The Shanghai update was activated back in March 2023 and it enabled the possibility for everyone who staked Ethereum to the Beacon chain to be able to withdraw/unstake. This was one of the most anticipated updates and there was a lot of uncertainty around it. Everyone who staked ETH was unable to withdraw it, effectively locking it until this update happens. As a reminder, the beacon chain went live at the end of 2020, and it takes two and a half years since then for the unstaking option to went live.

How is this affecting staking Ethereum? Are more users unstaking or maybe staking now? Its been five months since the unstaking is live so lets check it out.

Image background generated with Midjoureny

Here we e will be looking at:

- Staked Ethereum by date

- Staked VS Unstaked ETH since the Shanghai update

- Share of staked ETH

- Number of validators

- Top stakers

- Change in the staked ETH by users since the update

The data presented here is mostly gathered from Dune Analytics and Ethscan.

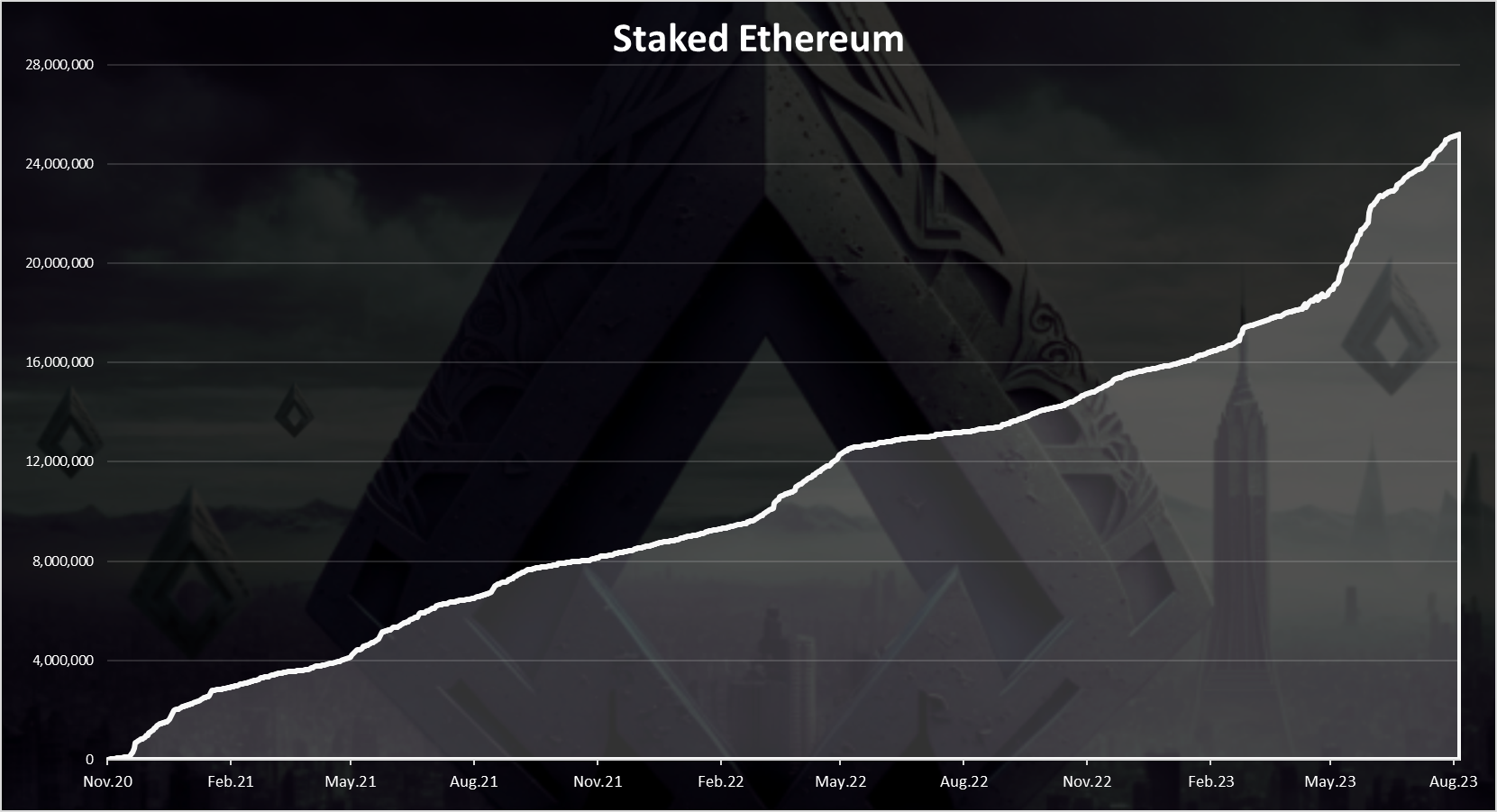

Staked Ethereum by Date

Here is the chart.

This is the amount of staked ETH since the launch of the Beacon chain and the option for staking Ethereum in November 2020.

We can see a constant growth in the amount of ETH staked and, on some occasions, a sharp increase. We can notice that in the last few months there is an uptrend. At the moment of writing this there is 25.2M ETH staked.

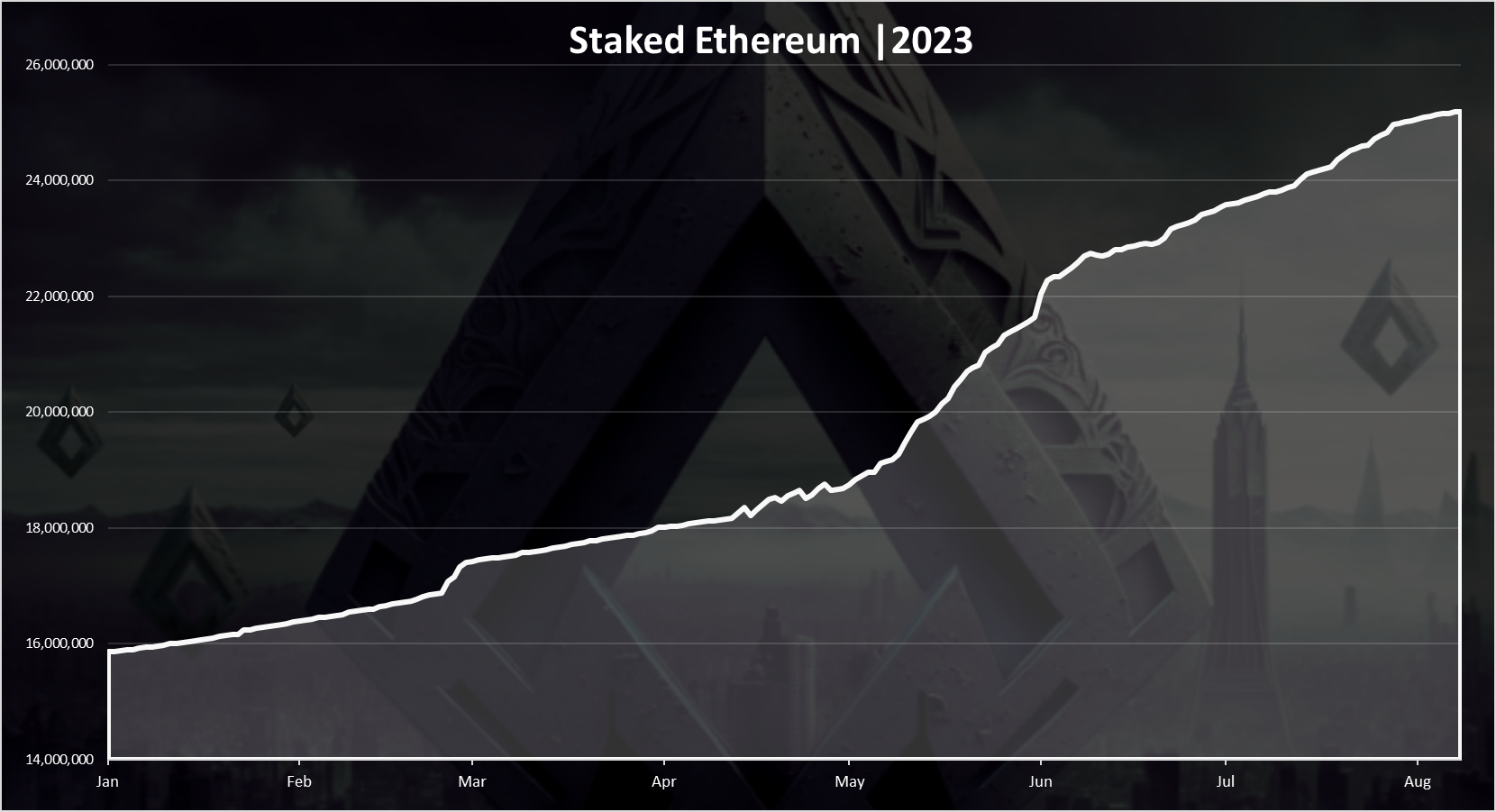

If we zoom in 2023 we get this:

Here we can notice some ups and downs back in March and then a strong growth in May 2023. The unstaking option has caused more Ethereum to be staked than unstaked. Probably users felt more comfortable staking now knowing that they can unstake at any moment if needed.

At the moment of activating the Shanghai update there was 18M ETH staked and now there is more than 25M. A 7M more ETH staked after five months of the update.

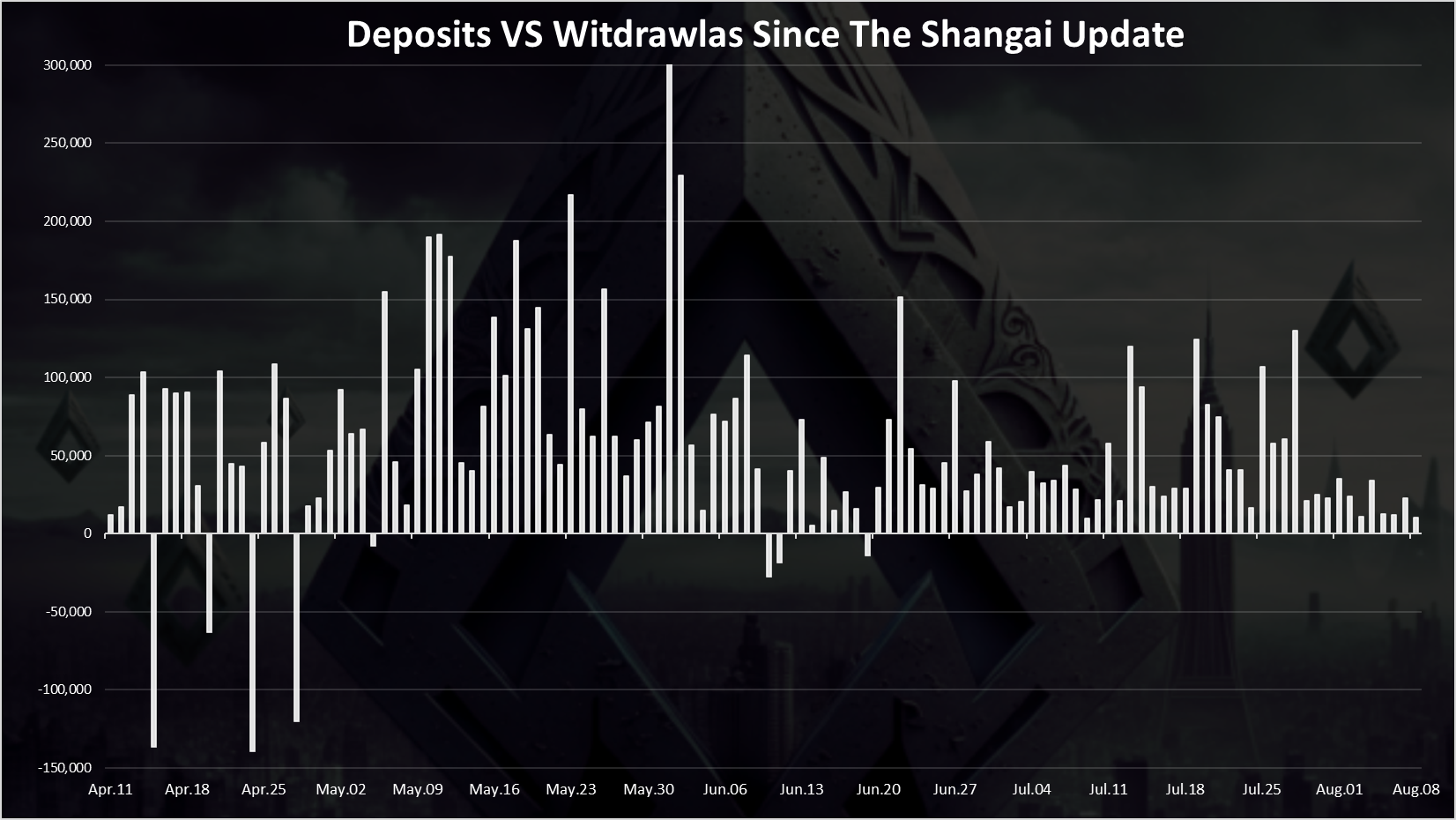

Deposits VS Withdrawals Since the Shanghai Update

If take a look at the daily deposits vs withdrawals since the update we get this:

Most of the days are in positive, meaning that more ETH is being staked in general that ustaked, even with the ustaking option enabled. There are few big unstaking events in April, where more than 100k ETH was unstaked in a day.

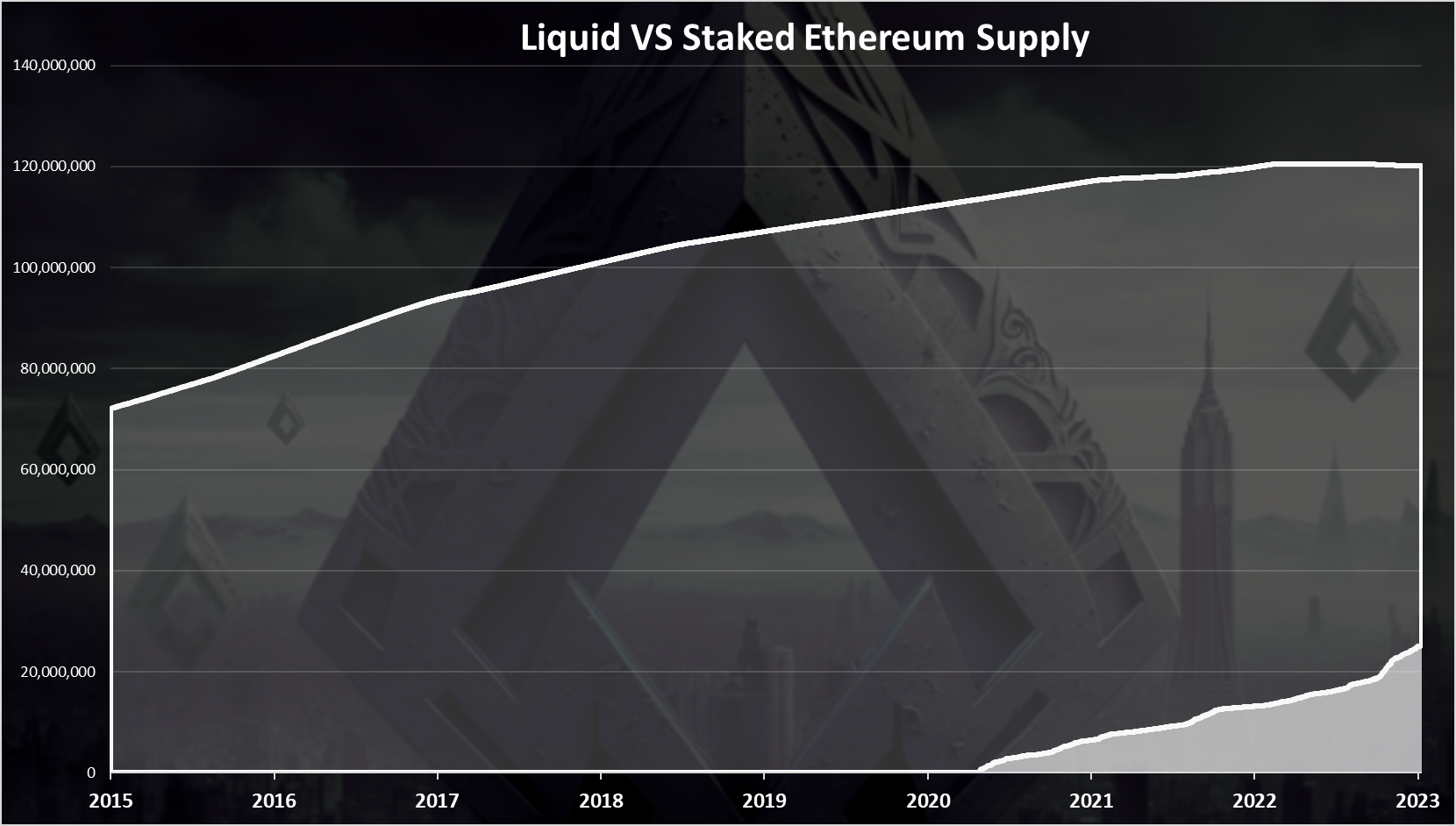

Share of Staked Ethereum

What is the share of staked Ethereum? Here is the historical trend.

We can notice that the staking was activated later in the Ethereum lifecycle and since recently it has started to gather more momentum. It’s worth noting that since last year Ethereum cut their inflation down as well and is deflationary in the last period. What this means that the ETH issuance is lowered, and at the same time the staking is locking more ETH, basically lowering the liquid supply from both ends.

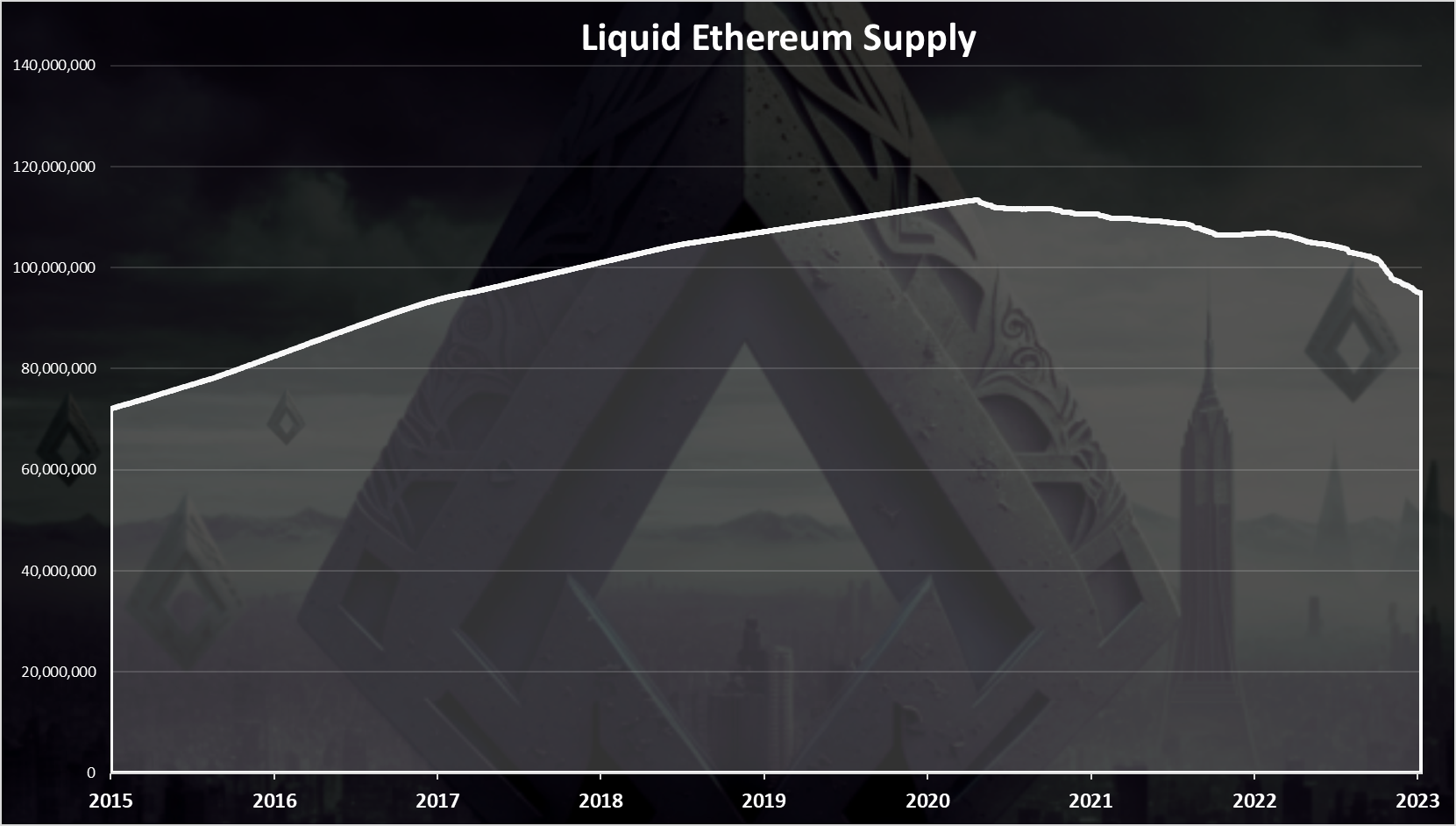

The liquid Ethereum supply looks like this:

We can see the drop in the liquid ETH supply, from 113M at the top in 2020 to 94M now.

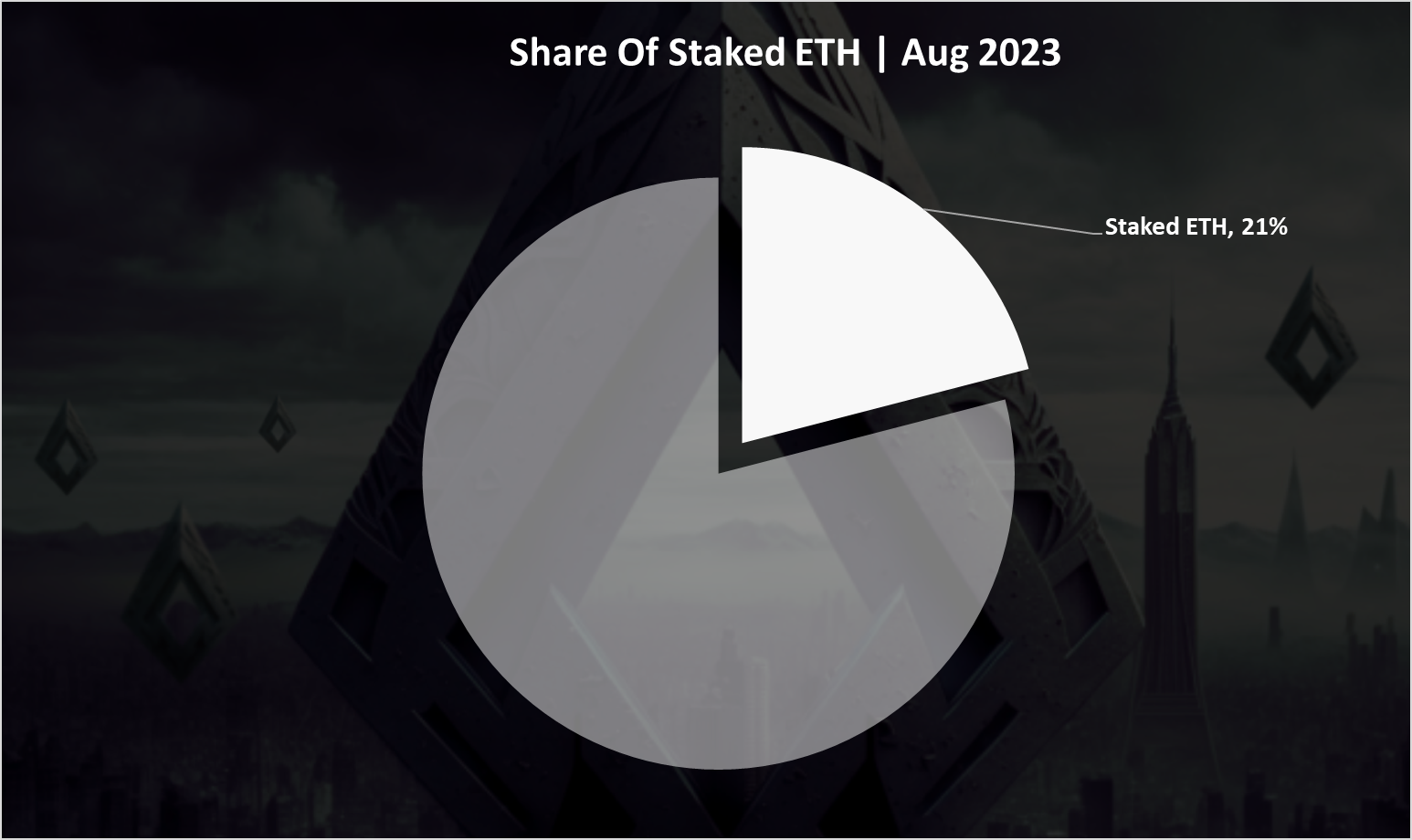

The current share of staked ETH looks like this:

When compared to the total ETH supply that is around 120M now, the 25.2M staked ETH represents a 21% of the supply.

Number of Validators

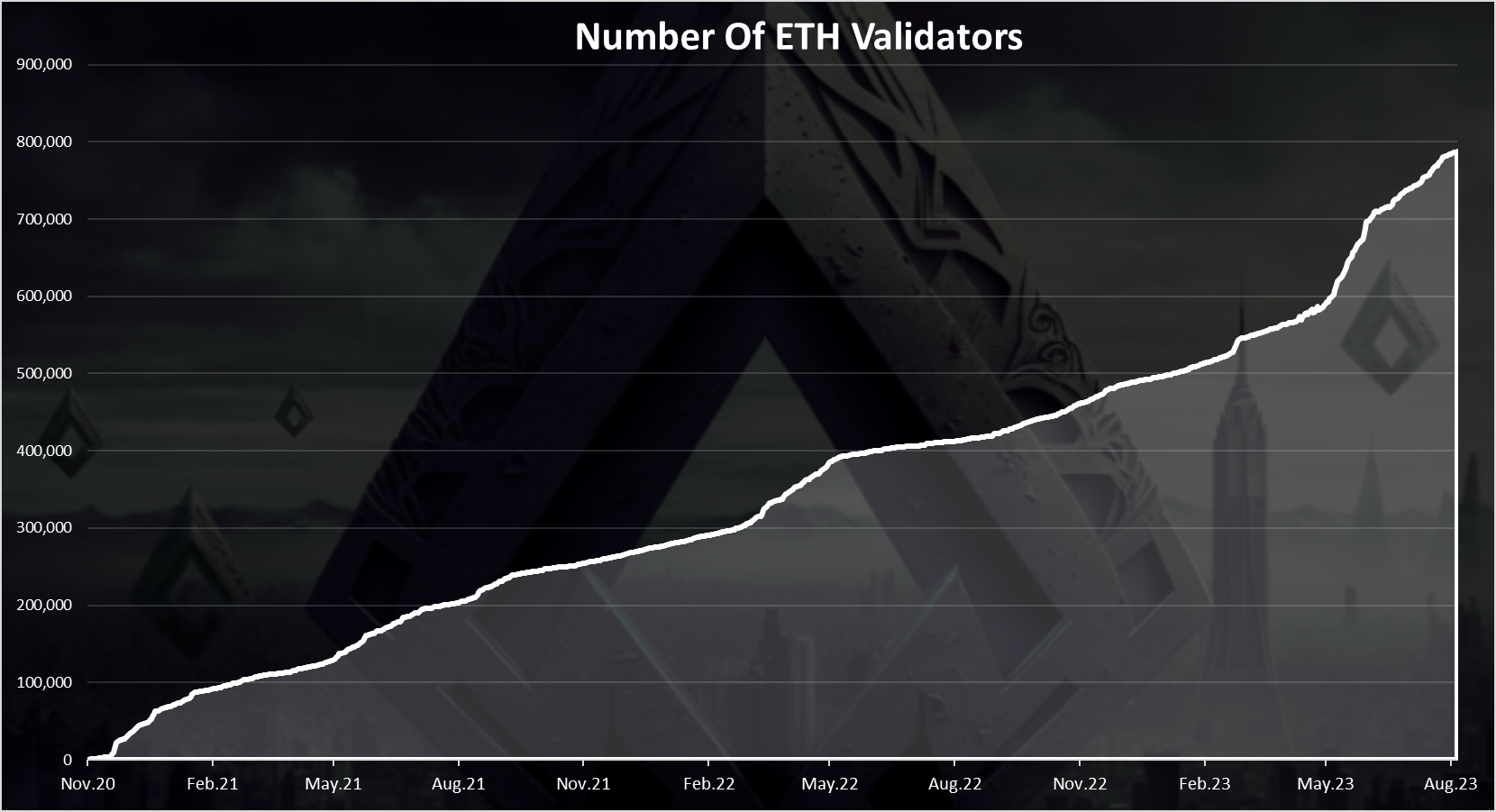

Here is the chart.

The number of validators has also continued to grow. At the moment there is close to 800k validators, adding 200k more since Shanghai.

Note that these are not unique validators, as most of them are represented by a pool or some type of CEX. There is now even a proposal to increase the upper limit for a validator from 32ETH, so at some point the number of validators might consolidates.

Top Ethereum Stakers

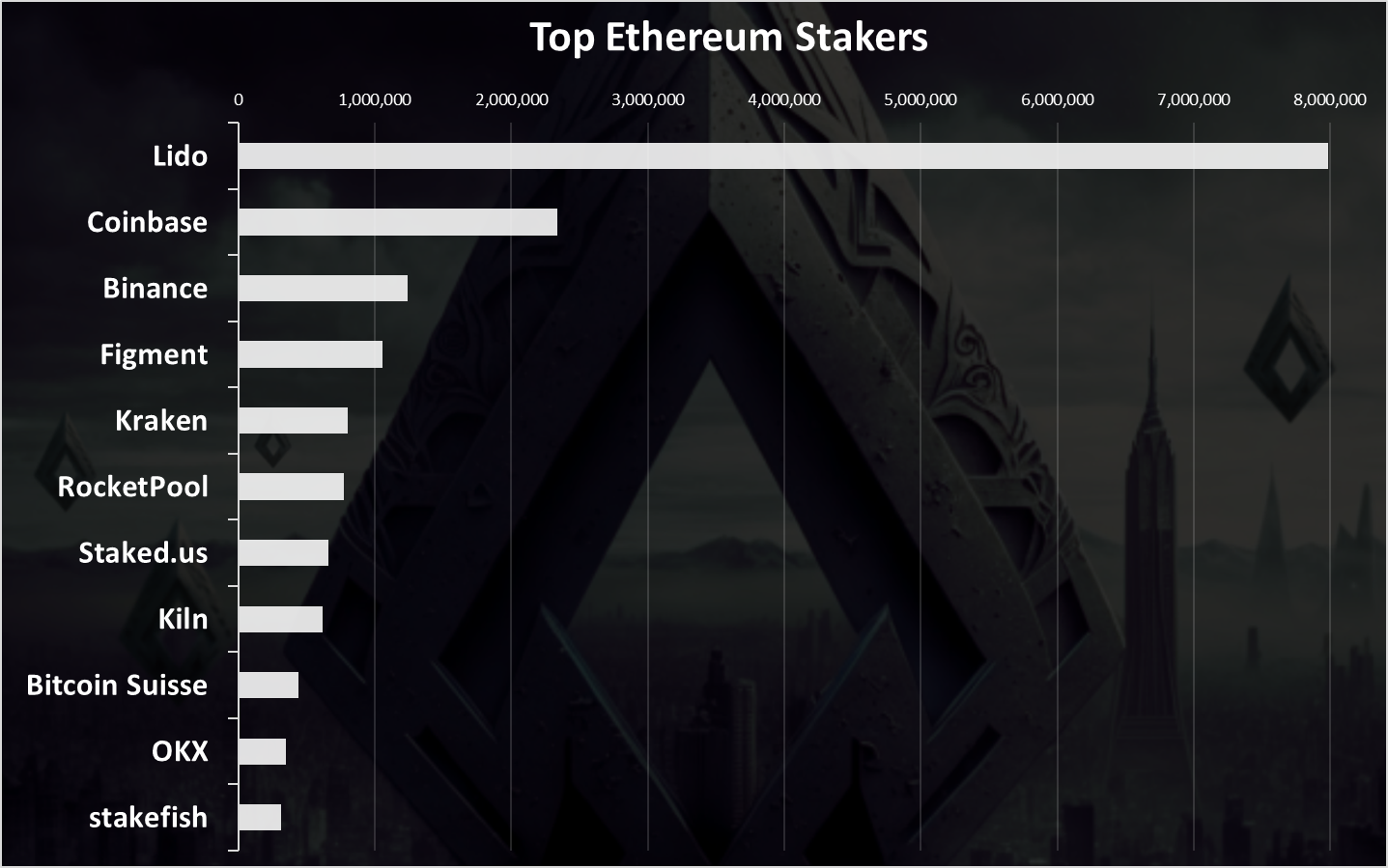

Who is staking the most? Here is the chart.

The Lido pool is on the top with almost 8M ETH staked. This pool has even its own token for governance. On the second spot is the Coinbase exchange, followed by another exchange Binance. Figment and then Kraken are next on the list, but this exchange is already in a process of unwinding its staked ETH as it got a fine from the SEC for offering staking as a service.

Who Has Been Staking/Unstaking the Most Since the Shanghai Update

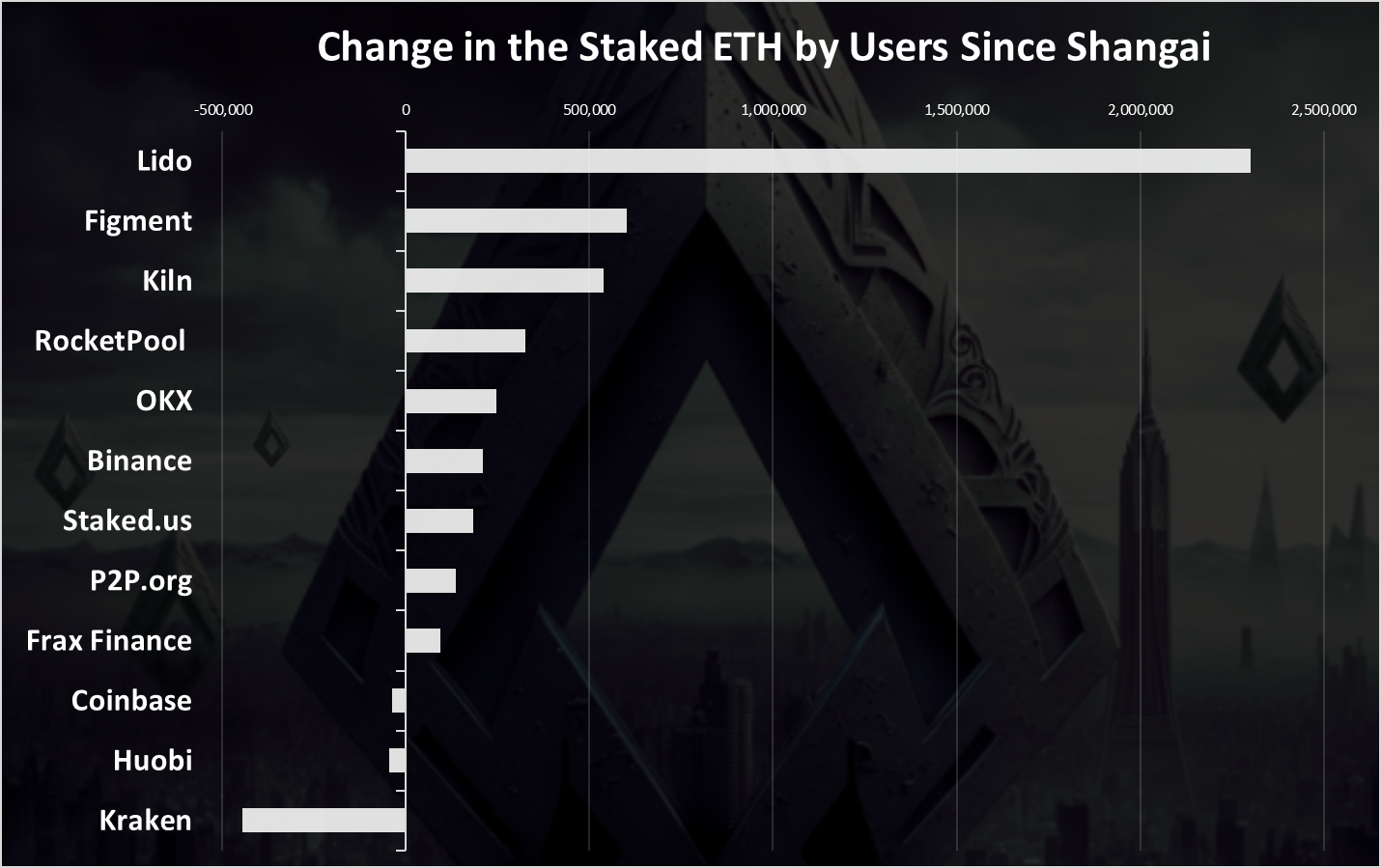

Here is the chart.

Kraken is the outlier here with -450k ETH unstaked since the update. This is most likely due to the legal issues the exchange has with the SEC.

On the other side of the spectrum is the Lido pool, who has increased its staked ETH by 2.3M ETH since the update. The LIDO protocol has grown so much that it is now a concern for the Ethereum ecosystem causing a centralization issue.

All the best

Posted Using LeoFinance Alpha

There is too much concentration in LIDO

Yes

Great analysis update about ETH and its activities

It is nice to see the numbers of ETH validatore increasing

Thanks for sharing

Thank you for the great analysis of ETH staking. I learned a lot by reading this. I wonder what would happen if Lido was hacked like Curve was recently.

!PGM

!ALIVE

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @tuisada. (4/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power and Alive Power delegations and Ecency Points in our chat every day.

It's really nice to know about all this and thanks for sharing.

Thanks for sharing this.

Always like to see your posts because it gives us very great and amazing knowledge. Thanks for sharing.

I liked how you analyzed staking and unstaking trends with charts and data. I think this is a very relevant topic for the Hive community and cryptocurrency investors in general.

Congratulations @dalz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 12000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: