After the extreme volatility seen recently, the tide has now turned. What does this behavior tell us? In the analysis and forecast of Bitcoin that I carry out below, we discover it.

At the time of writing, BTC is trading at $29,741, accumulating a gain of 2.03% in the last 24 hours, although maintaining a slight loss of 0.57% in the last 7 days.

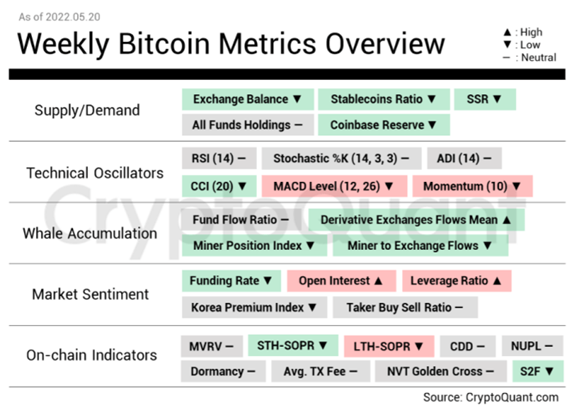

In CryptoQuant's weekly roundup, the overall indicator reading tells us that investors are expecting a real low.🙂

Metrics related to supply/demand and whale behavior speak of a long-term bullish sentiment.

However, technical oscillators, market sentiment and a key on-chain indicator say that we could see a search for a new low.

Open interest in futures markets hit $1 billion, and traders are over-leveraged. Generally, this is negative for the short term.

The LTH-SOPR indicator tells us that both short-term and long-term holders are losing at a loss (possible capitulation). However, the MVRV and the NUPL indicate that the price is about to enter the undervaluation zone.

Bitcoin Weekly Forecast

Today on the weekly Bitcoin chart, the forecast we can get is bearish for the short term.

Despite good buying pressure above the $30,000 support, we still see no further signs of a reversal.

Recent bearish volume is still very dominant, and this recent sentiment could still cause more problems.

Regardless, we see that the price is already close to the 200-period SMA, strong selling is quickly wrapped up, and the long-term trend remains in the hands of buyers. It is quite likely that the bottom is very close.

The 8-week EMA and 18-week SMA are crossed to the downside, following the short/medium-term trend. Overcoming them would be the ideal signal to confirm that the previous direction is being resumed. For now, this is far from happening.

It looks like the best we could see in the short term is broader sideways action.

Short-Term Key Levels

To make a more accurate Bitcoin forecast for the short term, we will review the daily chart. Here we can quickly identify a downtrend.

After the flash crash that touched a low of $26,700, the price breathed higher but showed no signs of reversal. We now see BTC locked in a bearish pennant, where it will most likely break lower.

It is feasible to wait for a possible upward breakout, since we are on a relevant support. But, the recent lack of determination of the buyers, does not allow this scenario to have many probabilities on their side.

If the current $29,000 average is broken, a search for the nearest support level at $26,300 is likely. Further down, the next one is at $22,720.

In the event of a breakout to the upside, it would not be too important as long as $40,000 is not broken. As I said in previous paragraphs, it is more likely to see a broader sideways behavior, before resuming the long-term trend.

💪✌️🤙