A strange affair about gold in the heart of the City

In this article we deal with an affair that happened in British precious market circles.

In the background is the Western attempt to limit gold sales by Russia, a country that for its part is trying to circumvent the limits by increasing sales in the eastern market through an arrangement with China.

The background scenario

Under a 2020 memorandum of understanding, Russia has in fact been granted by China to join the list of international members of the Shanghai Golden Market (SAG) so that it can sell gold in the eastern market.

This situation mirrors that of oil, in which Russia, to make up for losses in Western markets, is simply selling surplus quota to the east.

The eastward expansion of oil and gold sales makes the effects of Western sanctions against Russia less effective.

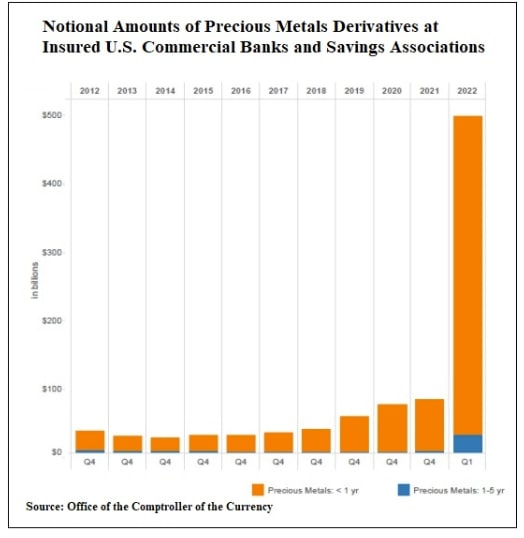

As for gold, the chart below is a sign of the strength with which Western banks are attempting this downward manipulation (the huge bar on the right shows the large amount of derivatives accumulated in the first quarter of 2022 by J.P. Morgan and Citibank to reinforce the downward manipulations):

This incredible chart was published by the OCC (Office of Comptroller of Currencies), the U.S. Treasury body that oversees U.S. banks.

The remarkable yellow bar on the right shows a hyperbolic amount of gold derivatives held by just two banks-JP Morgan and Citiybank, which are also the banks indicted by the U.S. Justice Department for decades-long manipulation of the gold market...

The ingredients are all there:

- an acceleration of gold manipulation (seen these days)

- a disentanglement by some Western traders hovering between East and West

- a growing conflict over currencies and commodity markets

Today, this chart tells us that, at least as long as the conflict with Russia allows it to be justified as a national security measure, such manipulation is as strong as ever and probably even risk-free from a judicial perspective, if the Justice Department turns a blind eye in view of the exceptional situation in which it is implemented.

The unintended consequences

As usual, though, things are not always as black and white as they may seem.

In the gold market, as in so many other commodities sectors, it is not easy to exclude with a stroke of a pen one of the major international players, Russia, which over the years (we should say: centuries) has created an endless series of partnerships, interconnections and cooperation at all levels with so many countries, including Western ones.

In the precious metals market for example, there are many joint companies created on the basis of understandings between Russia and Western countries.

It is not easy (perhaps it is impossible) for these companies to take sides. And in some cases on the contrary there can be a reluctance to play the part assigned to them from the simple fact of being in the wrong hemisphere of the earth.

The case in point

The event we want to deal with arises at one such point of intersection of Russian and Western interests in the specific area of the gold market.

The protagonist is Peter Hambro, scion of an English banking family, whose great-great-grandfather founded Hambros Bank-which in 1957 incorporated the English valuables broker Mocatta & Goldsmith-and whose father headed Samuel Montagu, another major English broker.

The Hambro family was therefore a cornerstone of what became the London Bullion Market (LBMA), i.e., the association that at one point brought together in a single "cartel" all the British banks and brokers involved in precious metals and that has been manipulating the gold market downward for decades.

Peter Hambro himself was a deputy director of Mocatta & Goldsmith, a broker who now belongs to the same "cartel," the LBMA, which has expelled Russian banks from its membership, and he is also the founder of Peter Hambro Mining (now Petropavlovsk), an Anglo-Russian mining company.

It is precisely in this corporate holding midway between East and West that one should probably look for the reasons for Peter Hambro's unexpected accusation against the LBMA, i.e., the "cartel" that his own family helped to create.

Hambro accuses the LBMA of manipulating the gold market all along; and so far one could say that there is nothing new. The U.S. Department of Justice has dealt with the same allegations and even proved their validity by convicting the banks involved.

Hambro goes further, though. He does not just accuse the perpetrators of the crime, that is, the banks and brokers already convicted by the Justice Department.

Hambro points his finger at the principals of the crime, going all the way to the top of the "dome," i.e., to the BIS - Bank for International Settlements (the central bank of central banks) which, according to Hambro, is the real brains behind this decades-long crime.

Even more interesting is the fact that the accusation did not appear on Twitter or any social media, but in Reaction, which is a reputable British magazine run by an editorial staff made up of the country's top political and economic names.

The obvious purpose of these accusations is to discredit the current bullion market, which is dominated by the LBMA "cartel."

Until now such accusations had been made only by representatives of the nascent Emirates gold market, for obvious reasons of competition with the old London market.

Now, however, we have an initiative that starts from within this "cartel" (or at least from some representatives of it who do not share their government's anti-Russian line) and aims directly at the "jugular" of the system, that is, at the instigator of the crimes, that BIS that not even from the Emirati side had dared to touch.

To what end?

it is naïve to think that Hambro and other entities or people behind the article and the heavy charges we have cited want to go so far as to break the LBMA monopoly. There could be a number of less ambitious reasons, such as an attempt to influence or at least disrupt the decision-making chain from which anti-Russian sanctions and their enforcement measures start.

Or an attempt to stimulate the Justice Department, or perhaps British justice organs, to make new investigations, thereby weakening the valuable manipulation procedures that have become powerful again today.

Although the event itself is of some interest, its eventual repercussions, if any, are therefore all to be seen over time.

It is highly unlikely, however, that this fact was thought to be a motive for arriving at an exauthorization of some kind of the LBMA.

The fact that this is taking place against the backdrop of the Sino-Russian gold partnership does not even imply that some sort of forced path has been taken toward the separation of the official eastern and western gold markets.

The only concrete event that would lead to this ultimate goal would be the establishment of two official gold prices, one set daily in London and the other daily in Shanghai.

Without this preliminary measure, it is not even conceivable that we could arrive at Russian or Chinese national currencies pegged to gold or oil (as some conspiracy sites speculate).

For there would always be the possibility on the part of the West to discredit with its derivatives the collateral of these new currencies, namely precisely gold or oil.

Until, therefore, we see a real separation of prices set in the East and West, the very process of creating two separate markets and two separate economies, between East and West, is much less concrete than it seems.

So, let us resign ourselves: the situation between East and West is still very fluid and we are unable to say what new (or old) balances it will lead to.

The only certainty at the moment is that the price of gold continues to be manipulated by the West worse than before, with the complicity or at least the tacit acquiescence of the eastern central banks.

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more, by @cryptomaster5.