The HBD APR for savings was set to 20% back in April 2022, after the previous 12%. A lot of users have taken advantage of this, but the recent downtrend in crypto has put a lot of pressure on the tokens, HIVE included.

To get interest users need to transfer HBD into the savings on their Hive wallets. This allows for better tracking on the overall balances in savings that are eligible to earn HBD.

The withdrawal from the savings account is three days, that is a reasonable period. It’s like staking with three days unlocking period.

When the interest on HBD was first set by the witnesses somewhere in March 2021 it was only 3%, then they push it to 10%, 12% and now a 20%!. You can see what the interest rate is set by the witnesses here https://peakd.com/me/witnesses.

Now let’s take a look at the data and see how much HBD has been transferred to savings and who is taking advantage of the HBD interest rate.

The period that we will be looking at is starting from 2021 to June 2022 .

We will be looking at the following:

- HBD balance in savings

- Daily interest rewarded

- Monthly interest rewarded

- Cumulative interest

- Top accounts that hold HBD in savings

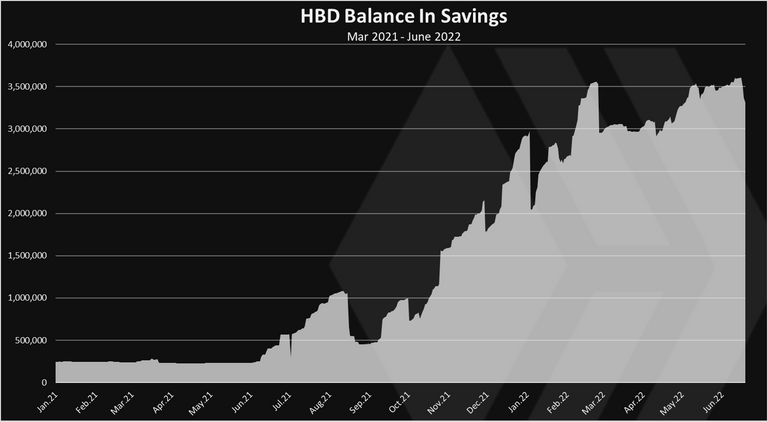

HBD Balance In Savings

Here is the chart for the HBD balance in savings in time.

Prior to July 2021 there was somewhere around 150k in the savings. Then they stated growing and continue an aggressive expansion up until March 2022, with some bumps in the way. In March 2022 the ATH for HBD in savings was at 3.6M. Then there was a big withdrawal from one account and it dropped to 3M. As steady growth till recently when the savings reached 3.5M, and we have a slight drop now again.

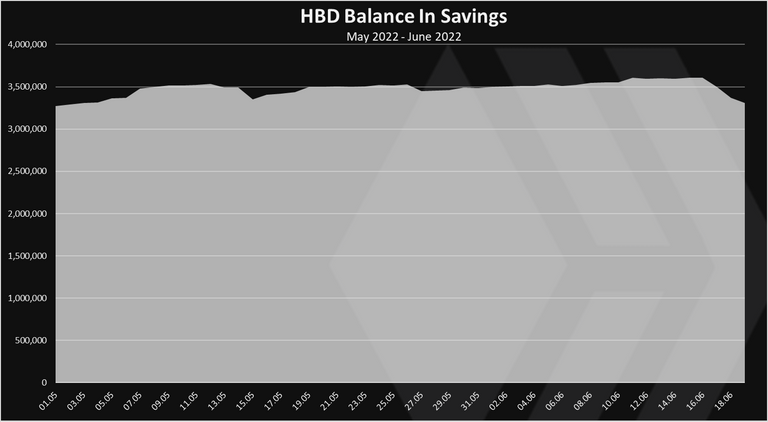

If we zoom in the last two months May and June we get this.

We can notice the drop in the last week from 3.6M to 3.3M where it is now.

This is understandable as the overall crypto market has been in a sharp drop in the last days. The overall HBD supply has also declined in the last period as a respond to the downtrend.

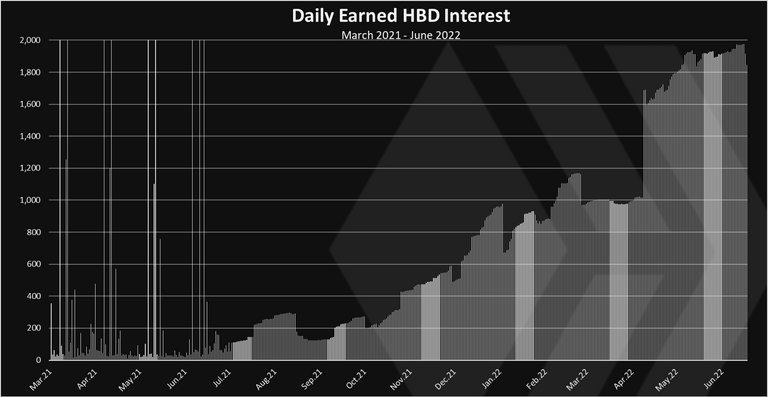

Daily Interest Rewarded

How much interest is paid to the HBD in savings? Here is the chart.

At first in 2021 the interest was paid to all the accounts that holded HBD, without the need to be put in savings.

Then after the HF in June 2021, HBD interest is paid only for HBD in savings. We can notice the sharp drop at that time.

The payouts started growing and reached to around 1k HBD daily prior to April 2022. Then the APR increased to 20% and so did the interest to 1.6k and later to almost 2k HBD daily as the HBD balance in savings was growing. We can notice that at the end of the chart now it dropped as there were withdrawals from savings.

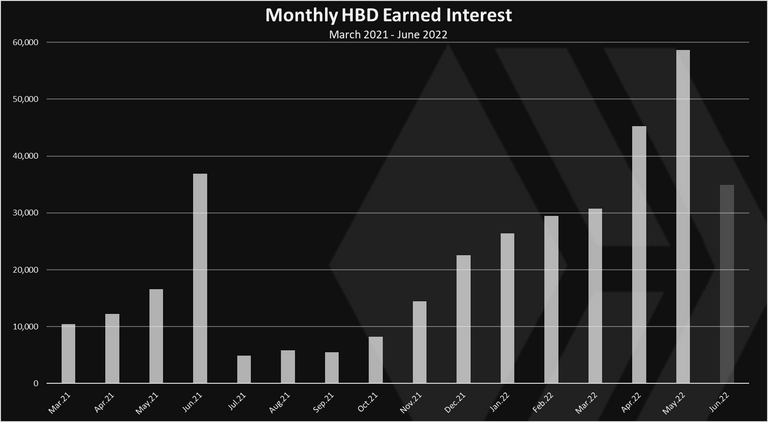

The monthly chart for the HBD interest looks like this:

May 2022 has a record high amounts in HBD interest paid with almost 60k HBD.

June is not over yet, but most likely it will be lower, somewhere around the April level around 45k probably.

Note the data above is for HBD earned, that sometimes can have a delayed claim.

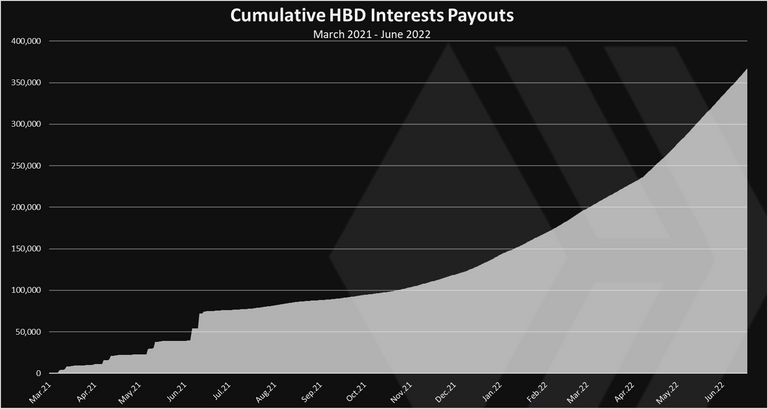

Cumulative HBD Interest Payouts

The chart for the all time cumulative HBD interest earned looks like this.

A total of 360k HBD earned as interest in 1.5 year. In 2022 alone this number is at 225k HBD. At the end of the year it will probably be around 500k HBD paid as interest on a yearly level. For comparison there is around 2M HIVE equivalent minted per month, or somewhere around 24M per year.

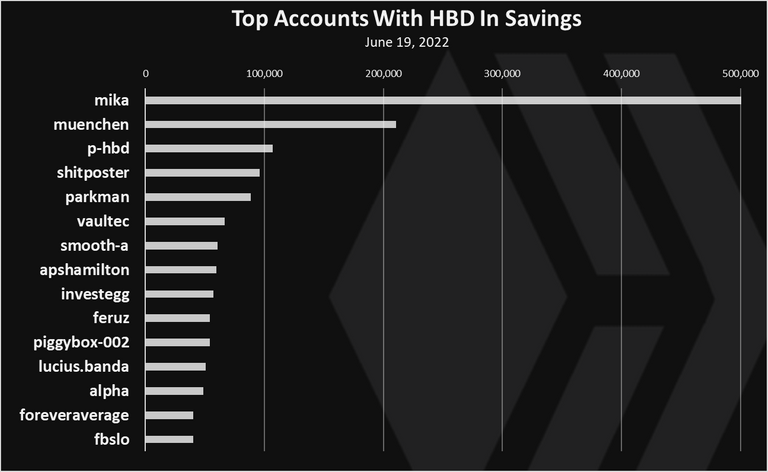

Top Accounts That Hold HBD In Savings

Who has the most HBD put in savings? Here is the chart.

The accounts on the bottom at the char have around 40k HBD in savings. More than 6k accounts have at least 1HBD put in savings, while 1165 accounts have more than 100 HBD in savings.The @mika account is on the top with more than 500k HBD in savings. At one point this account had almost 1M in savings, meaning it has reduced its holdings. Next is @muenchen and then the Leofinance custodian account for pHBD, @p-hbd.

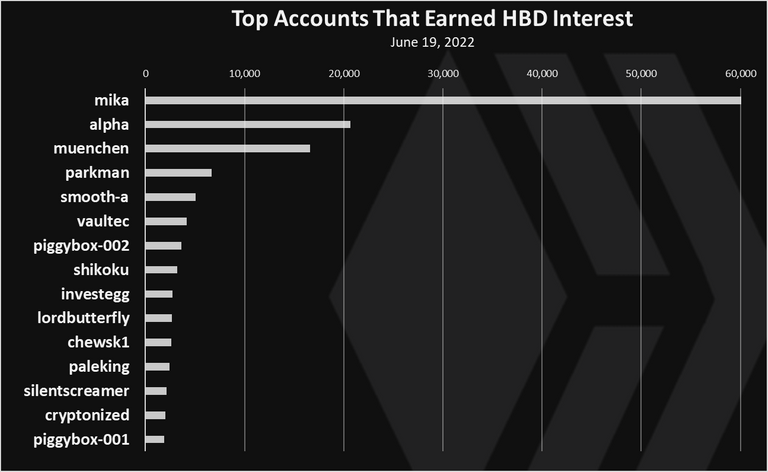

Top Accounts That Earned HBD Interest

The above was the current situation for accounts that hold HBD in savings. Some might have added and others removed. Who has earned the most in the past?

Here is the chart.

@mika comes on top here as well, followed by @alpha and @muenchen.

An overall uptrend for the HBD in savings just until recently. Depending how will the market perform so will the HBD balance.

Seeing HBD balance adjusted according to market conditions is overall a good thing, as users are aware of the risks of the haircut rule and adjust there holdings in time. The overall HBD supply has also been going down, meaning less debt for the system and lower price for HIVE at which HBD is sustainable.

HBD has proved to be resilient even under the current conditions and with all the mechanics in place has hold its peg. As time progresses and the concept proves itself more, we might see more and more HBD put in savings, that will on the other hand put pressure on the HIVE price as well.

Not to forget that HBD savings are on L1 blockchain, not an anon defi app. Payouts are in the native HBD token, not a secondary yield token. Much better security and stability.

All the best

@dalz

It's at this moment I wish I would have left my HBD instead of buying hive with it at $0.70 lol oh well I still feel like we will be above that again here within a year!

You should left something out :)

You can never time this things, dca seems like an elegant solution ... not the most effective though

Interesting data. I think it is worth mentioning that the top 8 accounts received over half of the HBD interest last month.

If my calculations are correct, HIVE is currently giving out 1 million HBD a year in interest.

Most of this HBD will be converted into HIVE. Converting 1 million HBD at $0.33 would create 3 million HIVE. That is a lot of HIVE that the market must absorb.

Because of the 20% interest on HBD, I no longer advocate investing in HIVE. One should only invest in HBD.

HBD interest is putting a huge downward pressure on the price of HIVE. Since interest compounds, the downward pressure will increase with time.

Without any variable changed, 20% out of 3.3M in savings is 0.66M HBD, yearly. Its not 1M. For 2022, till today the payout are around 0.22M, so 2022 will most likely end around 0.5M.

How much will this be in HIVE depends on the yearly average price. Today hive price, that is a yearly low, is 0.36, at which this is equivavlent of 1.8M in aditional HIVE created per year, (worst case scenario) on the top of the 24M regular inflation.

It is for sure and additional inflation, but to say a huge downward pressure is a bit to much. 1.8M HIVE per year, is around 0.5% aditional yearly inflation on top of the regular 7% inflation. Also not to forget HBD creates an up pressure for HIVE as well if there is demand for it.

At the end its perssonal deccison where you think you should invest, just wanted to be exact with the numbers.

Does paying so much interest negatively effect hive or HBD? The value has to be coming from somewhere right?

Its not that much of an interest when you compared to the overall inflation .... see comment above...

I’m only holding hbd to for hive, waiting patiently to see hive drop to the price I want and buy

Posted using LeoFinance Mobile

That is one of its main use cases :)

I allready started buying.

I believe at the moment converting hbd to hive us a good decision to take for more profits to occur soon when the price of hive eventually goes up

Yep, its like buying hive.