The US central bank's attitude will continue to be fact-oriented. Markets go down? Accommodative statements. Inflation bites back? Hawkish statements.

Always with the hope of having a hedge against a significant rise in interest rates.

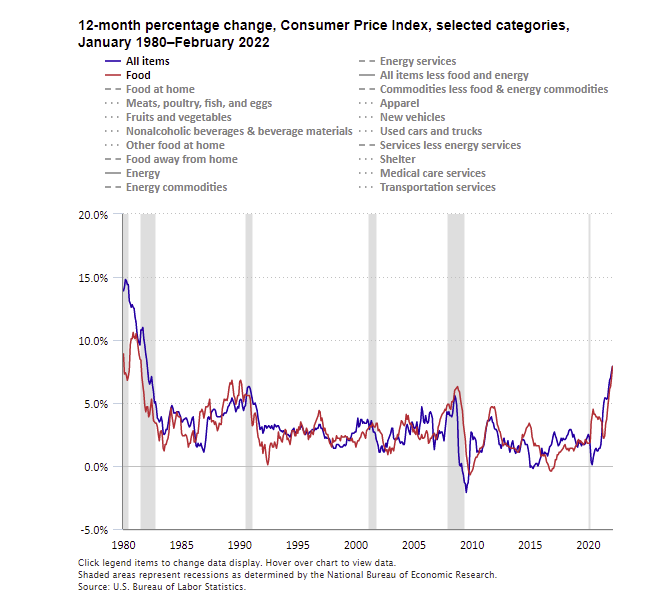

On the other hand, with YoY inflation at 8%, a rate hike of 25 basis points is little more than a warm fuzzy (compared to the 50 announced in February).

If we want to evaluate the Federal Reserve's decisions yesterday, we have to put on the scales, on the one hand, the monetary restraint measures and, on the other hand, the liquidity that the government continues to inject into the system.

Let's do the math:

Monetary restraint:

Yesterday, the Fed decided to:

- Increase its target for the federal funds rate within a range of 0.25% to 0.50%.

- Increase the interest it pays banks on reserves by 25 basis points, to 0.40%.

- Increase the interest it charges on Repos to 0.50%.

- Increase the interest it pays on Overnight Reverse Repos to 0.30%.

- Increase the prime lending rate it charges to banks to 0.50%.

- Confirm the end of QE: by deciding to keep the level of government bonds on its balance sheet stable, buying only bonds to replace those maturing.

Liquidity injected by the US government:

Congress approved from 2020 until last week a liquidity allocation of about 7 trillion (7 trillion), through the following measures:

- the CARES Act in March 2020 in the amount of $2.2 trillion ...

- in December 2021 an additional $900 billion appropriations bill

- the American Rescue Plan in March 2021, which added an additional $1.9 trillion

- the $1 trillion infrastructure plan in November...

- last week the $1.5 trillion plan to make the US economy self-sufficient.

The difference between the availability of the federal budget (far less than this 7 trillion) and the need to mobilise this excess liquidity by taking it from somewhere, creates a continuing lack of liquidity in the derivatives markets.

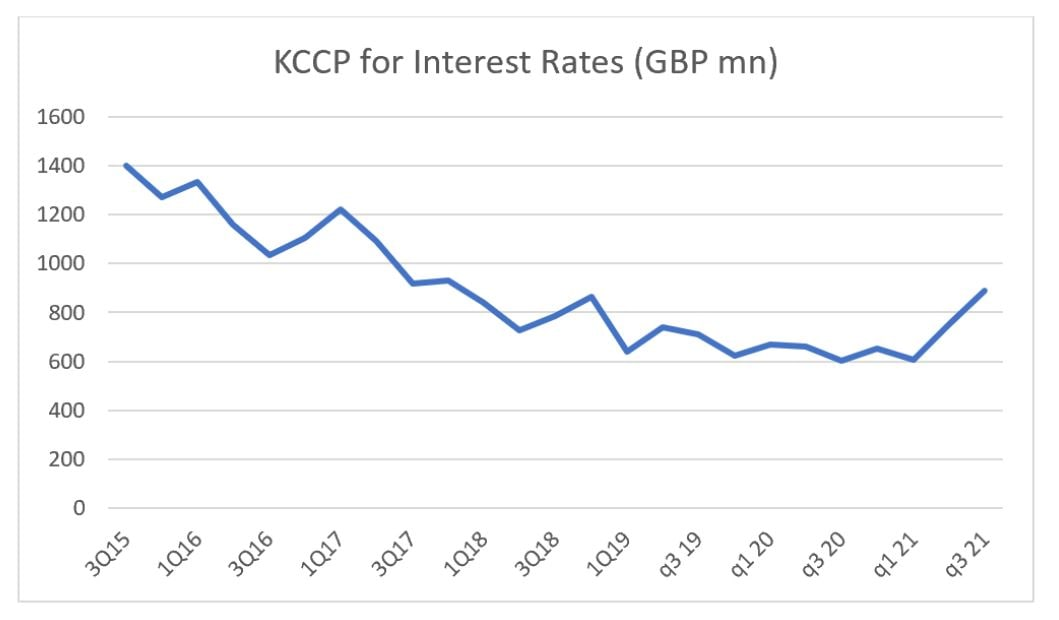

This chart shows the climb in the last quarter of the KCCP, which measures the need for funds to cover the margins of the clearinghouses, i.e. the companies that handle derivatives trading.

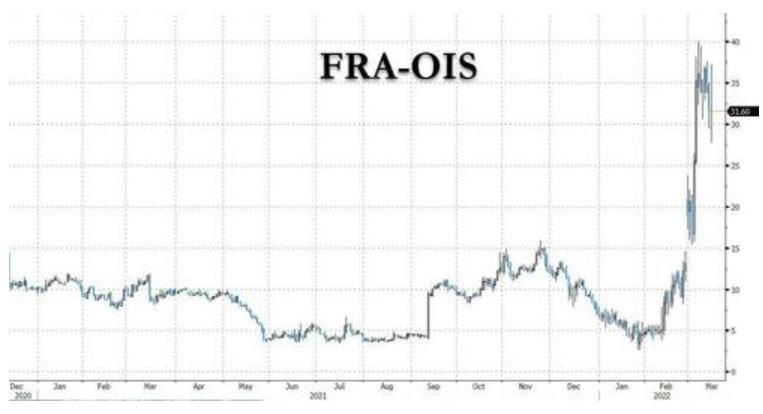

This graph, on the other hand, measures how much it will cost banks to lend money in the future compared to the official interest rate.

The exponential increase of this indicator (equal only to that which occurred at the beginning of the pandemic) reveals that banks will not be covered by interest rates, however much the Fed decides to raise them.

I realise that these are somewhat technical concepts.

Basically, the decision to raise interest rates and not to increase purchases of government bonds, which serve as collateral in interbank loans and repo operations, comes at a time when there is already a shortage of liquidity in banks, mainly due to the derivatives market.

Apart from the risks of liquidity crises in the repo and derivatives markets that might require new injections of liquidity by the Fed, this approach by the US central bank reveals a remarkable change of perspective.

In practice, the Fed has decided, for the first time in 20 years, to let the stock markets go to their fate.

This approach is very reminiscent of the behaviour of the Chinese central bank, which periodically skims the market (especially the credit market), letting the weak links fall by themselves.

The Fed thus seems to have set up a period of 'Darwinian selection' of the same kind.

The effects of this unprecedented central bank policy will only be seen in the coming months.

For now, no one (except Polskar and a few other analysts who pay particular attention to repo markets and derivatives) seems to have understood what is at stake.

We will, however, be keeping our eyes open to see what the consequences will be.

Stock markets have risen sharply yesterday, temporarily reversing course after the Fed's announcement,

However, I think these are just aftershocks as it is exactly what everyone expected.

On Friday 18 March we will have another key date, with the expiry of a significant number of equity options.

So from tonight until Friday we expect a significant increase in volatility in the markets.

Bitcoin has faithfully replicated the trend of equity indices and since this morning has been looking for a technical break of the psychological threshold of $40K without success, at least for the moment.

To highlight once again the extreme resilience of Bitcoin, which shows a much better hold than the S&P 500.

And I think this is natural.

Indeed, in a situation of global inflation and geopolitical turmoil, betting on the collapse of one of the few assets that protect against inflation itself is strange and illogical.

However, that doesn't mean that Bitcoin can't take a dip in the short term.

In an extremely deteriorated Marco picture, we cannot rule out a retest of the support area at $35K or even an absolute low in the key $30K region.

But in case it will be a price action driven by panic and FUD, with a short-term breathing space.

Therefore even a buy on sub-optimal price levels will still be closed in profit with the right perspective.

The key in this case is patience.

The same cannot be said for those who persist in selling Bitcoin short, and this is the key difference between the cryptocurrency market and other financial markets.

February inflation figures YoY in the US, with the consumer price index reaching 7.9%. The last time inflation was at these levels, the Fed funds rate was 13%.

Hyper-simplifying, it is as if our salaries or yields had fallen by 8% in the last 12 months.

And in Europe it's no better.

The problem is even more serious, since in the current geopolitical and macroeconomic scenario the central banks' hands are basically tied, with the ECB reiterating that it will not raise interest rates and the Fed taking a softer approach than it had planned only a month ago (0.25% rise instead of the 0.50% forecast).

If the war in Ukraine and the geopolitical tensions between Russia and China on the one hand and the US and Europe on the other are not resolved as soon as possible, we are on the verge of stagflation.

I will address the subject of stagflation in more detail in the coming days, but in short stagflation is a combination of weak economic growth, high unemployment (a direct consequence of the economic crisis) and high inflation.

In the current context, all the conditions for such a scenario have been created, in a tremendous vicious circle culminating in the unprecedented rise in commodity prices.

With current prices, it is difficult to implement a plan to protect one's savings. Gold is already near all-time highs and we know that it is never a good idea to buy an asset at highs (silver might be worth a look today).

Bitcoin is still perceived (wrongly) by many as a speculative risk-on asset like equities and is therefore subject to short-term turbulence due to correlation with equity indices. The $40,000 level is clearly not yet a region that can significantly increase demand (although in the long term we are talking about a price region that is undoubtedly good). However, as written in yesterday's post, the cryptocurrency market is definitely different from what it was 2 years ago, much more mature, with most BITCOIN in HODL.

DATA SOURCES:

https://www.bls.gov/news.release/archives/cpi_03102022.htm

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more, by @cryptomaster5.

yes that's right, according to the FED's plan there will be a gradual increase in rates as economic indicators return to 'optimal' levels and in order to combat 'endogenous' inflation.