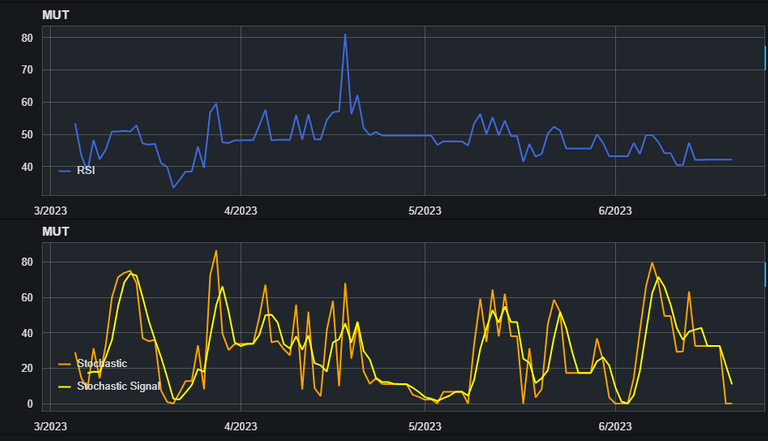

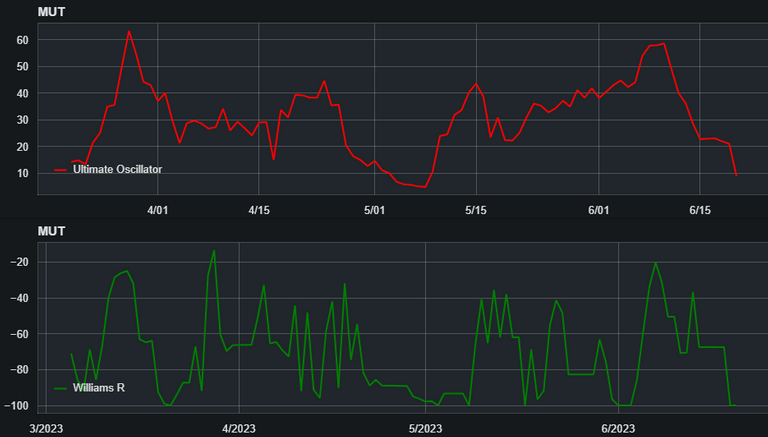

MuTerra - MUT

The price of MUT has been slowly declining since a massive spike in mid-April 2023.

Technical Takeaway: The Williams R, Ultimate Oscillator, and Stochastic indicators all point to oversold conditions. The Stochastic indicator is also waiting on a crossover to possibly bring the price of this token back up. MACD is rather stagnant and RSI is stuck in mildly bearish rut. With such low volume ($70 today), it's easy to shift this around and cause a spike with an extremely modest transaction on Hive Engine. It could turn around, but the spread is too discouraging and market is too thin.

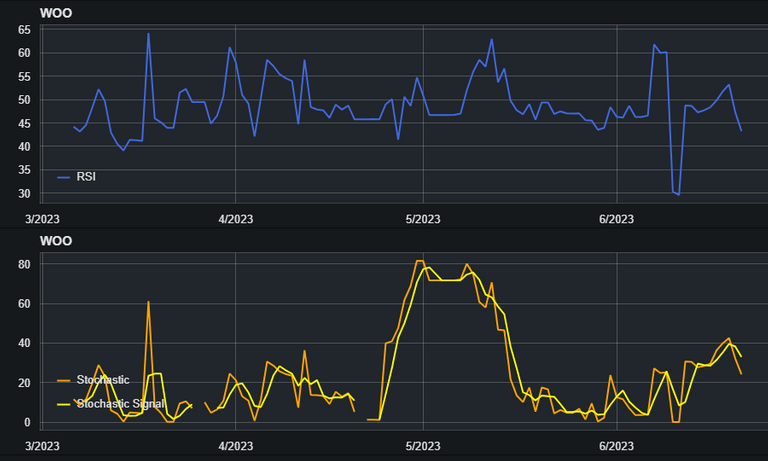

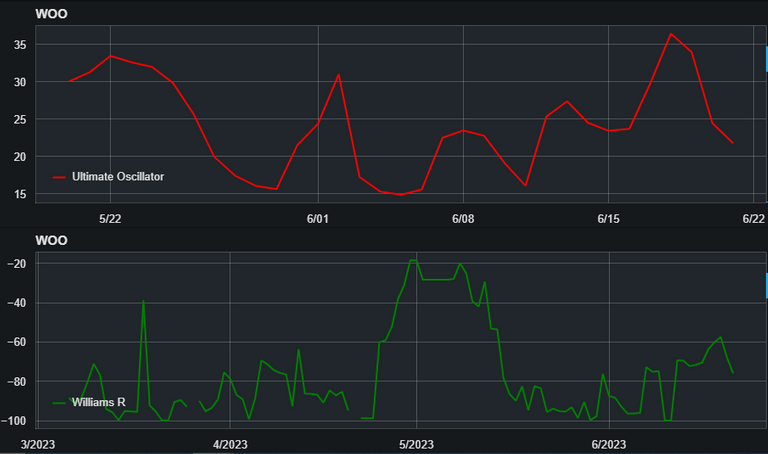

Wrestling Organization Online - WOO

WOO is pretty flat price-wise with occasional intraday spikes, but there's no real reason to buy for any sort of a price movement one way or another.

Technical Takeaway: It's generally oversold, but the price action is flat. RSI and MACD support this idea with the price of WOO.

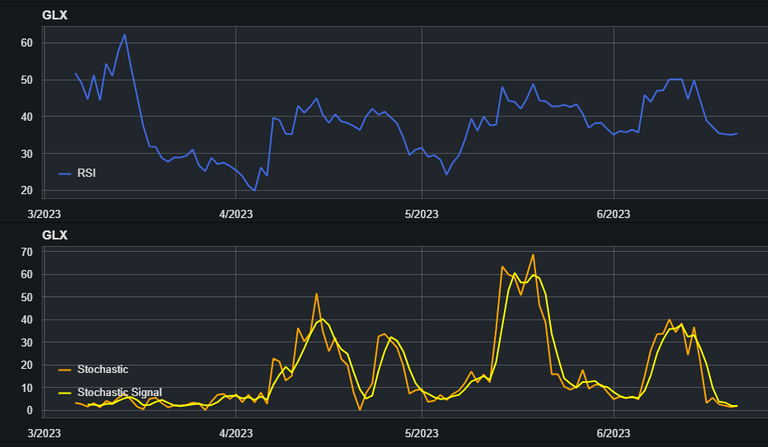

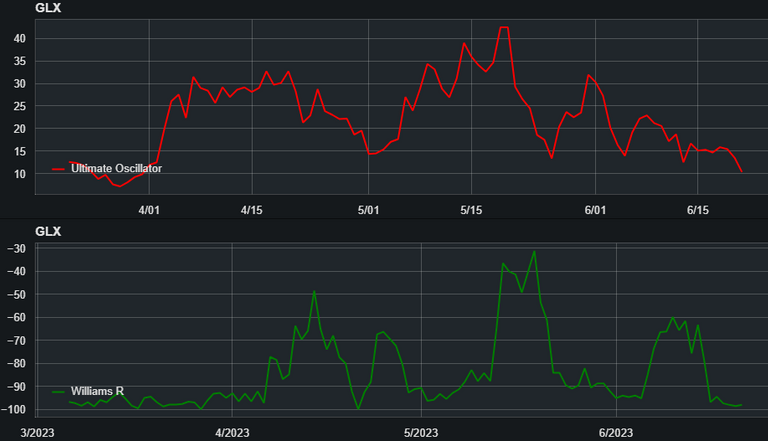

Genesis League Sports Governance Token - GLX

GLX is more than just a punchline, it's a Governance Token that has fallen considerably in value. The words All-Time Low come up at least every two days with this token and as long as the token continues to be printed and the reputation of the game is harmed by past manipulation activities, it's a phrase that will continue to be used.

Technical Takeaway: The conditions are clearly oversold (Williams R, Stochastic, and Ultimate Oscillator), but the MACD and RSI just point to a lack of strength in any sort of a movement upwards when it happens. More reason to remain bearish here.

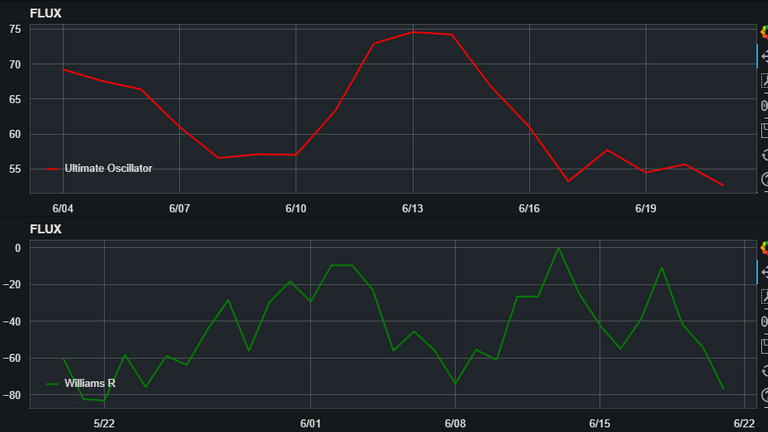

Terracore Flux Token - FLUX

FLUX was flat and then rose in price in recent days to return back to the equilibrium price range.

Technical Takeaway: Bearish movement is certainly possible with the MACD bearish crossover and the the RSI falling below 50. Stochastic is reaching oversold territory, but it may reach a bullish crossover again in a week while under 20. Williams R is about to reach oversold territory and Ultimate Oscillator is meandering above 50. It's a bearish bias, but the strength may not necessarily be there to push the price below the equilibrium price range.

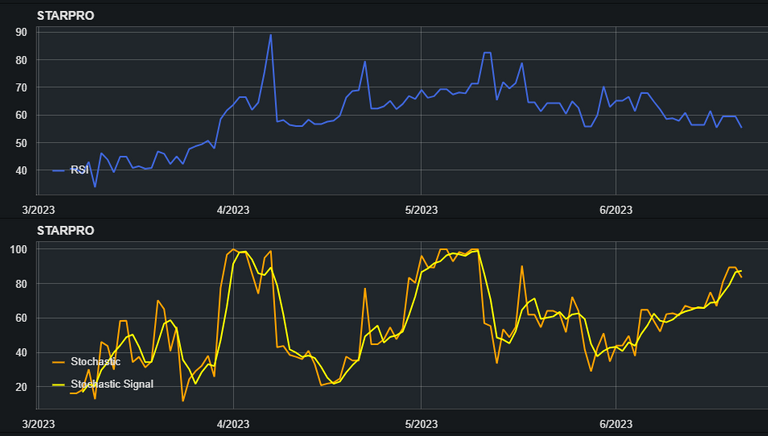

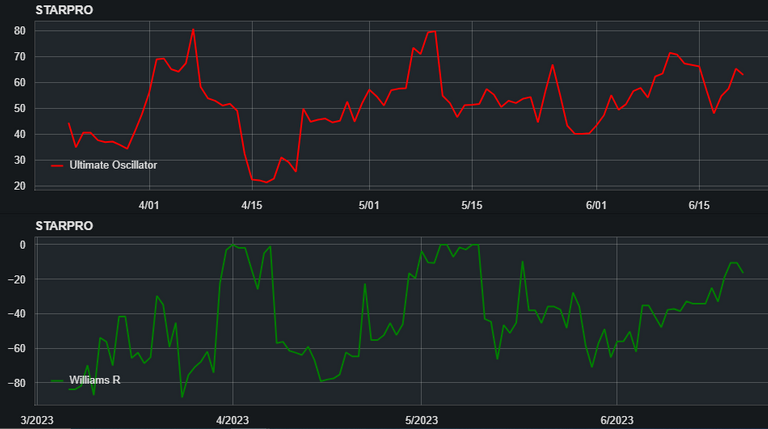

Rising Star Promoter - STARPRO

STARPRO survived a large intraday price drop, it has been rising for the previous 2 months and now is finding a stasis at around 30 HIVE.

Technical Takeaway: MACD is showing that STARPRO is in a bearish phase, but if this what bearish is, it's quite weak. RSI is showing no signs of bearishness either. Stochastic Oscillator is showing a bearish cross above 80, which is the overbought zone. Williams R is in the overbought zone, which is above -20. Trading volume is too thin for STARPRO to show a clear countertrend.

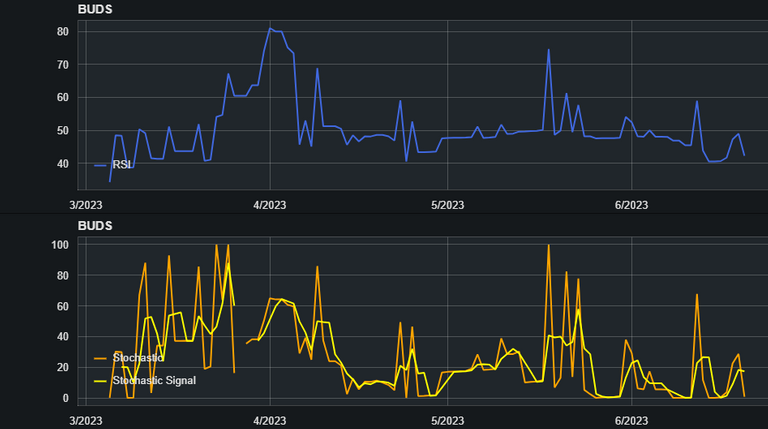

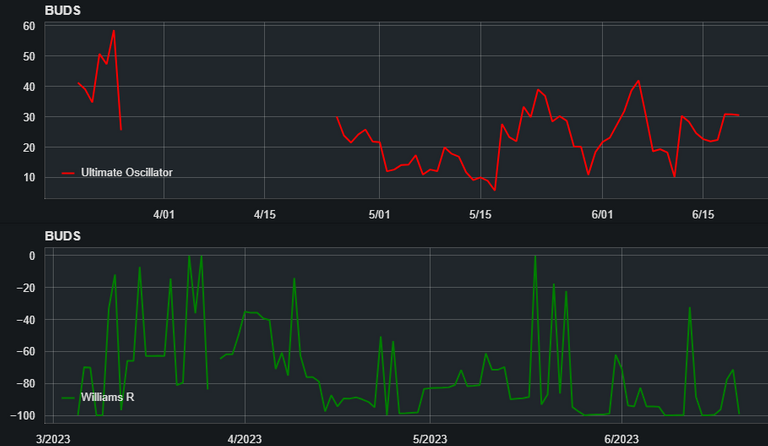

HashKings Buds - BUDS

A new token to be analyzed and it is also thinly traded. This is the big issue with many tokens on Hive Engine, lots of thinly traded tokens with low trading volumes and high spreads as a result. It's an issue of adoption for the individual games and inspiring investment in them.

Technical Takeaway: MACD does appear to show a possibility for a bullish move to come, there was a little fakeout, but it is still very possible for a bullish cross here. RSI is below 50, but still quite neutral. Ultimate Oscillator is coming out of the oversold zone, Stochastic Oscillator is in the oversold zone and coming off a recent bearish cross, and Williams R is also in the oversold zone. Look for more progress coming out of these oversold areas before buying. More volume would also be a positive development, probably the most positive development outside of attracting new players.

Congratulations @crootin! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 4000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP