This is a report for the Hive supply and inflation for April 2022. Tracking the HIVE supply has always been challenging and this monthly post aims to provide an overview of the flow of inflation, conversions etc.

Let’s take a look!

The projected inflation for 2022 is around 7%.

The thing is Hive has a double currency system HIVE and HBD and there are conversions between them that add or remove HIVE from circulation on top of the regular inflation. Furthermore, there is HIVE in the DHF that is slowly being converted to HBD and also HIVE sent to the DHF is also converted to HBD. Because of this additional mechanics the HIVE inflation and supply can be drastically different in real time then the regular one.

To be able to follow the HIVE supply we need the following.

HIVE Created:

- Author rewards

- Curation rewards

- Witness rewards

- Staking rewards

- HIVE from HBD Conversions

HIVE Removed:

- HIVE to HBD conversions

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

- Transfers to null + null as post beneficiary

- New accounts creation fee

HBD Created:

- 10% share of the inflation to the DHF

- HBD Author Rewards

- Interest payouts

- HIVE to HBD Conversions

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

HBD Removed:

- HBD to HIVE Conversions

- Transfers to null + null as post beneficiary

When all the above is summed up, we will get all the differences between them and how much HIVE and HBD was created or removed in a certain time frame.

With this said let’s take a look at the charts.

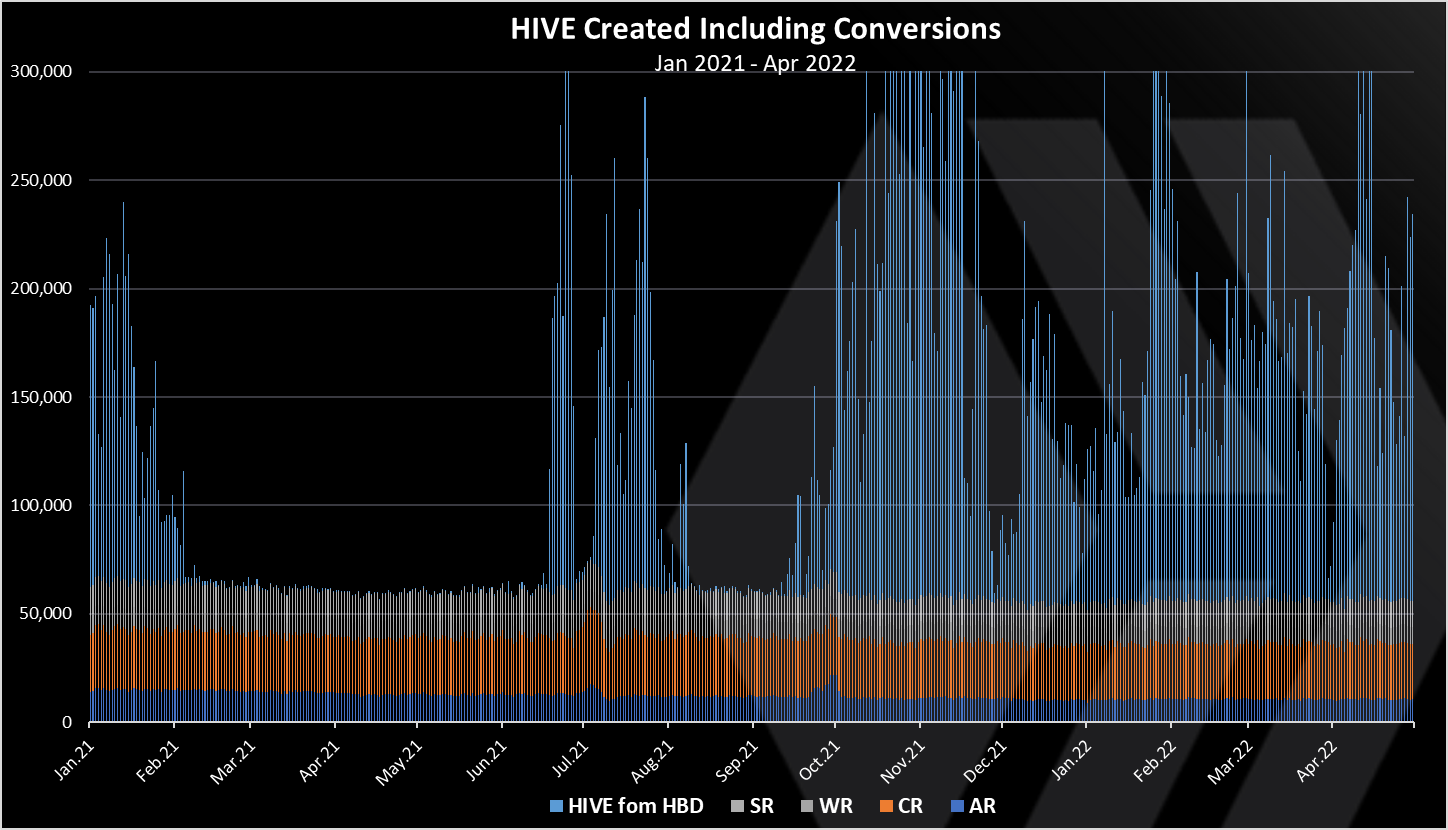

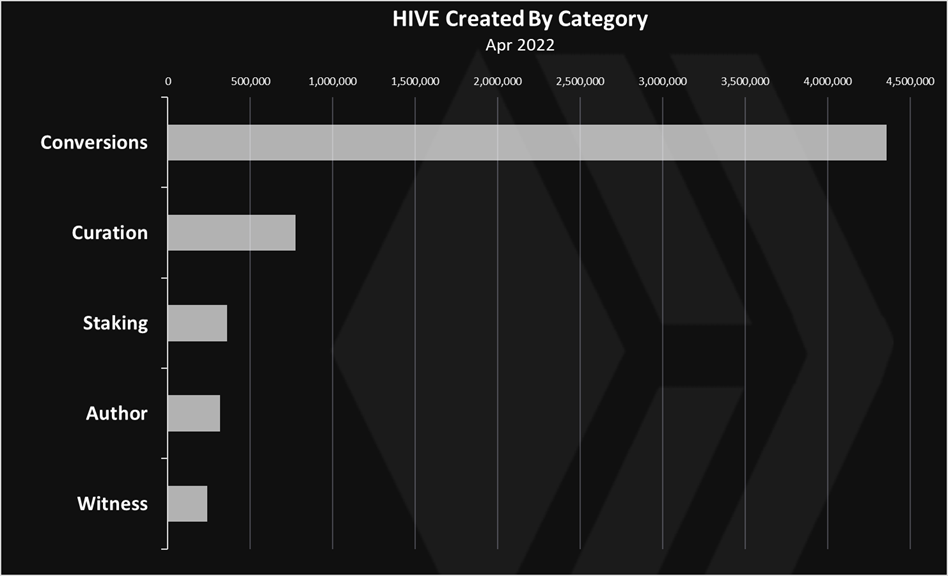

HIVE Created

Here is the chart.

- HBD to HIVE conversions

- Curation Rewards

- Author rewards

- Staking Rewards

- Witness Rewards

All the above are paid as Hive Power or VESTS, except for HBD to HIVE conversions.

We can notice that the HBD to HIVE conversions are the dominant in the chart. Thing is these work both ways and a big part of them is converted back to HIVE, especially through the work of the stabilizer.

The regular inflation is around 55k HIVE per day. It has been slowly decreasing in the period. In April there was on average there was around 145k HIVE per day from HBD conversions, although as noted most of them are converted back to HBD. A big part of the conversions in both of the directions are now generated from the @hbdstabilizer.

A total of 6M HIVE was created in the last month, out of which 4.3M from conversions and 1.7M from regular inflation.

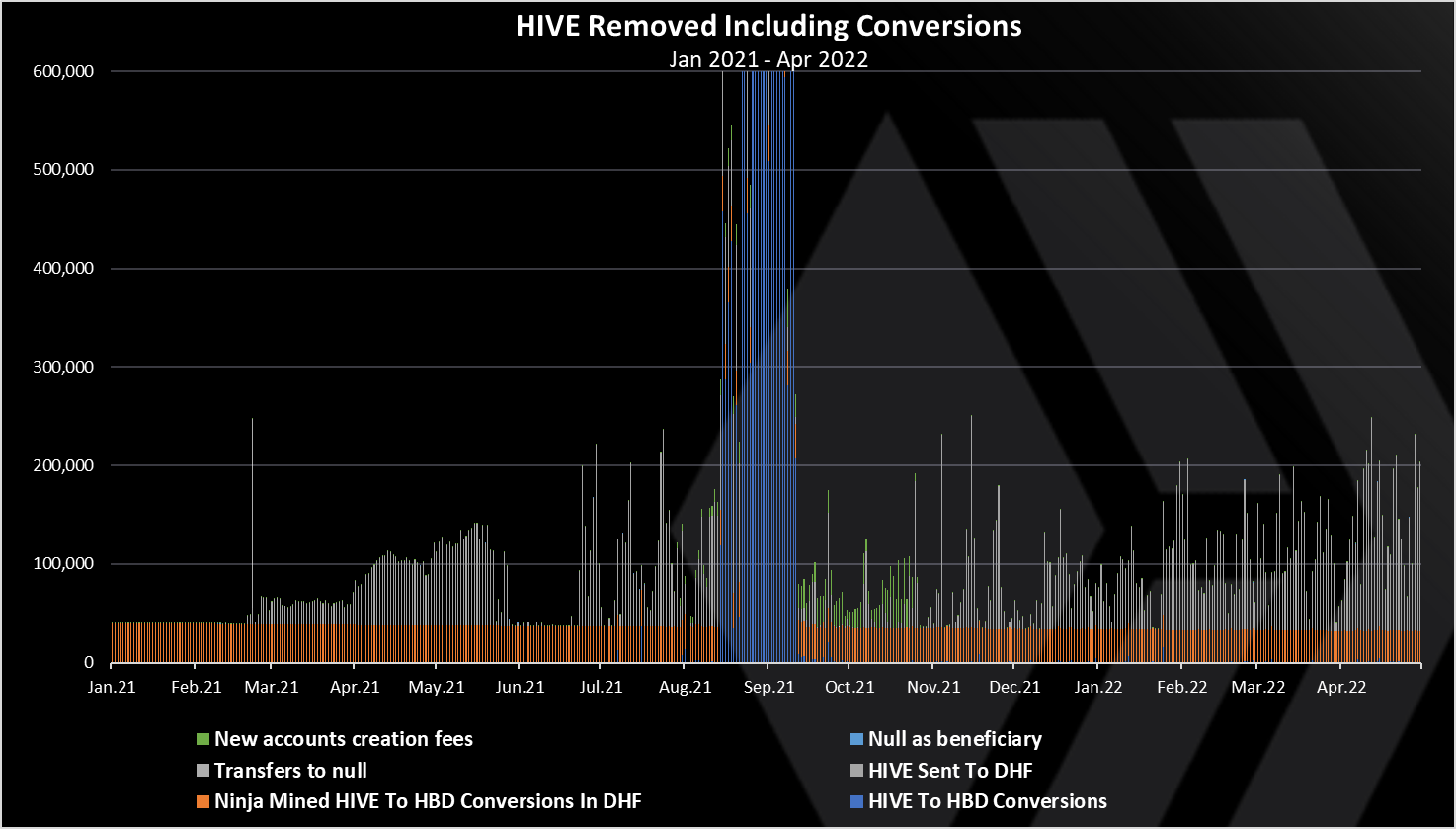

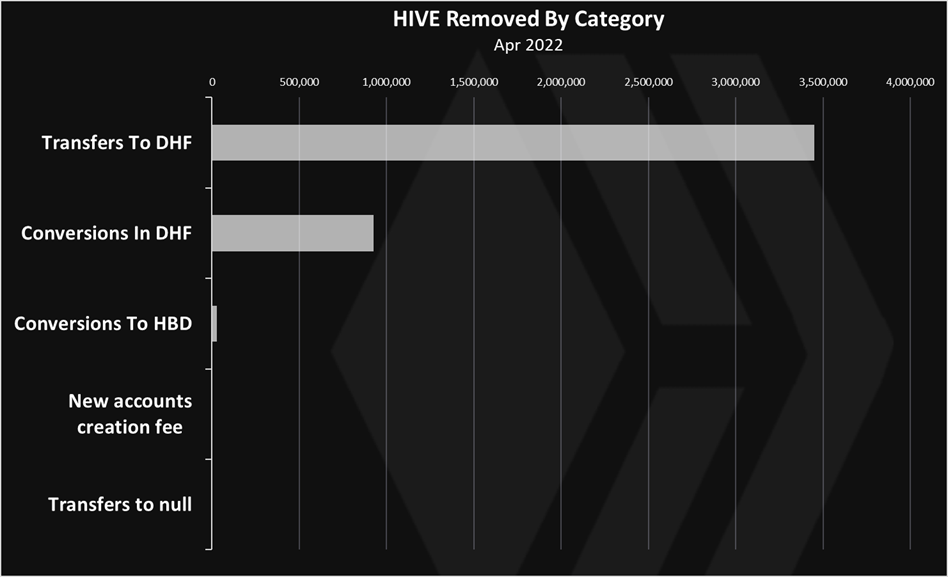

HIVE Removed From Circulation

Here is the chart.

The above takes into consideration six different ways of HIVE removed

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

- Transfers to null

- Null as post beneficiary

- New accounts creation fee

- HIVE to HBD conversions

As we can see the conversions from HIVE to HBD that happened at the end of August and begging of September 2021 have impacted the chart heavily. On a few occasions there was 2M HIVE converted to HBD in one day.

Cumulative a total of 4.4M HIVE was removed in April 2022.

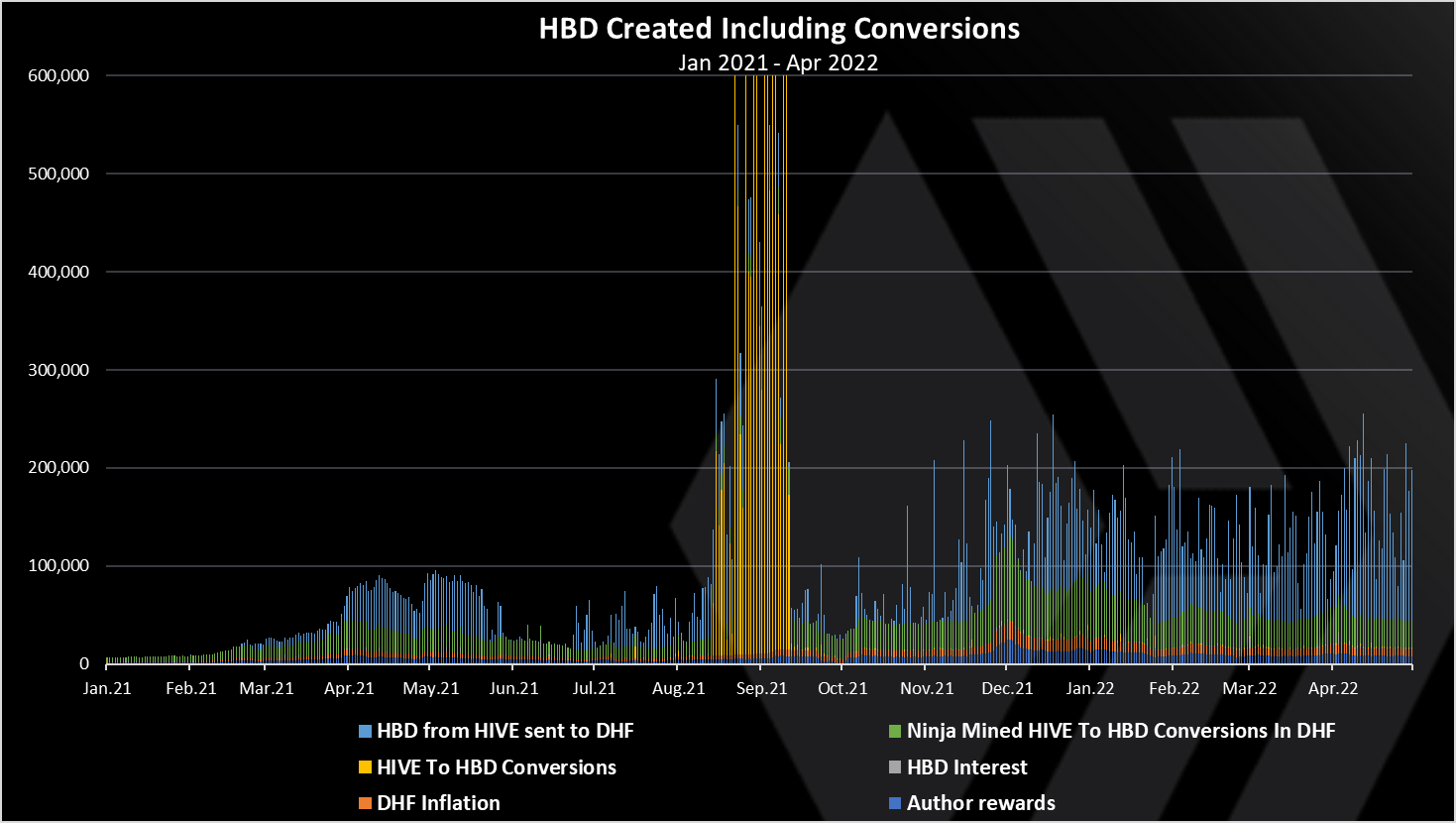

HBD Created

Here it the chart.

The above is a chart for HBD created without the conversions. It includes to following.

- 10% share of the inflation to the DHF

- HBD Author Rewards

- Interest payouts

- HIVE to HBD conversions

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

Here again we can see that the conversions are dominant when it comes to adding a new supply of HBD. The August and September 2021 period is when a lot of HBD was created.

The ninja mined HIVE conversions are also adding significant amounts of HBD in the DHF. Note that the HBD in the DHF doesn’t count as debt.

A total of 4.9M HBD was created in April 2022, most of it from HIVE transfers to the DHF from the stabilizer (3.4M) and from the ninja mine conversions in the DHF (0.9M).

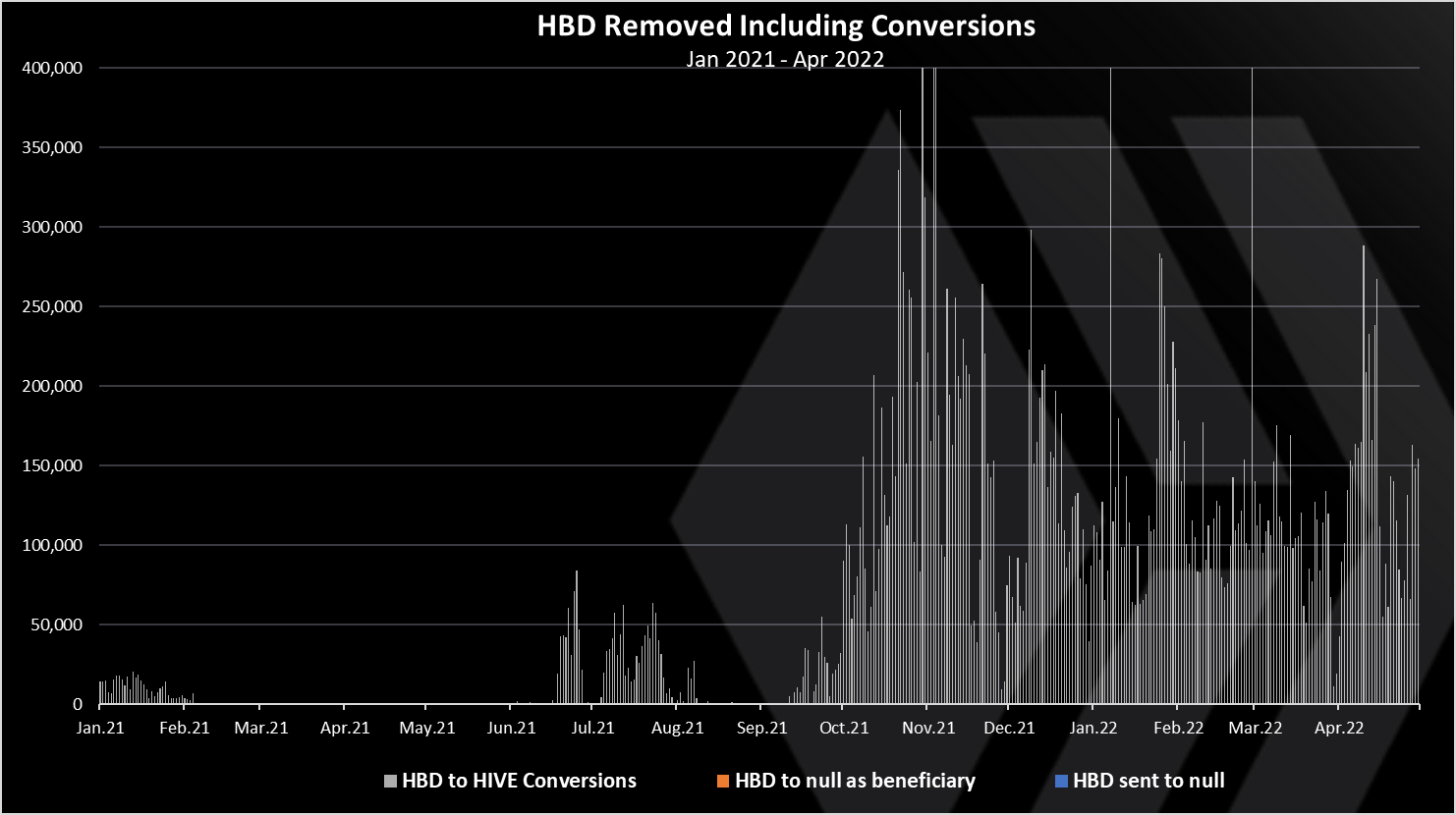

HBD Removed

Now let’s take a look at HBD removed. Here is the chart.

HBD is mainly removed when converted to HIVE, but also with transfer to @null and setting null as beneficiary on posts rewards.

HBD is being converted to HIVE when the price is below the peg. We can see that in the last period there is a lot of HBD conversions. A total of 3.2M HBD was removed in April 2022, most of it from HIVE conversions.

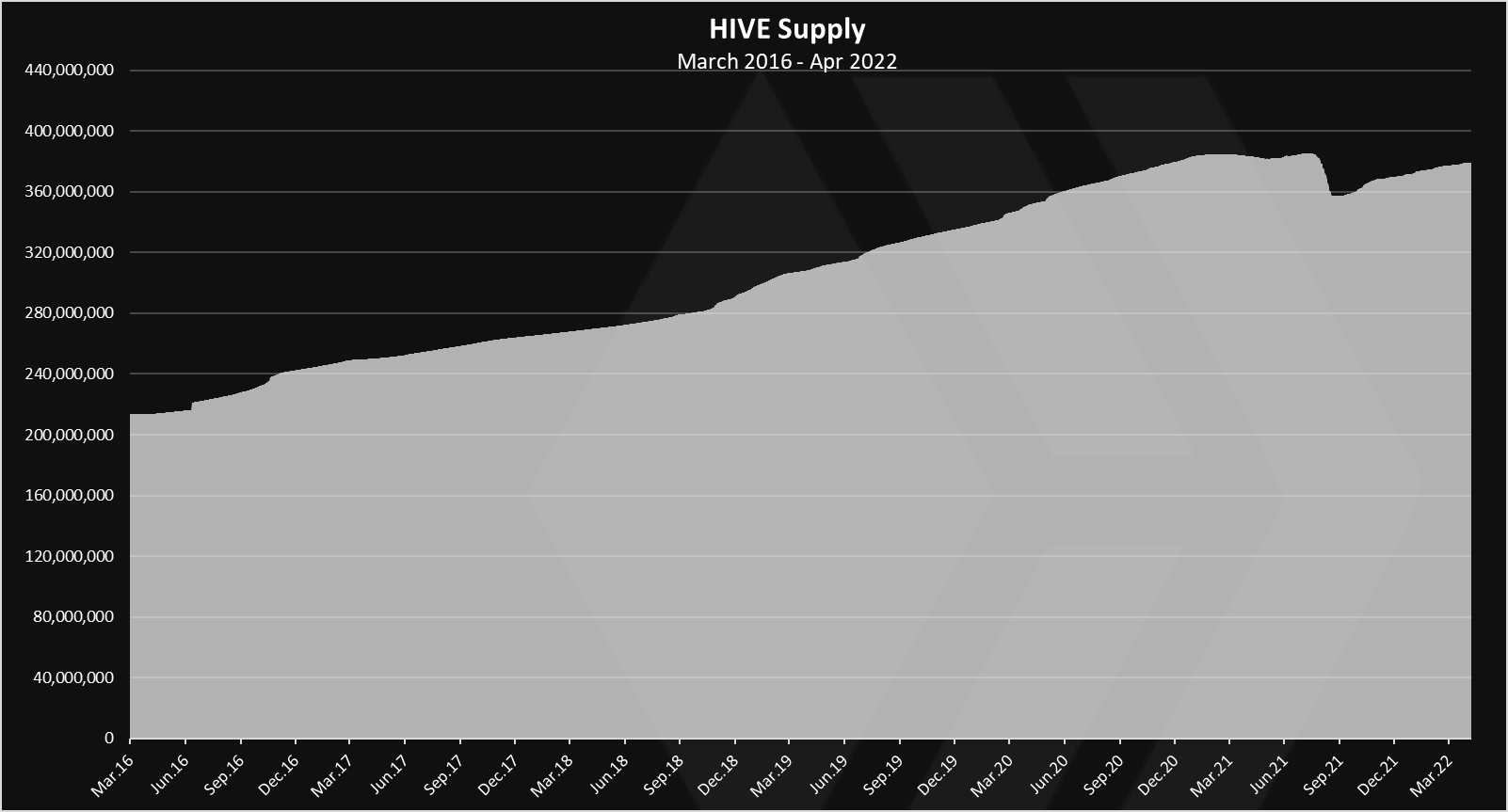

HIVE Supply

When all the above is added and removed, we get this chart for the all time HIVE supply.

Up until August 2021, the supply was almost steadily increasing with a small fluctuation. Then a huge drop in the supply in August and September 2021. An increase since then and at the end of April we are around 379M HIVE in circulation.

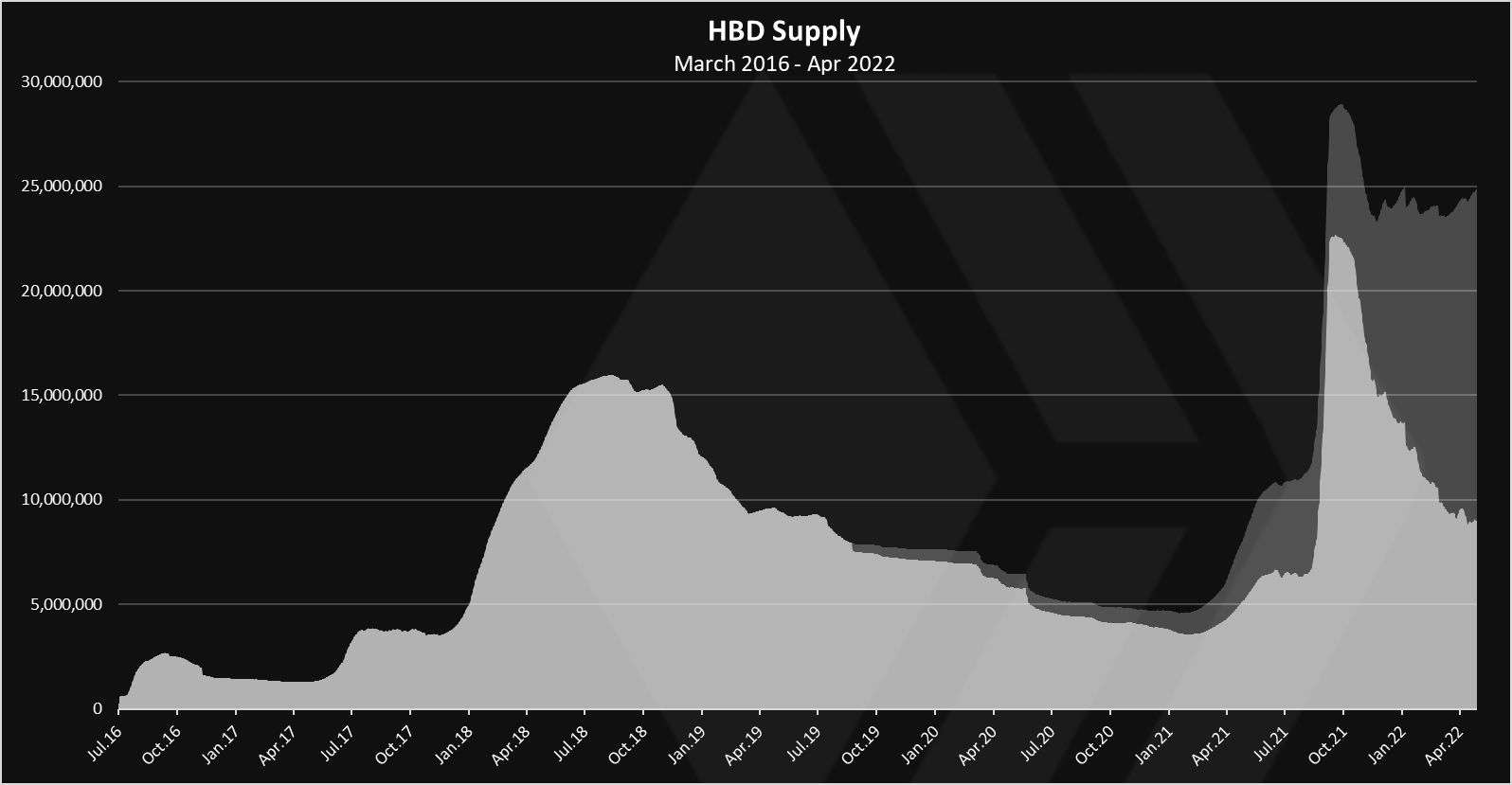

HBD Supply

Here is the chart for the HBD supply.

The light color is HBD in the DHF.

As we can see the HBD supply has expanded a lot in 2021, but it has been in the downtrend in the last months. While the HBD supply in the DHF is growing and it is maintaining the cumulative supply around 24M, the HBD supply excluding the DHF has been going down and now it is around 9M HBD, down from the 9.4M in the previous month.

In April the supply of HBD (excluding the DHF), decreased for around -0.4M. As mentioned, it was most because of the conversions to HIVE. With this amount of HBD and the HIVE price the debt is now at 2.7%.

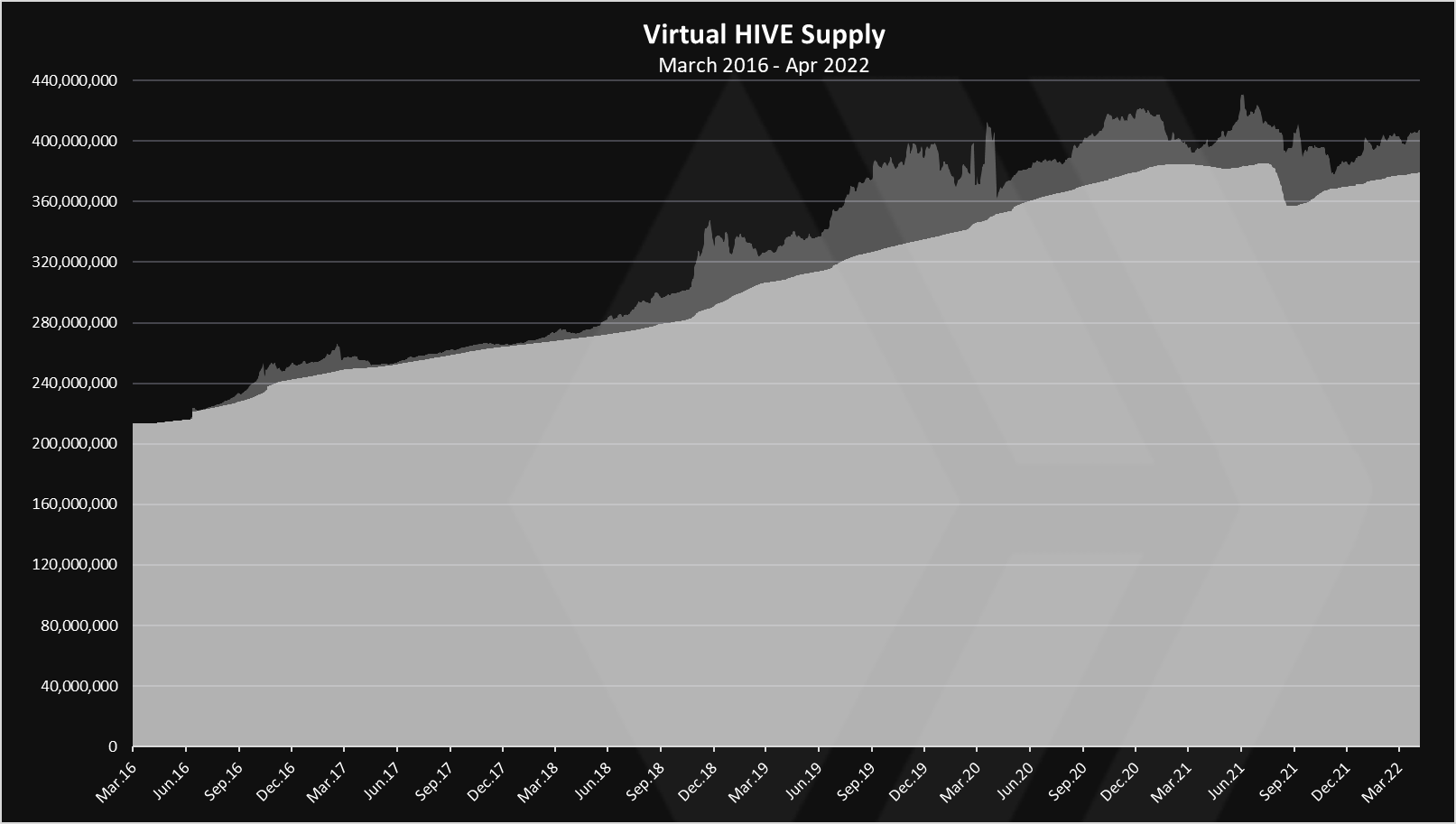

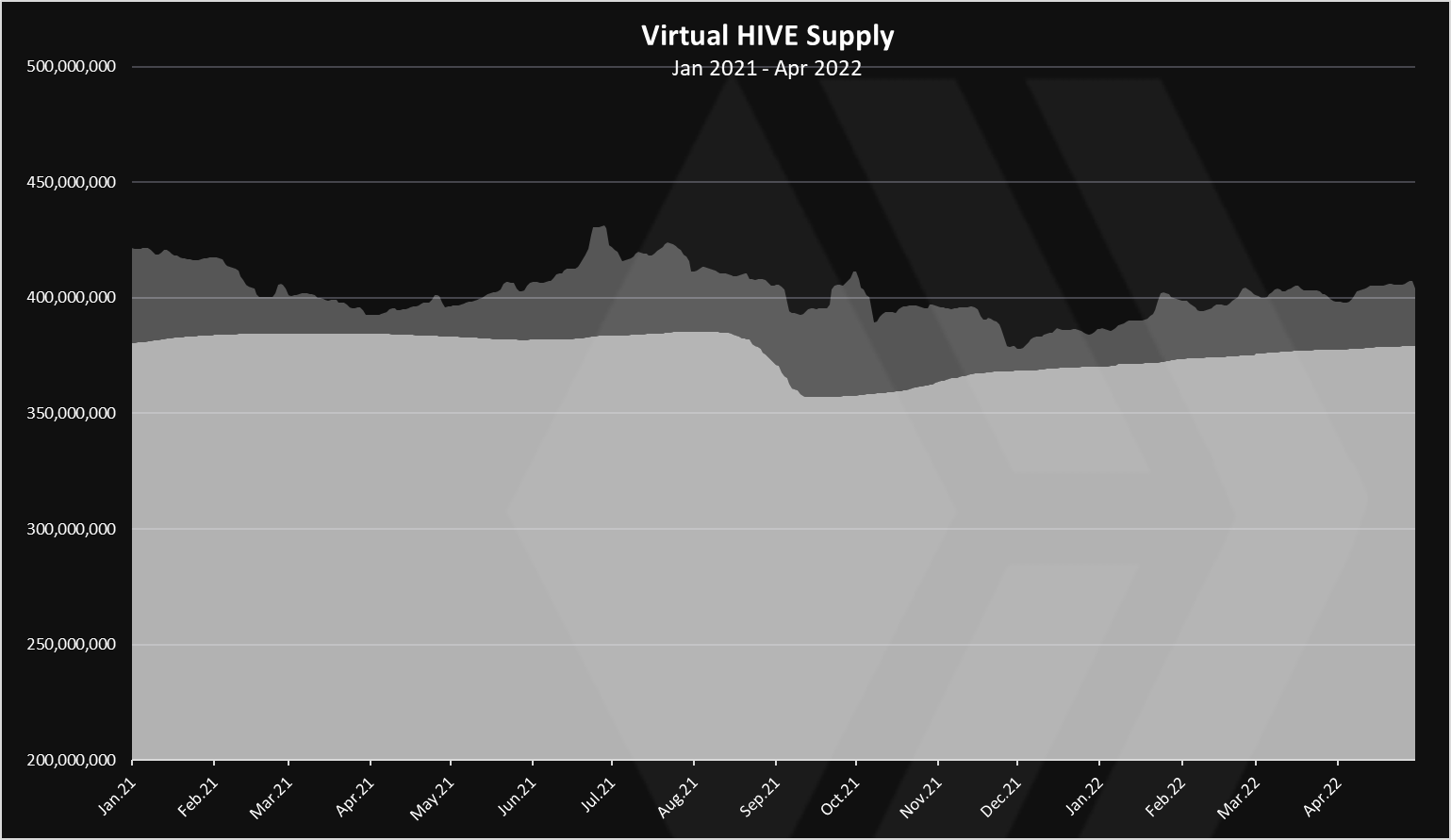

Virtual HIVE Supply

When we add the HIVE equivalent supply from the HBD in circulation to the HIVE supply we get the chart bellow.

When we zoom in we get this.

The light color is HIVE that in theory can be converted from HBD at the current market prices for HIVE.

We can see that the virtual supply fluctuates quite a lot, mostly because it is tied to the price of HIVE. As the price of HIVE increases, the virtual supply decreases and the opposite.

Monthly Inflation

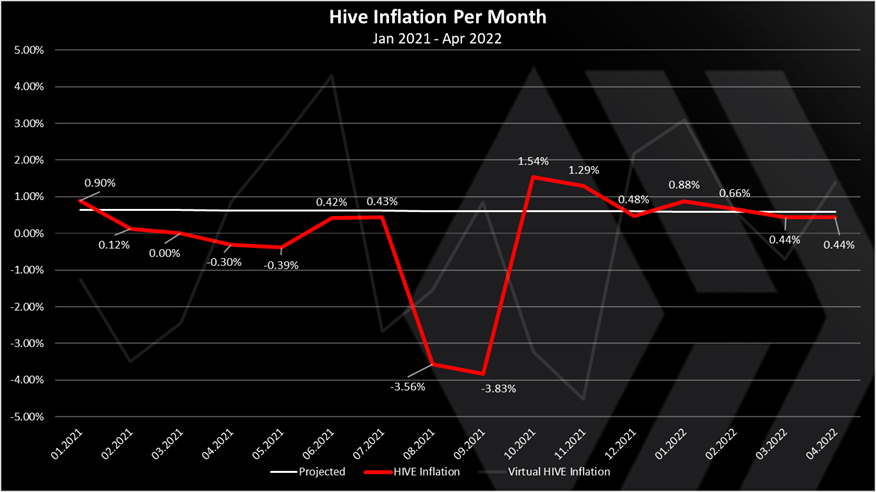

If we plot the monthly inflation, we get this.

The red is the HIVE only inflation, the light dark VIRTUAL HIVE inflation, and the whit is the projected inflation.

The monthly inflation for April 2022 is 0.44%. The projected monthly is 0.58%.

We can see that the highest the monthly inflation has been is 1.54%, while it has reached negative -3.83% in September 2021. For April 2022 the inflation is at 0.44%, while the virtual HIVE inflation is negative 1.4%.

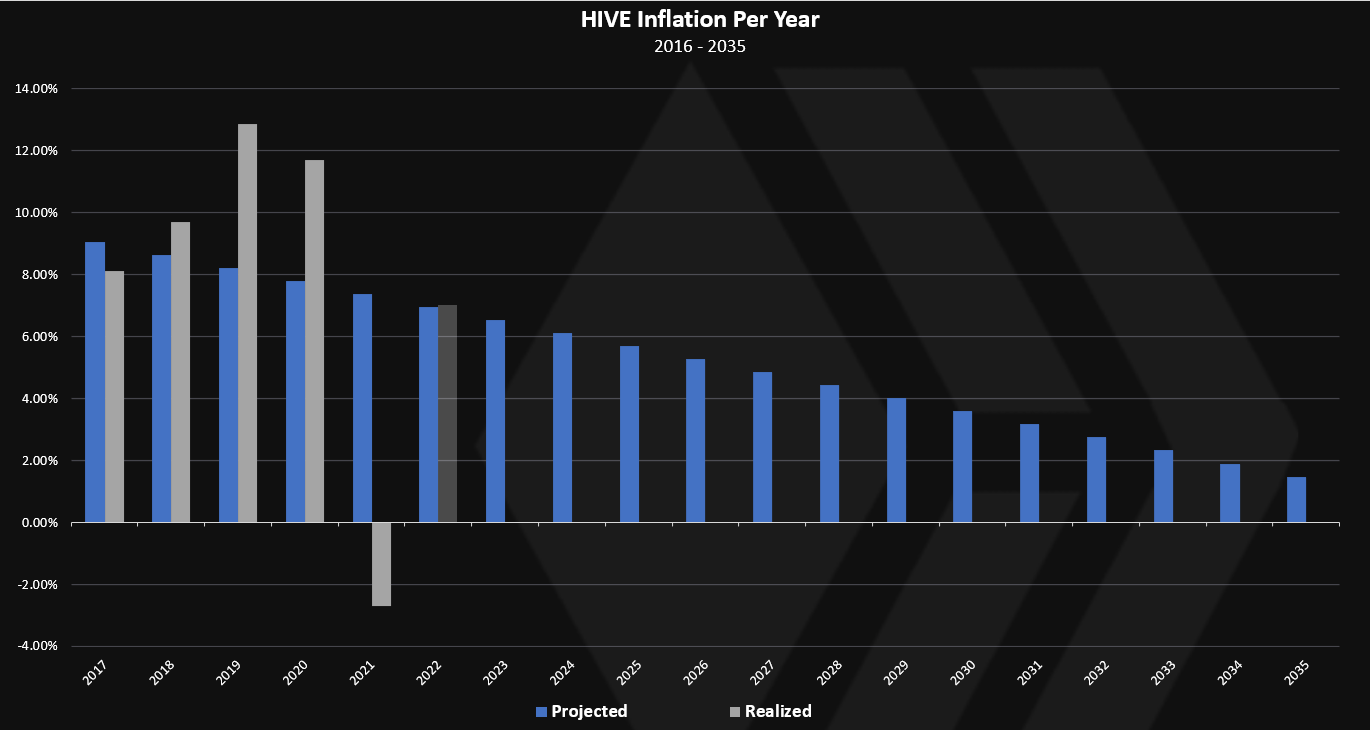

The yearly inflation, projected and realized looks like this.

Quite the differences here. Again mainly because of the HBD conversions. In 2019 and 2020 we can see that the realized is quite above the projected, while in 2021 the inflation is negative -2.7%.

2022 is projected at around 7% (0.58% monthly). The first three months are around that number, will see how it goes for the rest of the year, as there is still a lot to come.

Supply Summary

Here is the new HIVE put in circulation by category.

We can see that conversions are the number one way for creating HIVE in April 2022. Part from the authors rewards are paid in HBD, so there is a share of authors rewards in the conversions as well, but not as big.

The curation rewards are second.

HIVE removed by category.

The transfers to the DHF are on the top here. This is basically the excess HIVE from the @hbdstabilizer. When these funds are sent back to the DHF they are instantly converted to HBD. On the second spot are the ninja mine conversions in the DHF.

Net HIVE created in April 2022 **1.67M **.

All the best

@dalz

Posted Using LeoFinance Beta

I honestly don't expect much of a increase of supply in HBD until hive goes back over $1 and we will most likely see a higher conversion into HBD. Right now at least to me it makes more sense to convert the HBD to Hive because I honestly expect it to climb 20%+ with a years time frame. But really in order to break even with the HBD interest I only need about a 9%-11% raise in Hive price as my curation rewards and staking rewards would offset it. It's simply just not attractive enough even at 20% that doesn't mean we should keep pumping up the APR rate though there just needs to be more built around HBD which we should see soon with DeFi rolling into hive.

Yes more build around hbd and easier for whales to enter and exit .... more liquidity

I would have a feeling that would play even more havoc on the stability of it.

Hmm, even less free HBD.

Yep ... imagen that ... I expect more in the next month.

If I was a whale I would have auto upvoted your every post. These stats are out of the world and these are the only ones that matter when speaking of price.

Tnx!

Well, that is pretty surprising to see. I am quite baffled by that. I am going to buy some HBD next week to add to my savings account.

Inflation meaning the reward pool (in HIVE) will get lower and lower each year?

Yes

So it's means, that the price of HIVE will grow?

Hello Dalz! First of all, every day you post I learn something new, I really appreciate all the time you dedicate to your analysis.

Having said that, I had a question to see if you could solve it. I recently started a HBD savings plan and although right now it is very very modest I have a doubt thinking about the future, if someone needs to get hundreds of thousands of dollars or maybe millions (I'm optimistic I know haha), would there be enough liquidity somewhere for the process to be immediate or at least fast and that each HBD would have the value of 1 dollar? I say this because on platforms like hive engine when a number of buy orders are closed the HBD starts to drop in value. What is planned to solve this issue? What happens when a large number of HBDs are sold? Does it burn, does it become hive? If one day you could do an in-depth analysis on this it would be incredibly useful for those of us like me who are new to HBD savings.

Buying large amounts of HBD is a chalange ... with the recent launch of the pHBD-HBD pool on Polycub, there is like around 350k in liquidity in the pool there.

The best place to buy large amounts of HBD probably remains the internal DEX https://wallet.hive.blog/market , but it needs to happen with multiple orders in a period of days, not one big sum.

Selling and converting HBD are two different things. You can sell HBD on the internal DEX for HIVE or on any other exchanges where HBD is listed. If a big amount is sold at once HBD will dip, but most likely recover fast, because the blockchain offers a 1$ worth HBD through conversions.

When you make conversions from HBD to HIVE, the HBD is destroyed in the process (burned), and the blockchain gives HIVE, that is worth for 1$ price for HBD. With conversions one can convert any amount of HBD to HIVE without impacting the HBD markets.

https://peakd.com/hive-167922/@dalz/what-is-the-best-place-to-buy-hbd-or-data-on-hbd-liquidity-and-trading-volume

Awesome update as always. Keep up the good work.

More Hive and HBD were created in the past few months.. A lot of transactions going on.

Thanks for the update🤗

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Very interesting, thanks dalz

I thought witness rewards would correspond for a bigger portion of created Hive than it does so that was interesting to learn

Posted Using LeoFinance Beta

That is incredible. Nearly 4.5 million Hive was created !

I was expecting more HBD because of the 20% APR but the numbers aren't that high. Also, the inflation of Hive doesn't look that bad either because there is a decent amount removed from the stabilizer and the DHF.

Posted Using LeoFinance Beta