The media is still using the words "organised" and "coordinated" in regards to the WSB short squeeze, and while that was true two days ago I don't believe it to be the case now.

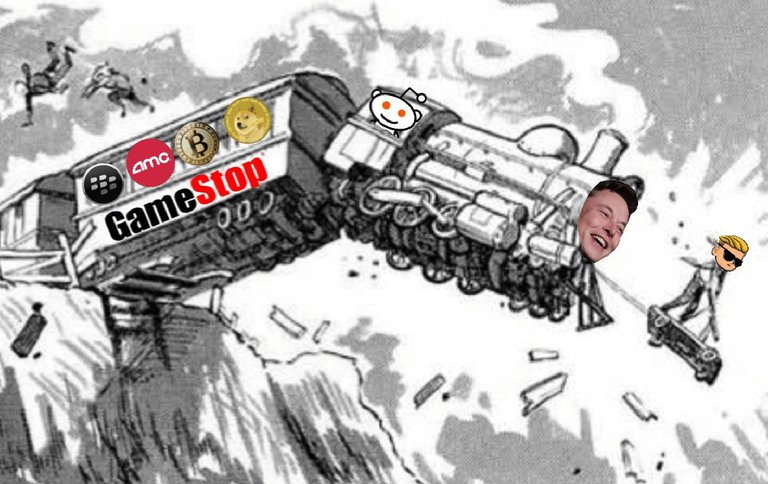

The WallStreetBets discord was taken down and the subreddit itself is hitting people with bans for trying to steer the movement in an actionable direction. Simply put, the "organised" movement is now nothing but noise. Chaos.

This is dangerous because amateur investors are still flooding in, late to the party but wanting to join in. Encouraged by screenshots of 800% gains in portfolios, the promise of millions of dollars. Or for the chance to "stick it to the man", many people would happily lose $500 if it meant a hedgefund investor lost 1000 times that.

The original "targets" all had similar traits. They were failing businesses (with the exception of AMC, they were hit by the pandemic mostly) that had billions of dollars of shorts against them. The short squeeze worked because of the sheer numbers of people concentrating their investments in such a small number of stocks.

Once the censoring began so did the increase in noise, and as more "targets" were called, the less concentrated the investments became. The short squeeze has turned into totally random pump and dumps.

For example, dogecoin fit none of the criteria for a short squeeze. People just made enough noise to attract the mobs attention.

In summary

Be careful Lions. Trading is volatile at the best of times. That isn't the case this week. This week is mayhem.

Posted Using LeoFinance Beta

These guys made a point though and turned some heads towards crypto.

Posted Using LeoFinance Beta

Oh yeah, I fully support what is happening. And see this as a very good thing for crypto. I'm just concerned that people are going to see this as still being an organised plan for easy money, which it was, but isn't anymore.

Posted Using LeoFinance Beta

Collusion in these markets are always unstable and short lived because the collusion itself creates the incentive for individuals in the group to "cheat". The "success" or the rise in GME prices also makes it attractive for people on Reddit to profit take. If you are a Redditor that is holding GME you have incentive to tell others or to buy while you sell.

The success or rise in price also gives an incentive for hedge funds to re-short and the re-short becomes more difficult to squeeze than the original short. Hedge funds are already resetting the their shorts at the high 300s price. If you are gonna squeeze those hedge funds you would need to drive GME even higher. The $300+ stock prices means that it is difficult for you to buy enough shares to do that.

The people who bought GME at over 300 are now the ones that really get squeezed because they are going up against short sellers and they are also being squeezed by other Redditors who are panic selling.

Posted Using LeoFinance Beta