We finally get to see some of the inner workings of Coinbase for first time since they submitted paperwork for their long-awaited public listing.

Coinbase generated $1.3bn in revenue last year, up from $534m the year prior, enabling the company to turn a profit of $322m in 2020 after losing $30m in 2019, according to a filing with US securities regulators.

I have been waiting for Coinbase's public debut, because they are blazing the trail for exchange direct listing that will bring further legitimacy and adoption to the crypto space. It's also projected to be one of this year’s largest new tech listings and would mark a milestone for emerging sector. Coinbase is aiming to list in late March.

The listing market has been on fire with investors recently buying up shares in unicorns like Airbnb and DoorDash. The listing of unicorns such as Coinbase is worrying some as they are comparing this surge in listing that was a similar trend in the 2000 dotcom bubble.

Coinbase filed for a direct listing rather than a traditional initial public offering, meaning it will not raise additional capital when it goes public. From the amount I pay them in trading fees I don't think they need to raise any more capital either...

When discussing the listing, Brian Armstrong, chief executive of Coinbase, warned that prospective investors should expect volatility in the company’s financials. Any one involved in the crypto space understands this, but I cant wait to see what traditional markets think of the volatility.

“We may earn a profit when revenues are high, and we may lose money when revenues are low, but our goal is to roughly operate the company at break even, smoothed out over time, for the time being,” Armstrong wrote in a letter attached to the filing.

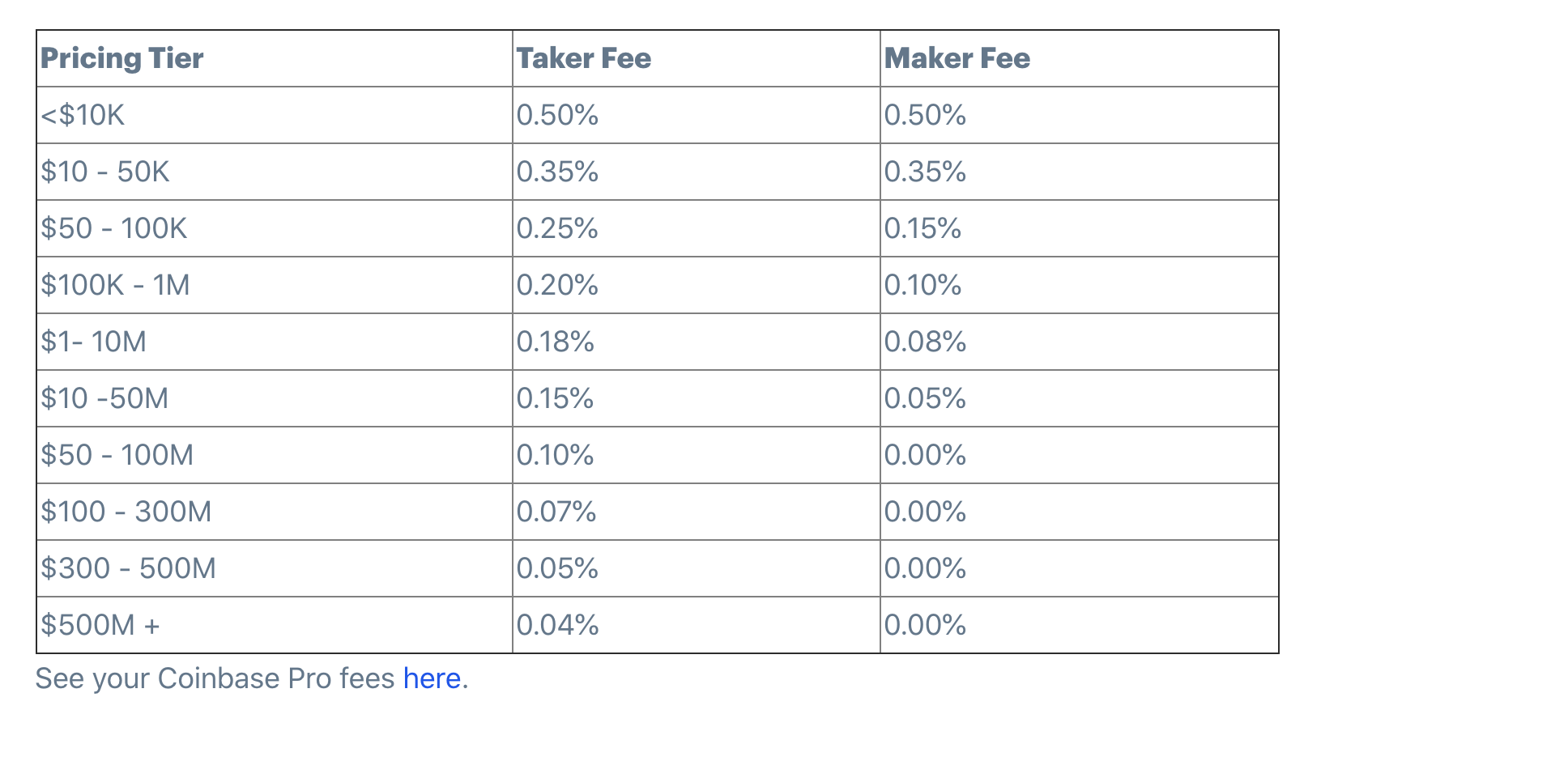

Almost all of Coinbase’s revenue came from transaction fees last year, it said in the filing, underlining the company’s dependence on cryptocurrency trading fees.

Personally, their fee structure is high and even worse if you are buying on Coinbase.Thise fees have led to a roughly $100bn valuation, according to people briefed on the trades, up from $8bn less than three years ago.

The real question is what price are they going to list their shares at? I wish they would allow users of their product to purchase share before they list. It's the least they can do for the highway robbery of their fee structure.

Posted Using LeoFinance Beta

Now THAT'S an idea I could get behind! They certainly received their share of fees from me. I can still recall being unable to join Coinbase in 2017 as my home at the time was in Germany, but my legal address was in the US. Thank goodness we finally got that all figured out! :)

Posted Using LeoFinance Beta

For US traders there are not many option unless you use a VPN and they don't have security which then makes me not want to use an exchange. The break points for fees is also pretty crazy that some are doing 1b of volume.

Posted Using LeoFinance Beta

will the stock be available on all Trading Platforms ?

Posted Using LeoFinance Beta

If it’s listed it should be traceable for most all brokers.

100% not a fan of this. As soon as a company goes public for trading it turns into shit. Expect fees to go up, worst customer experience and so forth it happens with EVERY company that goes public to try and please the investors.

Posted Using LeoFinance Beta

That would be a good idea so probably why it won't happen. :-) I do like that we'll have a publicly traded exchange though so we can have some transparency into how they're operating. I want to see what their revenue streams are...

Posted Using LeoFinance Beta

I'm all for transparency and if crypto enters a bear market I can short coinbase to ride out the down trends lol. Social justice for the fees lack of tradable coins. I hope it also make filing taxes easier for crypto as they get more involved with traditional markets.

Posted Using LeoFinance Beta

Congratulations @cryptictruth! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 7500 replies.

Your next target is to reach 60000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

This is actually a big deal. Having a crypto company with a huge market cap on one of the big exchanges further legitimizes cryptocurrency. The more people get used to crypto as just another business, the more we can get away from governments FUD about crypto as being something shady.

Posted Using LeoFinance Beta