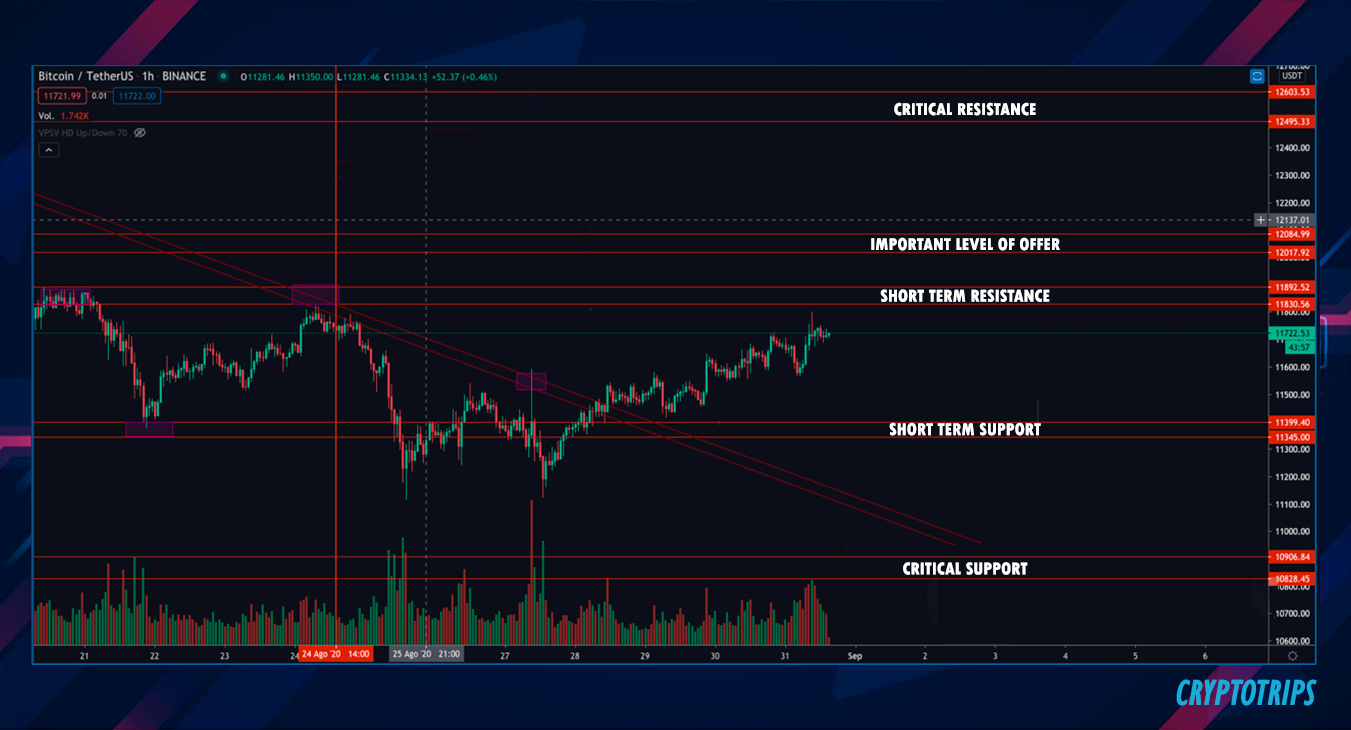

The price of Bitcoin remains in an uptrend despite the last retracement we observed in the price of 11% , where we saw the price fall from 12,500 to practically $ 11,100 .

The market threatened to lose the support levels that are in the area of 11,200 and 11,300 dollars. However, since the market tried to trade below this price range, we quickly saw a recovery of almost 6%, leaving behind for the time being the idea of being able to trade below $ 11,000 .

It has been almost a month since the market has been able to quote below $ 11,000 and, at a technical level - graph, a large area of demand begins to consolidate, which is reflected by all the minimums that the price has consolidated in that level.

The market is still in a process of transition, we have generated new highs less than 2 weeks ago, we experienced increases in volatility and volume, followed by large movements, not only in the Bitcoin market, but also in most of the global markets.

Today Scenario

As of today, the price is trading around $ 11,800 , we can see that the price has left behind the downward momentum that it had maintained from $ 12,500 .

The price has remained trading above $ 11,000 for 27 days, creating a demand zone around $ 11,000 and $ 11,100 .

At the moment we must keep under surveillance the area of $ 11,800 , which is our zone of "short-term resistance" , it is there where the last levels of supply have been registered.

Bullish scenario

The bullish scenario remains practically the same with respect to last week, this scenario would begin with the exceeding of the level of $ 11,800 and, its objective is the zone of $ 12,000 .

It is important that we see the price respect the bullish guideline indicated on the chart. If price is able to break through "short term resistance" and has not yet pierced the bullish guideline, then we can give it a higher degree of probability that we will finally hit the target zone.

Bearish scenario

The bearish scenario would begin with the drilling of the “Demand Level” , we believe that if the price is able to trade below this level, we could see a decline to the area of $ 11,366-11,337 .

This decrease of 2% in the price would take us again to the important level of $ 11,300 , in case the movement shows signs of continuity from the supply, we believe that it is possible that the price will try to even reach the level of "Short-term support" we mean the $ 11,100 and $ 11,200 levels.

Some conclusions

After a setback from the $ 12,500 level , which is the last important maximum registered in the price, what we have observed is that the market seems to continue developing a lateral process, this process is quite normal, we must have take into account the context in which the market is located.

We have been able only a month ago to overcome a maximum level that remained in force for practically 1 year, we refer to the level of $ 10,400 . It is for this reason that after the large increase in volume and the upward momentum, it is normal that we see the price form lateral structures like the ones we find ourselves in today, these lateral structures generate a lot of indecision in the market and at the same time many expectations.

We must keep our eyes on the levels and possible scenarios that we proposed in this analysis, we believe that the price will respond to these ideas and they may be one more tool to make decisions in the market during the next few days.

This is a personal analysis, it is not an advice for you to follow it without first doing your own research and having your own opinion, and remember: read, learn, enjoy, follow me on my new Twitter (or the less important one: tip me if you liked it)... and with or without Bitcoin, be happy!