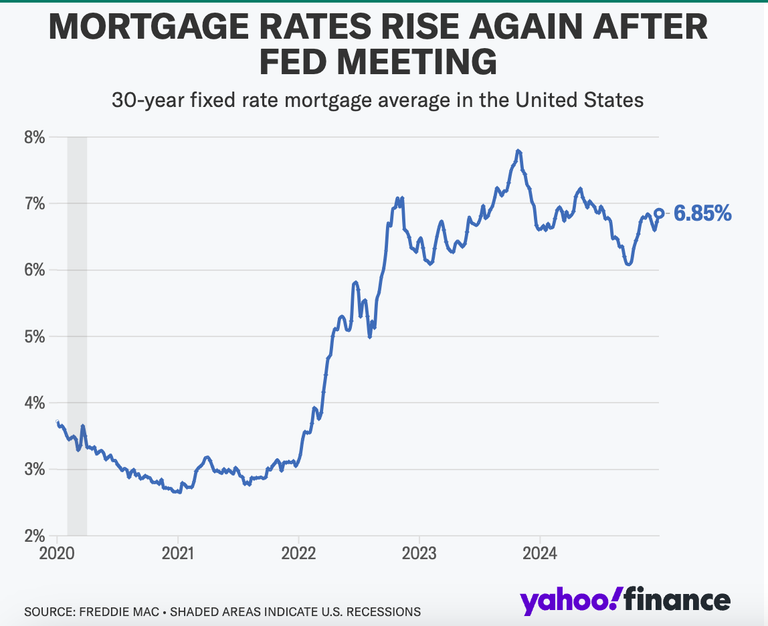

In the world of investing, finding reliable indicators to guide trading decisions is crucial. While many traders focus on traditional metrics such as earnings reports, market trends, and economic data, one less obvious yet highly relevant indicator can be found in mortgage rates. Mortgage rates rose again this week to end the year slightly higher than where they began. The average 30-year fixed-rate mortgage rate was 6.85% for the week through Wednesday, according to Freddie Mac data. That’s up from 6.72% a week earlier. Average 15-year mortgage rates rose to 6% from 5.92%.

Understanding the relationship between mortgage rates and stock performance can provide valuable insights to navigate the markets more effectively. When you think about it, mortgage rates are closely tied to broader economic conditions. When interest rates are low, borrowing becomes cheaper, stimulating home buying and refinancing activities. This influx of capital into the housing market typically suggests a robust economy where consumers feel confident about making significant financial commitments. Conversely, when mortgage rates rise, it often signals tightening monetary policy aimed at curbing inflation or cooling off an overheated economy. Higher borrowing costs can lead to decreased consumer spending on big-ticket items like homes or cars.

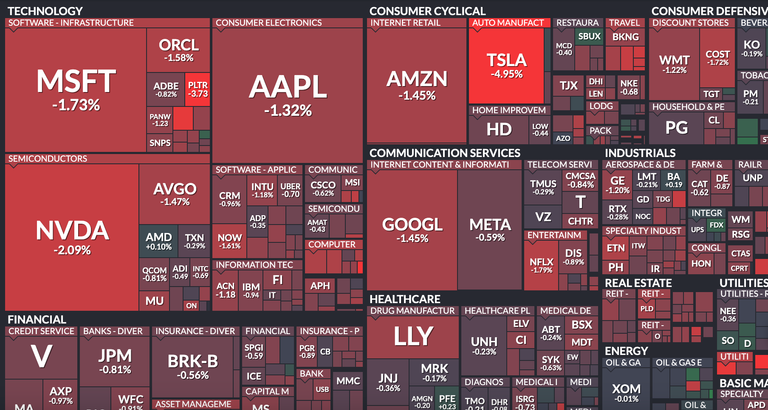

The latest increase in rates follows the Federal Reserve's meeting and interest rate cut last week. There, central bank officials signaled that they're likely to cut benchmark interest rates just twice next year, while many analysts and economists had expected as many as four reductions in 2025. This sent the stock market dipping which did end up recovering some of the losses during the low volume holiday trading session. However, yesterday we saw another 1% selloff in the S&P500.

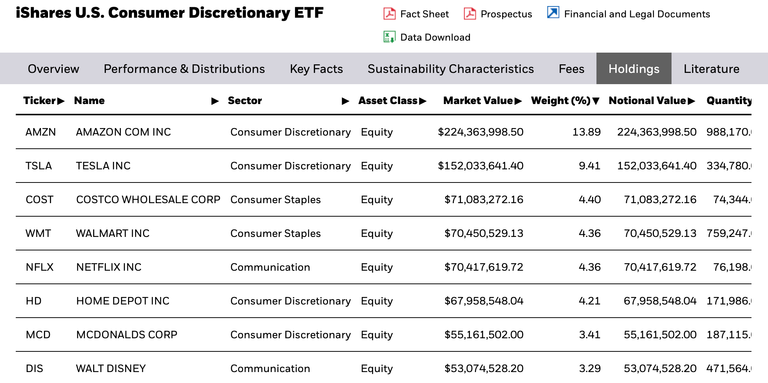

Once sector I have been shorting is the consumer discretionary. As individuals face higher monthly payments due to increased mortgage costs, their disposable income shrinks—leading them to cut back on non-essential expenditures.

I have been short Walmart (WMT) since it reached all time highs and Trump won office. I think the Fed reduction in rate cut along with the the possible tariffs could spell disaster for this retailer.

The other sector I have been looking at is the financial institutions which heavily rely on net interest margins. When mortgage rates rise significantly without corresponding increases in savings account interest yields, banks may see improved margins leading to better earnings reports. I have always like JPM so in Q1 of 2025 I will likely be adding to my position.

It will be essential not to overlook how intertwined our financial ecosystems really are next year. I know I'll be keeping an eye on shifts occurring within residential lending landscapes through fluctuations in rates. I'm just happy we locked in our 15year rate at less than 2.8%!

Happy trading and good luck in 2025.

Posted Using InLeo Alpha

I'm still very happy with my 3.75% mortgage rate! My wife and I have been looking at moving, but I hate to lose that!

It's making it tough to give that up. I'm not lucky, but I caught the bottom on our refinance which means we are going to be staying at our place until it's paid off. At that point we could roll that into a new house and hopefully get a better rate.

That is my hope too. We still have a long way to go on our mortgage, but I know we are going to want to move. Ideally, on our next house I'd love to just get a 15 year mortgage or something like that. Perhaps crypto will help get me there.

Wow, you really provided a sharp insight and in-depth analysis on how mortgage rates affect different sectors of investment. In addition, you also managed to connect the relationship between monetary policy, interest rates and stock market dynamics in a very informative and relevant way. That's cool my friend!

Thanks I try to mix it up and post some about my life, but a lot of my content is around trading stock, metals and crypto.

Mortgage rates here have dropped a point and a half over the year in 3 drops. Very considerable seeing as housing prices are nuts and a drop that big means considerable savings every month.

Gonna be an interesting year in real estate for sure!

the jump to 7% makes most hope unaffordable. Add in housing prices skyrocketing and investment firms buying up the supply 2025 could get really interesting.

Mortgage rates have increased due to high interest rates, which has hurt the stock market.

It's all related that's why it's good to take a holistic approach to investing.

I may have the luxury of being mortgage free but I know some of my friends, neighbors and family that are hurting under that burden. The cost of living is so high in western Canada that even most immigrants, international students and Canadian citizens are leaving.

The cost of living has become quite high now and if the cost of things increases, people will not bear it