Today I watched an interesting video with a physicist (Giovanni Santostasi) who was basically relating Bitcoin to the Power Laws. The explanation that the Bitcoin story of adoption can be described in a mathematical language. Giovanni has been researching and studying Bitcoin for 12 years already so this may not be so crazy what he is now saying. Time will tell if his theory is right or wrong.

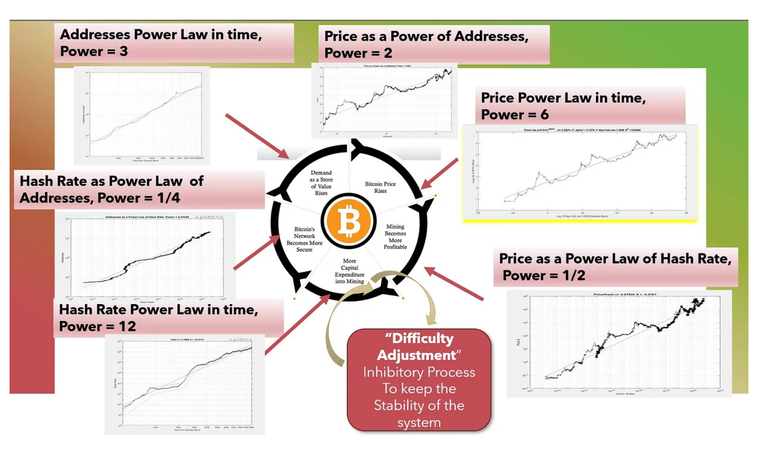

A Power Law is generally about finding a relationship between thigs through gathering data. This is normally applied to objects like cites or organisms mapping their overall growth. These are all growing through increased networks nd why Bitcoin falls into a similar category. The time factor is obviously an important part of these calculations because this is how they can predict the rate of growth. This is me dumbing down and simplifying this so it makes this Power Law term easier to understand.

His theory works o the relationship between price and time which is mirroring the adoption of Bitcoin which as we all know ultimately affects the price of crypto.

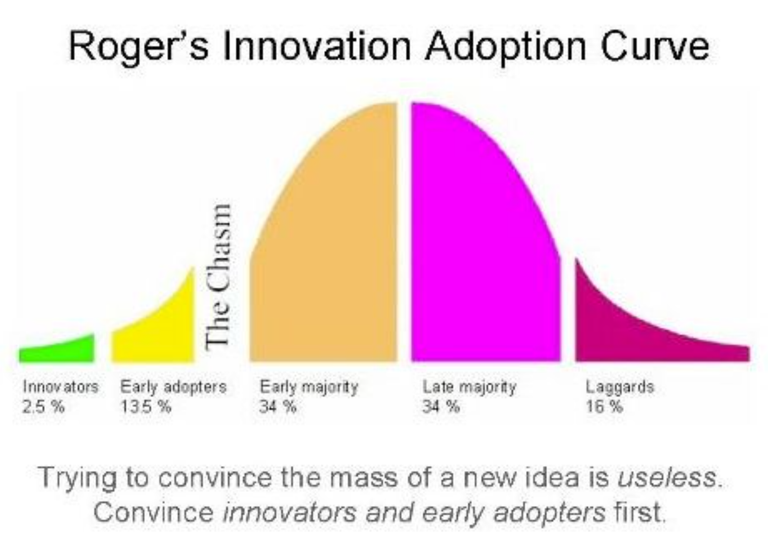

Giovanni's theory says that Bitcoin is not like other technology that has been adopted following the route of the adoption graph above, but a growth rate to the power of 3 in time.

The difference between an S curve adoption and a power of 3 adoption in Bitcoin's case is all of the various other factors involved. The hash rate increasing in difficulty as time goes on reducing the supply every 4 years dictating the Bitcoin cycle which ultimately dictates the price.

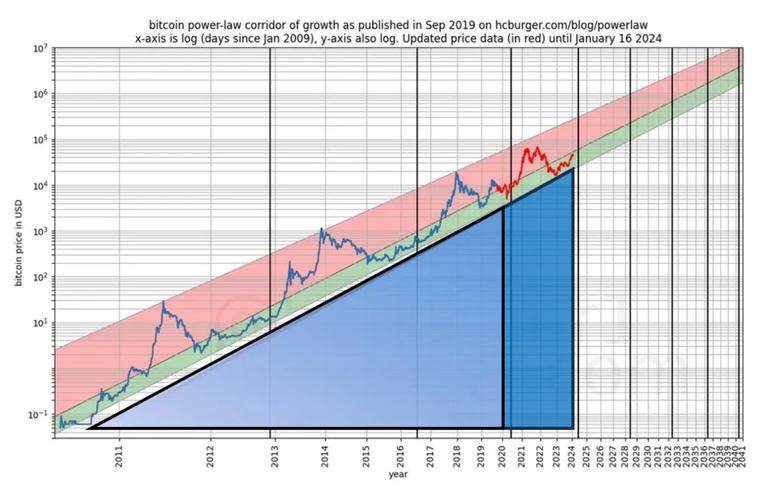

The Bull and Bear cycle is explained by the price over shooting due to the euphoria in the market when the bubble bursts and why it eventually always comes back to the growth line that we know Bitcoin just seems to track.

I don't quite know what to make of this because we do not know if Bitcoins price trajectory over time will be sustainable or not. The power of 3 that Giovanni refers to is worked out accordingly which is quite remarkable if this is indeed true. If you hold Bitcoin for 10 years and double the time to 20 years you are basically expecting a growth of 2x2x2x2x2x2 = 64 x so a 30 year hold would see a 729 x growth in value. He predicted that Bitcoin according to his theory would reach $1 million between 2021 and 2036 which I do believe is very possible and is not crazy.

Posted Using InLeo Alpha

Congratulations @cryptoandcoffee! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Congratulations @cryptoandcoffee! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: