Stablecoins continue to be one of the hot topics in crypto. Regulators are now watching closely on all stablecoins, especially the centralized ones like Tether USDT, USDC etc. DAI has been the long term champion in the decentralized stablecoins arena, but now it seems that it has a legit contender in UST.

I have already mentioned that I personally I’m not a fan of DAI because of its overcollateralization and capital inefficiency. While it may sound great to have a stablecoin that is 200% backed with assets, the markets doesn’t want this. It locks to much capital.

The FEI stablecoins was one attempt to create a different and more efficient stablecoin, but it had its issues and being an Ethereum token probably didn’t help towards to goal.

What is Terra Money?

Terra Money is a whole new protocol and blockchain based on the Tendermint tech, the Cosmos blockchain is build on. The Rune protocol also uses this tech.

It is a proof of stake PoS blockchain.

There is a 130 validators that are assigned to run the nodes. They are elected based on their voting power (own stake) and other voting power who delegate the stake to them. The native token to the protocol is LUNA.

One of the underling function of this blockchain is to mint stablecoins like USD, EUR, YUAN, KRW, etc.

How Does Terra Money Works?

Terra Money is a protocol that in theory can create a multiple stablecoins, not just the USD dollar pegged TerraUST or just UST for short. It can create TerraEURO, TerraKRW etc.

How are all these stablecoins created?

The way the stablecoins are created is basically by conversion of the native token LUNA to any of the other stablecoins. For simplicity we will be looking at the LUNA and UST currency here.

LUNA is the native token to the protocol. It is being used for governance to elect validators and they are receiving staking rewards in the LUNA token.

Staking rewards come from three sources: gas (compute fees), taxes, and seigniorage rewards.

To create one new token that is equal to one UDS, users need to convert LUNA to UST, burn LUNA in the process and mint UST. The validators also work as a price oracles providing price rates at which the conversions is happening. If the value of the UST is a bit higher at some exchanges, then users can mint UST from LUNA and make arbitrage on this.

Also, if the price of the stablecoin drops below the peg (1 USD) on external exchanges, the protocol offers an exchange rate of one dollar in terms of LUNA tokens, so users can buy the UST on exchanges for lower prices and exchange it on the protocol for one dollar in LUNA and make a profit.

What this means is basically the native token is acting as the collateral for all the stablecoins, providing an option for conversions in both ways. (sounds familiar? 😊).

Fees

Yes, conversions and transactions in general are not free on the Terra blockchain. There is a basic fee for every transactions that is set by the validators, and plus there is a tax on top of it.

The tax system depends on the current economic situation but basically works like this.

- Demand goes up, lower the tax

- Demand goes down, increase the tax

When the demand is up and more stablecoins are needed, the tax is set lower, meaning less LUNA burned in the process of conversions, resulting in more LUNA supply and when the demand is down, a higher tax is set resulting in more LUNA burned in the process.

Locking Periods

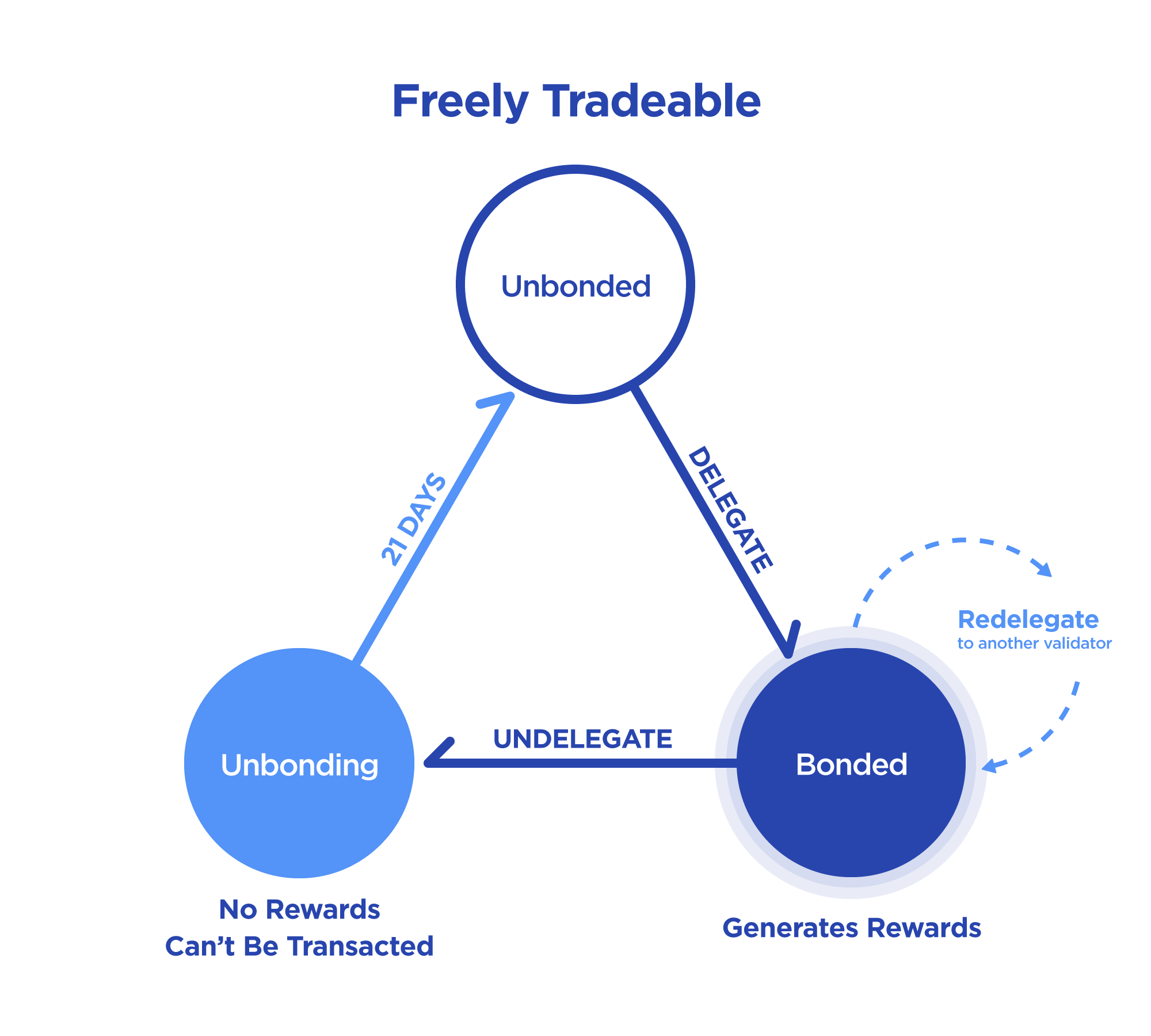

There are three terms that the blockchain uses for the LUNA tokens:

- Unbonded

- Bonded

- Unbonding

Unbonded LUNA is liquid LUNA that can be transferred around freily. The bonded LUNA is locked/staked and can only be delegated, but not transferred around. If the user wants to unlock its tokens then he needs to unstaked them, putting them in a unbonding mode, that last for 21 days.

One of the key points here is the unstaking period that last for 21 days, in which users can't do anything with their funds but wait. We are seeing more and more of a long term periods presented in crypto and defi and this is one more case. The 21 days unlocking period shows a commitment for the project.

Market cap numbers

The LUNA token has been very successful in the last period. At the moment of writing this it is a no.12 position on CMC with 14B in market cap. The UST stablecoin has also gowned immensely and now it has a 2.6B in liquidity. The token is starting to get recognition from a lot of defi apps and I can see it now in a lot of defi application where a yield is giving out for holding it as a stablecoin. This mean it use is growing. The stability of the token in the period has been great.

This is just a rough overview of the Terra ecosystem. You can read more here:

Lessons for HBD

UST seems to be growing and succeeding as a decentralized stablecoin. The native token LUNA has already surpassed the DAI governance token MAKER. The UST is also growing in liquidity and adoption and probably soon it will surpass the DAI marketcap.

TerraUST design is unbelievable similar to HBD.

For Hive, both the HIVE to HBD and HBD to HIVE conversions have a time delay of three days. While this prevents price manipulations, like the flash loans attacks we have seen in defi, it is still a long period for fast price feedbacks for a stablecoin. For starters we might do ok if we set it say for one day.

There is a fixed fee for the HIVE to HBD conversion of 5% basically (1.05 HBD price), but zero fee for HBD to HIVE. There need to be fees for the both directions that will burn HIVE, but they need to be lower, probably less then 1%, or maybe max at 2%. The fees level can be a witness parameter and set depending on the market conditions.

Bridges. Having a decentralized stablecoin in an isolated environment like the Hive ecosystem wont go to far. Terra has it native bridge to Ethereum. From here on it is used in all the defi apps. If Hive manages to create a great bridge to Ethereum and the other EVM chain, the HBD can then start being used on all the external defi apps, driving the demand and growing the overall ecosystem.

All the best

@dalz

Some other platforms reviews I have done recently:

Posted Using LeoFinance Beta

I agree I really miss out

when it was only 7$ I had bought these but needed money so had sell them in lose

I learn a lot from it but I still have some and hoping for a better future for luna

LUNA is going for 35$ these days.

yeah, I missed it but I won't take it to heart cause If I did I will live in past and forget about future

After taking a look at Terra (LUNA) for our @crypto-guides project, I'm extremely bullish on their entire ecosystem.

Decentralised, algorithmic stablecoins are going to be the future and UST is by far the best of the bunch.

I am interested in how you see Hive's own HBD comparing to UST and how it may fit into the overall landscape.

What are your thoughts?

Posted Using LeoFinance Beta

HBD, 10% on the native chain is one strong use by it tself. HBD is much more imporved since the last HF. It can be a bit more impoved with shortening the conversion time, conversion fees, and increasing the debt ratio.

In time if the peg holds, more use will be found in the hive ecosystem.

One thing that is needed the most is secure and liquid bridges to eth and all its copy chains, so its use can grow outside the Hive ecosystem and use in defi apps ... that would be amazing :)

The extent that could potentially burn HIVE blows the mind. :D

Inflation is our killer app, but much lamented because it hasn't had as many great uses as would've been possible. What you suggest offers much potential to put that HIVE inflation to good use.

Its a million dollar question .... a balance between community building (free money) that we now have, and investor friendly, nice apr without hard lockups... airdrops from time to time ... something in that direction .... and offcourse a great product

It would work as an exchange system for government currencies and their analogues, or something like that, but with cryptocurrencies, it seems like a very good idea ...

I think, someone was building that ?

Yes it was fbslo

Didn't Solana devs shut down the blockchain without community intervention? I thought it was agreed that Solana was a centralized blockchain. But now with you saying this, I'm starting to hesitate. I don't know what's true.

Solana and terra are totaly different things

ahhhhh I was told that Terra lived in Solana blockchain!

Terra is its own blockchain, it has a bridge to Solana and the UST is supported there as well .... same as UST is on ETH

aaaaaaaa

I was misinformed :c I feel sad

Great recap, thank you. I reblogged for awareness. I'm abig fan of Luna since basically the Chia days. For me, the best lesson for HBD is adoption. The main driver this days for the Luna ecosystem is the myriad of projects being launch on a weekly basis that are relentlessly locking UST everywhere. Pools, vests, vaults, farming, you name it. So people needs more and more UST... Which puts pressure on Luna.

The best Hive catalyst until today is Splinterlands. With 5 Splinterland-size projects, Hive will be at $5. Easy peasy.

I was looking to promote this post so which should I send it to? I'm asking you cause I saw your name in the moderator section on top so I didn't know another user will reply but you do on most of the comments so I'm asking you.

Its greek and spanish

my post is in English so how do I promote it?

Not sure what you mean for promote ... you can promote it on the leo web by burning some leo

@tipu curate

Upvoted 👌 (Mana: 10/70) Liquid rewards.

Spot on. Bridges to assets external to the chain are needed. I also agree with your proposed changes to the conversion parameters.

Completely necessary to keep it balanced, as well as offering $ LUNA as a guarantee in case the stable currency does not maintain parity with the dollar, we need more projects with these fundamentals.

Posted Using LeoFinance Beta

Interesting post and wanted to know more as I hold Luna in my bags. I knew it had a use case printing stable coins but had no idea how.

Posted Using LeoFinance Beta

HBD is the solution...we don't need Terra UST😆

Is only usdt,I know may be,I will check more information concerning them on Luna wallet.

Apart from getting those token on Luna wallet, can you get it in another wallet

Posted Using LeoFinance Beta

That will be a verifiable case for Hive and the blockchain

ecosystem.The #HBD approach could be welcoming for all DEFI, most likely #BSC and #Matic.

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.BEERHey @dalz, here is a little bit of from @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Terra is hands down my favorite Blockchain protocol. A stable of stablecoins. As you mentioned, they are the future because they are very important for e-commerce. I can see its demand rising. Their apps are used by millions of users in Korea and Mongolia. Getting popular in Asia and beyond.

If you stake UST (Terra USD) on Anchor Protocol, you get 20% stable yields. I don't know if any other stablecoin can provide such a high yield.

Posted Using LeoFinance Beta