Adamant Finance is probably the no.1 yield optimizer on Polygon/Matic. For those not familiar with the platform it is basically like Autofarm and Beefy on BSC, Harvest Finance on ETH etc. The latest upgrade to Cub is also working like this.

What these platforms do is they auto compound your assets from other defi platforms for you, increasing your APR for a minimum effort.

A lot of the yield optimizers on Polygon are apps from other platforms like BSC or ETH, that have transitioned to Polygon. Autofarm and Beefy both have their versions on Polygon. Adamant is one of the few in house grown platforms specialized for the Polygon ecosystem. Lets take a look!

Adamant started its journey in April 2021, when the Polygon ecosystem started growing a lot. Till this date the platform has been working great with no security issues.

In fact, in the past there was an interesting situation when an investment fund deposited more than 200M in stable coins farming the platform token and dumping it immediately. While this was bad for the short term token price it showed that the platform has been checked by serious players who are willing to put in large amounts of funds, confirming the security of the platform. Adamant also uses Chainlink oracles to prevent feed price manipulation etc.

At the moment Adamant has 177M in TVL and a 53M market cap.

How Does Adamant Finance Works?

As already mentioned, it is a yield optimizer for Polygon apps. It takes liquidity from other apps and compound them. You deposit on some other platform first, then go to Adamant and deposit the LP (liquidity provider) tokens.

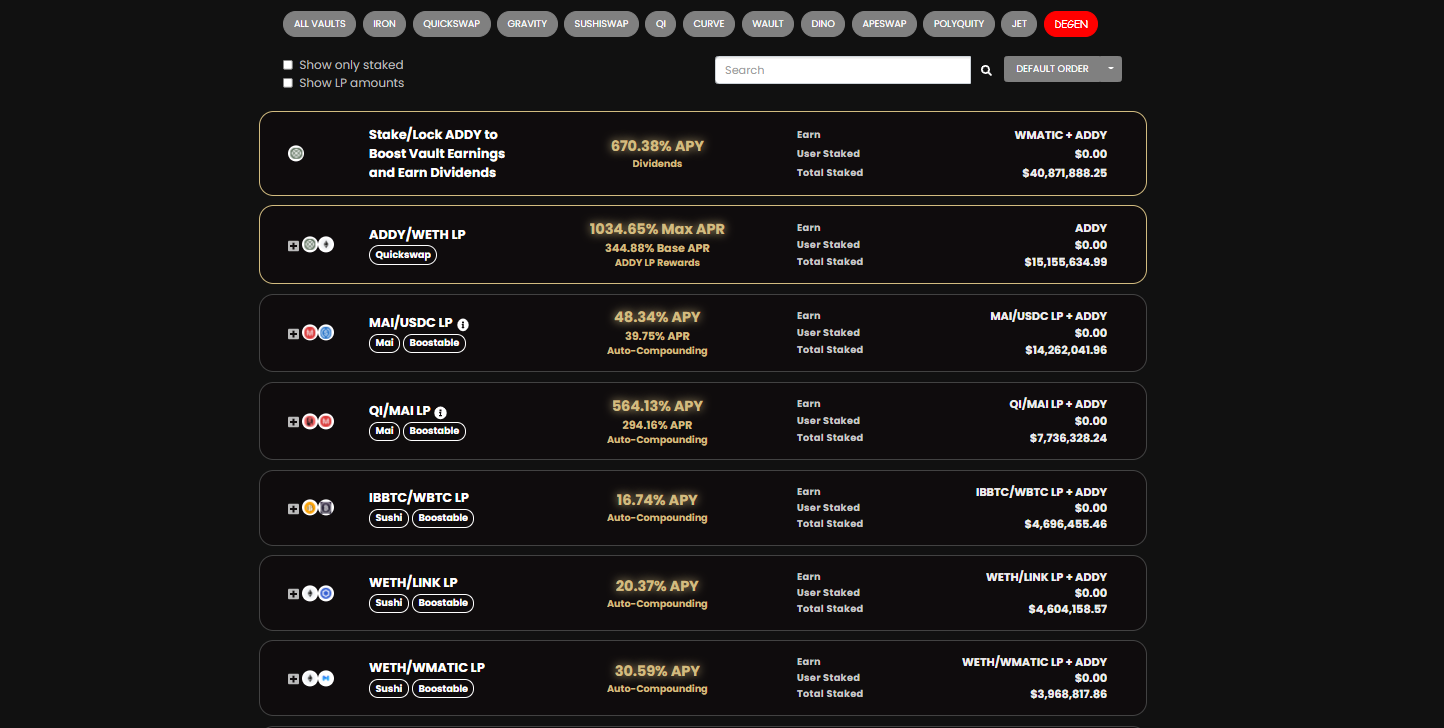

As we can see there is a lot of platforms to choose from, like Quickswap, Iron, Sushi, Curve etc. There is also a degen tab for the super high risk yield.

Adamant Finance will compound the deposited assets growing them constantly but then on top of them it will give out their token ADDY. A double rewards! There are some small vaults that don’t get ADDY tokens, but the platform just gives you the service of compounding for them.

Tokenomics

Apart from the security that has been good till now, the other interesting thing about Adamant is its tokenomics. It is a mix from few platforms, and I think they got one of the best tokenomics from all the yield optimizers. This doesn’t guarantee a success, but it is a prerequisite for it.

Here are some of the key features of the Adamant Finance tokenomics:

- Performance based inflation

- Vesting period for rewards

- Option to lock tokens long term

- Boosting rewards with locked tokens

- MATIC rewards on top of ADDY

- Smelting/Burning ADDY for other tokens

Performance Based Inflation

This is a feature that Adamant has taken from Bunny. What this means is that there is no fixed inflation rate like XX tokens per block, or % per year, but the amount of new tokens put in circulation depends on the performance of fees the protocol has earned:

ADDY has an emission system similar to Bunny's, where for every 1 BNB earned in performance fees, 5 BUNNY were minted. In ADDY's case, 400 ADDY are minted for every 1 ETH earned in performance fees.

So, for 1ETH earned from the protocol, 400 new ADDY are minted. There is also 15% more tokens on top of this for the team.

The amount of ADDY per ETH minted will be reduced in the future on a monthly level.

For 2021 it looks like this:

| Month | ADDY per 1 ETH |

|---|---|

| April | 500 |

| May | 475 |

| June | 450 |

| July | 425 |

| August | 400 |

| September | 380 |

| October | 360 |

| November | 340 |

| December | 320 |

At the end of 2021, it will be 320 ADDY per ETH. This reduction will continue in 2022 as well, and at the end of 2022 there will be a 160 ADDY minted per one ETH earned. This is a reduction in the minting emission for more than a half.

Vesting Period For Rewards

All the ADDY rewards that are earned from deposits are vested for three months. This aspect of the platform takes from Elipsis.

There is an option to claim your rewards instantly, but you will need to pay a 50% fee, that goes back the other users that have locked ADDY, boosting the APR of the ADDY token.

Locking rewards might not be so popular among users looking for quick profit, but it shows determination and a long term thinking for the platform. Seems to be working for now. The 50% penalty for early exit provides a way out for anyone that wants to exit fast.

Option To Lock Tokens For Longterm

Unlike the vesting period that is mandatory and put on the users from the protocol, the lock in option is voluntarily. Once you have your rewards liquid from the vesting period, or you have bought some liquidid ADDY users can choose to lock ADDY from 91 days up to 1460 days.

This is a period from three months up to four years! There is no option to unlock it, like for the vested tokens from rewards. Once tokens are locked, they are gone without any option out until the expire date.

Four years in crypto looks like eternity but this shows a long term commitment.

Locking ADDY up to four years is element that they have taken from Curve.

Why would someone lock tokens up to four years?

Here are the benefits:

- MATIC rewards from performance fees

- 100% of the penalty fees paid by users who withdraw vested tokens

- 100% of ADDY from buybacks

- A boost to the ADDY earned by staking in normal vaults

A total of four reasons to lock your tokens. This might be enough for some patient long term thinkers 😊.

The last bullet on the boosts provide users with higher APR for deposited tokens. Your deposits will earn more if you have more locked ADDY.

Here is the table on the boosts weight.

| Lock Duration | 1 ADDY = X BP |

|---|---|

| 4 years | 1 |

| 3 years | 0.75 |

| 2 years | 0.5 |

| 1 years | 0.25 |

| 91 days | 0.0623 |

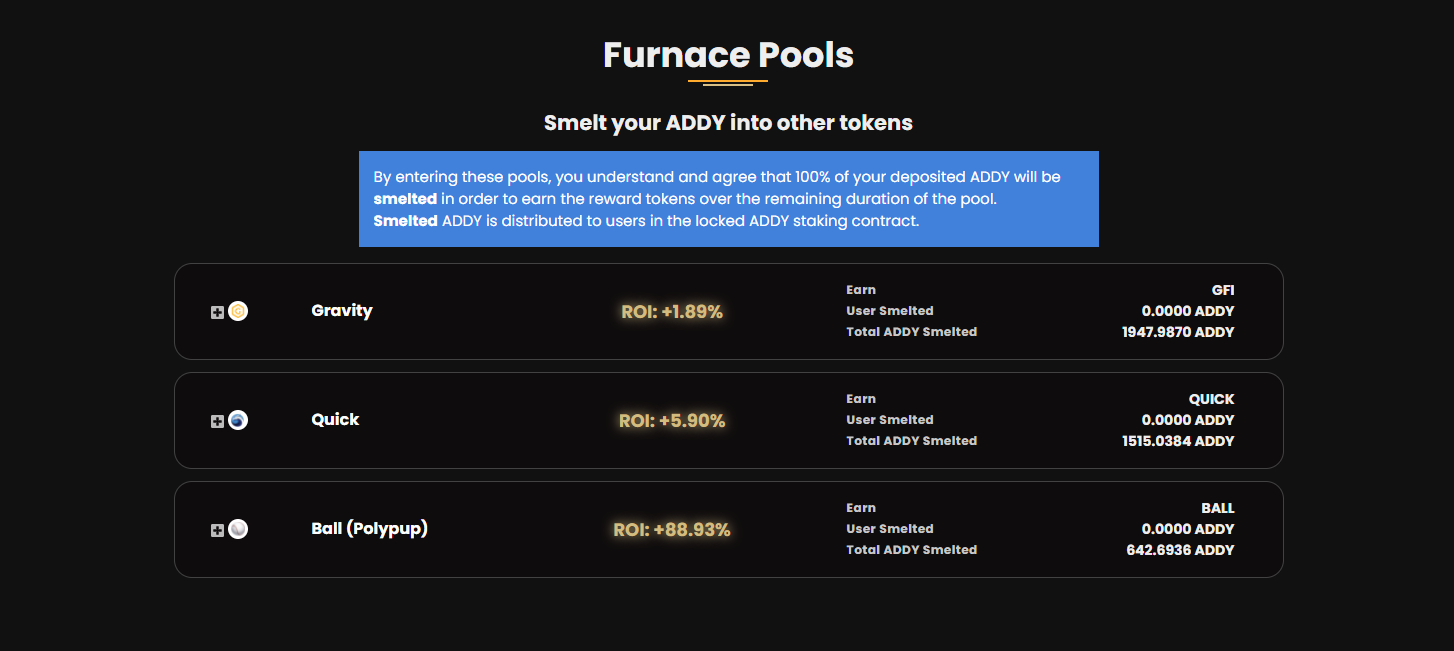

Smelting/Burning ADDY For Other Tokens

This option was added recently under the Furnace tab. This allows the platform to have collaboration with other tokens and proved ADDY holders with options to earn other tokens with ADDY. It is a great boost for the token.

The way it works is users put in ADDY in the furnace (smelt it) and receive the other token in a value higher than the initial value of the ADDY put in. This is the ROI of the token.

There are only three tokens under this option for now.

Usually, the more reputable tokens have lower ROI, like QUICK, and the less know new tokens have higher ROI like the Ball token in the case above. The conversion of the token is not instant but over certain period of time.

The ADDY that has been smelted is not burned but it is given back to users that have locked ADDY increasing the APR of the ADDY in the locked vaults.

Personally, I have been using the platform for compounding my assets on the Polygon network for a while now and it has been working fine. The token price has gone trough some ups and downs in the period and now is at some medium level.

I’m a fan of the security of the platform, although nothing is 100% safe in crypto so don’t risk too much. As for the tokenomics, I really think they are one of the best in the industry and other platforms can learn from. They have combined some great features from other platforms resulting in a unique tokenomics of their own. What they are missing is probably a launchpad module to be really complete 😊. The furnace feature is a step in that direction but it can be extended for buying privilege at tokens sales etc. The design might be also a bit improved, but for my personal taste its ok I guess.

Hive itself can definitely take some aspects of the platform especially for the vesting and locking period and implement them for the Hive Power.

All the best

@dalz

Some other similar platforms reviews I have done recently:

Posted Using LeoFinance Beta

Looks interesting, I'll have to try and check it out. Hope not to Fomo. Maybe on the next bull run

If you have some assets on Polygon, you can just use the platform to compound ... without investing in the token itself

Posted Using LeoFinance Beta

Just realized I had some unclaimed rewards there, thanks.

I started using Beefy when it launched and completely forgot about Agamant even though it was my first choice. Nothing wrong with the project but I just don't like the UI for some reason.

Hoping Cub Kingdoms will put them all to shame thb...

Posted Using LeoFinance Beta

Yes I mentioned the UI :)

Its a bit rough ...

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Where do I start if no experience on polygon at all?

Probably with setting up a metamask to work with the matic network, and then transfering some funds via a bridge to matic

wow! Just, Wow! Great breakdown and explanation very well done. I appreciate this immensely, I'm gonna be able to actually makes heads and tails of Defi now and it shows a great use case of scaling solutions like Matic. Impressive and thank you, not my first step down defi, but the first one that finally gives me some useful direction. Thanks! keep it up!

Posted Using LeoFinance Beta

Thanks!

Cheers for this write up and the little boost I needed to change gears.

Yesterday, after reading this, I added my entire DINO - USDC pool to Adamant ( after testing the waters for a bit with a small amount ).

Nice to get a nice chunk of ADDY as a bonus, now, after having seen the value of my LP evaporate day by day, since DINO's all time high 3 weeks ago.

Posted Using LeoFinance Beta

Nice well organized review. Thank you.

Posted Using LeoFinance Beta

Congratulations @dalz! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz: