Fear is never a good investment motivation.

Conspiracy social pages pushing to invest in gold by leveraging pessimism in the media are on the rise.

The idea is growing that gold is an investment linked to fear. In reality, no investment is.

On the contrary, all investments are based on one thing: entry price and exit price. And gold is no exception.

I therefore propose this brief reflection on gold:

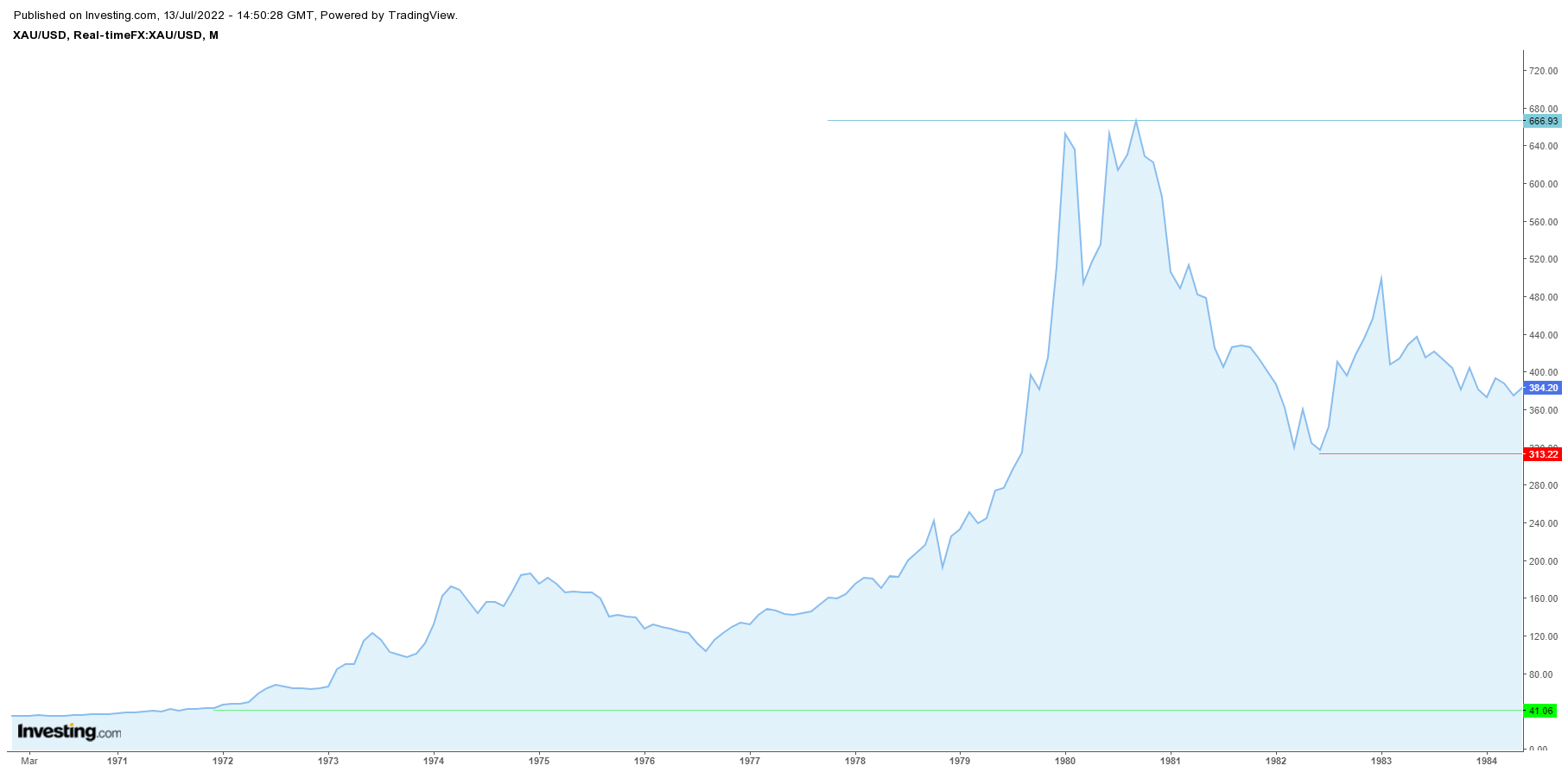

Between August 1971 and January 1980, gold rose nearly 15 times in value, peaking at $663 an ounce...only to fall 50 percent by February 1985.

Those who had bought it at $663 in 1980 had to wait until July 2007 just to break even. We are talking about a full 28 years...

.png)

Finally from July 1999 to August 2020, gold rose eightfold to $2,062 an ounce.

So it is correct to say that over 50 years gold has not lost value, but it is equally correct to say that in smaller time frames (over decades, not centuries), the timing of entry and exit weighs heavily on gold's returns.

Those about to invest in gold must first consider the time frame of their investment. Are we talking about a century? Is this an investment you want to pass on to your children and grandchildren? Or could it be that in 5 or 10 years you will need liquidity and will already have to disinvest your gold?

From personal experience, I can tell you that-even with all the good intentions in this world-it is really unlikely that in the next ten years you will not need the money you had invested thinking you would not touch it until your 100th birthday!

So invest responsibly: which means: invest with the short- and long-term trends of what you're buying in mind. Gold is no exception!

When to invest in gold?

The U.S. is most likely entering a recession, while inflation is rising to its highest level in 40 years.

All this creates so-called stagflation (inflation + recession), a phenomenon that most economists say was the main driving force behind the bullish gold market of the 1970s.

But then, why is gold so weak today, unlike in the 1970s?

The reason is simple.

In the 1970s there was a flight from the dollar, both in America and abroad, precisely on fears that galloping inflation would cause its value to plummet.

Today, on the other hand, stagflation being a global phenomenon, the dollar has become the least broken of the now large group of world currencies on the verge of collapse.

The world's major currencies, such as the euro and yen, have collapsed in recent months for a multitude of reasons, some spontaneous, such as excessive global money supply and the effects of covid on the economy, and others created on purpose to favor the dollar, such as the Russian-Ukrainian war and sanctions.

As a result, unlike in the 1970s, the value of the greenback is rising, while gold futures and physical metal prices are falling.

But how long will the dollar's strength last?

The dollar and gold are following the same path as in 2018.

At that time, just like today, the mix of tariffs against China and Federal Reserve rate hikes caused a run on the dollar and a flight from gold (the latter touched bottom in September, reaching an intraday low of $1,180/ounce).

Should we expect that this September, too, gold could hit a low, trading at $1,500, while silver will approach $17?

Unlike in 2018, today the Fed is planning for rate increases well in advance so as not to take markets by surprise.

Thus, the trend of December 2018, when at yet another unexpected rate hike, the S&P 500 fell 19.8 percent and Trump and Mnuchin agreed with the top executives of the major banks by creating the Plunge Protection Team, i.e., a group of traders deputized to manipulate upward the stock markets to counter a fall that seemed unstoppable, should not be repeated.

Today, thanks to the Fed's much more timely communication, markets can afford a longer-term outlook.

Here, then, in the stock markets, investors are already divided between those taking appropriate countermeasures to deal with further rate hikes by the Fed (these are the ones selling gold and preferring dollars) and the others who are instead preparing for the aftermath, that is, when the Fed will begin to lift its restrictive policy (the rise in the stock markets for four days in a row last week is a sign of them).

To complicate matters, if in 2018 there was the Plunge Protection Team, today there are groups of traders working with the opposite objective, that is, to keep asset prices low so as to discourage investment and reduce the money supply to the bone (we have shown the presence of these groups in precious metals and crypto, but surely there are others working in equities and bonds).

In any case, market responsiveness today will be much faster than in 2018, and early signs of a recession may put a brake on gold's descent, or at least shorten the yellow metal's dwell time at prices we thought it would never reach again, like $1,500 an ounce, precisely.

Conclusion.

Further declines in gold, even sharp ones, are not to be ruled out, perhaps just for September. In any case, before investing in valuables I would at least wait for the Fed to openly announce the end of the rate hike.

Posted Using LeoFinance Beta

That explained the rally of DXY, thanks

Is a fact that the market is recognizing and it is the result of the current tighter monetary policy. Other countries are far behind in raising interest rates.

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more, by @cryptomaster5.