I think most of us who have been keeping up to date with the COTI project know what is happening and what to expect, but it is great to read what plans lie ahead. The COTI team released their road map for 2023 and beyond today and this is the first project I can say I thought I knew everything, but there are some great surprises. The expansion plans are exciting and this is only going to create huge value and can hardly believe COTI is at 7c. This is no small project and seeing the growth whilst being part of it is the fun part.

DJED

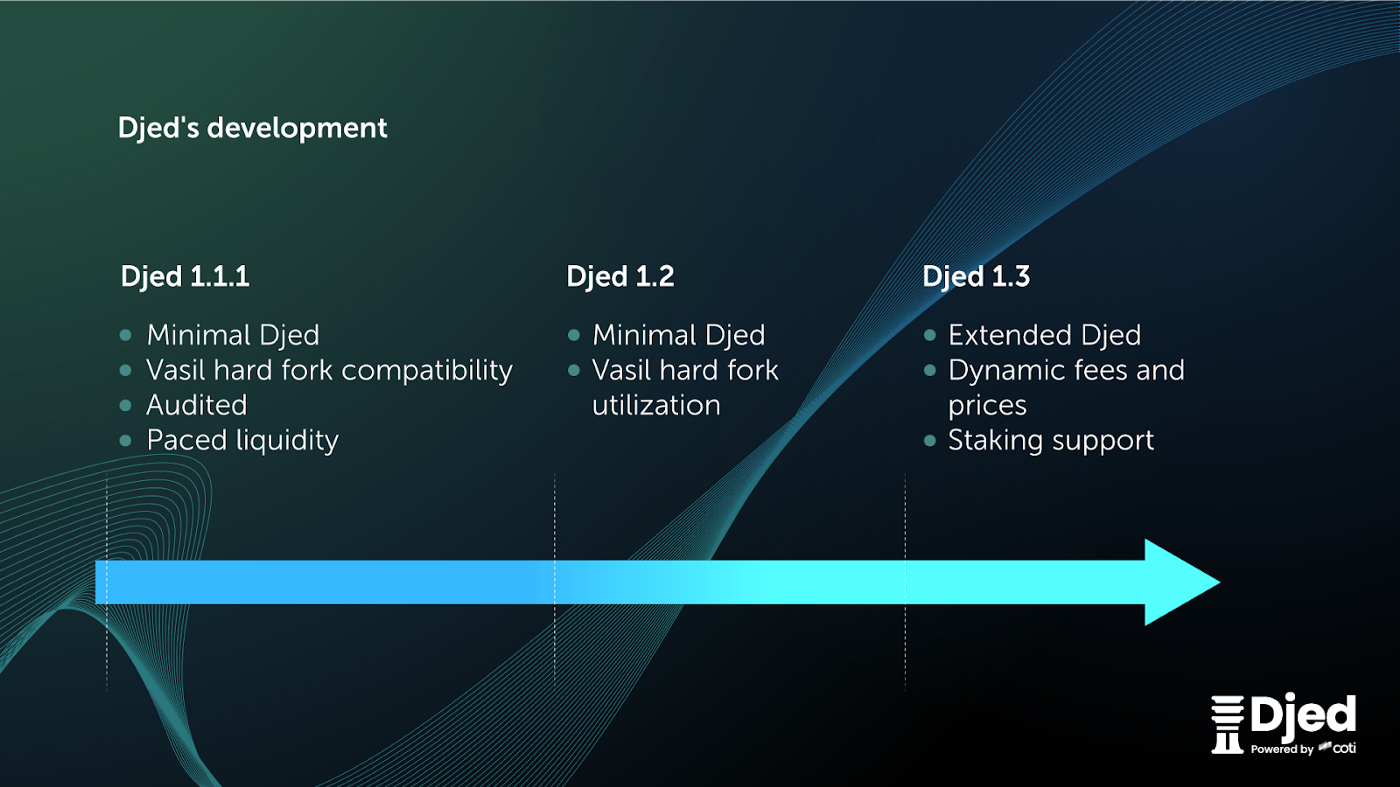

The Stablecoin for the Cardano ecosystem is up first launching later this month with the aim of being the main stablecoin for the Cardano network. This has been over a years worth of work coming to fruition which should add a constant stream of funds boosting the APR for those staking COTI. The aim is to start slowly, but then again this will be all about supply and demand.

GCOTI

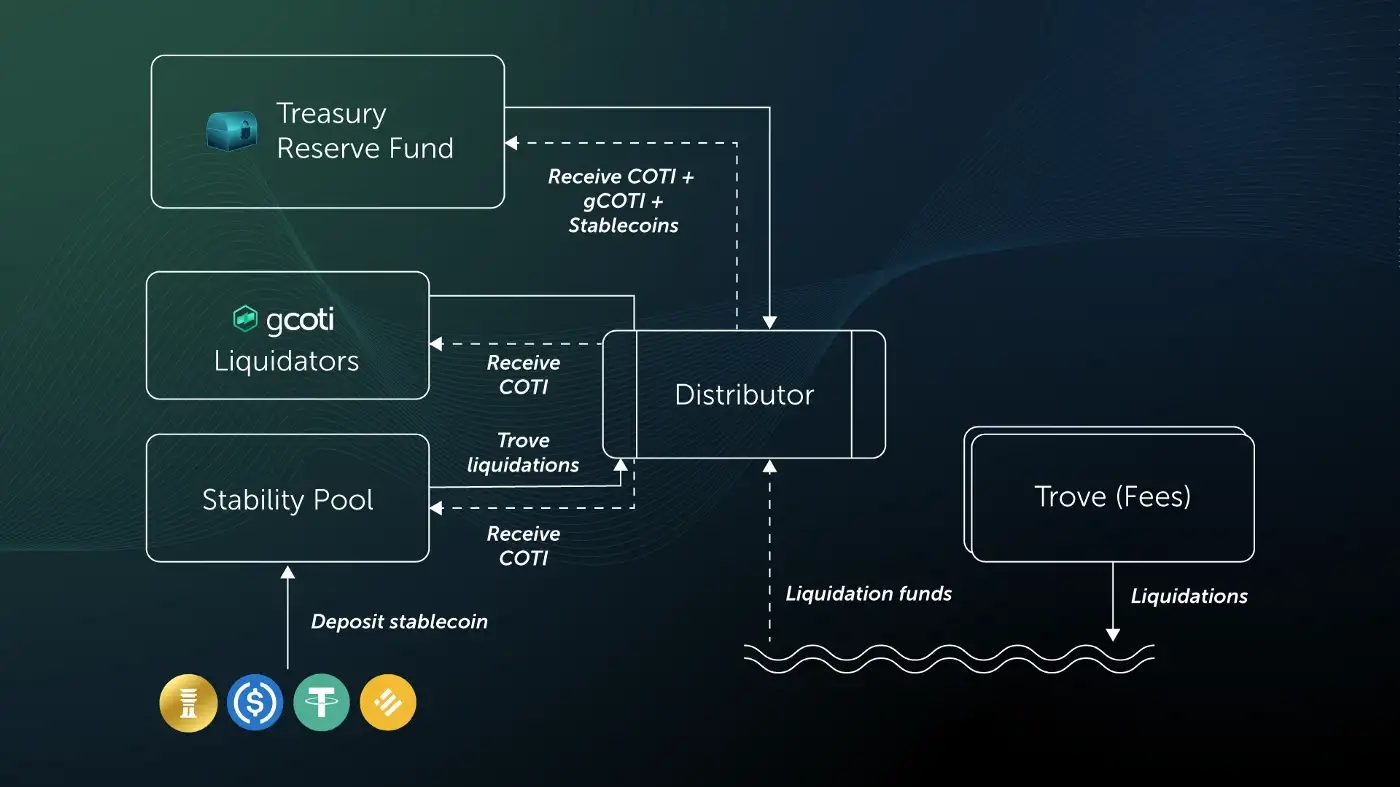

The Governance token known as GCOTI was mentioned that this will be launched in February directly after DJED. This GCOTI is important as this will be reflected in the initial airdrop as between 10 and 15% will be released in the first phase. This is airdropped more on your Trust Score earned via the Treasury and not on the size of your stake. The GCOTI will allow you to earn extra APR and will become an important part of the earning potential. This will not be sold on the exchanges, but some may want to sell so there could be purchasing opportunities.

As a Governance token this will assist in helping make decisions on how the Treasury works through your vote. One added snippet is when there are liquidations there will be discounted COTI on offer along with the fees being earned. This is a new idea which we haven't seen as yet.

TREASURY 2.0

The COTI Treasury is nearly 1 year old having launched in February 2022 and has grown and grown with over 44% of the circulating COTI staked. The additions coming will assist not only more staking options, but more minting for the Enterprise Tokens due later in the year. DJED and SHEN will have staking in the Treasury so the big change will be felt as we see multiple coins being staked.

This is in my thoughts is way bigger than DJED as the Enterprises opens up a whole new world of earning capabilities boosting the APR. The aim is to allow developers using COTI as a layer 1 which will be meeting compliance and regulatory requirements. COTI is moving towards a more decentralised system which has always been the aim.

Treasury Reserve Fund

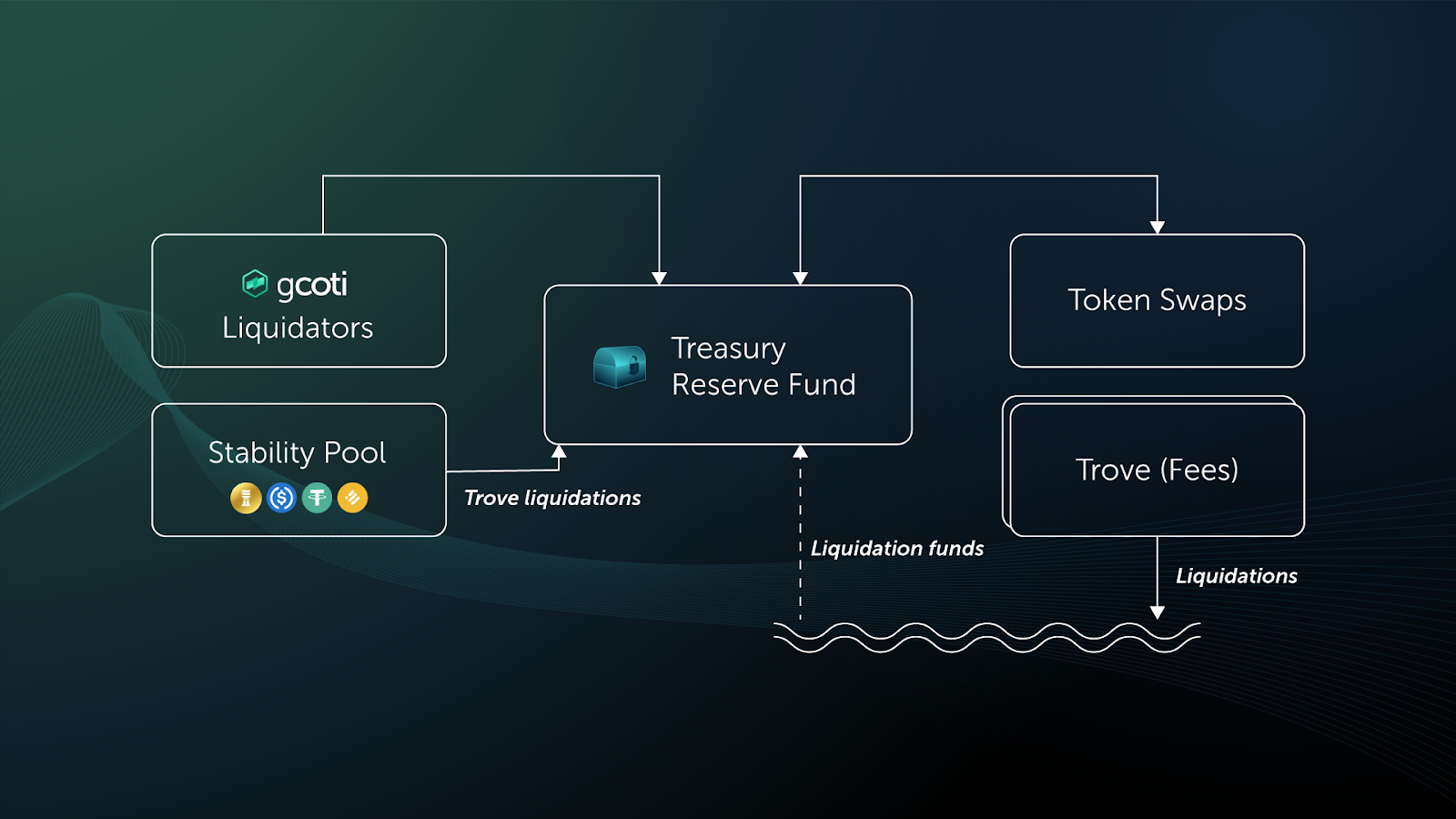

An important new feature which is designed to help maintain stability. The Reserve fund will be the component that collects all the fees being earned by the various services provided by COTI. Up till now this has not been required but things will become more complicated as there will be multiple earnings flowing. The Reserve Fund will distribute the earnings managing this internally and externally controlling the liquid. This shows everyone how big this is going as this has never been required up until now.

Stability Pool

Told you things are getting big and this is another addition turning COTI into a beast of serious growth and earning opportunities. Other networks will be able to stake in the Treasury via the bridge.

Using Bridge 2.0 we can allow the inflow of stablecoins from different types of networks to be deposited in the Treasury, such as USDC, BUSD, USDT, and DJED.

These stakers will be stability providers earning and benefitting from liquidations with no risk. The team talks about a new stream of rewards so we need to pay attention to what these are going to be.

One other addition is the token swap facility comprising all the tokens within the Treasury. This will have a small fee attached but what is great is that one could swap out a token for a stable coin and exit without having to use an exchange. This is where I see this heading and is great to see.

COTI PAY BUSINESS

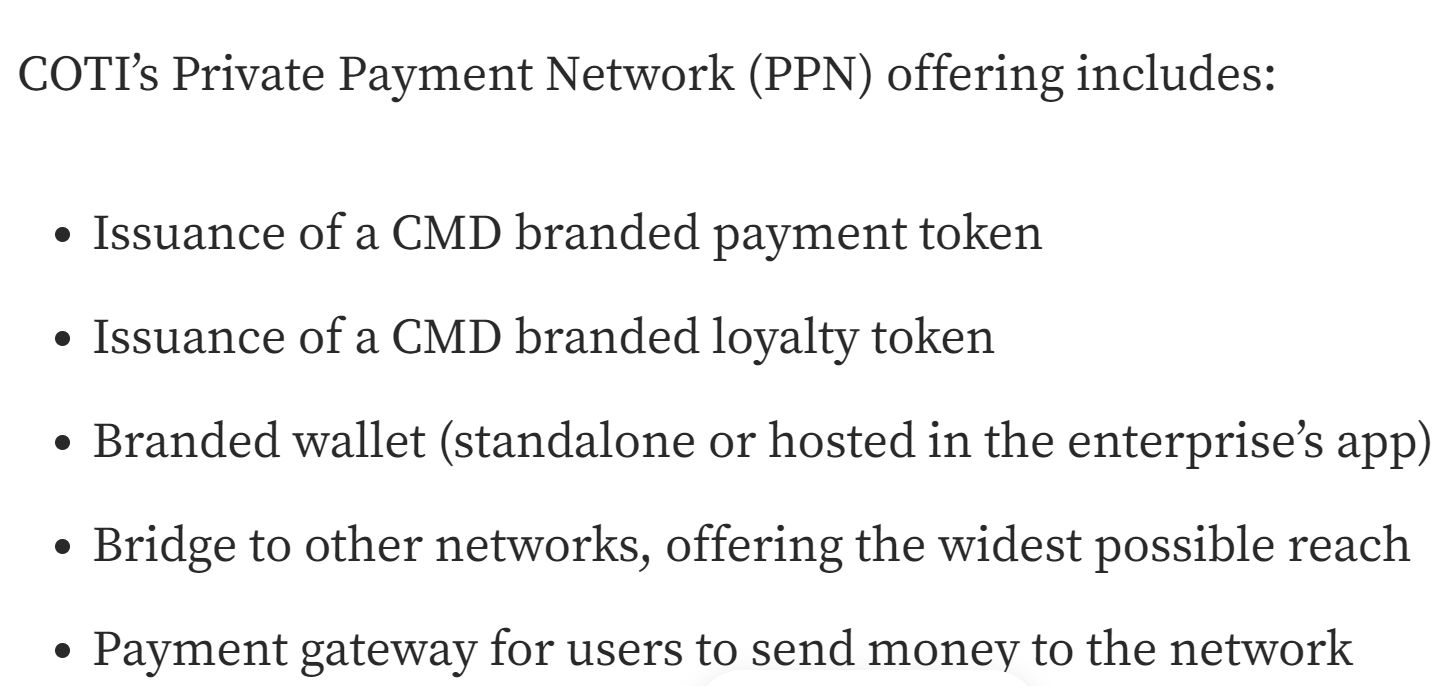

The big one for 2023 if you can say that with so much going on but this has to be the exciting part of the road map. The Private Payment Network or PPN will offer Enterprises the opportunity to launch their own payment networks. The important key points is COTI is regulation ready, turnkey ready, custom branded tokens, website integration, wallets and processing gateways all formatted to the exact needs and requirement of each business. What is important is Enterprises will not invest into Crypto if there is no regulation or compliance as there is legal issues which are holding them back. This is why the States cannot stake within the COTI Treasury currently as legally this is still being worked on and what is holding the Enterprise tokens from launching.

WE know there are 3 Enterprise companies working behind the scenes and will only launch when they can legally do so. When you have lawyers involved this has to be done correctly with no grey areas and this is what is taking the time. The one guarantee is whoever is planning their launch is no Mickey Mouse company and they have to be very big.

COTI V2 again is left out as this is a post on it's own due to it's importance and will make sure I get this done tomorrow. This is all about regulation and compliance and is a major development for not only COTI, but Crypto in general.

Like every investment please DYOR and learn about the project you are investing into.

Posted Using LeoFinance Beta

If you could only pick one, COTI or HIVE?

Really hard one as both are so different and will do very well individually. I am more personally involved with Hive and has taken 5 years to build so far. Would be Hive, but very close if I am honest.

Posted Using LeoFinance Beta

I had already started doing some research but this post clarified my ideas a little more!

A thousand thanks!

Have fun as this one is very different to other investments.

Posted Using LeoFinance Beta

hmmm, i need to get more informed on this, ty ... i've always been impressed by Hoskinson, ty

Yeah I agree as he is not stupid and knows what he is doing even if it takes forever.

Posted Using LeoFinance Beta

COTI is becoming a beast, wished just I had bought more tokens when it hit bottom. Still appealing on the market to buy some more...

Posted Using LeoFinance Beta

Yes it is still appealing and need to hit my targets slowly. Treasury fees are only reduced from tomorrow from 0.5% to 0.25% so this is a small difference that adds up.

Posted Using LeoFinance Beta

I saw they are getting ready to launch the new fee structure soon. I honestly don't pay too much attention to what is going on with COTI since I am not able to do anything with it. Once that changes I might pay more attention. It just seems pointless now.