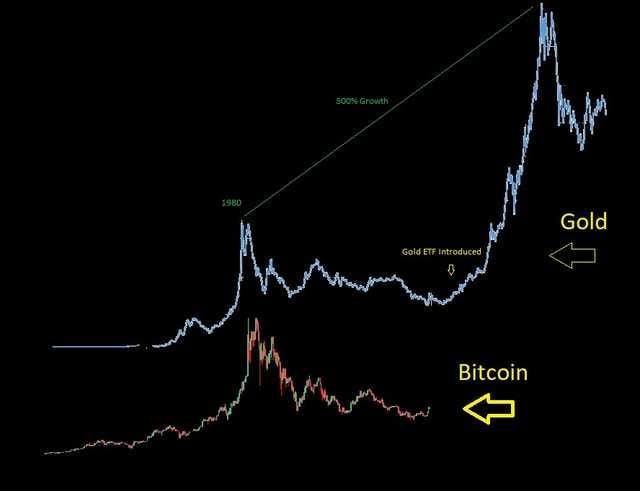

This is actually quite interesting to compare what happens when the Bitcoin ETFs are introduced to that of when Gold was offered as an ETF. The first Gold ETF was launched 20 years ago back in March 2003 and had an immediate impact on the price.

Gold did more than a 5 x in price from 2003 to 2013 with the largest Gold ETF today being the SPDR Gold Trust with over $55 Billion invested and more than 6 million dollars traded daily. This is roughly half the value of the total gold ETF market being at $110 Billion. Obviously there are many ways one can buy gold and an ETF is just one of those methods.

I do think we can use the Gold ETF's as a guide but would be disappointed if it took ten years for Bitcoin to do a 5 x and that is why it can only be seen as a guide.

The Bitcoin halving is next year in April which normally coincides with an upswing in price and having ETF's available this would create an unprecedented pump in value never seen before.

Bitcoin's ATH market cap of $1.27 trillion when it reached $67,549 should be surpassed with ease. One of the big differences is Gold never had all the FUD and negativity involved with restrictions on how you can purchase your investment.

The States has been held back and now with this the way Bitcoin can be traded by institutions this should be far more popular than any Gold ETF ever was. We all know why this has been manipulated with the introduction of Bitcoin ETF's with the service fees that are going to be generated making serious money for those managing the funds.

If you consider a normal ETF has a service fee of around 0.54% and Grayscale is reported to going to charge 4 x more coming in with a 2% service fee. We can expect to see a high number of Bitcoin/Crypto ETF's in the future (Gold has 35 in the US alone) so service fees will drop with more competition. Those institutions that get approved early will make the extras before others start competing for investors offering lower service fees.

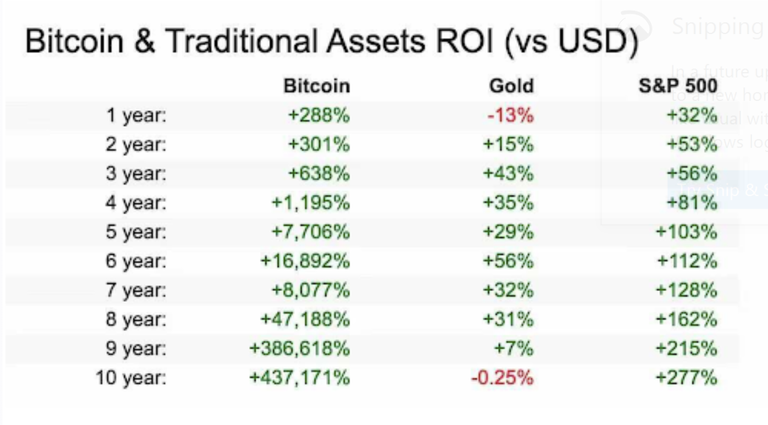

Between the 10 year period 2011=2021 Bitcoin out performed every other stock/asset not by a little, but by a lot. Nothing has come close to what Bitcoin has done and continues to do. This is why Bitcoin will boom when the ETF's go live and like everything else in crypto prices will rise with the alt coins benefitting.

How much value will this add to your portfolio over the next few years we have no idea yet, but everything points to monster values being added. This is the time for crypto to shine with everyone wanting a piece of the action as this is how the markets tend to work. Exciting times lay ahead and why we need to just keep on growing as this is the same as money printing being involved this early.

Posted Using LeoFinance Alpha

Thanks for sharing your content on leothreads. By following the format in the linked post you can increase the reach and effectiveness of your content

https://leofinance.io/posts/anomadsoul/curation-on-leo-finance-threads-outreach