A year ago, on this date, Ethereum went trough its most significant upgrade, the so called Merge. The Beacon chain and the Mainet were merged, that made it possible for the old proof of work chain to be phased out, making Ethereum transition from Proof of work to Prof of stake.

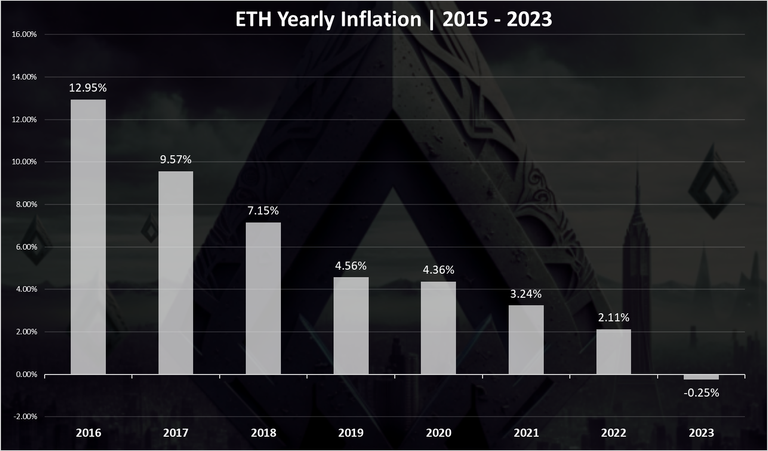

This transition allowed the base inflation to be reduced 10 fold, from around 4%, to 0.4%.

Aditionaly ETH is getting burned with every transaction, so that 0.4% base inflation is pushed down.

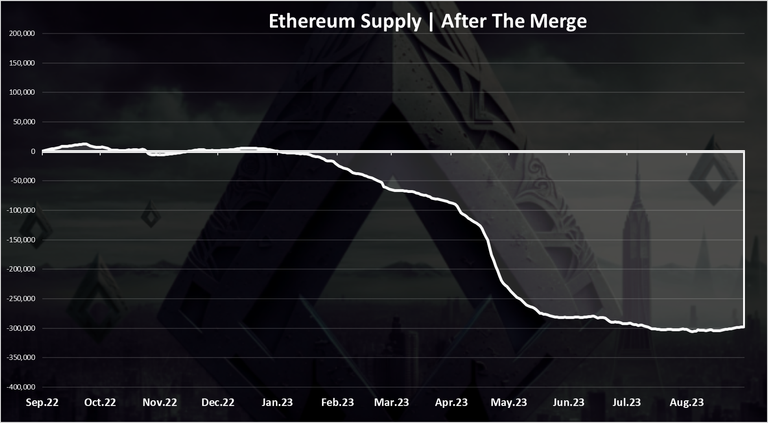

We can see that most of the burning was in April 2023 due to increased transactions and fees. In the last months there is much less burning and the inflation is almost stagnant.

Since the merge, the Ethereum supply has reduced for around 300k ETH. The current ETH supply is around 120M, so in percentage terms this is around -0.25%. A negative inflation.

On a yearly basis the ETH inflation looks like this:

We can see the constant drop in the inflation, from more than 10%, to around 4% in the last few years, and now in 2023 it will be most likely negative for the first time to around -0.25%.

ETH supply plateaued since August. The bear market is in charge.

Yes, not a lot of movements in the last months

Any word when thoee original Beacon chain stakes will get their rewards and there will be an "Inflation Bomb"?