The upcoming halving of Bitcoin rewards, known as halving, scheduled for April 2024, stands to be a major event in the fintech industry globally. In this article, we will explain what halving is, why it is momentous and some key aspects of the crypto market related to this event.

What is Bitcoin Halving?

Halving involves the halving of rewards received by Bitcoin miners every four years. At the next halving, scheduled for April 2024, the reward will be reduced from 6.25 Bitcoins to 3.125 BTC per block mined. The purpose of this reduction is to control the supply of new bitcoins in the market, keeping the cryptocurrency scarce.

.png)

Why is the Bitcoin halving important?

In the previous three halvings, a substantial increase in the value of Bitcoin was observed, sometimes reaching a growth of approximately 10 times its original value.

When halving occurs, the whales (wallets holding large amounts of Bitcoin) tend to sell, by taking advantage of the growing demand and scarcity of Bitcoin.

When the halving occurs, whales (wallets holding large amounts of Bitcoin) are inclined to sell, taking advantage of the growing demand and scarcity of Bitcoin. This can result in steep price drops, creating opportunities for purchases at significantly reduced prices. A strategy of scheduling limited purchases during the eve of halving is suggested, taking advantage of possible price drops.

In this regard, a strategy to consider on the eve of halving is to schedule limited buying looking for downside candles of ~-20%, ~-30% or even more. Volatility on this date can be an important ally as a price flash crash could be hunted.

Bitcoin's fintech climate

According to Pantera Capital, bitcoin's price performance is highly dependent on its halving cycles and given that the next one will occur very soon, the firm is betting that historical trends will continue. The firm expects the BTC price to reach USD 35,000 before the halving and USD 148,000 in the 3 years after it occurs . Despite these optimistic projections, the fear and greed index indicates some indecision in the market.

At this point, two things are certain:

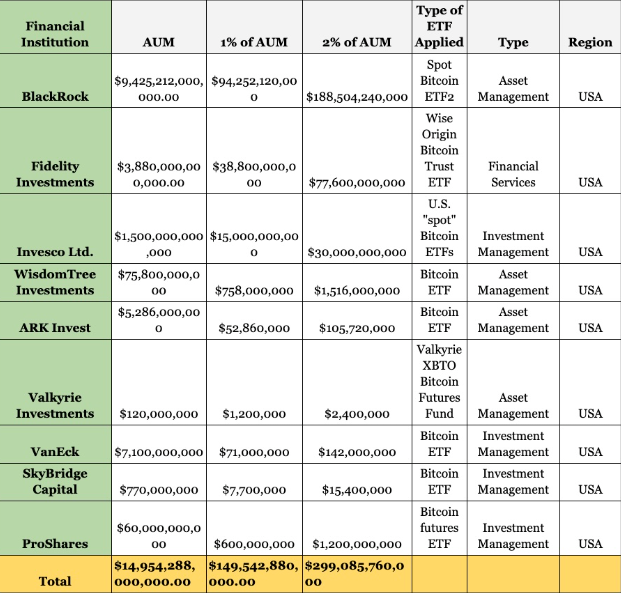

- Bitcoin is gaining institutional acceptance, with large sums of money being invested in ETFs and there are several companies hedging their capital in Bitcoin.

- The first halving has just begun and Bitcoin adoption among all Internet users is in its early stages.

Conclusion

Given the high volatility of the cryptomarket, users should approach any investment with caution and after thorough research. Bitcoin's fourth halving promises to trigger significant market movements, not only for Bitcoin, but also for all BTC-linked altcoins. Taking advantage of the opportunities generated by the volatility could be key to making significant returns in this exciting period of the crypto space.

What do you think?

Posted Using InLeo Alpha