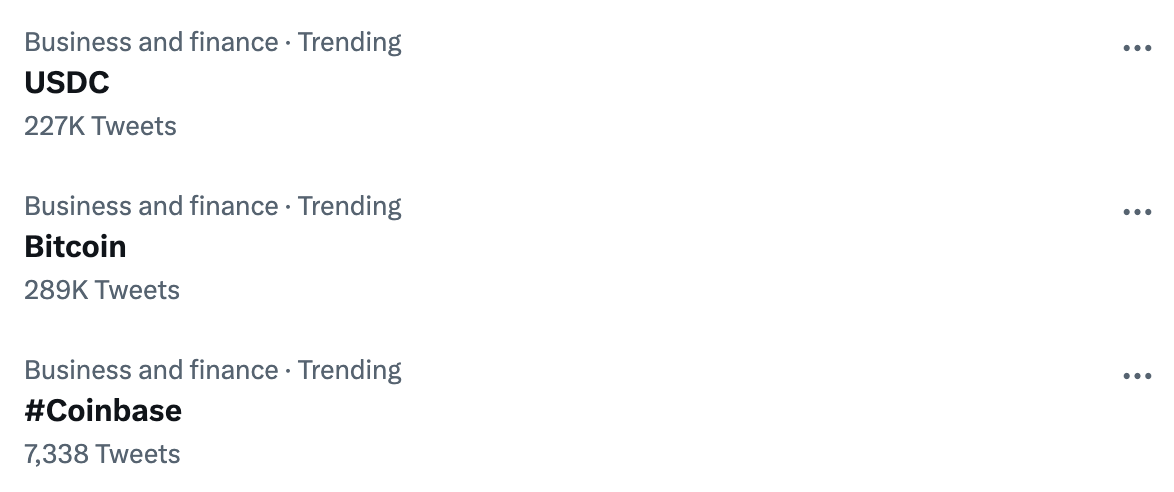

If you have logged on to Twitter this morning there is a good chance you will see all things crypto on your trending page. Over the past year when this happens it's not been good news and today is no different. USDC is trending for all the wrong reasons.

USDC's creator Circle said about $3.3 billion, or more than 8% of over $40 billion USDC reserves, are held at Silicon Valley Bank, which collapsed on Friday as investors created a 'run on the bank'.

There's been ton of stable coin drama over the past year and investors are fearing that USDC could be the next Luna or even cause exchanges like Binance to fall like FTX. Binance and Coinbase both have had to go to Twitter to comment on the USDC situation.

These comments are in response to investors cashing out more than $2.3 billion USDC in the 24 hours. While most of the USDC reserves are invested in Treasuries, close to $9 billion of them were held in cash at banks including:

- Bank of New York Mellon BK

- Citizens Trust Bank

- Customers Bank

- New York Community Bank

- Signature Bank SBNY

- Silicon Valley Bank

- Silvergate Bank

Silicon Valley Bank on Friday became the first major bank since the global financial crisis in 2008 to be taken over by the Federal Deposit Insurance Corp (FDIC) showing the instability of the finical system. The FDIC has taken over more than $175 billion in deposits at Silicon Valley Bank. For those of us that are familiar with traditional banks the FDIC’s standard insurance covers up to $250,000 per depositor so there's a lot of uninsured assets. This situation is very fluid and to add insult to injury. Silvergate shared on Wednesday that it would wind down operations and voluntarily liquidate its bank division, which will cause problems for the larger digital asset ecosystem and compound this USDC issue.

Posted Using LeoFinance Beta

I now discovered why there was a massive dip in the market days ago

The insiders knew what was up early!

So, it's true we are going through worst financial recession. People talk a lot about it. It's means there are more news like this are about to come, we need to prepare our selves.

Seems like things are starting to fall apart. I know I have seen cracks in the system as I believe we are in late stage capitalism.

I have some news from the people who have some knowledge about crypto that this year will be rough and we will some bulls in the 2024 when the halving event will come close.

Crazy stuff. I moved the little USDC I had over I to BTC. When USDC recovers the price of BTC might be back up and I can maybe make a little bit of money.

Yeah I'm thinking it's about time to consolidate everything either to BTC or HIVE. I got a small long liquidated which is frustrating. I hate that we keep having these events that are trigging pretty wild swings. I hate to say I'm pretty concerned about the traditional finical markets at this time.

Yeah, it is quite a joke that there are still so many weak hands out there. Also ridiculous that we are still having to deal with big players wrecking such havoc. I look forward to the day we are past all this silliness.

That's what they want is havoc. They can take way more risk than we can because of their safety nets.

Posted Using LeoFinance Beta

The way we are seeing now that after Friday is coming with bad news and people are too scared if they keep their money in stable coins then that too has come down. Once again if there is a scene with Luna and FTX we will see the market go down a lot.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.