Investing in cryptocurrency can be an exciting and potentially lucrative endeavor, but it can also be risky. As with any type of investment, it's important to diversify your portfolio to reduce risk and increase your chances of success. In this post, we'll explore how to create a diversified crypto portfolio and manage risk effectively.

Assess Your Risk Tolerance:

The first step in creating a diversified crypto portfolio is to assess your risk tolerance. This is important because it will help you determine how much risk you're comfortable taking on and what type of investments are suitable for you. Factors that can influence your risk tolerance include your financial goals, time horizon, and overall financial situation.

Identify Your Investment Goals:

The next step is to identify your investment goals. Are you looking for short-term gains or long-term growth? Are you looking to invest in established cryptocurrencies or newer, emerging projects? Knowing your investment goals will help you create a portfolio that aligns with your objectives.

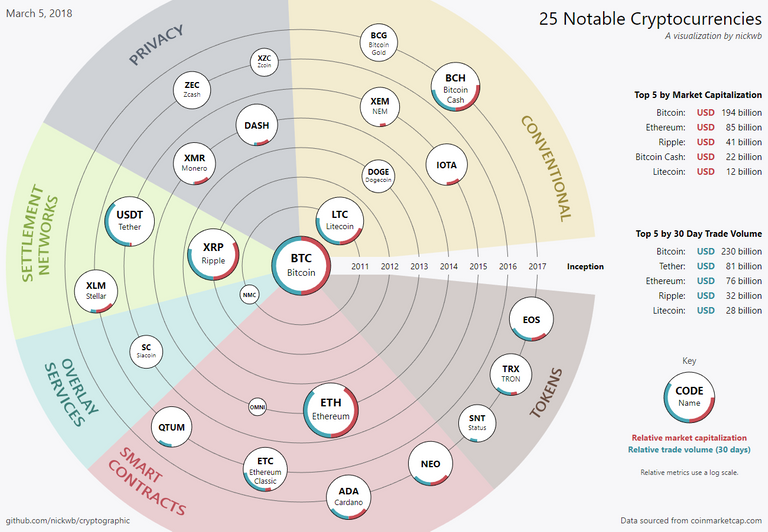

Choose a Mix of Cryptocurrencies:

Once you've identified your risk tolerance and investment goals, you can start building your portfolio. A diversified portfolio should include a mix of different types of cryptocurrencies, such as established coins like Bitcoin and Ethereum, as well as newer projects with high growth potential. The key is to strike a balance between established and emerging projects, as well as large-cap and small-cap coins.

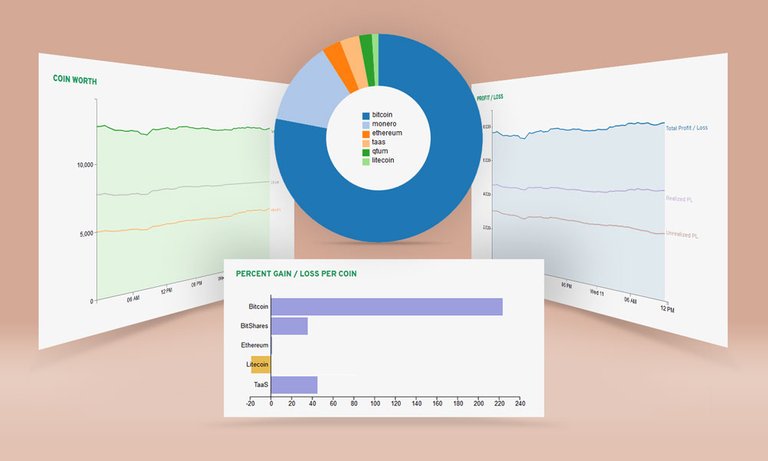

Manage Your Portfolio:

Creating a diversified crypto portfolio is just the first step. To manage risk effectively, you'll need to monitor your portfolio regularly and make adjustments as needed. This may include rebalancing your portfolio, trimming positions that are underperforming, or adding new positions to capitalize on emerging trends.

Creating a diversified crypto portfolio is an essential part of managing risk and increasing your chances of success in the cryptocurrency market. By assessing your risk tolerance, identifying your investment goals, choosing a mix of cryptocurrencies, and managing your portfolio effectively, you can build a strong foundation for your cryptocurrency investments. Remember, investing in cryptocurrency can be a volatile and unpredictable market, so it's important to do your research and seek professional advice before making any investment decisions.

We hope you found this post helpful and informative. If you have any questions or comments, please feel free to share them in the comments section below. Remember to always do your own research and invest wisely. Good luck on your crypto investment journey!

Posted Using LeoFinance Beta

Congratulations @cryptomoky! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 100 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!