Foreword:

This is a post in response to @steem.leo's writing contest. I like to take this chance to express my gratitude to @steem.leo for picking my entry as a winner for the previous contest. Thanks! As 2019 draws close, it is certainly fun to do a prediction of what might be installed for 2020. Before jumping in, I just want to emphasize that these "predictions" that you are about to read are my personal opinions and not financial advice. I consider them more like my wishlist than predictions 😉. Here goes...

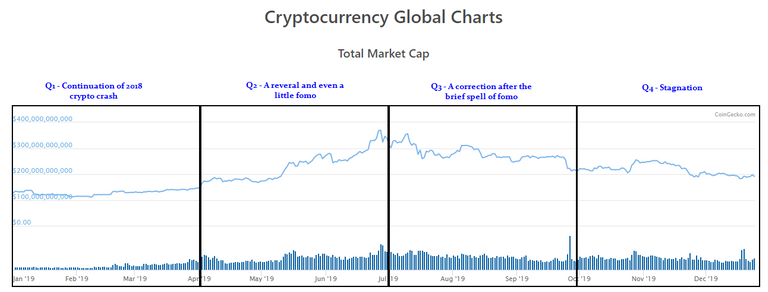

2019 has been a roller coaster ride for crypto hodlers. The first quarter is largely a continuation of 2018, where Bitcoin crashed to 3.5k and global crypto market cap almost went below $100b. In Q2, there was some kind of reversal, and I could even sense a level of FOMO.

Q3 is a correction for Q2. The run-up in Q2 was too fast and a correction is only natural. Q4 is basically stagnation. If you zoom into smaller timeframes, it seems like it was still volatile. However, looking at the bigger picture, Q4 was relatively stagnant. In Q4 the total crypto market cap ranged between $250b to $180b, which is not that volatile by crypto terms 😅. The chart below is an overview and summary of 2019.

Courtesy of @coingecko

The Bottom is In

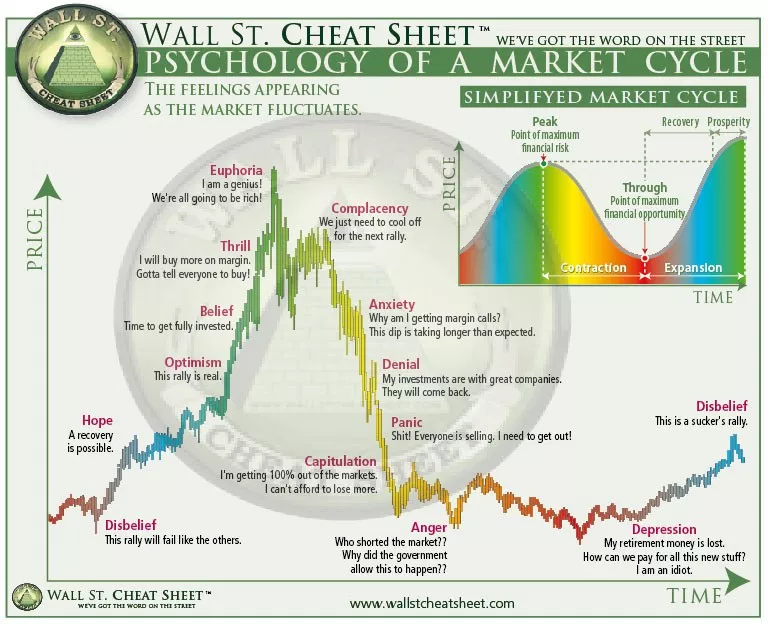

Judging from the price movement of the overall crypto market cap, I think the bottom was in on 15 December 2018, the day which the global market cap hit $102b. The crypto winter was officially over on that day and Spring has begun. If we draw reference from the famous "Psychology of Market Cycle" chart below, I dare say we are in between the depression and disbelief phases.

Source

The best time to accumulate is between the depression and disbelief stages. In 2020, I think accumulation will continue and leading up to the next cycle.

Institutions Accumulate in the Shadow and Still no ETFs

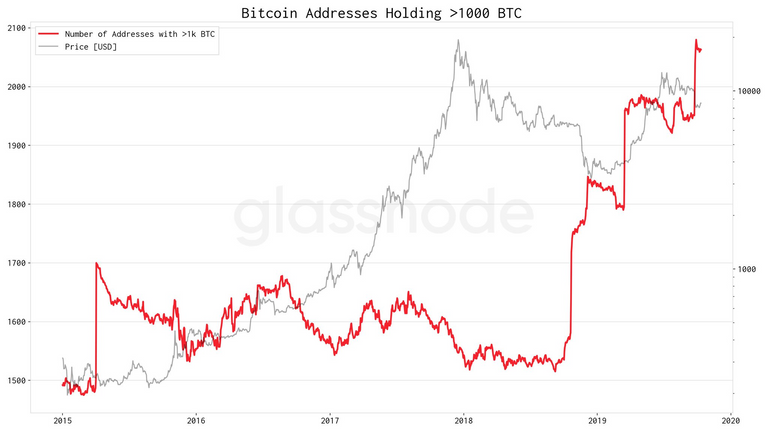

As mentioned, the period of depression and disbelief is the best time to accumulate. Without any doubt, financial institutions, the smart money, also know this. In this recent Tweet by Glassnode, the number of Bitcoin addresses with over 1k BTC is on the rise. By looking at the chart below, you can clearly see a surge in the number of such addresses between late 2018 to 2019.

As I always emphasize, it is important to not just listen to what people say but to observe what people do. An address with more than 1k BTC represents over $7m invested. Though there are many rich people out there in this world, this amount of money is still a hefty sum for individuals to put into an asset which is yet to be proven.

My own hypothesis is that many of these addresses are owned by smaller hedge/investment funds that are more nimble and less regulated. These are the funds that do not mind experimenting with something new and taking up more risks to achieve higher alpha. Often times, adoption starts from the smaller players and gradually move up the ladder. I think 2020 will be this period of silent institution accumulation.

As a result of that, a Bitcoin ETF is unlikely to become a reality. If smart money wants to accumulate and get in before the masses, they will certainly not want to have an ETF which may potentially drive up the price substantially. Hence, I think a Bitcoin ETF will not be approved in 2020 so that institutions can continue to accumulate Bitcoin and other cryptocurrencies in the shadow.

Millennials Continue to Drive Adoption

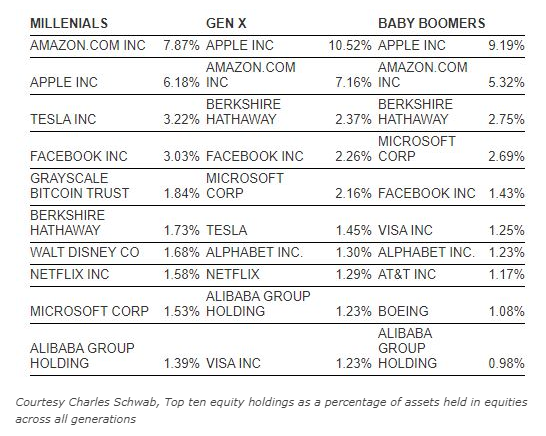

In a survey earlier this year, it was found that Millennials exhibit a higher propensity to purchase Bitcoin. This was further supported in a even more recent report which says that the Grayscale Bitcoin Trust is the fifth most popular equity within Millennials investment portfolio.

Source

With every passing year, the Baby Boomers generation shrinks in size while more Millennials move up the career ladder. In the next decade, we will witness a great wealth transfer from Baby Boomers to Millennials, largely due to inheritance.

With the rise of Millennials, we are likely to see crypto assets increasingly being accepted as part of investment portfolios. Coupled with the wealth transfer, I believe that we will see more adoption and price appreciation over the next decade. 2020 will be no exception.

DeFi, DeFi and DeFi

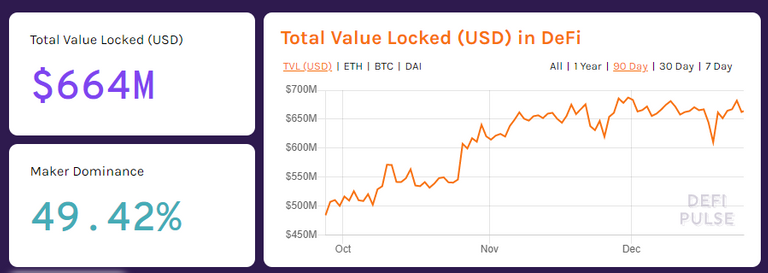

In 2019, we have seen substantial growth in the DeFi space. I have mentioned DeFi a number of times and that is because it is a movement that I strongly believe in. In 2020, I expect the DeFi movement to grow organically.

Source

As the DeFi ecosystem grows, there will be more projects emerging to fill certain needs. Currently, there are multiple platforms providing collaterized loans. In addition, we are beginning to see other DeFi applications growing. For example, Synthetix is an interesting platform which provides derivatives using cryptocurrencies as collateral. Nexus Mutual is a decentralized insurance which can cover your losses in the event a DeFi smart contract fails. I expect these projects to grow in terms of adoption and the amount of value locked in them.

Eventually, and possibly in 2020, the larger institutions will want a share in the DeFi pie. Since these traditional players are regulated, I expect more services that are required in traditional finance to emerge. For instance, custodial solutions and identity validators. In the identity validation space, I think the ERC725 standard will be worth a look, since DeFi is largely dominated by Ethereum based projects, it is only natural that this standard gets adopted for identity assertion in the digital realm.

Finally, I also think there is a small chance that we will see a little ICO fever again. However, this time round, the project ideas will largely be related to DeFi.

Digital Ownership Gains Importance

In 2019, a number of successful blockchain based games have shown that there is a demand for digital collectibles. Blockchain and smart contracts enable the concept of digital ownership and I think this will gradually gain importance throughout 2020.

Games like Gods Unchained and Axie Infinity have shown that there is a market for people who want to trade digital collectibles and play blockchain based games. Besides games, Ethereum Name Service also demonstrated that there are people who wants to own digital names for branding and convenience. On OpenSea, all these digital collectibles can be freely traded and there is a substantial trading volume.

Source

As a result, I won't be surprise if larger game companies start to adopt the concept of blockchain-based digital collectibles. It will only take one or two top games to spur the entire market towards that direction. With Microsoft having also embarked on creating digital collectibles as a reward to their Azure contributors, I do not see why there will not be more companies following suit.

Bitcoin Halving Turns Out to be a Non-event

Bitcoin block rewards is set to half in May 2020. In previous 2 halving events, the price of Bitcoin surged substantially, especially after the event. Hence, there is a huge deal of anticipation for this year's halving.

Source

My contrarian view is that this event has kind of been priced in and with this level of anticipation, it is likely going to turn up as a disappointment. I think in the first halving event, the effect of the lowered inflation makes a difference given that the total circulating supply was still relatively low. Similarly for the 2nd halving event, the total supply is still considerably lower than now. Hence, for this 3rd halving, my gut feel is that it might turn out to be inconsequential to the price. If there is any huge surge in price, I think it will likely be due to other reasons than the halving event. This is probably not a popular opinion, but it is still an opinion 😜.

Steem Partners with BAT

Recently there is a rumor going around which suggests that Steemit might be bought over by Tron. Though this piece of news is bound to have a positive effect on STEEM price in the near term, I actually don't quite like the idea of Steemit being operated by Tron. Perhaps I am biased, I personally think that Tron is much fluff and less substance.

On the other hand, a partnership with BAT will be something interesting. On YouTube or Twitter, you probably will notice a tipping function if you are using the Brave browser.

I hope to see this kind of integration between Steem and BAT and I think it makes a lot of sense as it is another source of income for content creators. Overall this will benefit both the Steem and BAT ecosystem. This is more of a wishlist than a prediction though as there is so far no signs of such collaboration happening in the near term.

Conclusion

As someone who firmly believes in cryptocurrencies and decentralization. I think the worst is over for crypto hodlers. 2020 will largely be a year for accumulation and building of foundation. I do not anticipate a wild ride up, but I do think price will appreciate gradually and projects will gain adoption in an organic manner.

10% of post rewards goes to @ph-fund and 10% goes to @leo.voter to support these amazing projects.

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

Fair appraisal on markets, thanks for sharing your insight.

Thank you!

I wish this possible

Posted using Partiko Android

Same here 😆

Great effort on this one and appreciate the informed opinions you shared here! These are the kind of prices we may not see again ever so if there's time to get back in after feeling one has "missed out" then now is the time.

Steem partnering with BAT would be awesome but I believe if you use SteemPeak, there's already some integration or way to tip using Brave? Not 100% on that but not too keen about the TRON rumours myself.

Thanks for your comment! I am looking for tighter integration where BAT holders can tip content creator like you directly through Steem interfaces. It is possible on Twitter, YouTube and even Reddit now. So I think it will be nice if Steem is also onboard. 😉

Yes definitely agree with that if STEEM can be added to that list. I have linked my Twitter and YouTube account to BAT rewards as far as I know so STEEM would seem like a natural choice for it as well, given that people would have joined due to some interest in cryptocurrency already.

You can notice a great job to create this post, I congratulate you for it.

I would also like to say that I think the worst for the cryptocurrency market has passed and that 2020 will be a better year, but just as you say, it is only my personal opinion on the topic :)

Thank you for reading and your kind comment! 👍

Good morning @culgin

I just had chance to bump into your old publication - I wonder if you will still check comments ;)

Personally, I considered 2019 more quiet than year 2018.

Thank you for solid read and sharing your predictions on 2020. I'm hoping that crypto and blockchain will finally be regulated across the globe and time of uncertainty will finish. After all it's a huge put-off to most investors out there.

Yours, Piotr

I actually want regulations to come later and I expect regulators to be slow in this game 😉

This post was shared on Twitter as part of #posh