Cryptocurrency and blockchain technology are both tightening their grip and moving towards self-custodianship. A major reason for this is the irregularities shown by custodial facilities in the past few years, but this is not the only reason, self-custody options are outspokenly more convenient and relatively more secure. The process of swapping your assets on a decentralized exchange is unarguably simpler than moving the assets to and fro exchanges. We can argue all day about which option costs more, but the convenience felt is obvious.

But this is not the main topic of this article, this article was produced to explain how MOSDEX is positioning itself to take advantage of the evolving space. One step ahead, MOSDEX is fashioning the arbitrage protocol to be able to trade price variations across decentralized exchanges like it currently does on centralized exchanges.

Arbitrage on centralized exchanges is quite understandable, even though a good technology (like the one MOSDEX claims to currently offer) is required to make the most of these facilities and the opportunities they offer. Three major utilities and principles make up MOSDEX’s arbitrage system on centralized exchanges: exchange APIs, an algorithm developed using Ai and machine learning, an economic system, and a system that synergizes all of these. While the last three are still part of the bot’s arbitrage system on decentralized exchanges, the first one (exchange APIs) won’t work on decentralized exchanges.

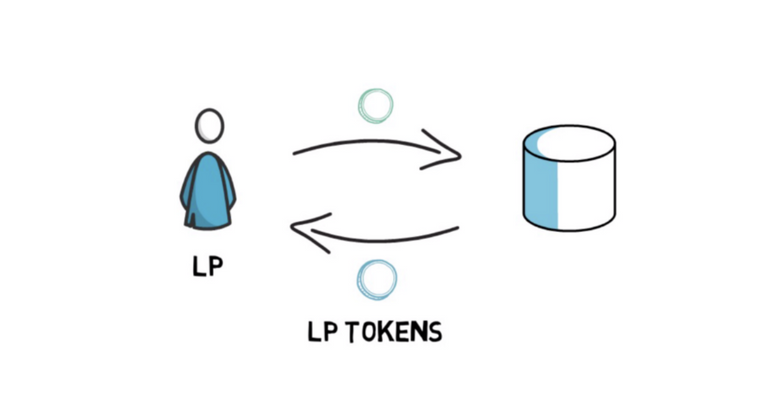

Decentralized arbitrage trading is the process of snipping price and resource variations across various AMMs (automated market makers) and liquidity pools and deploying techniques and principles to perform trades across these platforms in such a way that maximum profit is returned for the trader(s).

The rigid access system on decentralized exchanges is the main hinge for projects trying to automate a trading system for decentralized exchanges. But front-running bots are already plying their trades on decentralized exchanges while Dex aggregators are able to pool data of trading across decentralized exchanges and present to traders, the best route to take for their swaps. MOSDEX claims to be working on a solution that mirrors these two applications and utilizes their principles in the most possible way. Frontrunning bots are a menace to decentralized exchanges, but at least, they show that bots can function just as well as they do on centralized exchanges, on decentralized exchanges.

Here’s MOSDEX’s decentralized exchange arbitrage trading theory:

A specialized Dex aggregator is designed to work in synergy with the rest of the trading system. The aggregator is plugged into several AMMs and pools the trading data from the AMM and the resource availability in the pools. This is relayed to the trading algorithm which proceeds to deploy resources to the selected AMM(s). The trading process could differ for decentralized exchanges and the bots will likely implement smart contracts to automate the trades.

The economic principles will likely apply the exact way it does on centralized exchanges. Its duty remains the same – asset and profit management. This keeps the system alive and a regular review of profitability keeps it maintained.

MOSDEX is implementing several sustainability goals and these goals are meant to keep the system working and profitable for users who devote their resources to powering the bot and the whole ecosystem. To be a part of this community, Click here to register for a MOSDEX account and receive your 30 USDT welcome bonus. Note that the contents of this article are not financial advice. Always do your own research.

Posted Using LeoFinance Alpha

Congratulations @cryptoscripts! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 50 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: