A beginner's guide to Bitcoin that answers how it works and why it has value.

Created by Satoshi Nakamoto in 2009, Bitcoin is the original and biggest cryptocurrency.

Running software on a decentralised network that has quickly become the most powerful in the world, it allows users to use Bitcoin for peer to peer transactions, without the need for a third party such as a bank.

All such transactions are recorded on a distributed ledger called the blockchain, ensuring issues of fraud and double spending are avoided.

Satoshi Nakamoto is the pseudonymous person (or people) who first developed Bitcoin by writing a white paper and then developing the first reference implementation of code.

The coolest thing about Satoshi Nakamoto is that nobody knows who they are.

Adding to the mystery, Satoshi Nakamoto actually hasn’t been heard from and his wallets remain untouched since 2010.

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

-Satoshi Nakamoto

Bitcoin could turn out to have the biggest technological impact on society as a whole, this generation.

This Bitcoin guide explores the cryptocurrency in detail, while offering tips on how to buy BTC below.

Introduction to Bitcoin

After introducing Bitcoin and Satoshi Nakamoto, we now focus on BTC as currency and a network.

As mentioned above, Bitcoin is a digital currency.

Running on a decentralised network, a blockchain is used to record transactions and maintain a trustless, peer to peer system for transacting value.

Let’s differentiate between Bitcoin (BTC) as a currency, and the Bitcoin network used to run the software and facilitate transactions.

Bitcoin (BTC)

Bitcoin (BTC) refers to the digital asset used as currency.

When people hear about Bitcoin, it conjures up imagery of physical coins like you’d find buried at the bottom of your wallet.

The difference is that BTC is entirely digital.

Unlike traditional coins that can be endlessly added to the supply from central banks, there will only ever be a maximum of 21 million BTC in existence.

The amount of new BTC mined gradually slows down over time until mining rewards will finally be exhausted decades from today.

The Bitcoin network

But to transact without permission, the Bitcoin network is required.

The Bitcoin network is simply a huge network of computers running the Bitcoin software, all connected via the internet.

Each individual running the software is otherwise known as a Bitcoin miner.

Via miners, the Bitcoin network’s primary job is to secure the network by recording transactions on the blockchain.

This is how anyone with an internet connection is able to transact in BTC without having to ask permission or receive clearance from a bank.

Nobody can stop the network from processing transactions or manipulating Bitcoin’s supply for personal gain.

Bitcoin is what Bitcoin is.

How does Bitcoin work?

Bitcoin works thanks to miners securing the network and processing transactions on the blockchain.

Satoshi’s whitepaper was revolutionary, making the Bitcoin network the first blockchain of its kind.

While most cryptocurrencies today are backed by a blockchain of some sort, this Bitcoin guide will focus on the technology behind Bitcoin’s specific blockchain.

The Bitcoin blockchain

The Bitcoin blockchain is exactly as it sounds - A series of blocks, connected together by chains.

Each block contains a Bitcoin transaction, and since the blocks are chained together, each block can easily be processed within an organised manner.

The blockchain is the manner that Bitcoin keeps a total, immutable record of all transactions that have been performed on the network.

On the Bitcoin network, a new block is created about once every 10 minutes.

Each new block is then confirmed by the distributed network of computers known as miners, ensures all transactions are processed and finally recorded forever more on the Bitcoin blockchain itself.

Whenever new blocks are added to the blockchain, the newest version of Bitcoin’s ledger is also transmitted, ensuring the security of the network.

As the blockchain is run by a decentralised network of miners competing to keep it secure, there is nothing or nobody you need to trust other than the code itself.

Right there for everyone to see from the start.

It’s this trustless nature of the blockchain that gives Bitcoin value, with every transaction always publicly detailed right there on the blockchain.

By simply Googling ‘Bitcoin block explorer’ you are able to view every piece of data on the blockchain, presented in a myriad of ways.

Bitcoin miners

As we mentioned above, the Bitcoin network is made up of connected computers running the Bitcoin software.

These are what are called Bitcoin miners.

Miners process transactions by adding to the blockchain and secure the network.

As a result, miners are rewarded for their work by being paid in newly minted Bitcoin.

The process of mining bitcoin involves finding new blocks on the blockchain.

While the word miner conjures imagery of men down a coal shaft, it’s actually just computers solving complex math problems.

You see whichever miner solves the problem first, they are the one that gets to add the next block to the blockchain.

Other miners on the network verify the block, the miner is awarded a mining reward as payment and the blockchain continues.

The importance of the Bitcoin blockchain

It can’t be understated how important the blockchain is to the Bitcoin network and as a result, money’s freedom of movement.

The mainstream media likes to run negative stories about how much energy the Bitcoin network uses.

While there’s no denying the fact that Bitcoin’s proof of work mechanism is highly power intensive, it is extremely important for the freedom of money.

The majority of this energy is being used by miners to solve the math problems required to add a new block to the blockchain.

But it’s imperative for the security of the network that these math problems are extremely difficult and require huge amounts of processing power to solve.

This is because the more difficult these problems are to solve, the harder it becomes for the network to be interfered with.

What gives Bitcoin value?

Bitcoin gains value from many of the same characteristics as fiat currencies. Let’s explore the concept of value in more detail below.

All advocates of decentralised cryptocurrencies have been asked what gives Bitcoin value at least once.

Whether it’s messages from lazy friends, dinner table questions from ignorant family members, or from a smug financial advisor whose vested interests lie elsewhere.

Yikes, can you feel the frustration in my writing?

The thing is, when the switch goes off in your brain and you realise that a decentralised future is the best way forward for society, you too will feel that frustration when speaking to the aforementioned individuals.

So with that in mind, let's take a look at some of the characteristics that give Bitcoin value.

Characteristics that give Bitcoin value

The characteristics that give Bitcoin value are actually exactly the same as those behind the value of whichever fiat currency sits in your wallet.

In the section below, I will outline what gives Bitcoin value, compare these reasons to what gives traditional fiat currencies value and show why Bitcoin is actually a better solution than central bank backed fiat currencies.

Accepted

For Bitcoin to have value, it must be widely accepted to have value.

The concept of value is as simple as people believing an asset is valuable, and wanting to accept it.

Therefore it becomes worth something.

It’s safe to say that as each year goes by, everybody on the planet has some basic idea of what is Bitcoin and why it’s valuable enough to accept.

No matter where you are on the planet or in the eCommerce driven digital realm, organisations both large and small are likely to accept Bitcoin payments in one way or another.

Portable

The next characteristic that gives Bitcoin value is its portability.

Bitcoin (BTC) offers you the ability to take full control of your money, spending or transferring it then and there, without the need for any third party intervention.

Being a digital asset that is nothing more than numbers on a blockchain, Bitcoin’s portability is unquestionable.

Whether you have an electronic device connected to the internet yourself or not, all you need is your keys.

Divisible

Bitcoin’s divisibility is a hugely valuable trait.

A common misconception about Bitcoin is that you have to transact in whole numbers and with 1 BTC currently worth $40,000 at the time of writing, this is obviously impractical for your regular Joe.

But Bitcoin is actually able to be subdivided to the 8th decimal place, with the smallest unit of currency called a Satoshi after Bitcoin’s creator.

1 BTC is actually made up of 100,000,000 satoshis (sats) which can all be transferred individually as required.

Secure

Its highly decentralised network and cryptographic technology make Bitcoin highly secure.

While you may have read headlines about hacks like Mt. Gox, this was simply a front-end exchange hack and not the Bitcoin network being compromised itself.

The Bitcoin network is the most secure computer network in the world and as long as you keep your private keys safe, your funds will always be secure.

Ask the good people of Greece or Cyprus if they could say the same thing about their European Central Bank administered Euros during the last financial crisis.

Fungible

The concept of fungibility is whether Bitcoin can be considered uniform and interchangeable wherever you go.

While the mainstream media will always value Bitcoin in USD terms, it’s important to remember that 1 Bitcoin is actually always worth 1 Bitcoin.

Bitcoin is the first and most widely accepted cryptocurrency making it highly fungible whether fiat is present or not.

Scarce

The final characteristic that gives Bitcoin value is its scarcity.

With only 21 million Bitcoins to ever be introduced into the network at one time, BTC is a highly scarce asset.

In an event known as the halving, occurring approximately every four years, the number of BTC released by miners in each block is cut in half.

This limits the supply side of Bitcoin until eventually, there is no more Bitcoin left to be mined.

Robust

Robustness is another benefit worth discussing when it comes to what gives Bitcoin value.

Bitcoin is the centerpiece and reserve asset of the crypto-asset ecosystem, which is much, much more robust than the legacy system.

A correction like the one during the last couple of weeks would've crippled the legacy system, forcing central banks to print uncontrollably and governments to loot taxpayers once again.

But instead what we saw was another real world example of just how robust the crypto ecosystem actually is.

Its capacity for self-healing is very impressive and there are few moral hazards built into it.

In this correction, the losses were all suffered by over-leveraged and careless investors who did not do their research.

No one else lost anything.

In contrast, the legacy financial system is a fragile, top heavy network that feeds corruption and degeneracy wherever its tentacles reach.

Bitcoin is valuable

Ultimately, a combination of the above characteristics gives rise to Bitcoin’s network effect and ultimately comes together to give Bitcoin value.

Most of which are the same as those giving value to fiat currencies, or at least what you perceive to be giving them value.

As a result, Bitcoin is actually a better solution than central bank backed fiat currencies.

How can I keep my Bitcoin safe?

You can safely store your Bitcoin using hot or cold wallets. But always remember: Not your keys, not your crypto.

While we’re going to be talking about the best Bitcoin wallets, it’s important to note that a ‘wallet’ isn’t as you think it is.

Bitcoin is not actually coins that move around and therefore, a Bitcoin wallet does not actually hold them.

Technically, Bitcoin wallets merely facilitate the transfer of Bitcoins and give ownership of the Bitcoin balance to the owner of the corresponding set of public/private keys.

While it seems like you have Bitcoin in your wallet, you actually just have access to a private key that corresponds to that balance on the distributed ledger (blockchain).

Types of Bitcoin wallets

With that in mind, there are two types of Bitcoin wallets.

To put it simply, a hot wallet is connected to the internet while cold storage keeps your keys entirely offline.

Hot wallets

A Bitcoin hot wallet refers to a wallet connected to the internet.

The most common type of hot wallet is simply the Bitcoin stored in your broker’s account.

But remember the saying ”not your keys, not your crypto”?

As we spoke about above, your wallet doesn’t actually hold your Bitcoin.

Only your private keys.

When your Bitcoin is stored in your broker’s hot wallet, they’re in fact holding those private keys on your behalf.

The advantage of a Bitcoin hot wallet is that they’re easier to access and make trading Bitcoin as easy as a few clicks on the broker’s platform.

But conversely, hot wallets require you to trust a third party with your keys.

A big price to pay for convenience.

Best brokers to store Bitcoin in a hot wallet:

Here is a selection of the best Bitcoin brokers who offer Bitcoin hot wallets:

- Binance

- Bittrex

Cold storage

Bitcoin cold storage refers to a wallet that is not connected to the internet.

The most common type of Bitcoin cold storage device is an encrypted, portable device that stores your private keys offline and gives you access to your balance.

While you must make a transfer to a hot wallet in order to trade, by having full control of your keys, you and only you are in control of your balance.

As you can see, cold storage is the more secure option.

But they’re also less convenient and you pay for the privilege of control with a good cold storage device costing in excess of $100 USD.

Best Bitcoin cold storage devices

Alternatively, here is a selection of the best Bitcoin cold storage devices.

- Trezor

- Ledger Nano S

When to use cold storage to keep your Bitcoin safe

The clear tradeoff between Bitcoin hot wallets and cold storage is convenience for security.

Here’s an analogy for you.

Are you comfortable leaving your entire life savings under your hotel room mattress where management and cleaners can access or grant others access to your room at gunpoint?

This is essentially what you’re doing by leaving all your Bitcoin on a broker’s hot wallet.

Doesn’t sound like a good idea.

You should only be leaving as much Bitcoin in your hot wallet as you need to trade or transact within the extremely short term.

The rest should always be held in a safely stored cold storage device.

Bitcoin pros and cons

For a full overview of Bitcoin, you must understand there are both pros and cons.

Now that we’ve gone over the basics, let’s take a look at the pros and cons of Bitcoin.

Bitcoin pros

Let's start with the positive aspects of Bitcoin.

1. Blockchain technology

Bitcoin uses blockchain technology to record every transaction on its immutable ledger.

Once a block is created, there is no way to edit or modify the record on Bitcoin’s blockchain.

This prevents double spending, making Bitcoin extremely fraud resistant.

2. Quick transactions

Bitcoin is a P2P currency whose network can generate 4.6 transactions per second.

You can quickly transfer Bitcoin anywhere in the world, without having to rely on a third party.

Compare this to transferring large sums across borders using the legacy banking system and you’ll see the huge advantage Bitcoin has.

3. Decentralised currency

Bitcoin’s decentralised nature gives individual control to the specific users.

The decentralised nature of the Bitcoin network means there is:

No control over the network by an individual

No control over the Bitcoin network by a company

No control over the Bitcoin network by a government

If you own your keys, you have full control over your funds.

4. Secure transactions

When it comes to security, this is everyone’s priority.

Bitcoin is very safe and the network itself has not once been hacked.

Your private keys are a secure, string of numbers that make them almost impossible to guess using modern computing technology.

While all transactions are public on the blockchain, your transactions can be viewed, but unable to be stopped.

6. Best performing asset

Bitcoin is actually the best performing asset over the last decade.

An amazing achievement when you look at how niche cryptocurrency investing is, even today.

Due to its decreasing supply structure, one benefit of Bitcoin is that its value increases with time.

For example, if you bought 1 Bitcoin when it was worth 1 USD, you would have 36k USD as of today.

Many people have become Bitcoin millionaires as a result.

Bitcoin cons

But as with everything, there are some negatives to Bitcoin that you must understand.

We go over a few Bitcoin cons below.

1. Bitcoin used on the dark web

You may have heard about the dark web.

The dark web is all online content that exists on darknets.

These are overlay networks that use the internet, but require specific software and setups in order to gain access.

Bitcoin has become the default currency of the dark web due to its permissionless transactions.

2. Decentralised currency

You may ask how decentralisation can be both a pro and con for Bitcoin?

This is because the majority of people aren’t ready for the responsibility that comes with being in total control of the security of your funds.

If something goes wrong because you didn't secure your keys or sent your money to the wrong address, you have nobody to blame but yourself.

With great power comes great responsibility.

3. Highly volatile

There's no denying that Bitcoin is a highly volatile asset.

This means that Bitcoin can crash 50% in a day and nobody will bat an eyelid.

Obviously a prospect that conservative investors can't deal with.

But it's this volatility that also offers upside unseen in any other asset class.

However, the diminishing supply curve of Bitcoin should see this volatility even out over the next decade and beyond.

4. Online frauds

As Bitcoin gains popularity and value, people will use social engineering techniques to engage in fraud.

While the Bitcoin network itself can’t be hacked, people who store their keys on exchanges or their own servers can be hacked or simply tricked into giving their keys to malicious actors.

Bitcoin isn’t the risk here, the people holding them are.

5. Dependant on the internet

We round out our list of Bitcoin cons with one for the doomsday preppers.

The Bitcoin network runs entirely online and technically if we saw a global power shutdown, then we would be unable to transact.

Yikes.

Do Bitcoin’s positives outweigh the negatives?

Yes, overall Bitcoin’s positives outweigh the negatives.

Bitcoin brings banking services to everyone on the planet and has the ability to free millions of people from restrictive, controlling governments.

With Bitcoin, no matter who you are or where you’re from, you can truly take control of your own financial future without fear.

Bitcoin is freedom.

Should I buy Bitcoin in 2021?

We cover the reasons you should buy Bitcoin and consider how much to buy.

In 2009, Bitcoin cryptocurrency was a curiosity limited to hard-core academics and people with too much free time on their hands.

Moving onto 2013, Bitcoin was one of a handful of cryptocurrencies looking for use cases beyond peer-to-peer payment.

By 2017, Bitcoin was leading the charge in the famous bull run of that year.

Now in 2021, Bitcoin has become the undisputed King of Cryptos.

Considering the path that Bitcoin has forged, the answer to the question "Should I buy Bitcoin?" is a resounding yes.

Reasons to buy Bitcoin in 2021

Regardless of the ups and downs in its fiat paper pricing, there are several reasons for not only for buying Bitcoin but also for feeling good about buying Bitcoin:

- Impact

- BYOB - Be Your Own Bank

- More than a feeling (or fad)

- Crypto beyond the currency

- Proven and perceived value

- Performance

Impact

After all, Bitcoin is a technology that has had perhaps the greatest impact on society since the dawn of the personal computer era.

By being a decentralized, trustless and permissionless peer-to-peer digital currency protected by cryptography, Bitcoin has redefined money in ways even precious metals could not.

BYOB - Be Your Own Bank

Once you acquire Bitcoin, you truly own it (unlike a home or a car).

If you want to acquire more Bitcoin, all you need is to find a seller - That’s right, there’s no need to get permission, no applications to be filled out, no qualifications that need to be met.

Similarly, if you want to sell your Bitcoin, you just find a buyer for it (or let buyers find you).

Unlike with legacy banks where fiat currency is stored, there are no capital controls on the Bitcoin you own.

While many banks limit how much you can withdraw from an ATM within 24 hours (say, USD 1,000 in the United States), there is no maximum amount of Bitcoin you can withdraw is.

It’s your Bitcoin, you’re free to withdraw, transfer and spend it as you see fit.

Bitcoin offers its owners freedom in many forms, while the truth is that legacy banking offers its account holders debt.

For some people, that's reason enough to buy Bitcoin.

More than a feeling (or fad)

If Bitcoin was just a fad or flash in the pan, it would not have spawned thousands of altcoins during the last decade (including the Godfather of Meme Coins, Dogecoin).

For people whose knowledge of cryptocurrencies comes from Twitter and Tesla, consider this detail: there could be no Dogecoin without Bitcoin.

Crypto beyond the currency

Even the technology which makes Bitcoin possible, blockchain, has spawned numerous applications unrelated to payments.

Look no further than DeFi powered by smart contracts first popularized by Ethereum and social media in the form of LeoFinance, Hive.Blog, and its predecessor.

If you want something that does the equivalent of a Certificate of Deposit or a Savings Bond, there are even ways Bitcoin can be used to farm interest.

As with Hive cryptocurrency, Bitcoin can be staked on third party platforms so that it can work for you and earn income.

But as always… Not your keys, not your crypto.

Proven and perceived value

Given the impact cryptocurrencies have had on many aspects of society, there is no doubt that both BTC and its Bitcoin technology has proven themselves to be valuable.

With the fact that only 21 million units of BTC will ever be mined, people instinctively know how this pre-defined scarcity adds to its value.

Because of that scarcity in BTC, Bitcoin has become known as the gold of cryptocurrencies.

Performance

Cryptocurrencies are infamous for their volatility.

When they go up, they shoot to the moon, but when they go down, they hit the Earth like meteorites.

In the end however, both behaviours are just exaggerated versions of what happens to all assets in bull markets and bear markets.

What people need to realize is that even after a brutal drop in price, the gains which followed were magnitudes greater than earlier gains.

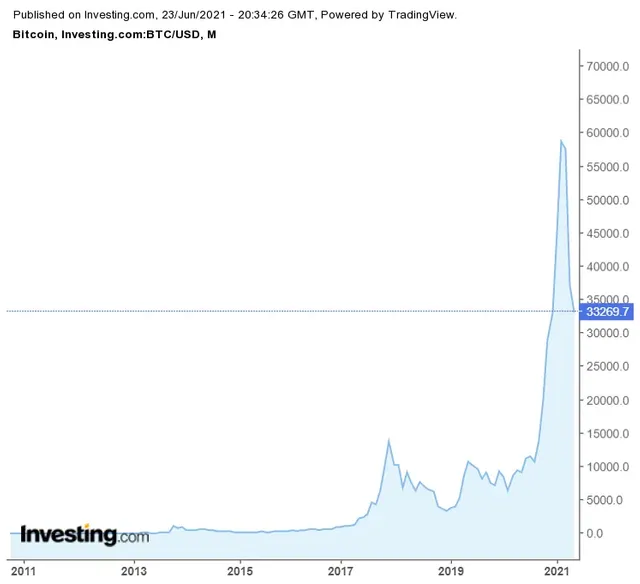

Just take the following Bitcoin chart from investing.com:

As with any other asset, hold it long enough and it will go through both drops and rises in price.

Not exactly financial advice, but still true.

How Much Bitcoin Should I Buy?

Short answer: Buy as much Bitcoin as you can afford.

At the time of writing, 1 BTC was worth USD 33,118.63 - Not exactly pocket change.

Keep in mind that while USD prices go to 2 decimal places, BTC prices are measured to 8 decimal places.

It’s this divisibility that makes it possible to buy and sell minute quantities of BTC.

These fractional values are called Satoshis (named after the creator of Bitcoin, Satoshi Nakamoto) and any quantity BTC can be purchased right down to that 8th decimal place.

1 Satoshi equals 0.00000001 BTC, and 10,000,000 Satoshis equal 1 BTC.

Below is a table of data from CoinMill which shows prices for certain values of BTC and USD:

| BTC | USD | USD | BTC | |

|---|---|---|---|---|

| 0.00002 | 0.66 | 0.5 | 0.00002 | |

| 0.00005 | 1.66 | 1 | 0.00003 | |

| 0.0001 | 3.31 | 2 | 0.00006 | |

| 0.0002 | 6.62 | 5 | 0.00015 | |

| 0.0005 | 16.56 | 10 | 0.00030 | |

| 0.001 | 33.12 | 20 | 0.00060 | |

| 0.002 | 66.24 | 50 | 0.00151 | |

| 0.005 | 165.59 | 100 | 0.00302 | |

| 0.01 | 331.19 | 200 | 0.00604 | |

| 0.02 | 662.37 | 500 | 0.01510 | |

| 0.05 | 1,655.93 | 1,000 | 0.03019 | |

| 0.1 | 3,311.86 | 2,000 | 0.06039 | |

| 0.2 | 6,623.73 | 5,000 | 0.15097 | |

| 0.5 | 16,559.32 | 10,000 | 0.30194 | |

| 1 | 33,118.63 | 20,000 | 0.60389 | |

| 2 | 66,237.27 | 50,000 | 1.50972 | |

| 5 | 165,593.16 | 100,000 | 3.01945 | |

| BTC rate | June 22, 2021 | USD rate | June 22, 2021 |

Who Should Buy Bitcoin?

There will always be people who buy insane quantities of Bitcoin regardless of price in local fiat currency.

Some of these purchases are one-time buys, some purchases are infrequent and others follow a consistent pattern.

Most people however, will purchase Satoshis - Fractions of a Bitcoin.

As they’re smaller in nature, these purchases tend to occur more frequently.

The Best Way to Start Buying Bitcoin

The best way to start buying Bitcoin is to dollar cost average your position.

An example of this slow and steady approach is to invest just $10 per day and allow your investment to compound over time.

The amount of local currency is fixed, but the price of BTC will vary at any given moment.

Some days are better than others, but if your purchases are consistent then you will likely have accumulated more BTC than if a one-time purchase was made for the same amount of total local currency.

This strategy of dollar cost averaging works with stocks, precious metals, and especially with Bitcoin.

Buying Bitcoin when prices are low is better than when it's near an all-time high, but with DCA, the time to buy Bitcoin is always now.

This is because DCA minimizes the impact of Bitcoin’s sometimes volatile price movement.

If you can afford to buy equivalent BTC at USD 20 every day, then great.

But even if you can only manage USD 5 every day, that's a better use of USD than a cup or two of overpriced coffee.

You can never have bought too much Bitcoin.

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Bitcoin? All comments that add something to the discussion will be upvoted.

This Bitcoin guide is exclusive to leofinance.io.

Posted Using LeoFinance Beta

Hey guys,

I (@forexbrokr) will upvote anyone who contributes content to this guide and transfer all final blog rewards to contributors.

To earn LEO:

Pick any of the subheadings from that template and publish content on your own blog.

Link back to 'https://leofinance.io/@crypto-guides/what-is-bitcoin-btc', anywhere in your blog using relevant anchor text.

That's it.

Help me out here?

Posted Using LeoFinance Beta

All author rewards have now paid to contributors of this Bitcoin guide.

Contributors:

Thanks guys.

Posted Using LeoFinance Beta

Congratulations @crypto-guides! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

And I've already gone from that to trade. Many people just can't discover typical crypto signals. Maybe it's helpful for someone one day, I can share. I therefore recommend you to see the greatest https://safetrading.today/blog/how-to-make-money-trading-bitcoin/ that allowed me to understand the market and helped me trade more effectively. But I'm so grateful, I haven't expected it. I hope I've all been able to help!