Intro

This article will be longer than the previous ones, which is why I have decided to divide it into two parts in order to give the topics the right amount of space: we will start with an analysis of the current situation, commenting on Glassnode's charts and then dwell on Willy Woo's observations.

In these summer months we do not concern ourselves too much with market movements, because they are not significant. On the contrary, what is moving below the surface at this time and is not (yet) showing up in the quotes is of extreme interest.

An eye on mining

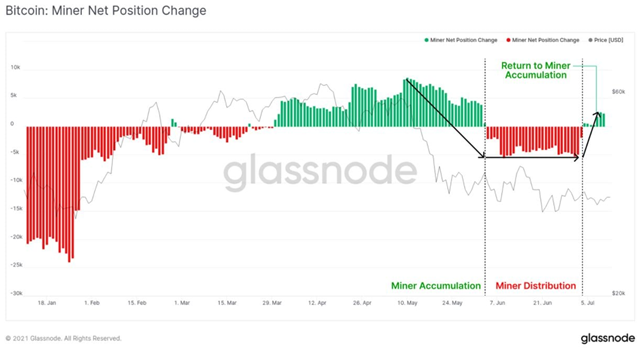

The mining industry located in China is engaged in a momentous logistical migration out of the country's borders.

This event is causing an influx of bitcoin sales by miners.

Both miners planning to reopen elsewhere (selling to meet the costs of this migration) and those who only intend to close down permanently are selling.

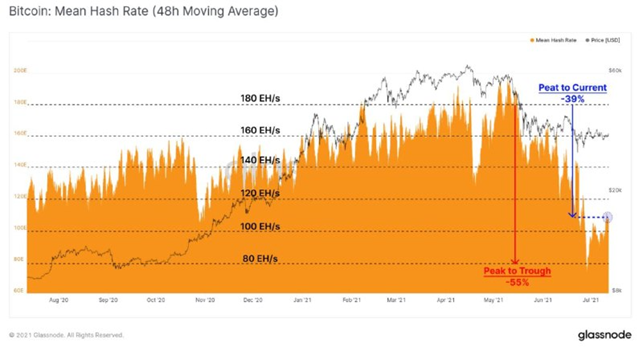

After falling 55% from its May peak, the hashrate has rebounded and is now only 39% below its peak.

A continued rapid increase in hashrate indicates that miners are managing to relocate their businesses, recouping their expenses and thus reducing the need to sell more bitcoins.

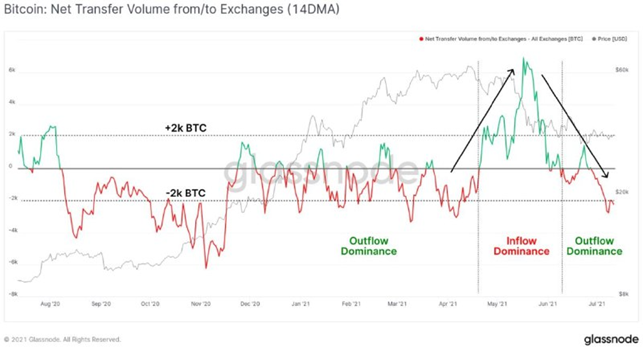

These charts show that in the last two weeks, coin exit from platforms has picked up. It therefore appears that institutions are once again accumulating bitcoin in their deposits.

In these summer months the derivatives market is completely dormant, both in crypto and other sectors, with a dramatic reduction in new positions and volumes.

The bizarre declines followed by equally bizarre rises, both in crypto and on the exchanges, despite being justified in the media by this or that particular event (e.g. the latest Federal Reserve speeches), are only the result of speculation by the few remaining participants in the derivatives market.

In the summer, these movements, even large ones, are more present than ever and provide the necessary pretexts for the media to continue their usual oscillations between alarmism and optimism, which otherwise should be given a break at this time.

As I said though, things are getting interesting, for serious data watchers...

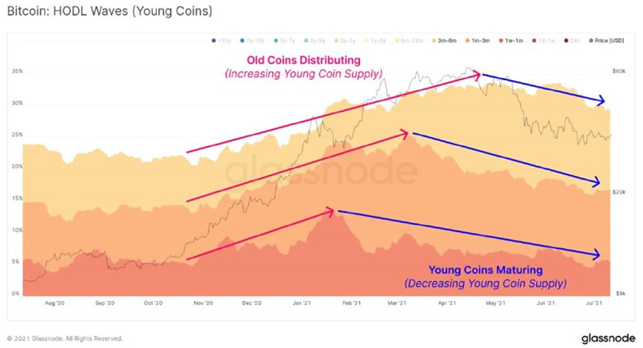

In crypto, the last important change we have to record today concerns the accumulation/distribution cycle. From May the distribution phase gave way to the accumulation phase, this chart now shows that the accumulation phase is coming to maturity.

What does it mean?

Distribution:

In bullish phases of the cycle, holders sell some of their coins in the peaks, "distributing" old coins to speculative traders, who buy them, triggering subsequent rises.

Accumulation:

In the bearish phases of the cycle, holders do not sell their coins either in the downturns or in the upward rebounds of prices, but rather buy them in the lows. For this reason we say that they limit themselves to "accumulate" them without distributing them.

During the accumulation, coinciding with the bearish part of a cycle, the availability of coins is progressively reduced, and they no longer provide the "fuel" for further rises.

First, the availability of the "old" coins is reduced, then gradually that of the less old coins and finally that of the younger coins. This last part can be considered a "maturation", whereby the process is practically coming to an end.

Another way to describe accumulation is to say that the more sales flows are reduced, the fewer new coins come into circulation that can fuel waves of new rises.

When a coin is sold by someone and bought back by someone else, it resets its previous age and is "born" again. But if the coin is not traded, its age continues to increase.

During accumulation, therefore, since there is no longer a continuous exchange of coins between sellers and buyers, the average age of all the coins increases, not only the already "old" ones, but eventually also the younger ones, which become progressively "older".

In the final stages of this accumulation (maturation) the reduction of the availability of coins reaches all the "age" categories, including the younger ones, which begin to "age" in the holders' deposits, thus denoting a general and complete reduction of the offer.

What's in the pot?

At this point, when the supply has been reduced to its minimum, the market prepares for a new upward cycle, because a slight increase in the demand for coins (a renewed interest on the part of investors) is enough to trigger a bull market.

To summarize: all these important developments (improved conditions for miners, capital outflows from platforms and reduced supply of new coins) are setting the stage for a new upward cycle.

Prices do not yet reflect these changes, but when the summer is over we will see the real trends begin, which the media will also be forced to address (late, as usual).

We will discuss this issue further in the next article.

Written by Macron, Cryptosniperz Team

Further reading

DISCLAIMER

We are not giving any financial advice regarding cryptocurrencies, but rather giving applicable advice for new, intermediate and experienced people who are currently into cryptocurrencies or someone who is just now realizing what it is. Before you read this I must say that this blog will be based on the assumption that you have already done some research on cryptocurrencies and the Blockchain ecosystem. We will continue to provide explanations and details to the best of our ability, however we encourage you to do your OWN research because only YOU will know how this second financial revolution will best fit into your life.

Thank you for reading our contents.

The Cryptosniperz Team

Posted Using LeoFinance Beta

Congratulations @cryptosniperz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP