How do non-gaming Hive Engine tokens look from a technical analysis perspective?

None of the below is investment advice, it is just an examination of technical indicators.

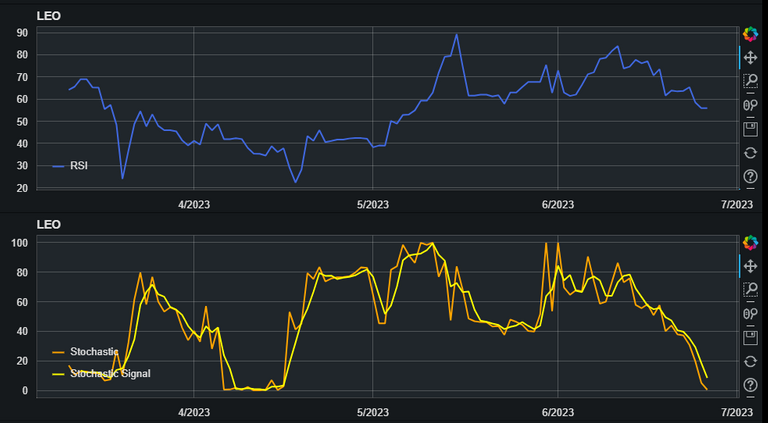

LEO - Leo

LEO/HIVE is showing a potential rounded top, even though it is a bit on the flat side. The price falling below .25 is an indication of a potential future fall in price. The MACD is also in a bearish mode on this daily chart.

Price came out of overbought territory on the 14 day RSI and is still above 50. Interestingly, the Stochastic is now in oversold territory, but there is no crossover yet, it could stay in this area for a few days before a crossover indicating a bullish move.

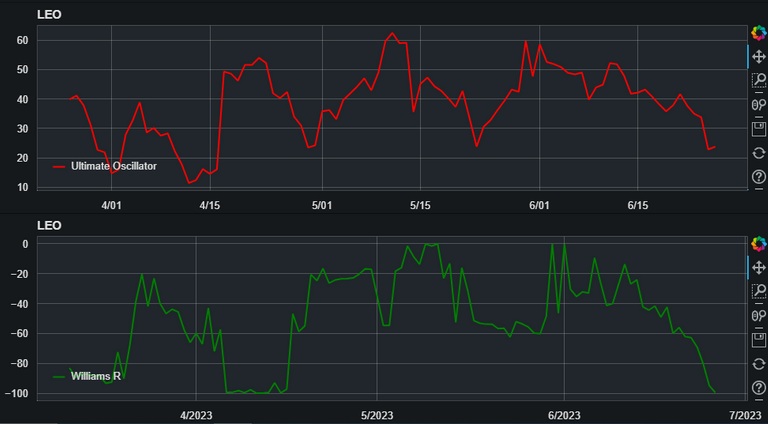

Ultimate Oscillator is inching toward oversold territory, but still has room to fall further in support of the bearish sentiments from other indicators. The Williams R is having none of that as it is oversold territory and the question is, "How long will it remain here?"

Key Takeaway: Presently, LEO/HIVE is in a bearish territory right now, but it could change in a week or two.

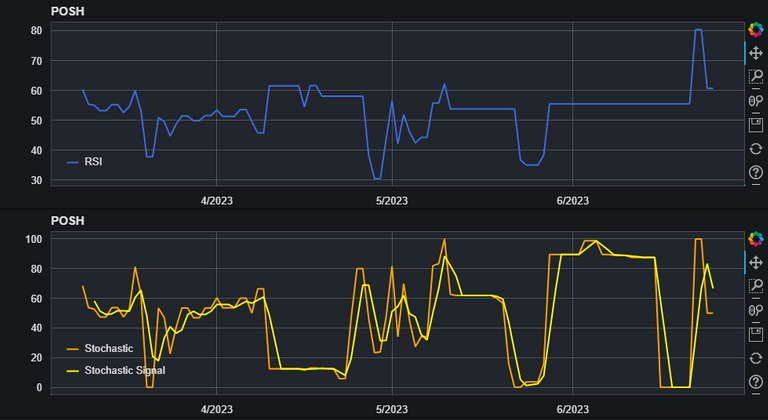

POSH - Proof of Sharing Token

POSH has been generally flat against HIVE. This trend is not necessarily supported by the MACD, which visually is more dramatic than reality.

The Stochastic and RSI have both come out of overbought conditions, but these are not strong trends given the actual price action.

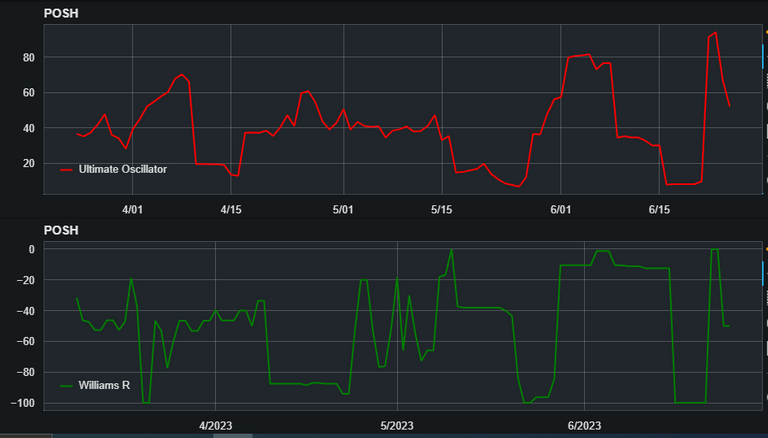

The same story continues with Ultimate Oscillator and Williams R that exists with the other indicators. The price is flat, but indications should be that the price is in a bearish mode.

Key Takeaway: Prices are flat here, but indicators are saying things are more bearish than they really are.

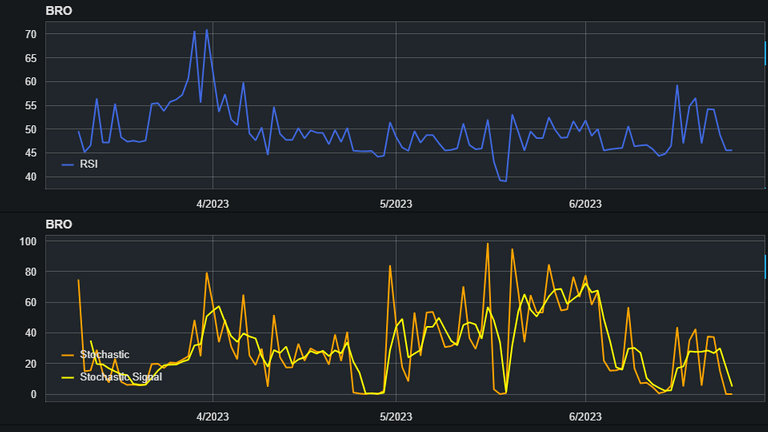

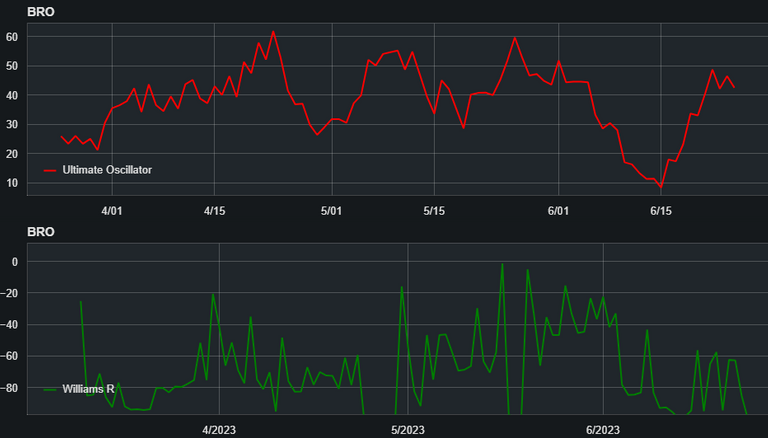

BRO - Brocoin

BRO has been generally in the 8-9 HIVE zone. It's not really making any moves one way or another. The MACD is also leaning into that same flat/ranging activity as well.

The neutral and flat themes continue into the 14 day RSI, where the indicator has called the 45-55 zone home for quite a while. Stochastics are pointing to more bearish sentiment, but with an overtone that tells traders that conditions are oversold.

The price came out of the oversold range on the Ultimate Oscillator a week ago and now is in a neutral territory. The Williams R has been bouncing from a bearish sentiment to a bearish-neutral sentiment since mid-June.

Key Takeaway: BRO is neutral right now, it is in a ranging phase. It is not the best time to buy for appreciation, but it is not showing signs that it will necessarily fall in price either.

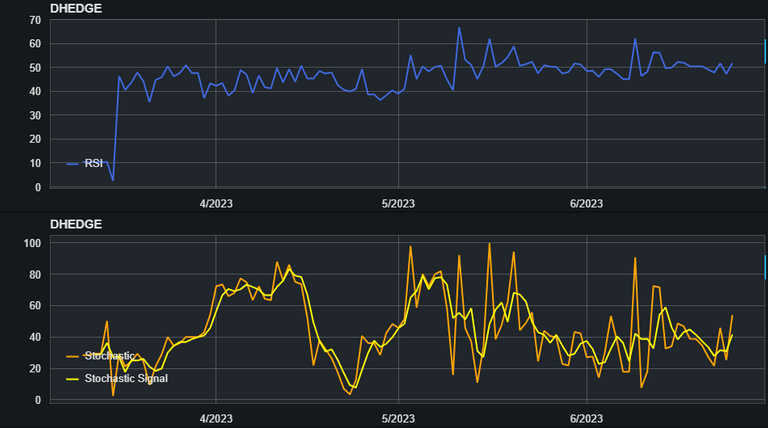

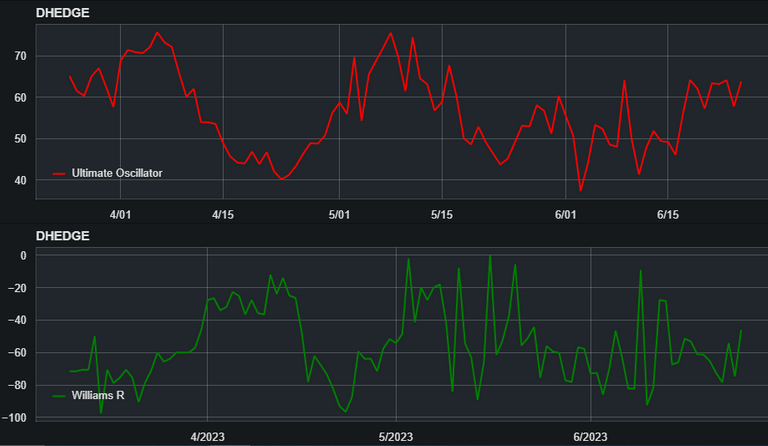

DHEDGE - Disco Hedge

Prices go through wild swings with Disco Hedge, this is due to the lower volume and relatively higher spread as it relates to percentage. MACD is showing a bearishness at the present time, but it is a weak bear.

Disco Hedge is not in the 70s with RSI, it's actually stuck around 50. So it is neutral. Stochastics are choppy and neutral as well even though there was a recent bullish crossover, but every other day there is a crossover.

Ultimate Oscillator is bullish, but there hasn't been an oversold or overbought zone situation in 3 months. This is a neutral stance, but with a slight bullish bias here. The Williams R has been choppy and volatile this month, but it landed in a neutral position today.

Key Takeaway: Prices are neutral here and the volume/spreads could make things difficult.

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

$PIZZA slices delivered:

(7/10) @torran tipped @crootin