How is the Ethereum network doing these days? The most recent update was the Shanghai update that enabled the possibility for everyone who staked Ethereum to the Beacon chain to be able to withdraw. Prior to this was the major update back in September 2022, when Ethereum moved from Proof of Work (PoW) consensus to Proof of Stake (PoS).

Since the PoS update the inflation was reduced for 90%, from 4.3% to 0.43%. Additionally, part of the ETH for transactions is burned, that pushed Ethereum into the deflationary territory. Meanwhile, the share of staked ETH kept on growing and is now approaching 20% drying up the liquid ETH supply.

Let’s take a look.

Image background generated with Midjoureny

Here we e will be looking at:

- Daily Inflation and Burns

- Overall Supply

- Number Of Wallets

- Active Wallets

- Transactions

- Fees

- Staked ETH

The data presented here is mostly gathered from the etherscan charts and Dune Analytics.

Supply

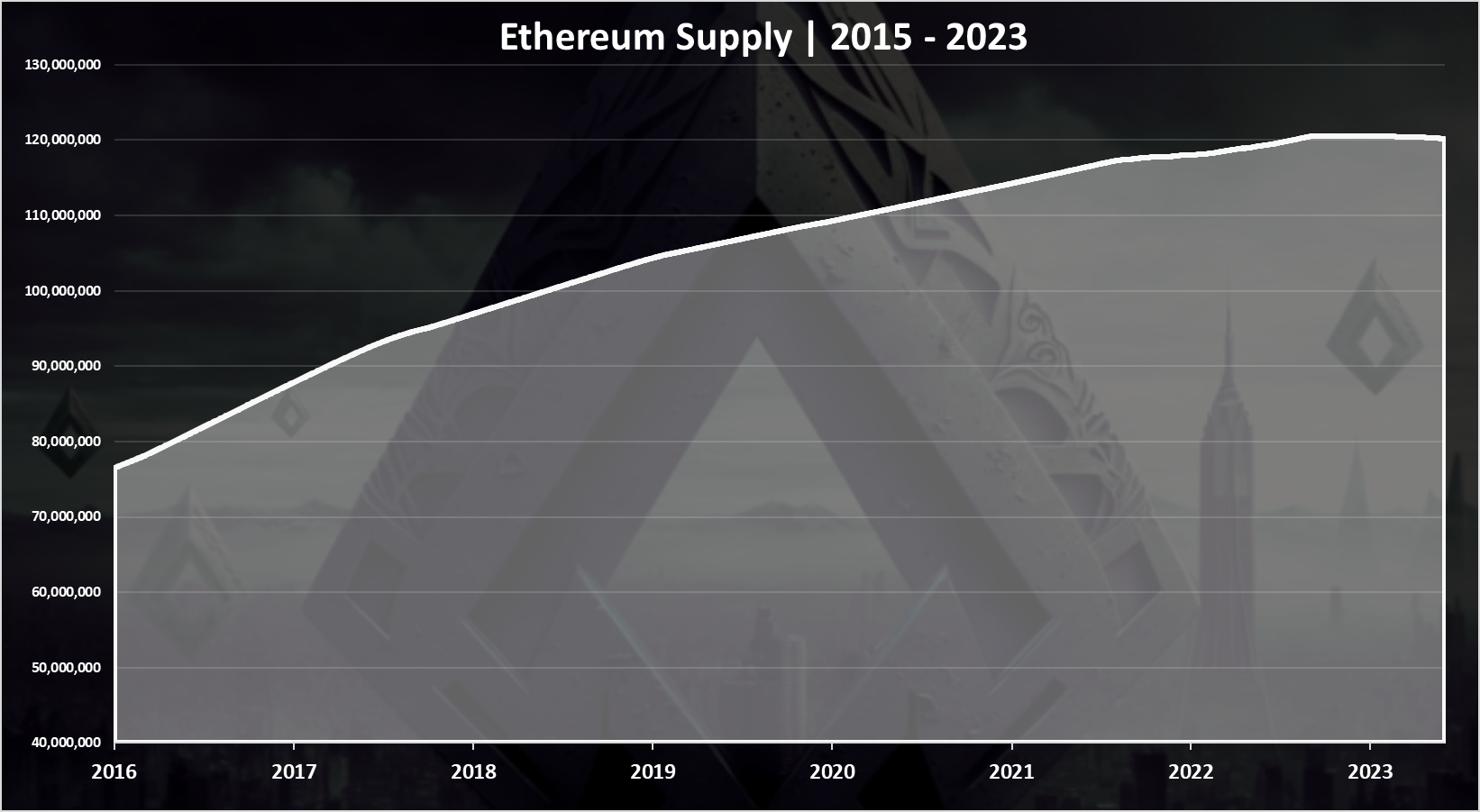

The overall supply now looks like this:

A steady increase in the supply from just above 70M in 2015 to 120M where we are now.

We can see that in the last period after the merge the supply has been almost stagnant, and even drop a little.

Ethereum Supply After The Merge

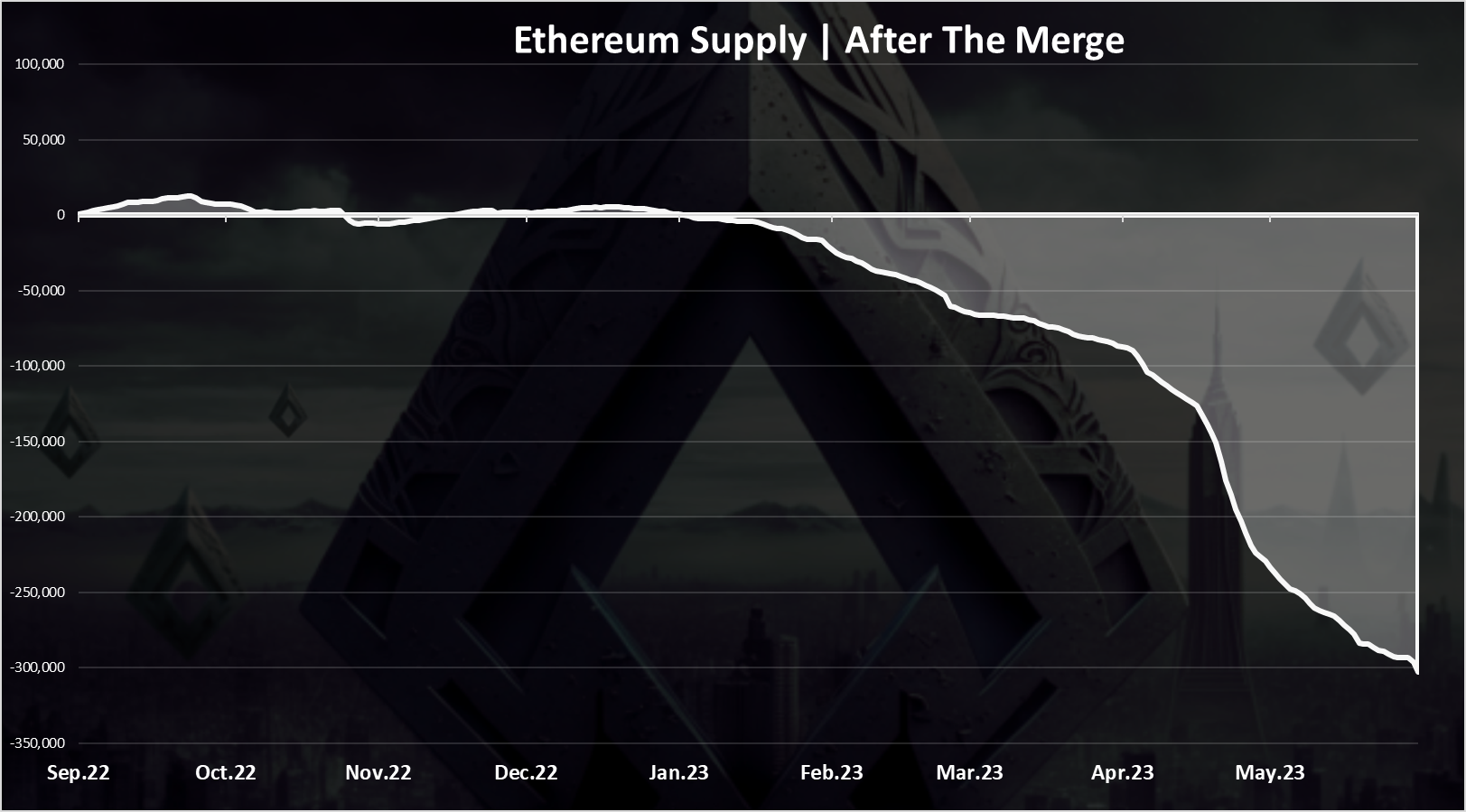

The chart for the new ETH issued after the merge looks like this.

Overall, ETH has been deflationary in the period. But for how much? In absolute numbers its around -300k ETH, while in relative number it is -0.25%.

We can see that while small, 0.25% is a visible number and the ETH supply tends to be deflationary now. Depending on the market and the overall transactions on the network this number can go up or down.

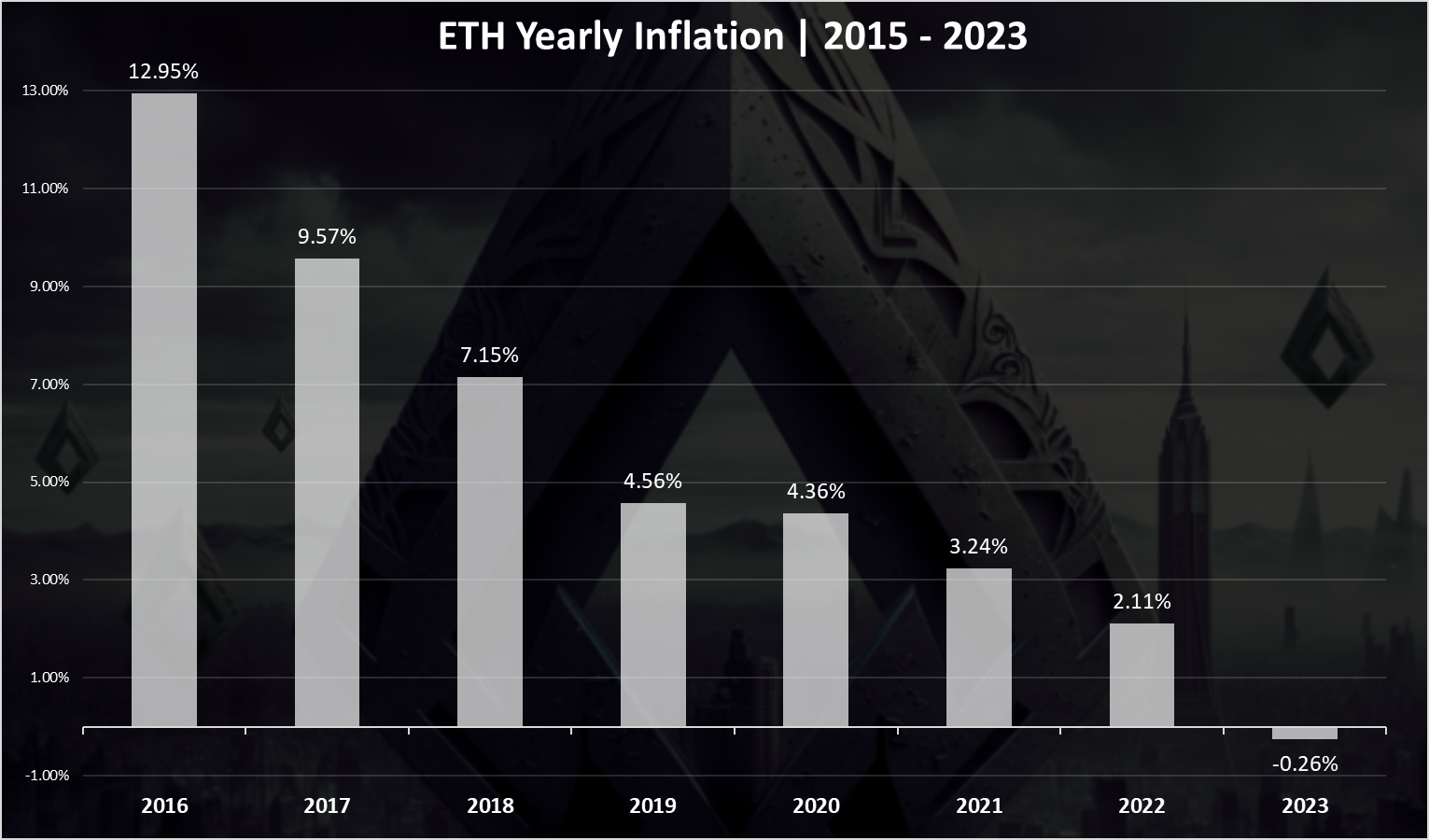

The table for the yearly inflation looks like this.

From more than 10% down to negative -0.26% in 2023. Note that 2023 is not over yet, but it will most likely end negative, and it will be the first year for Ethereum with negative inflation.

Number of Wallets

Now for the general network numbers.

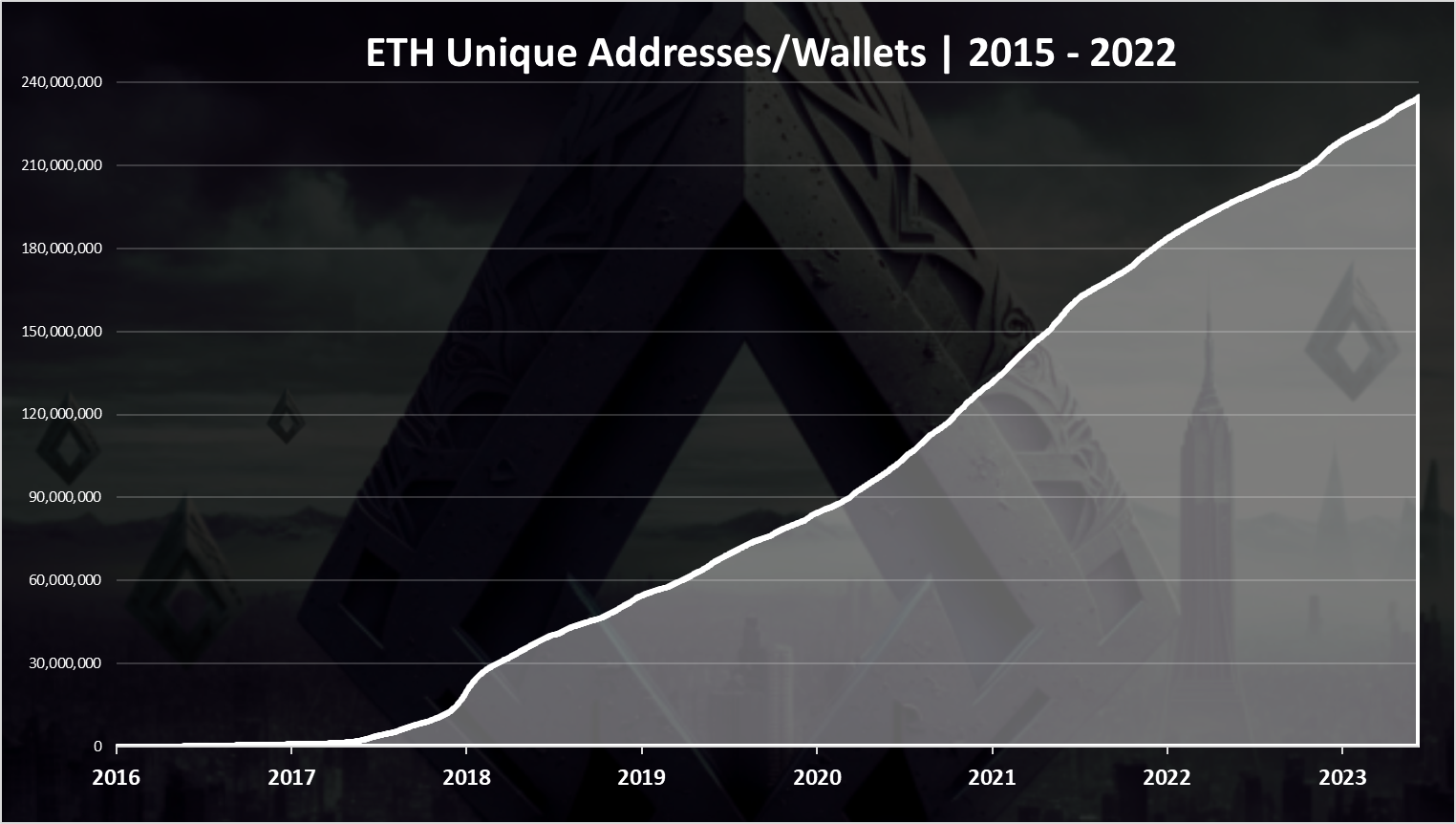

Here is the chart for the total number of Ethereum wallets created.

Ethereum now has more than 234M wallets!

It is the leading blockchain in crypto by the number of wallets. For comparison Bitcoin is still under 100M wallets.

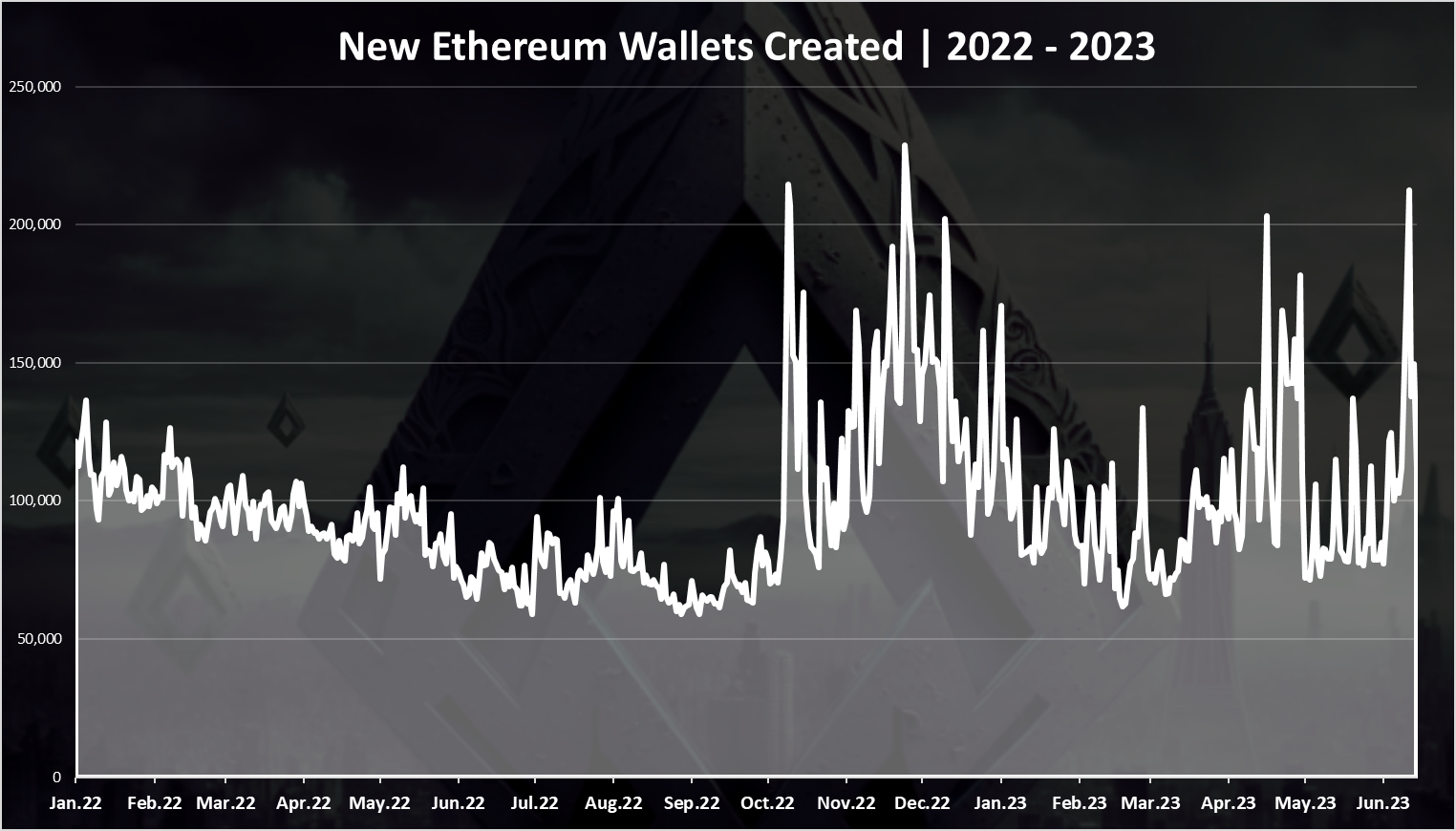

When we look at the number of new daily wallets created we get this chart.

This is starting from 2022.

A steady number of new wallets created and then a spike after October 2022. From 70k up to 230k per day. After December 2022 the numbers went down again and up again in May 2023 to 200k. In the last days we have around 100k new wallets per day.

Active wallets

How many of the are being used?

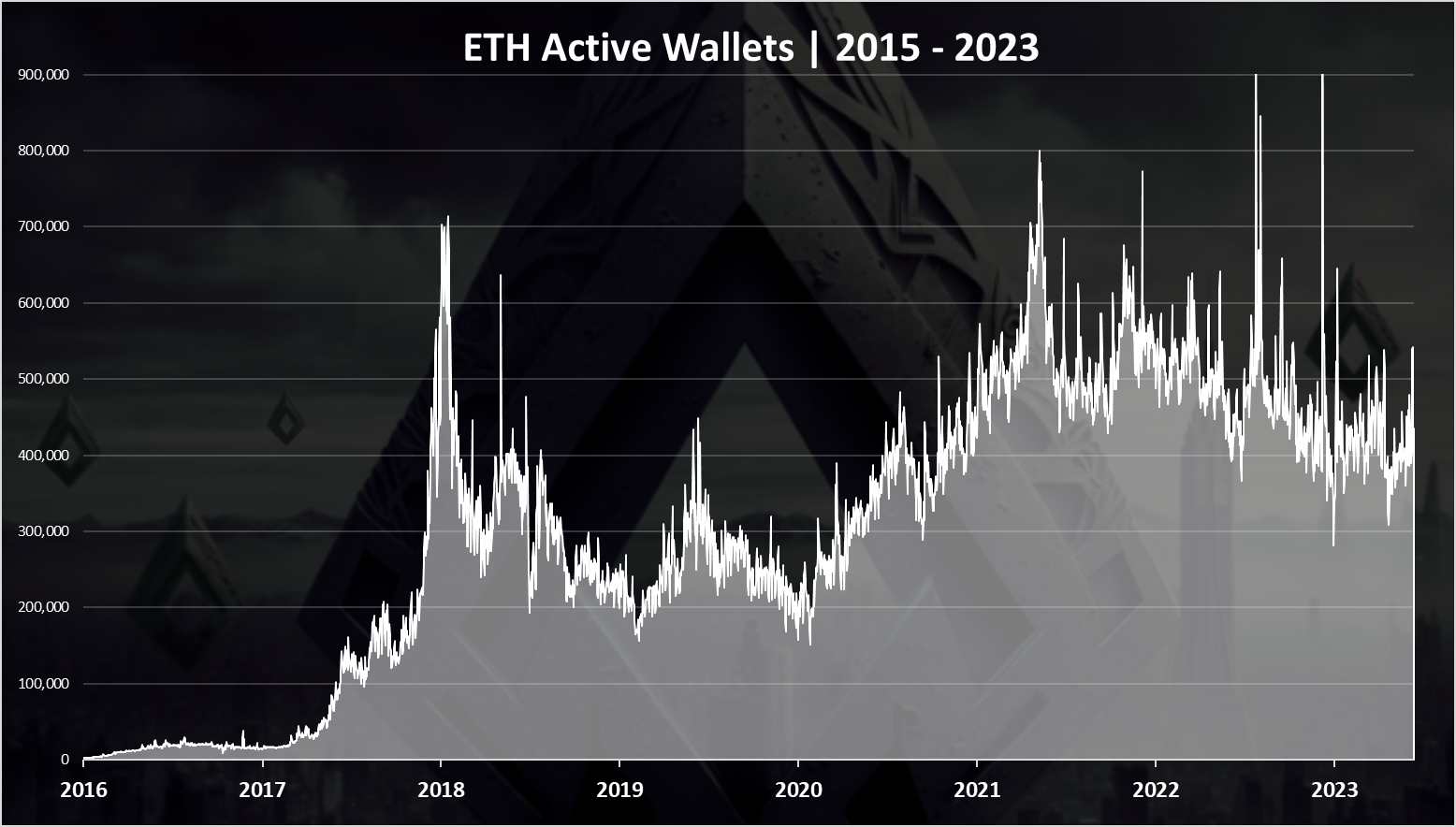

Here is the chart.

We can see that there was an overall uptrend up until 2021, reaching around 700k active wallets. Since then, there is a downtrend and we are now around 400k active daily wallets, with some occasional spikes.

Transactions

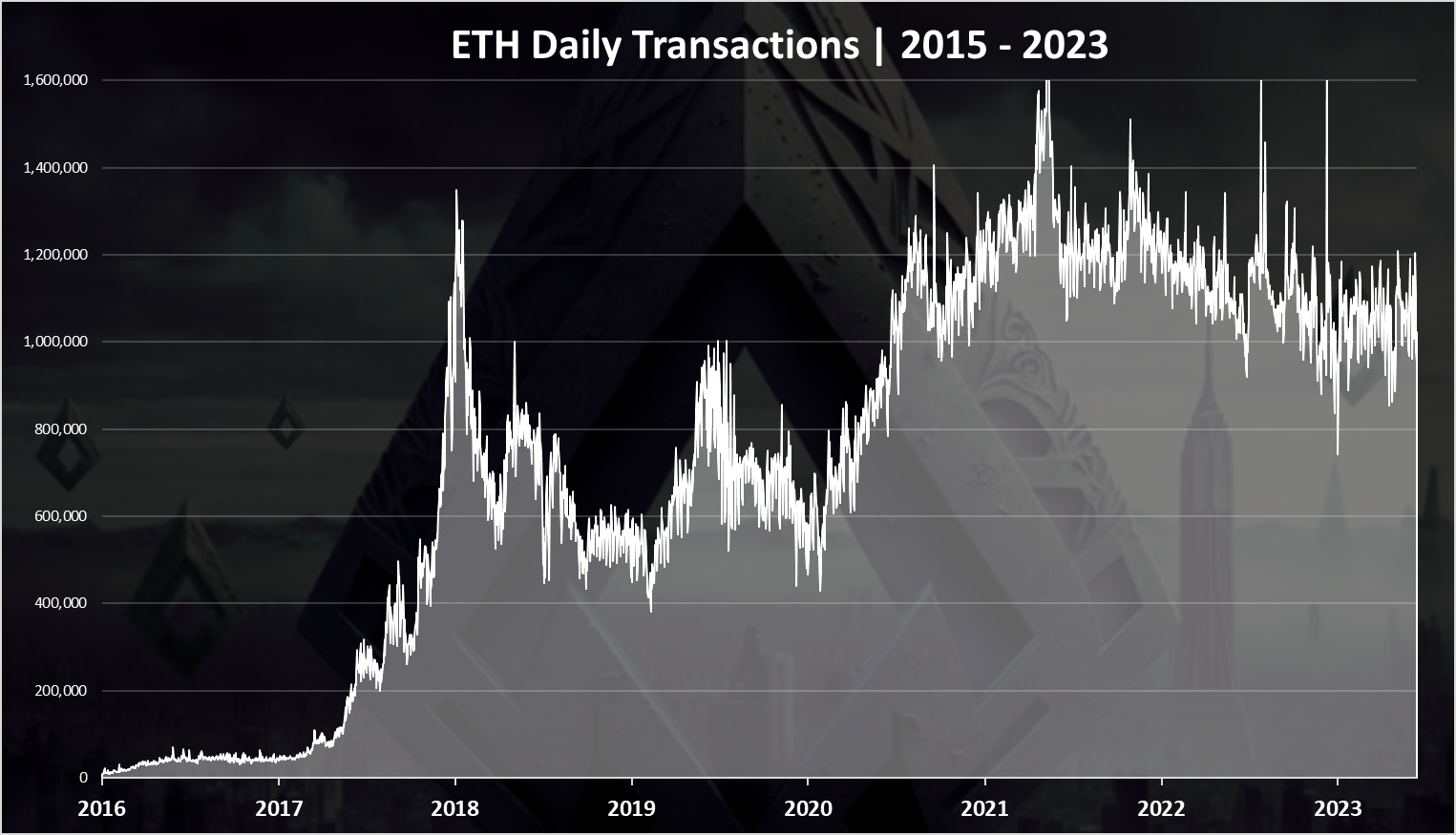

How about the number of transactions? Is the Ethereum network now more active after the merge? Here is the chart.

There seems to be a small uptrend in the numbers of transactions per day, but nothing significant. At the moment around 1.2M transactions daily on the Ethereum network.

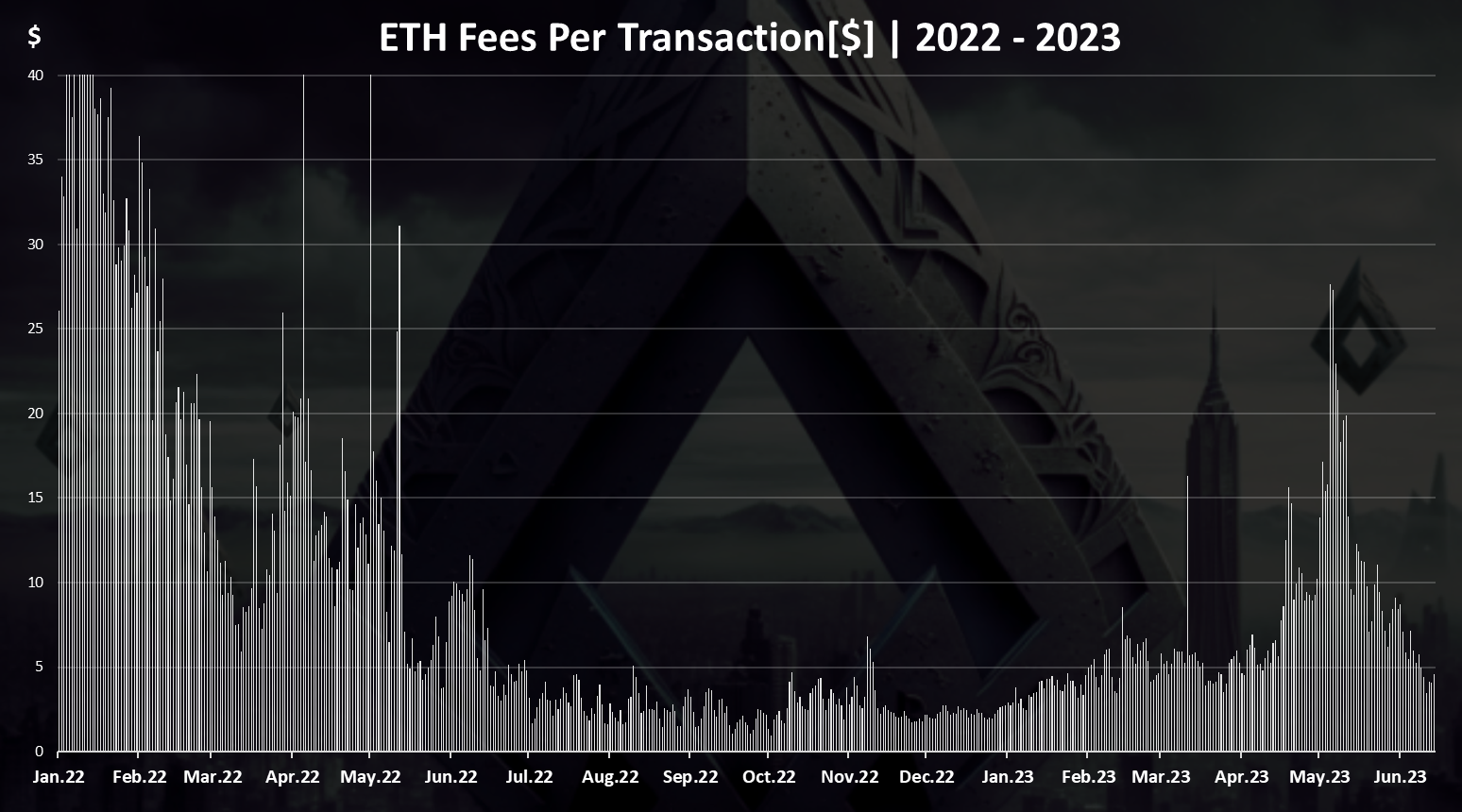

Fees

There was misunderstandings that the merge will make the fees on Ethereum smaller. But this is not the case. The merge is a consensus upgrade, not a scalability upgrade. That should come later with Sharding. Here is the chart for the fees in 2022 - 2023.

We can see that there was a small spike in the fees in May 2023, after a period of a downtrend dating back from 2022. The fees reached $25 for a short period of time and are now back at around $5.

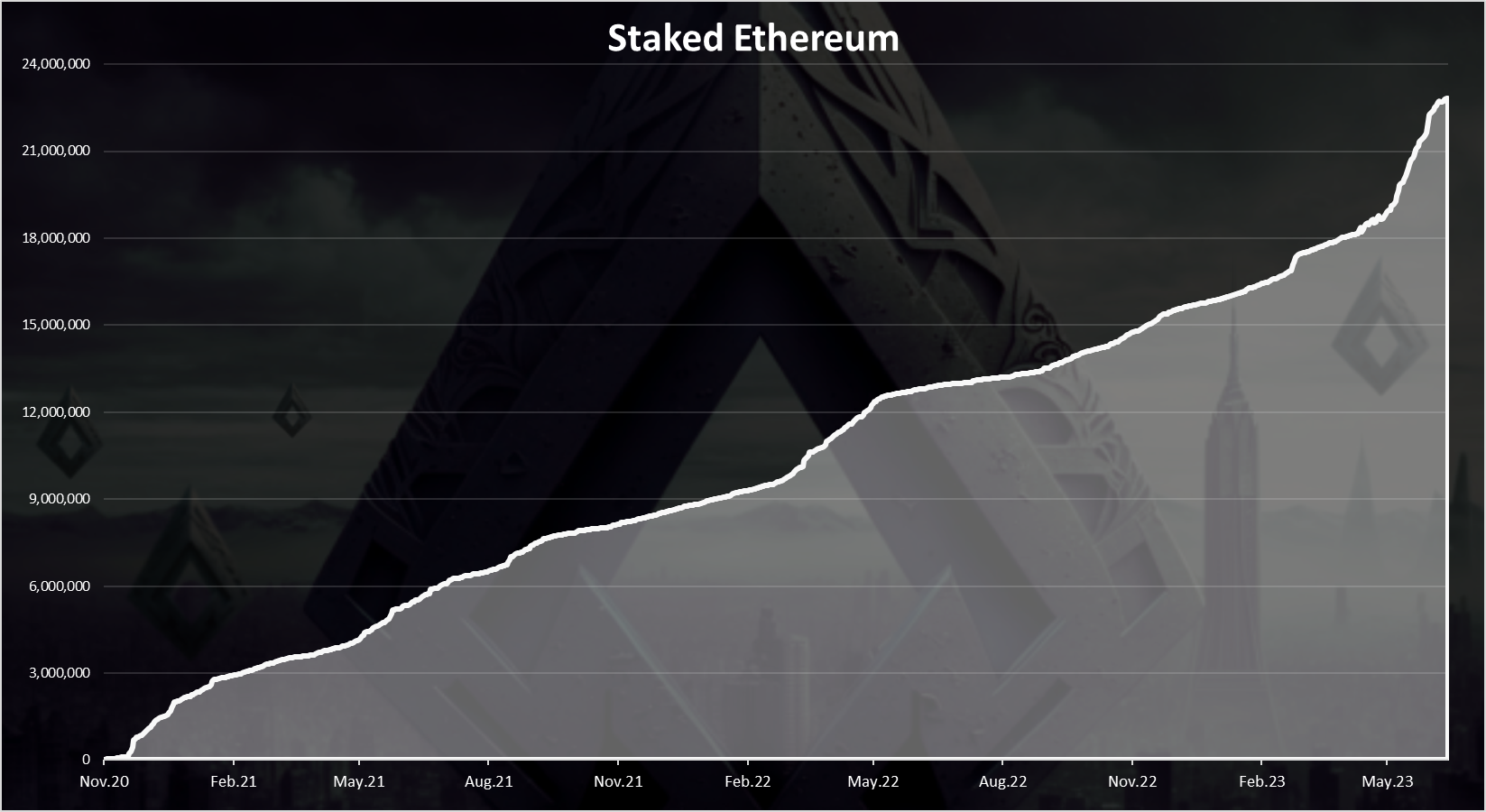

Staking Ethereum

Here is the chart for staked ETH.

The Ethereum staking has increased even more after the Shanghai update. There is now close to 23M ETH staked. The APR for staked ETH can vary but it is in the range of 4% to 6%, or on occasions when there are more transactions even more.

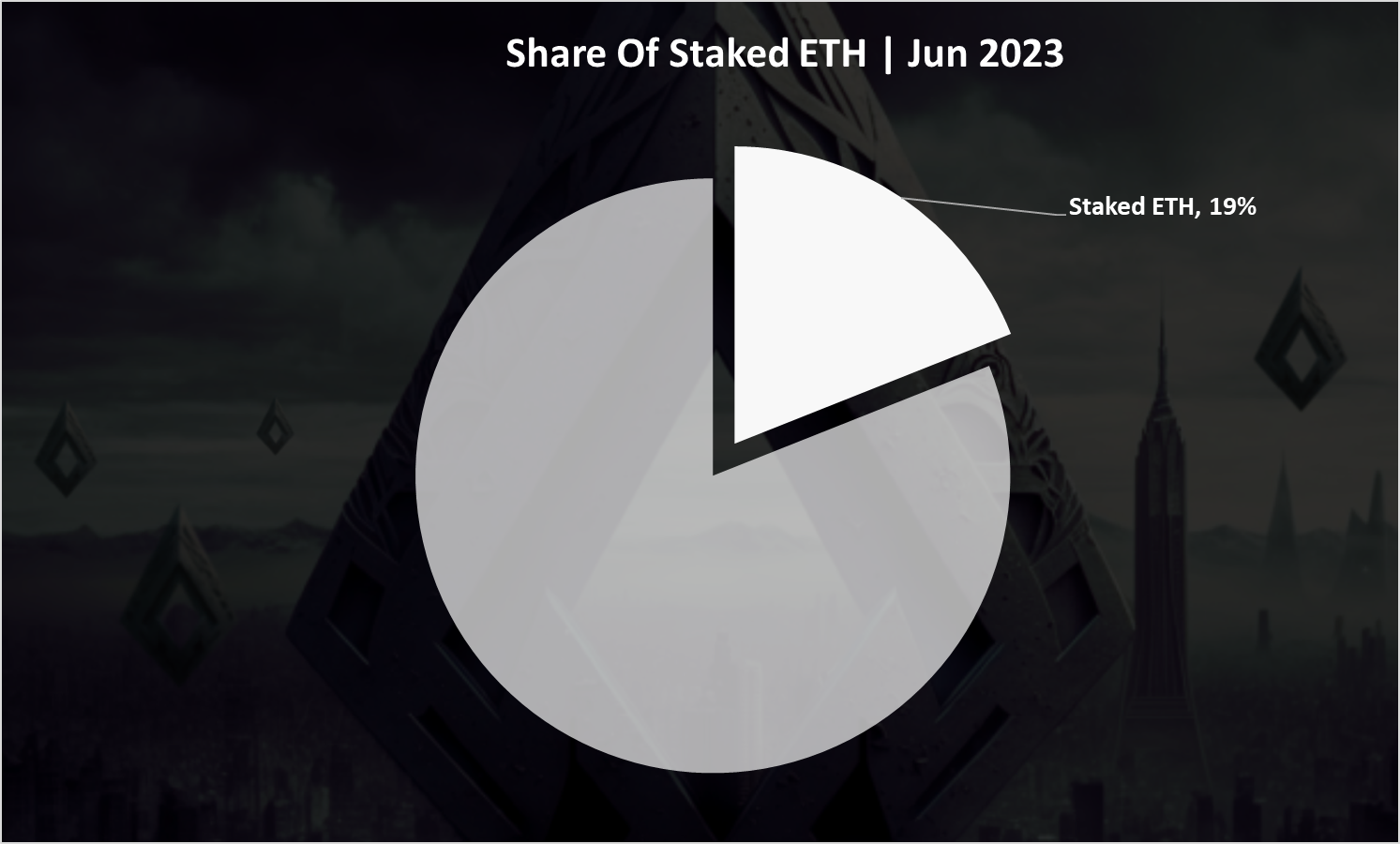

Share of ETH staked:

A 19% staked ETH from all the supply. We are now closing on the 20% mark. For a token of this size and market cap this is quite a big share, and the trend is still up.

Top Ethereum Stakers:

Who is staking the most? Here is the chart.

The Lido protocol is by far on the top position, with more than 7M ETH staked at the moment and growing. On the second spot is Coinbase and then Binance.

In summary the most noticeable change in the last period is that the staking is up, with Lido taking a big share, the transactions and the active accounts are stable with around 1.2M transactions and 500k active daily accounts. Fees are somewhat in the middle with around $5 per tx. The supply keeps going down and Ethereum is deflationary in 2023 currently with -0.26% on a yearly level.

The next steps for ETH are in terms of scaling. It will be interesting to see how this will be implemented and how will the network act in a next bull cycle.

All the best

@dalz

Posted Using LeoFinance Alpha

That is a really good sign!! i really belive that ethereum will do really good in the next bull run!

Eth is doing pretty good even in this bear market. Inflation has decreased amazingly , supply decrease is also shocking.

I didn't go through it. But really great information.

#hive #posh

The rewards earned on this comment will go directly to the people ( milaan ) sharing the post on LeoThreads,LikeTu,dBuzz.https://leofinance.io/threads/milaan/re-leothreads-2kgbwndkm

These are really great information every hivians should know

From the way we have seen all these things, it is clear that people also have a lot of faith in the base and they are stacking it due to which the demand for it is very high. This is very good thing happening as we may see its price go up a lot in the near future. Thanks for sharing this great knowledge with us.

$PIZZA slices delivered:

(6/10) @aurikan tipped @dalz

OPEN CHAOS AND HOLD

!PIZZA😎