In an explosive manner the BNB price reached 300$ at the moment of writing this. The main reason is the Binance Smart Chain! DeFi on BSC has been growing more and more. The high fees on Ethereum have pushed a lot of users towards BSC. Meanwhile more and more apps have been build on BSC and the transition to BSC made more attractive. It is also ETH compatible, users can move there with metamask and devs can build whatever they were building on ETH.

BSC is a PoS chain runed by validators that are elected by BNB holders. So the question of true decentralization remains.

One of the reasons for the BNB growth is because everything on BSC operates with BNB. Fees although small, but you need some BNB for them. Then the pooling. Almost every token and new defi app is pooled against BNB, locking a lot of BNB in a defi pools. At the moment of writing this there is more than 30M BNB locked in defi on BSC.

Now that BNB have went parabolic and there is a lot of possibilities out there what are some of the options if you want to get involved and gets a piece of the action.

I have been exploring the BSC chain for a few months now and have tested all the apps bellow. They are reasonably safe, but with crypto you can never be 100% sure.

1.Pancake

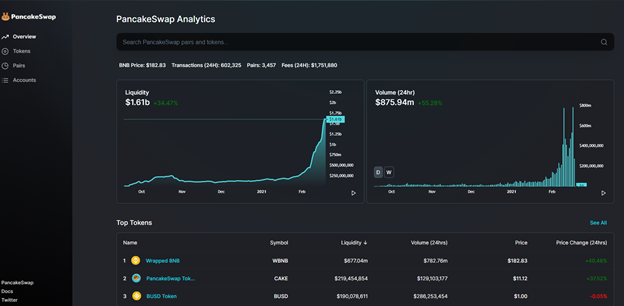

Pancake is the place to go if you want to provide liquidity and farm the CAKE token. It is a DEX on the BSC chain combined with farming and syrup pools. At the moment there is 3.8B in total locked value. Almost 4 billions, and it has flipped Uniswap.

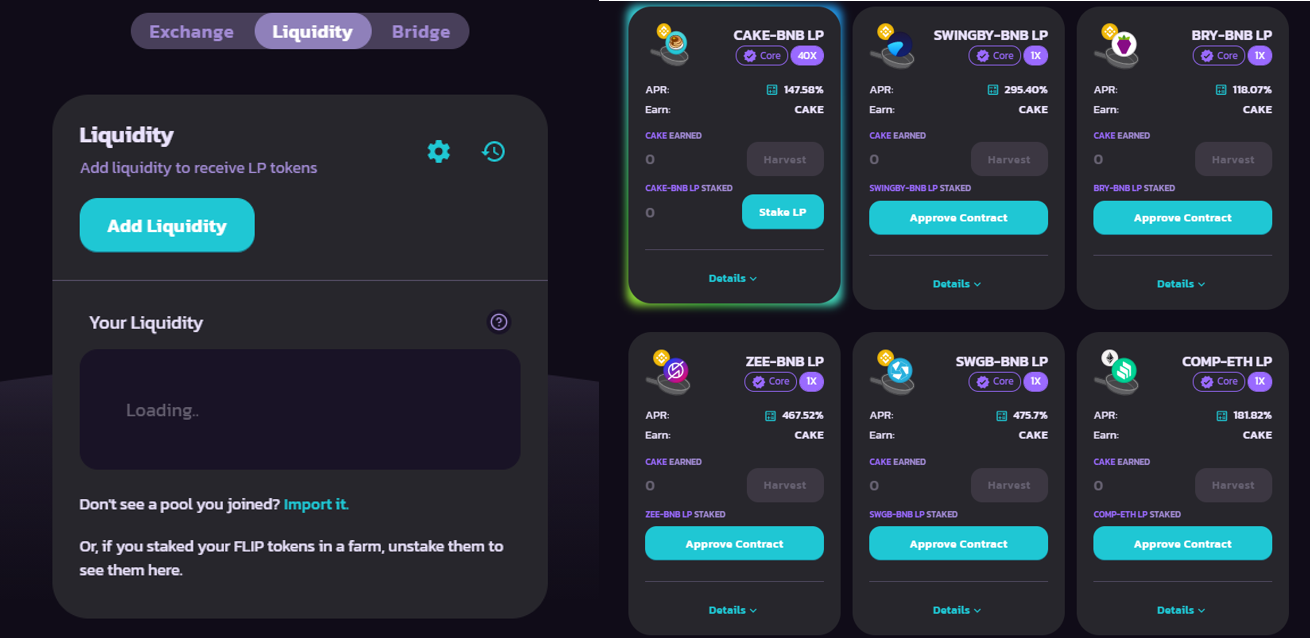

Farming is a two step activity here. First you provide the liquidity, and then you stake it in the farms.

Note, you can earn as a liquidity provider only by providing liquidity, without the staking part as well. But when you stake it you earn more as a CAKE incentives. You should be aware that you are giving up from the fees from the native tokens that you have pooled.

There is a bunch of option for pooling here, the BNB-CAKE pool as the most attractive with around 150% APY atm. There is also a stable coins pool for around 60% atm.

CAKE is an inflatory token, meaning its supply will keep increasing.

2.Autofarm

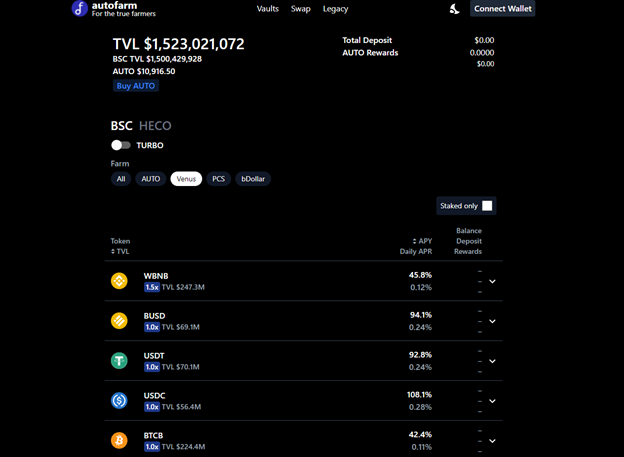

Autofarm is on of the platform that have seen an explosive growth, both in terms of price and total value locked [TVL]. In about two weeks it has grown from under 100M to 1.5B in TVL.

Autofarm is a yield aggregator and optimizer, meaning it is pooling liquidity from different defi apps and rewards you with its token on top of it.

It is quite easy to use, with a lot of single options, meaning no impairment loss and a lot of stable coins options. APYs are crazy high now from 100% to 500%.

For the single tokens you can stake directly from the app, if you have them in your wallet. For the pairs, LPs tokens you will need to provide liquidity on pancake first and then stake it here.

Autofarm is also know as one of the platforms with the lowest fees.

AUTO has a capp of 80k for the token. It is currently rewarded to LPs, until somewhere in October, when no more tokens will be issued and the rewards will be only from fees generated on the platform.

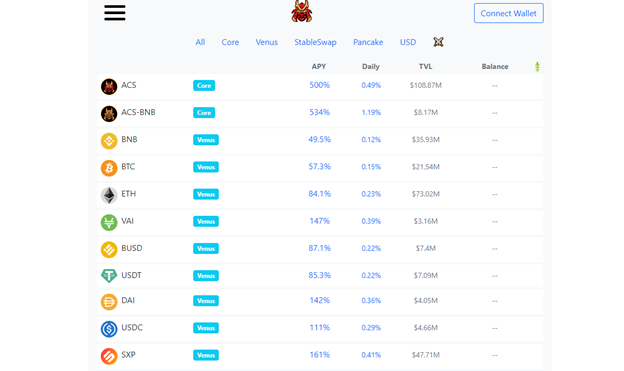

3. ACryptos

ACryptos is another Autofarm like platform. It is quite simple at first look, but it has some more advanced options like providing APY in the native pooled tokens plus the ACS token on the platform.

At the moment it has more than 500M in TVL.

For the staking, the same goes as for Autofarm, you can stake singles directly on the platform and the liquidity pairs first on pancake and then here.

ACS is also capped token, somewhere around 1.9M.

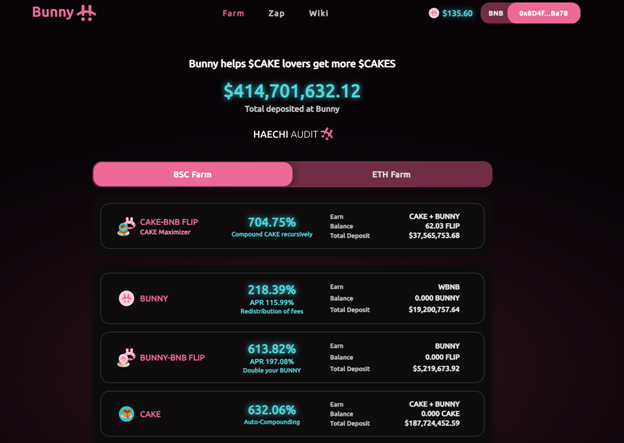

4. Pancakebunny

The name of this can be a bit confusing with the original pancake, but the extra here is the bunny. More than 400M in TVL on the platfrom at this moment.

Both in the name and in the token as well.

This platform has one of the most lucrative APYs on BSC now, without the doubt of being a scam. At this moment there is a 200% APY for stable coins and 1000% for BNB-CAKE. These will most likely go down in a few days. Or not 😊.

It rewards its users with two tokens, CAKE and BUNNY. It also has option for the pairs, do you want the native tokens as rewards + BUNY or CAKE + BUNNY (CAKE maximiser).

For most of the pairs on bunny you will need to add the liquidity on pancake first and then stake it on pancakebunny.

Be aware there are fees when unstaking in less than three days.

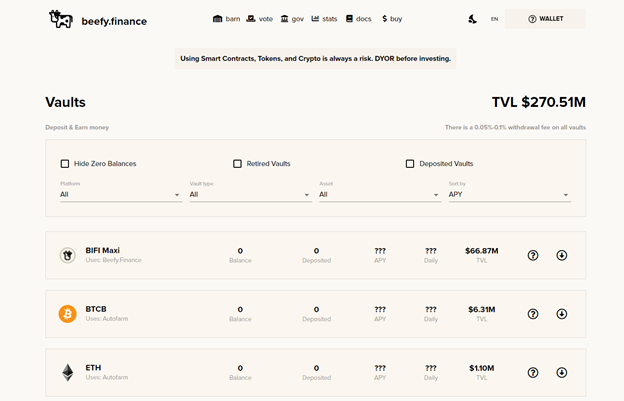

5. Beefy.finance

Beefy was one of the first yield aggregators on BSC, starting from October 2020. It has done OK in the past period in term of TVL and price, but not as explosive as the above. It has all the options like staking singles, stables and liquidity pairs.

One of the most interesting side of the beefy app is that they list fast new small caps tokens that can give out an unbelievable APYs in the first days.

The BIFI token is capped at 80k, but it is not rewarded to LPs currently.

A lot of opportunities on the BSC chain right now. These are some of the most prominent platforms and there are a new one coming out every day. The level of growth is coming to near hysteria levels right now. It is always good to try out new things, but always be comfortable with the investments you are willing to put in these platforms. Meaning don’t invest more that you are willing to loose.

All the best

@dalz

Posted Using LeoFinance Beta

This whole BSC supposed "DeFi" is the cancer in crypto we absolutely don't need. It goes against the very values of what blockchain/crypto should be. Ppl don't care about decentralization clearly, waiting for that "Not Safu" moment. We should be supporting Dex's , not this bs. Not your keys,not your money.

I agree about the decentralization.

The thing is, I think there are levels to it. Also there is an obvious issue with ETH fees.

What chain is the most decentralized out there?

Probably BTC. Is ETH decentralized? It had an ICO with 70% of the current stake sold to the VC.

This said, if things were on more equal playground, like similar fees, not a 100x difference, I would 100% go with the more decentralized option. DeFi is growing and ETH in a PoW version cant take it all.

Also this market is showing that CZ have earned some trust in the community.... why is ont EOS defi booming, or TRON defi ...

Posted Using LeoFinance Beta

News flash, CZ and Binance are most likely the cause of the high ETH Fees, something they have been doing for quite a while.

As you can see in the screenshot below,

@Binanceis one of the biggest gas spender based on @etherscan

Source: https://etherscan.io/gastracker#gassender

Which would be rather unfortunate because it would only mean they have been intentionally surpressing eth on purpose. I think after what we went through with #steemhostiletakeover, we know how low CZ can stoop and this would not be surprising one bit.

I want to refer you to this detailed tweet where this analysis was made, perhaps you can share your thoughts on it on another post...

Trust & CZ can never be in the same sentence, and that goes for Justin Sun as well!

it is decentralised my friend, as most amm use metamask binance smart chain. you got you keys all the time. but you may need binance to sell them coins altought.

Posted Using LeoFinance Beta

Huh? So NOT decentralized. You need to google on what "decentralized" really means.

$300 is stunning. Too bad I had withdrawn when it's above $100. Meanwhile, Pancakeswap is the best among those 5. It has surpassed Uniswap.

Posted Using LeoFinance Beta

It is the biggest :)

I have sold a tiny amount of the beefy, with a good small profit, as i have only a small capital. but pancake is the one surprise me alot. only hold 1 cake, and it is sill stake. : )

Posted Using LeoFinance Beta

I'm currently watching the video with you and the team of Leofinance about the DEFIs you're into and I feel like I'm missing a lot in crypto. I think I should dig more into these projects. Where are you from by the way?

I'm from Eastern Europe as well, Romania more precise.

Posted Using LeoFinance Beta

Hey thanks!

About my location, I want to go a low profile around here, for now...

But pretty near to you :)

Posted Using LeoFinance Beta

they are high risk high reward investments, can be all hacked, or the anonymous developer can sell his share making the price fall (sushi case), but they offer higher interest (APY is called) for you letting them to use your crypto for liquidity (where you lose percentage ot impermanent loss) or stacked in pools (kind of not losing value as crypto amount). you want more returns, you go there if you can cope with the risk involved.

These are just crazy times 😳🤑.

It is so hard to stay rational and not risk it all ! I have kind of let the Binance trade go.

I used to have hundreds of BNB just a month back...

Well that is life 😆. I am not doing too bad on other chains.

Just out of curiosity, how long have you been farming on BSC?

Posted Using LeoFinance Beta

Two-three months ... but more heavy in the last one!

Posted Using LeoFinance Beta

We’ll see some glorious volatility here, should be fun.

Posted Using LeoFinance Beta

what you think about $BAKE

it was just 0.1$ in 13 day its 2$ NOW

Posted Using LeoFinance Beta

Probably it's the second best after Pancake. Dont ask me about the price :)

Posted Using LeoFinance Beta

Im just telling you lol

I just tried pancakeswap yesterday but I miscalculated and did not have enough BNB to stake my CAKE-BNB LP. You mentioned it can still earn without staking it, how so? Forgive the n00bie question.

Posted Using LeoFinance Beta

No you need to stake it.

Posted Using LeoFinance Beta

you can stake on pools using cake for example, for pancakeswap, not on liquidity where you lose due to impermanent loss.

Posted Using LeoFinance Beta

Just watched the round table discussion. I'm new to LP staking, do you think using a stable coin like BUSD is better for someone like me?

Posted Using LeoFinance Beta

That is the safe option ... also less rewarding :)

Hodl and staking the yield token is the oposit.

In between would be the others top cryptos..

Just start with some small amount adopt on the way and see how it goes ...

Posted Using LeoFinance Beta

Alright. I'll give it a shot. I want to use Auto, do you think that is the best option for starters?

Posted Using LeoFinance Beta

Auto and the pancakebunny are the ones I'm in now

Posted Using LeoFinance Beta

Thank you. Let me create an on chain Binance account. I hold BUSD on the exchange but I don't actually use the on chain product.

@empoderat made a great guide .... bsc wallet = eth wallet

https://leofinance.io/@empoderat/how-to-get-started-in-binance-smart-chain-with-metamask

Posted Using LeoFinance Beta

It's CeFi, not DeFi. Beware of risks of losing your investment when putting your investment where you don't control anything. But of course when FOMO sets in people stop using their brains. Good analysis though. Thanks!

Posted Using LeoFinance Beta

I'm waiting for the first hack ...

Posted Using LeoFinance Beta

Or the first exit scam...

Yesterday I almost pooled some USDT and BNB out of FOMO but logic helped me stop.

Posted Using LeoFinance Beta

180 - 350 , crazy !! People seem to have lot of savings from Covid - 19.

Lol ... was 30 a few months ago

Posted Using LeoFinance Beta

What a great rundown on some of the options. I have been looking at autofarm lately, but I am in the process of waiting for some of my funds to be in place. The fact that the price of BNB keeps going up is not helpful to me. If my funds had moved quicker, I actually might have made some money on it. Hopefully the transfers happen sooner rather than later.

Posted Using LeoFinance Beta

Godspeed!

Posted Using LeoFinance Beta

thanks for the information and Binance is a universe.

Posted Using LeoFinance Beta

You are welcome!

Posted Using LeoFinance Beta

Nice writeup dude, BNB is crushing it, nearly 12B in total locked value, staking removes supply from exchanges, tons of utility, and it's deflationary!

Good call on "the question of true decentralization remains." I think the question is how many of the validators are propped up by binance owned BNB. We can call it CeDeFi...lol

Started with PancakeBunny yesterday, earning some CAKE yield! Have a good weekend bro.

Posted Using LeoFinance Beta

Thanks man!

You as well. Obviously people have some trust in CZ

Posted Using LeoFinance Beta

This is wild how many of these apps have popped up so fast. Awesome update and review on the main ones.

Posted Using LeoFinance Beta

Thanks cat!

Posted Using LeoFinance Beta

Damn.......... I remember when this baby was only few dollars and just a way to get 50% off of trading fees. Binance has become the king of: death to decentralization! Heaven for customer service!

I'm not hating on Binance. It's the fault of Ethereum and Uniswap for having such a bad UX for small players like me who couldn't throw $$$ on Tx fees. Rest of properly decentralized crypto should up their game and treat Binance as competition; not as enemy!

Posted Using LeoFinance Beta

Well said!

Thanks for this informative post and well written post

the problem, as you wrote, is that there is no real decentralisation, but Binance had a great idea.

!BEER

Posted Using LeoFinance Beta

Sorry, you don't have enough staked BEER in your account. You need 24 BEER in your virtual fridge to give some of your BEER to others. To view or trade BEER go to hive-engine.com

Great post and summary. I listened to your talk on Leofinance, no problem with your accent. Your English is very good, especially considering all the nicknames, abbreviations and idioms in both English and DeFi!

Thank you!

Upvoted-Promoted-ReTweeted!

Knowledge is essential.

Let the traders decide DeFi-CeFi-Risk-Reward.

Posted Using LeoFinance Beta

Hey ...thanks a lot!

Posted Using LeoFinance Beta

I like pancake, staking CAKE-BNB LP while keep on learning the whole platform. The Create a pool for your token part though, I don't know what that is. What happen somebody created a pool, we joined, and they popped smoke?

Posted Using LeoFinance Beta